Original Author: Pentos Ventures

World Economic Landscape

It's been many days into the summer of 2024, and the arrival of July means that the game has entered the second half of the year.

The market upheaval in September last year brought long-awaited hope to the crypto world. Since January 2024, the price of Bitcoin has been continuously rising, and most practitioners assert that the bull market has arrived. At this time, a large number of overvalued projects emerged in the primary market, with valuations reaching as high as 30 million and even falling into the lower valuation range. The main reason for the project's valuation is determined by the market's belief that the price of BTC will break through $100,000 in this round, and projects anchored to the change in BTC price should logically receive higher valuations. In fact, a fatal logical error has been made here. The change in the volume of market funds in the BTC price market does not equal the change in the volume of market funds in the altcoin market, and the two are not absolutely related. The valuation of the project should be defined based on its own merits.

Nevertheless, as market sentiment-driven players, investors have unhesitatingly made frequent moves in the face of unreasonable project valuations. Subsequently, the absence of takers for high-valuation projects listed on Binance became a focal point, and the market began to question who was actually making money as prices continued to fall.

To answer this question, we need to go back to the point made earlier that "the change in the volume of market funds in the BTC price market does not equal the change in the volume of market funds in the altcoin market." Here, we need to step out of the Möbius strip we are in and take a more macroscopic view of the market. The so-called global economy is a large-scale game of capital, and cryptocurrency is one of its components. Where does the capital of cryptocurrency come from? The answer is obviously clear — — — the traditional world.

So, how did the COVID-19 pandemic that ravaged the world since the end of 2019 affect global economic changes and radiate into the world of cryptocurrency? What is the global economic situation in 2024?

