Original author: Zixi.eth (X: @Zixi41620514)

The Ton ecosystem is still in its early stages. Ton has a lot of potential, but projects within the Ton ecosystem may not be accessible to large-scale funds.

After Ton began building its ecosystem in the second half of last year, we have seen the first wave of explosive growth in the Ton ecosystem this year. Overall, the Ton foundation has shown very strong execution, with the ecosystem taking shape in less than a year.

The Ton foundation is clear on which aspects should be decentralized and which should remain centralized. For example, wallets and payments should be centralized, which was one of WeChat's core competitive advantages in the past, and Ton is also very clear about this. Only by solving the security issues of fund custody (everyone will trust TG's technology, so wallets won't be lost), enabling simple fund payments (no need for cumbersome bank card payments, all on-chain using Ton/U), and making it simple and user-friendly (no need for multiple redirects when using metamask or okx wallet, or when shopping on early Taobao), can we truly achieve a web3 version of WeChat payment. Other aspects of the ecosystem adopt a crypto-native approach, outsourcing everything and incentivizing the community to participate.

The profit models of ecosystem projects no longer need to be like traditional web2/3 projects; they are becoming more diversified. Web2 models can earn advertising revenue, sell users to exchanges, sell value-added services in games, charge subscription fees, and may not issue tokens. Web3 models can earn fees from DeFi and other financial protocols, sell NFTs, and issue tokens.

TG's characteristic is having a basic flow of users and solving payment issues. These users have a certain level of crypto knowledge, but they are dispersed in low-value areas, and the unit value of most users is not high. Does this mean that Ton should not focus on developing web3 financial tools, but rather should lean towards a web2 approach to attract traffic?

The Ton ecosystem itself is a web2 company based on HTML5, with blockchain integrated into the payment/settlement layer. Similarly, why do these projects have to be integrated with Ton? In theory, they could fully utilize TG's traffic and then use Polygon, Solana, or other L2 solutions. Returning to the essence, TG has the traffic, and Ton provides the settlement. Other ecosystem projects do not necessarily need to start from scratch; they can simply integrate with Ton (similar to how Travala books flights and hotels, Oobit for crypto payments; Ton is a good addition, but not the core).

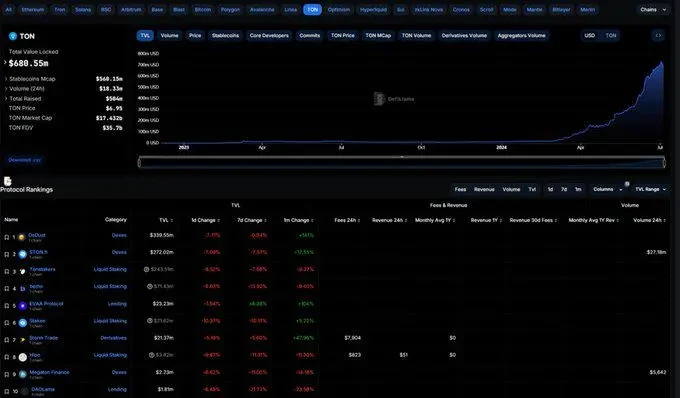

On-chain TVL is growing rapidly, but due to Ton's relatively small market value, there is a relatively low ceiling. DeFi should still be developed on BTC and Ethereum. However, Ton is different from BTC and Ethereum; Ton's chips are relatively concentrated. Do the core interest holders of Ton have financial needs? I am personally conservative about innovating assets other than BTC and Ethereum; this is no longer the era of DeFi and finance.

TG is a completely unregulated environment. This means that businesses focused on traffic and gambling can operate without legal supervision.

Currently, it seems that doing business on TG may make more sense than investing. Many projects have already generated significant revenue, such as Catizen with over $10 million in revenue and Hamster with daily revenue in the millions. However, as an investor, the risk-return ratio may not be high.

The lifecycle of projects here may be shorter. For example, the users of Catizen and Hamster are mostly speculative traders. Once the tokens are issued, and the traders start selling, the project basically ends with a 50% drop. Could this possibly evolve into an extreme ROI-driven business?

Crowdsourcing projects may naturally thrive on TG. It is precisely because TG has gathered a large number of low-value users (user profiles may be similar to YGG) and has positive cash flow that crowdsourcing projects may be suitable for TG. For example, data labeling, autonomous driving data collection, and food delivery.

