Original Author: Ren & Heinrich

Andreessen Horowitz (a16z) is one of the world's most famous venture capital firms. Their portfolio includes about 50 cryptocurrencies. In this analysis, I want to see if as a retail investor, if you copy trade, that is, invest in the same coins as a16z and sell them after about 5 months, can you make a profit in 2024.

Let's assume some conditions first

• You, as a retail investor, copy trade (i.e. invest in the same coins as a16z and sell them after about 5 months).

• Invest $100 in each of the top 25 coins in a16z's portfolio by market value (total of $2500).

• Investment period: from January 1, 2024 to June 6, 2024 (157 days).

In-depth analysis

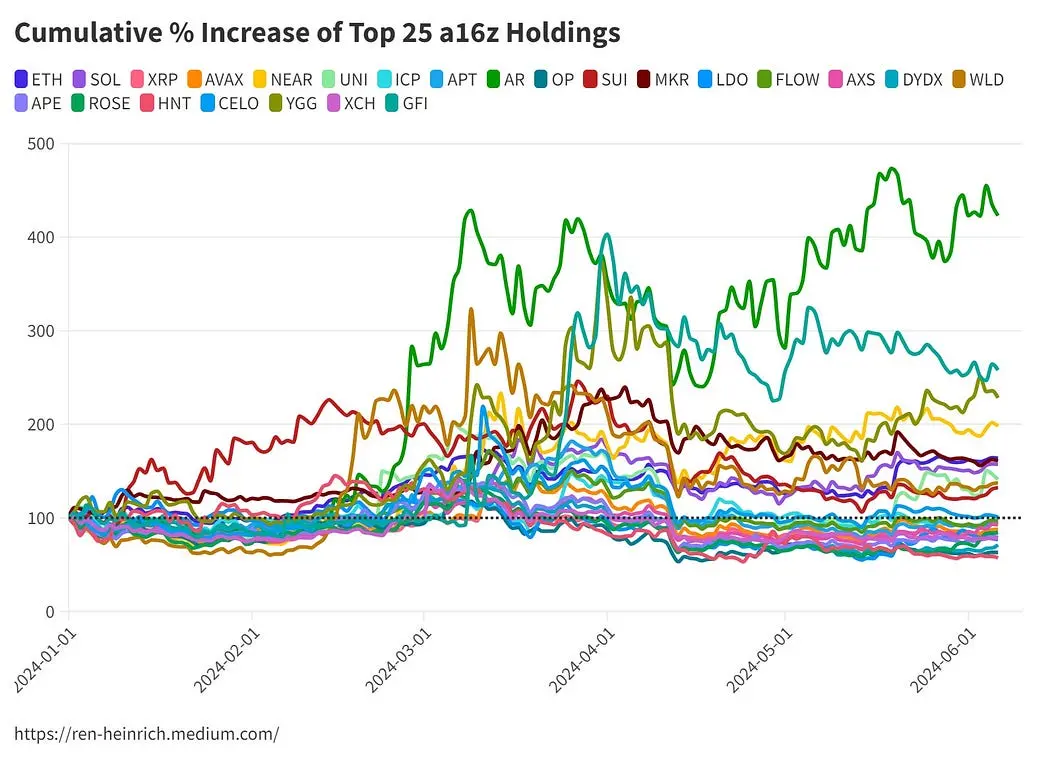

With these conditions, let's see how a16z's investment portfolio has performed since the beginning of the year.

The X-axis shows the time trend, and the Y-axis shows the percentage of profit or loss. A value of 200 means that the corresponding cryptocurrency has grown by 100% based on its original value.

As we can see, the situation is complex.