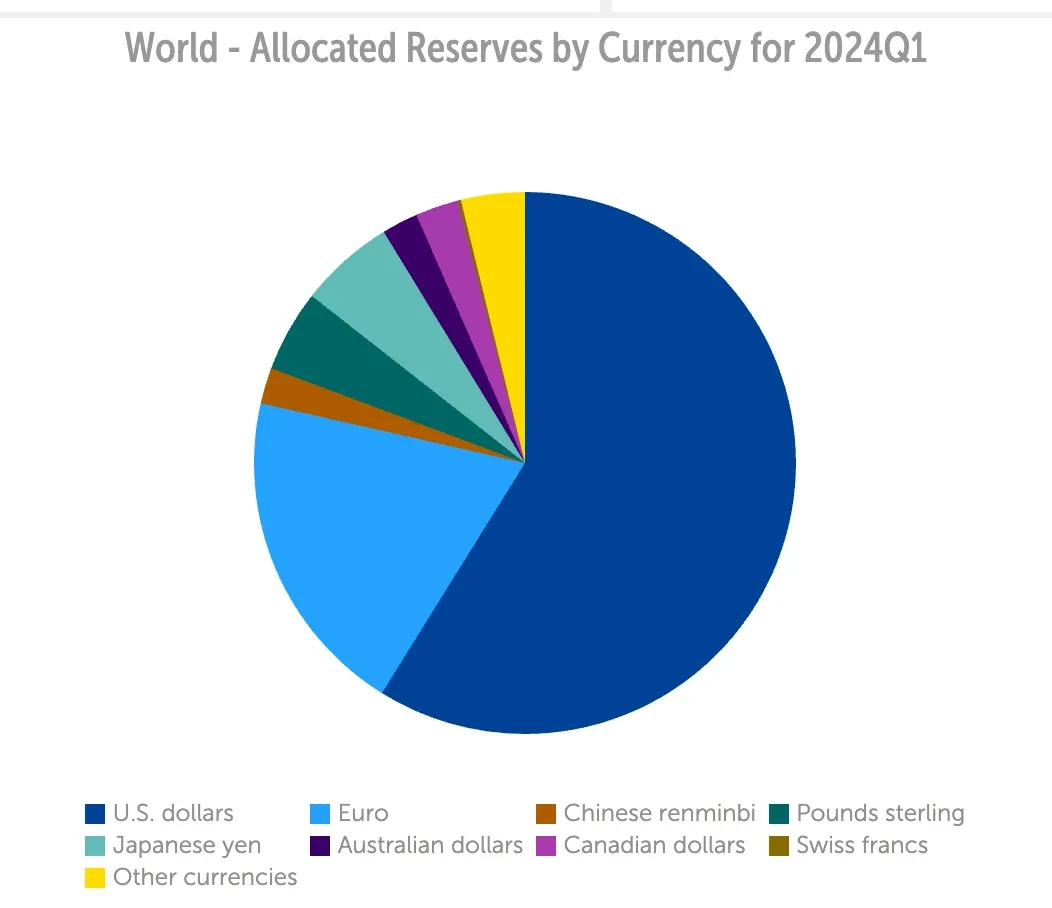

According to the latest data for Q1 2024 from the International Monetary Fund on the global distribution of currency reserves, the US dollar remains the dominant global currency. Therefore, all global economic issues are definitely inseparable from discussions centered around the US political economy.

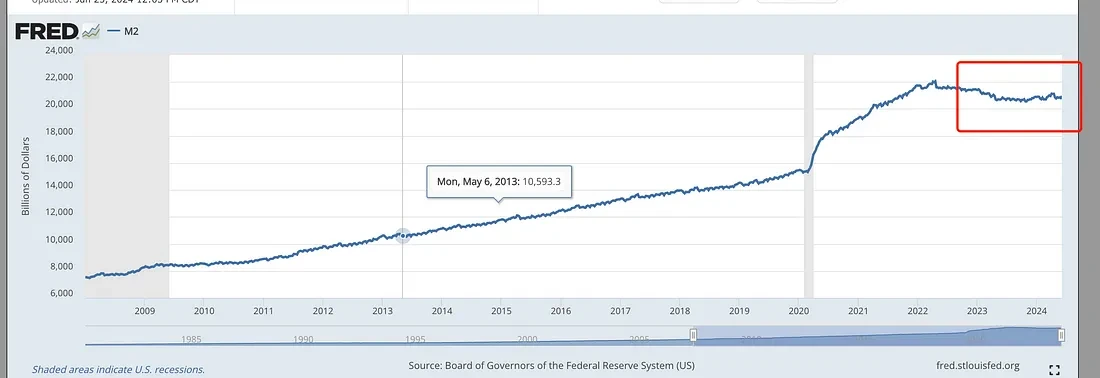

We need to note that since the outbreak of the COVID-19 pandemic at the end of 2019, the issue of US inflation began to surge in 2021, and the main cause of the surge in inflation comes from the impact on commodity prices. Driven by the unexpected rise in commodity prices and distortions in key product markets, such as the new and used car markets. The strong overall demand during the pandemic, coupled with supply constraints in certain industries, led to shortages and price increases in sectors. At the same time, the US printed over $3 trillion in 2020. This measure was aimed at stimulating economic activity and providing relief to those affected by the pandemic, but it also led to the rise in inflation. This further pushed up the prices of commodities, and as one of the categories of commodities, BTC, with a relatively small total size compared to gold, saw a more significant price increase.

When the economy overheats or inflation rises, the usual action taken by the Federal Reserve is to raise interest rates to cool economic growth and control inflation. The situation of inflation is closely related to changes in the Consumer Price Index (CPI). In 2021, the CPI rose significantly, with an annual growth rate of about 7.0%; in 2022, the CPI continued to rise, with an annual growth rate of about 6.5%. The growth of the CPI slowed down in 2023, but still remained at a high level, with an annual growth rate of about 4.0%. According to the latest data from the US Bureau of Labor Statistics, the CPI in May 2024 remained unchanged from the previous month, with a seasonally adjusted monthly change rate of 0%, but from May 2023 to May 2024, the Consumer Price Index for All Urban Consumers (CPI-U) increased by 4.0% 「2」

In general, when the annual inflation rate exceeds 3%, it may already be considered high inflation. From the above data, although the monthly CPI data changes have been controlled, from the annual data perspective, the US still remains in a relatively high inflation. In other words, under the annual interest rate hike measures, inflation has not been effectively improved. At the same time, due to the interest rate hike, the US is also facing other serious problems.

First, raising interest rates also increases the interest on US government debt. Despite the adoption of the FIMA repurchase mechanism, the US still needs to address the issue of interest on US government debt being the third largest expenditure after social security and healthcare. And where does the expenditure come from? During the US election, there has been a continuous encouragement of stimulating the manufacturing industry, not only to address domestic employment opportunities, increase research and innovation, but also to continue the US-China trade war. However, due to the interest rate hike, the manufacturing industry simply cannot afford high loans. As a result, the manufacturing industry cannot obtain the stimulus for development.