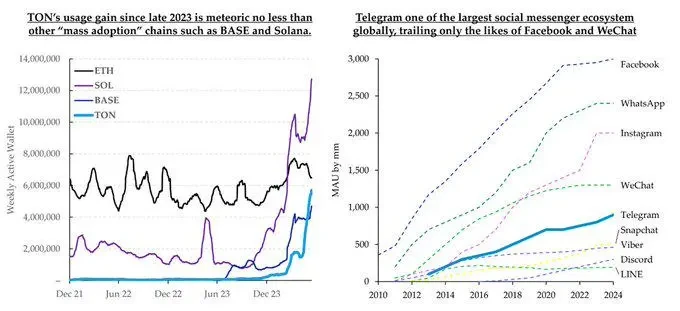

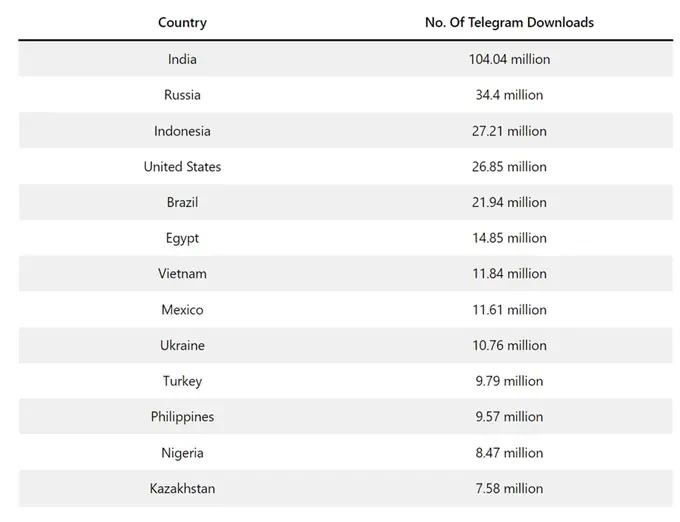

1/nTG is currently the fifth largest social platform, founded by the Durov brothers in 2013. Ton was proposed in 2017, launched its mainnet in the second half of 2021, and only began to focus on promotion and operation in 2023. Ton's comparable counterparts are Solana and Base, as they are all high-performance public chains with clear 2C attributes. Solana is backed by FTX, Base is backed by Coinbase, and Ton is backed by TG, all having a certain traffic carrier. Based on the current weekly active wallets, Ton's growth has surpassed Base and is close to half of Solana's. Ton is currently emulating WeChat mini-programs and embarking on its unique path to web3. (Image source: Folius Ventures)

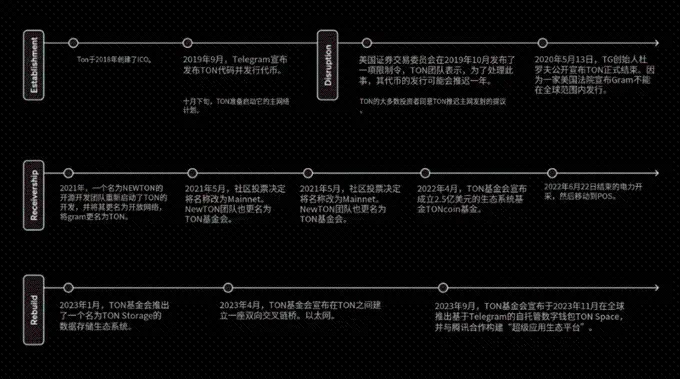

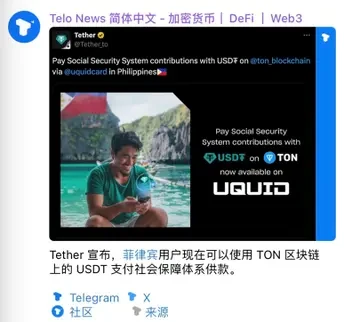

2/nIn 2013, the Durov brothers created TG; in 2018, Pavel Durov initiated TON and conducted a $1.7 billion ICO; in 2020, due to SEC entanglements, TG abandoned the lead development of Ton; meanwhile, the TON community established the Ton Foundation to continue leading Ton's development; in September 2021, the mainnet was launched and tokens were issued; from 2021 to early 2022, the Ton foundation and miners accumulated over 80% of Ton chips; in September 2023, TG announced an exclusive partnership with Ton, fully replicating the WeChat mini-program approach in its ecosystem; in February 2024, Pantera heavily invested $300 million in Ton; in April 2024, Tether began deploying USDT on Ton, allowing users to transfer funds through TG; in June 2024, Notcoin/Hamster/Catizen and others began to gain popularity on TG.