On the one hand, we see that some cryptocurrencies have performed well in price trends over the past few months, such as:

• Arweave (AR): +323%

• Goldfinch (GFI): +157%

• Ethereum (ETH): +63%

On the other hand, many prices have been declining, for example:

• XRP (XRP): -17%

• Optimism (OP): -38%

• ApeCoin (APE): -22%

Overall, 11 of the top 25 cryptocurrencies show a net increase. If we subtract the losses caused by the decline in other coin prices, the total sales price is $3158.82. Therefore, the total profit ($3158.82 - $2500) is $658.82, and the return on investment (ROI) is 26.35%, which is not bad.

In fact, those who only invested in Bitcoin or Ethereum during the same period would have made even greater profits.

Clearly, unconditionally copying Andreessen Horowitz's investment portfolio is not the most ideal choice.

How to make more profit?

What are the other ways to increase profits from copying the top 25 coins in a16z's cryptocurrency investment portfolio? Let's take a closer look at the timeline.

When Bitcoin started to rise in early March, the entire cryptocurrency market also showed a strong upward trend, but not all coins had the same rate of increase.

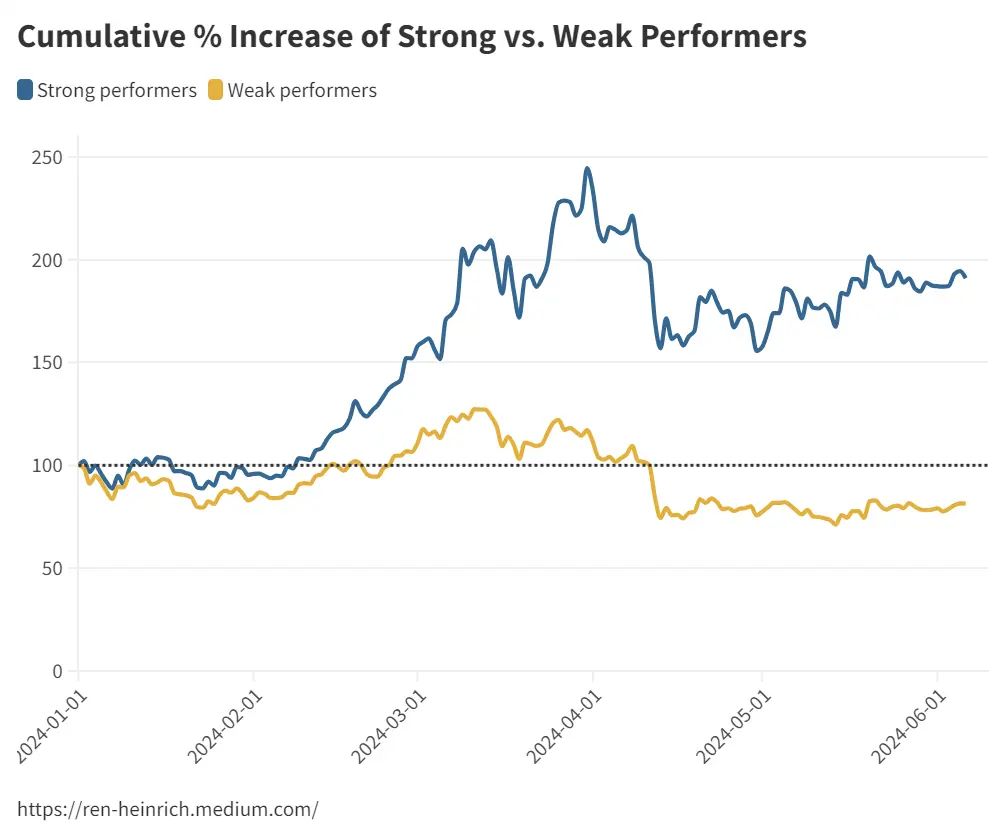

This chart compares the performance of strong and mediocre coins in a16z's investment portfolio (showing the average growth of coins with positive or negative gains in early June).

We can see that the strong-performing coins had significantly higher gains in early March (March 13, average +104%) compared to the mediocre-performing coins (March 13, average +27%), and were able to maintain this advantage in the long term.