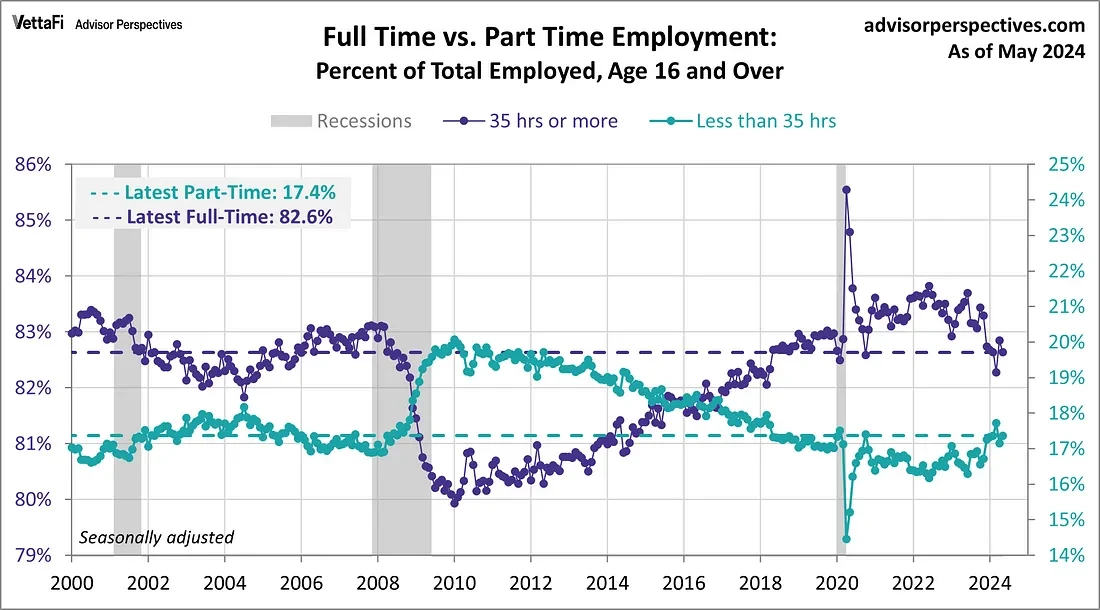

In the latest US non-farm employment data, it can be seen that the number of non-farm jobs increased by 272,000 in June 2024, higher than the expected 182,000 and the 165,000 in the previous month. Non-farm employment data is widely regarded as an important barometer of the health of the US economy. 「3」 If non-farm data exceeds expectations (higher than expected): it represents a strong economy, which is positive for the US dollar. If non-farm data is lower than expected: it represents a weak economy, which is negative for the US dollar.

The latest data seems to show a relatively good economic situation in the US. However, whether the actual situation is as such seems to require further comparison of more data. For example, the data on full-time and part-time employment in the US, part-time employment has been on the rise since the COVID-19 pandemic, which means that the non-farm data may still contain overlapping data. In addition, if we compare M2 data, we find that there has been no increase in funds in recent years.