3/nThe risk of highly concentrated chips needs to be considered. There are two types of contract addresses: Small Givers and Large Givers. The latter distributes more tokens each time (100,000 instead of 100), but requires more computing power. Telegram launched token mining on July 6, 2020, transferring tokens to 20 contracts through system addresses for distribution. Mining lasted from July 6, 2020, to June 28, 2022, but almost all tokens were distributed within the first 51 days: from July 6, 2020, to August 26, 2020, Large Givers distributed 4.8 billion tokens (96%), and Small Givers distributed 9.9 million tokens (0.2%); from August 27, 2020, to June 28, 2022, Small Givers distributed 117.3 million tokens (2.35%). It is worth noting that 3,278 unique addresses participated in mining, but only 248 addresses participated in Large Givers' distribution. Therefore, we know that 96% of the TON supply was distributed to 248 addresses. Furthermore, these 248 addresses are closely related: we found many mining address groups that are associated with each other and have similar patterns, such as the start and end times of mining or the operations of mined tokens. We also found some retail activity, but most of the token supply was mined by a group of closely related whales. Source: Whiterabbit

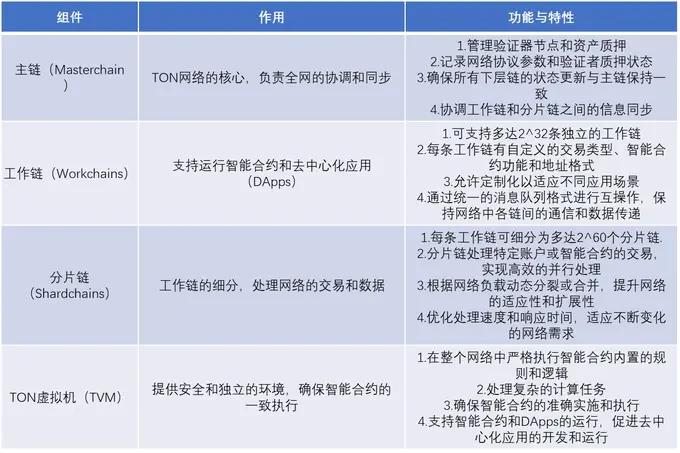

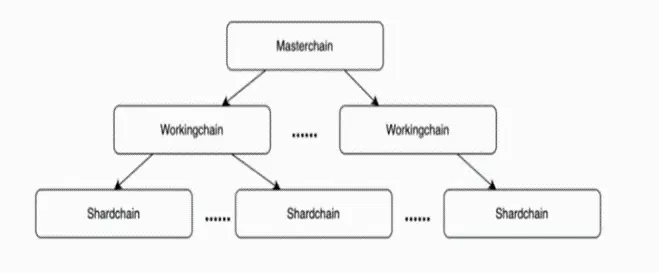

4/n From the perspective of the chain itself, the technical roadmap in 2021 looks very promising. The chain has been modularized directly. Ton's development language is different from the mainstream languages of web2 and Ethereum's EVM solidity. Ton has developed its own TVM (Ton virtual machine) and uses three programming languages: Fift, FunC, and Tac. These three languages are specialized development languages for Ton and are relatively new. The overall developer ecosystem is still in its early stages, mainly due to the early stage of the programming languages. FunC is a high-level language designed specifically for smart contract programming on the TON blockchain. It is a domain-specific, statically typed language similar to C. FunC is used to write smart contracts, which are then compiled into Fift assembly code and ultimately generate bytecode for the TON virtual machine (TVM). Fift is a low-level assembly language, and FunC programs are compiled into Fift assembly code. Fift is closer to the lower level and is not usually used directly for writing smart contracts; it serves as an intermediate representation between FunC and TVM bytecode. Tac is designed to provide a higher level of abstraction than FunC while maintaining compatibility with the TON virtual machine. FunC is a variant of the C language and is somewhat similar to C/C++. Ton chose FunC as its language because TG is written in C. Ton abandoned the crypto-native approach of EVM solidity and defined its own functions to assist TG in building its ecosystem. This means that Ton is not designed for Web3 geeks but is more focused on landing with web2 ordinary users. In other words, it is a blockchain designed for TG users. Therefore, some technical aspects, such as high concurrency and asynchronous structure, are based on web2 architecture. Therefore, the approach from the developer ecosystem perspective is very web2+web3. This can be seen in the subsequent development of the ecosystem.