Therefore, the strength of the increase is one of the indicators of whether the performance will be good in the coming months.

Once again, it is important to emphasize that time is crucial in cryptocurrency investment.

Just as Andreessen Horowitz will not hold onto their coins forever, you should always pay attention to trends and seize selling opportunities when copying trades, keeping only the most promising coins in your portfolio.

What does "strong" and "mediocre" performance mean?

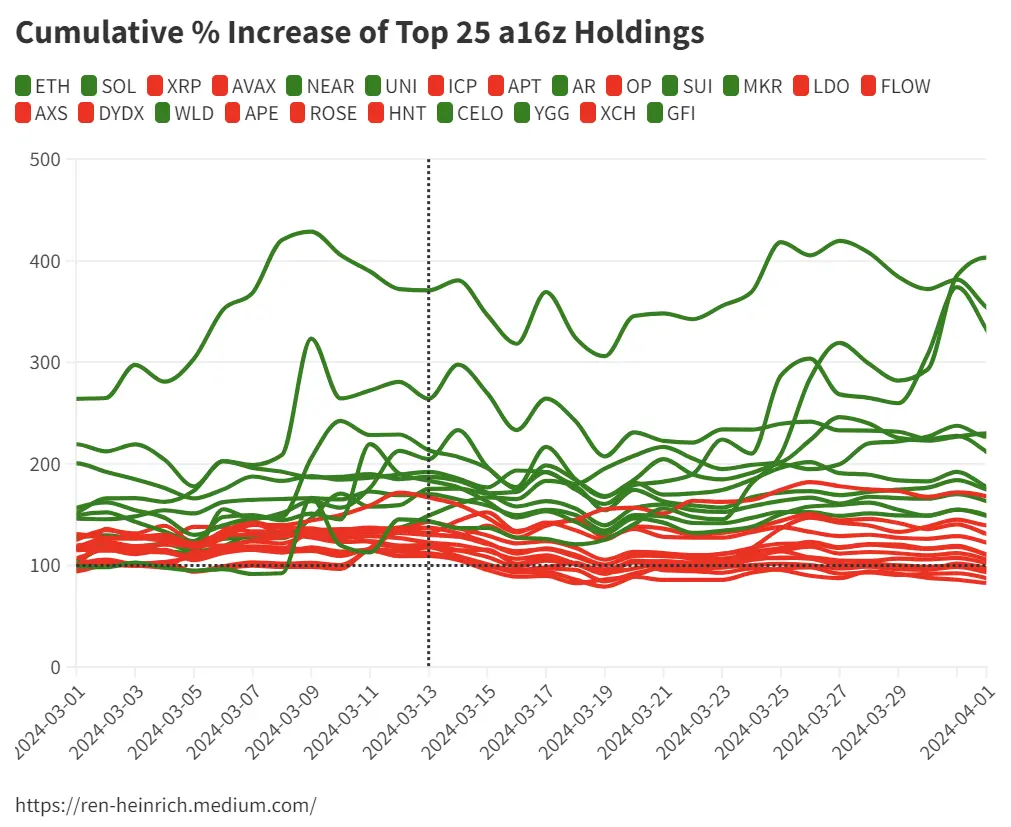

This enlarged chart shows all coins with positive gains by early June in green, and the rest in red.

As of March 13, we can see that the strong-performing coins had gains of at least 40%, while the mediocre-performing ones were almost all below this level.

Although no fixed rules can be derived from this, it shows that if you sold half of the underperforming cryptocurrencies in the portfolio around mid-March, you would have made a significant profit in June.

However, this does not rule out the possibility that these mediocre performers may have better performance later.

a16z's cryptocurrency investment portfolio demonstrates market diversity and challenges, and investors should be cautious when replicating their strategy, always paying attention to market trends and the performance of individual coins.

In this rapidly changing field, timely buying and selling decisions are crucial to seize opportunities and achieve sustainable investment returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。