https://fred.stlouisfed.org/series/WM2NS

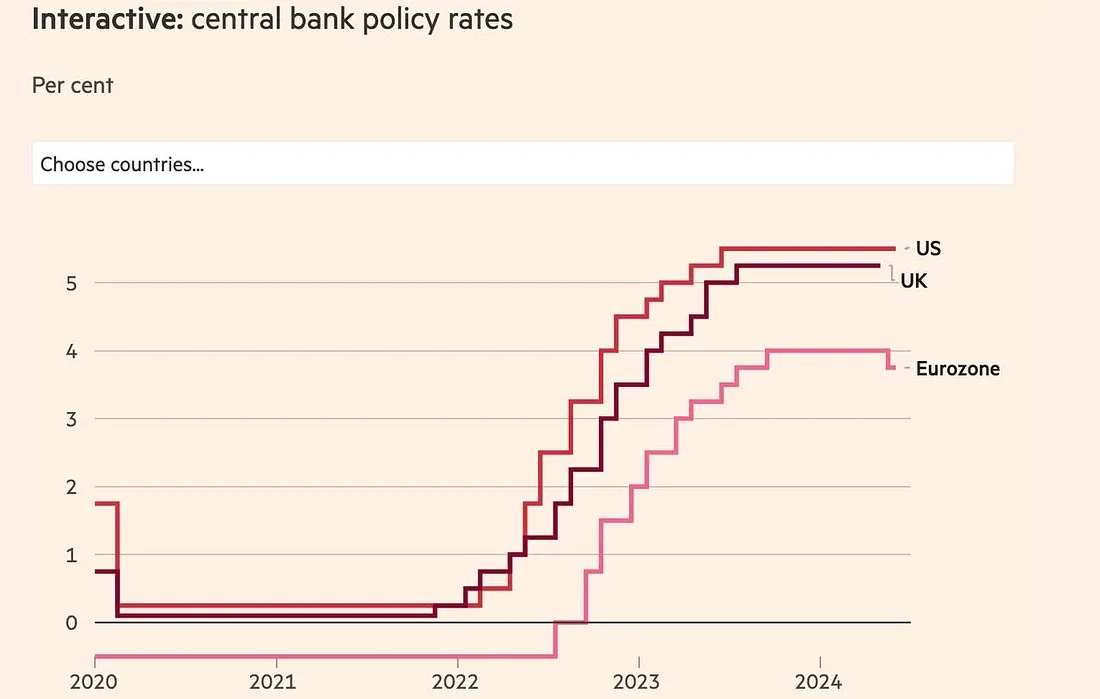

And currently, the United States is facing another major issue as Europe has recently chosen to cut interest rates. The euro, as the second largest globally circulating payment currency, has always been in competition with the US dollar. The interest rate cut in Europe has led to a large influx of funds into the United States, which will push up the cost of funds for US banks. The interest rate cut in Europe will further increase the strong competition from European companies, which will have a greater impact on the US manufacturing industry. The main consideration for Europe's interest rate cut is also based on internal economic problems, choosing to address economic issues in the face of inflation and economic problems. In addition, there is a high probability that this decision is related to the US interest rate hike and the Russia-Ukraine war, as the Russia-Ukraine war is part of the US dollar's acquisition of the euro. The interest rate cut can also be seen as a confrontation with the US dollar. Furthermore, after the Russia-Ukraine war, many countries have taken measures to avoid being acquired by the US dollar, such as Saudi Arabia and Iran settling oil in RMB, and the 10 ASEAN countries settling in their own currencies.

In the current situation, if the United States does not cut interest rates, facing economic encirclement from various countries, the US economy may collapse first; but if it does cut interest rates, facing a rebound in high inflation, the US dollar economy will also face serious problems. However, from the current situation, the US economy may be facing more precarious problems than inflation. And this year is an election year, according to the analysis of the International Monetary Fund (IMF), economic policies in election years are usually influenced by political and economic factors. The government may take measures before the election to maintain economic stability and increase voter support. However, the policies after the election may be adjusted according to the new government's economic strategy. So, the current situation suggests that there is a high possibility of changes around November.

https://www.ft.com/content/088d3368-bb8b-4ff3-9df7-a7680d4d81b2

It is difficult to make an accurate judgment on the current economic strategy at this stage. From an overall perspective, our view is that there is a greater possibility of interest rate cuts. This view is mainly intended to express some more macroscopic aspects that the cryptocurrency market is facing and should pay attention to. Ultimately, we need to consider and pay attention to whether there is capital entering the market.

Is the Technological Revolution Capable of Economic Recovery?

In addition to monetary policy to regulate the market economy, the development of technological revolution is also something that needs to be closely watched. Technological innovations at the technical level will change the way of productivity, thereby generating significant economic effects. For example, the emergence of the internet has changed all aspects of human communication, entertainment, and travel. The dominance of the US dollar economy is mainly supported by strong military hegemony and oil settlement, and currently, both of these cornerstones are being shaken. Therefore, for the US dollar to continue to maintain its dominance, it will need to find new support.