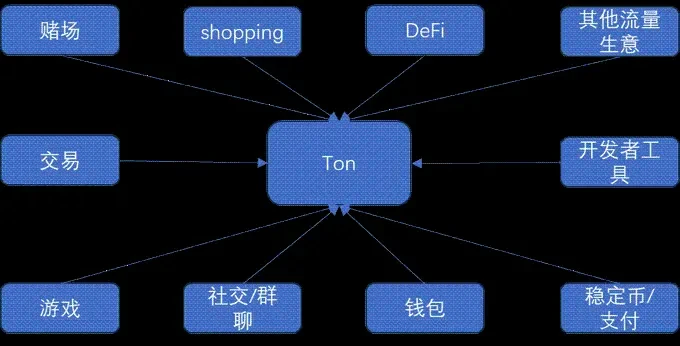

5/n Why has the Ton ecosystem attracted everyone's attention now? 1. True web2+web3. TG dapps (mini-programs) have web2 main business, and crypto is just a value add. For example, games can generate a large amount of revenue through web2 profit models such as advertising, avoiding the crypto model of spending money on marketing, data, and then running away. In addition, through crypto global payment, cross-border e-commerce, overseas business, and hotel reservations can have new payment expansion channels. 2. Low development costs. Most mini-programs can be deployed using HTML5, and Ton provides a series of technical development documents and templates, allowing developers to complete deployment without writing code from scratch. According to feedback, project teams with a web2 background can complete the deployment of a mini-program in two to three days. 3. For Web3, the Ton ecosystem opens up new possibilities for project teams, no longer focusing solely on Infra/DeFi and other crypto-native tracks, but supporting developers to build products in various fields such as social, gaming, e-commerce, and cross-border business, broadening the choices for project teams. Finally, when developers develop in the TON ecosystem, they can interact and integrate various products on a single platform on Telegram. For users, the mini-applications in the TON ecosystem have a clear advantage in interaction. Users can complete one-stop interactive operations by clicking on the wallet mini-program without leaving the Telegram platform, without switching to external wallets such as MetaMask. In addition, the wallet on Telegram already supports users to deposit fiat currency OTC, allowing users to directly purchase crypto assets using a credit card and seamlessly interact with various applications on the chain.

6/n Below is the Ton ecosystem, and currently, the most active developments are in gaming and social areas. The current gaming ecosystem mostly consists of tap games, such as clickers and match-three games, mostly using HTML interfaces, crypto-native economies, and advertising revenue. However, there are a large number of users, making them popular. In the Ton ecosystem, gaming is still in a highly competitive state, but cross-border e-commerce, crypto payments, and other web2-related scenes are relatively untapped.

7/n DeFi—underwhelming TVL performance, after all, it is not a crypto-native public chain. Ton's DeFi performance is relatively average, with an overall TVL of only 680 million, even lower than mid-tier L2 solutions such as Linea and Blast. However, it still makes sense. From the first day of development, Ton has not positioned itself as a crypto-native public chain, so DeFi is not the focus of its ecosystem development.

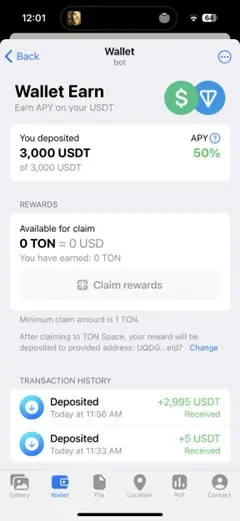

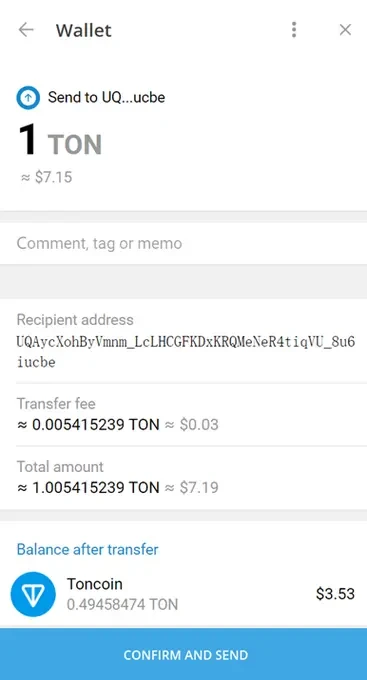

8/n Stablecoins/Payments/Wallets—priority strategy, web2 experience in the payment ecosystem. Since 2017, Telegram has been exploring its business model, whether it's payment services, advertising, or the ICO financing that was paused by the US SEC, but the results have not been ideal. Last year, Pavel Durov revealed that the annual cost of maintaining Telegram's normal operation is about $630 million. According to The Wall Street Journal, by April 2021, Telegram had accumulated $700 million in debt. Therefore, since 2021, Telegram has publicly issued oversubscribed bonds worth hundreds of millions of dollars multiple times, and in March of this year, it raised $330 million through bond sales. Telegram is often seen as the Web3 version of WeChat. From the perspective of active users, there is not much difference between Telegram and WeChat. WeChat has about 1.2 billion active users, while Telegram has 900 million and is still increasing, but there is a significant difference in profit models. Payments are the main commercial path for WeChat, and in comparison, Telegram will also choose payments. However, as Telegram is not regulated and cannot obtain mainstream financial regulatory licenses, it only has the Web3 payment path, and its founder Pavel Durov entered the crypto industry very early. Since the beginning of this year, Ton has been focusing on the stablecoin strategy, introducing USDT to the Ton chain and providing subsidies. After KYC, users (including those from mainland China and Singapore) can stake USDT through TG's official wallet Ton Space, and Ton offers a 50% APY reward with a limit of 3000U every two months. After two months of development, the issuance of Ton USDT rapidly increased from 100 million to 500 million. Ton USDT can be transferred directly to friends through the wallet, just like transferring money to friends on WeChat. In addition, this money can be withdrawn, which is completely different from traditional on-chain payments.

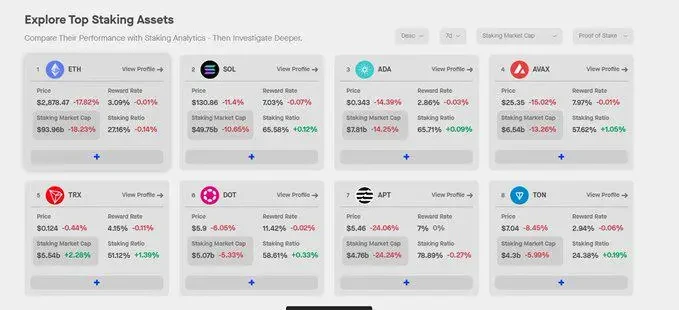

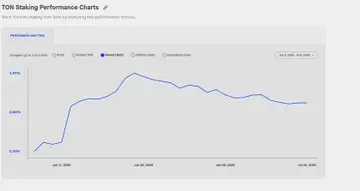

9/n The normal staking ratio for non-Ethereum public chains usually exceeds 50%, and there will be a high APY to attract miners. However, Ton's staking ratio and reward ratio are relatively low, speculated to be due to: 1. Most of the chips are still in the hands of the Ton foundation/early miners; 2. There are very few chips circulating in the market, and the number of people staking is even lower; 3. The reward ratio = inflation + gas fee. Ton's gas fee is low (0.005*7=0.035U), which can only indicate that the network activity is not as expected (this may be because most of the popular Ton ecosystem projects only have token issuance expectations and have not fully gone live on the chain). Ton's inflation is only 0.3%-0.6%, which means that the vast majority of Ton staking income comes from Ton gas fees, which is different from the measures taken by large public chains such as Solana.

10/n Catizen is a project created by an early web2 game team. They previously worked on a project called "tap fantasy" in 2021, which was a H5 idle game on Facebook. Catizen is a game where players can breed and raise cats. Two low-level cats can be combined to create a higher-level cat, which produces more as the level increases. Users can use additional crypto tokens or U to purchase additional features to speed up the production of cats. Catizen's in-game revenue has exceeded $10 million, achieved within about two months of the game's launch. In June, Catizen had over 20 million total users, with approximately 2 million daily active users (DAU), over 700,000 on-chain users, and approximately 500,000 paying users. The on-chain user conversion rate remains at around 10%, with over 50% of active users being paying users. Based on this, Catizen will gradually launch its own mini-game platform in the future, aiming to become the "Telegram 4399/Steam".

11/n Hamster Combat is the most popular tap game on Telegram. Players earn coins by idling, clicking the screen, or completing tasks, and use these coins to build a better team to earn more coins. Overall, it leans towards idling and nurturing. Hamster is very addictive—earning one coin per tap, with 1000 energy requiring 1000 taps and needing to wait for automatic recovery before tapping again. There are also 6 instant energy recovery opportunities per day. Passive income from idling is only valid for three hours after exiting the game and requires re-entering the game after the time expires. Hamster is very popular in the Middle East and Southeast Asia, similar to the logic of gold farming gamefi in the past. However, it is worth noting that Hamster has not issued tokens at the moment, which means that users only receive "points" instead of real tokens, making them more like "point farmers". Hamster's revenue comes from advertising and bringing new customers to exchanges, reportedly earning millions of dollars in advertising revenue daily, with the paying user group being the exchanges.

12/n The other ecosystems are relatively small, without much further information, so let's look at the images directly. The official track is likely to leave little opportunity for third parties to do anything further.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。