The breakthrough in AI technology is currently receiving a lot of attention, and it is believed that most practitioners are already or are in the process of changing the way they learn, produce, and think because of AI. Technological development always progresses exponentially, and while it replaces some job categories and opportunities, it also creates more extensive opportunities and imagination space. From a macro perspective, AI technology is likely to become the next support point for the dominance of the US dollar. And for the stability of the US dollar and the global economy, as the leading economy, the United States will have comprehensive motivation to promote the development of AI technology. Of course, it is undeniable that technological innovation is developing in an unstructured manner and has a high degree of uncertainty, but it is believed that with the support of the leading economy, AI will have a great possibility.

According to PricewaterhouseCoopers (PwC) research report on global artificial intelligence, it is estimated that by 2030, AI is expected to contribute as much as $15.7 trillion to the global economy. This growth mainly comes from the increase in productivity and the increase in consumer demand.

Increase in productivity: The application of AI technology can significantly increase productivity through automation and process optimization. It is expected that this part will contribute to about $6.6 trillion of economic growth.

Increase in consumer demand: AI can stimulate consumer demand through personalized products and services, and improving user experience, and is expected to bring about $9.1 trillion of economic growth.

Regional Impact:

China: It is estimated that China will benefit the most from AI, potentially increasing its GDP by $7 trillion. North America: The North American region is expected to increase its GDP by $3.7 trillion. Europe: European countries are expected to increase their GDP by about $2 trillion.

It should be noted that as of 2024, the global gross domestic product (GDP) is approximately $45.72 trillion. 「4」 So, despite the current global economy not being optimistic, there is still a certain positive attitude towards the future economic trend.

AI technology is bound to also affect the development of blockchain technology, thereby further changing the way the cryptocurrency game is played and creating more imagination. Currently, in the primary market, we have not yet seen particularly real and outstanding AI technology entering the industry. From the perspective of technological change and discussing new opportunities for capital entry, the fund believes that DePIN and Intent & Abstraction may rise in the current primary market, bringing new imagination to the world of cryptocurrency.

Imagination, the Rise of DePIN and Intent & Abstraction

The primary market has access to and in-depth research on many tracks. After years of hard work in the crypto world, many investors find it difficult to be interested in DeFi, GameFi, SocialFi, and other content. Because in these areas, it is difficult to see breakthroughs in new technologies and the infusion of fresh blood. However, projects and founders in the DePIN and Intent & Abstraction tracks have attracted the attention of the fund, and we also hope to share what we have learned and heard with the market.

DePIN Track

The outdated definition and classification of DePIN, as well as the related reports on the market, are numerous, so we will not go into detail here. We believe that many funds or users who have not had contact with DePIN projects still have certain biases against DePIN. In a rapidly developing industry, biases will always be an obstacle to raising awareness and capturing more opportunities to earn more capital. It is not difficult to imagine that if you have not had in-depth contact with DePIN, you may still think that the current DePIN track is similar to the traditional technology chain reform of the past. But the reality is not so. There are already some DePIN projects making a name for themselves in the market, such as the DePIN Layer1 project peaq, the Mapping track Hivemapper, the automotive IoT track DIMO, and the modular infrastructure IoTex, and so on. There are already many introductions and analyses of leading projects on the market, so we will not go into detail here. What we want to share more is what we have learned and seen in the primary market.

Through our study and research on the DePIN track and extensive contact with projects, we have found:

Projects with traditional real-world business applications are bringing incremental users to the cryptocurrency market and have the ability to convert users from Web2 to Web2.5/Web3

DePIN companies with the ability to meet real demand are entering this track, and their technological capabilities have certain advantages in the segmented field

The project teams have strong business landing expertise

In extensive contact with DePIN projects, there are many roles related to Helium. For example, Hotspotty as the first European hotspot for Helium, manages nearly 40% of Helium devices and has brought in nearly 300,000 users. Most of these users were previously unfamiliar with Web3 as Web2 users, and they are now continuing to participate in more DePIN projects because of Helium. Hotspotty co-founders Maxime Goossens and Daniel Andrade are actively expanding the DePIN Hub (a platform where users can find DePIN stories and alpha) and strengthening the cohesion of the DePIN community through innovative social features.

If Helium is one of the top-performing DePIN projects, it is an exception. Let's take a look at the situation of other DePIN projects, whether it's Natix, which focuses on mobile road maps, or Teneo, which started with an RWA Launchpad and gradually transitioned to the DePIN Data Layer. Most initial users come from the Web2 world (meaning users who are not familiar with crypto trading), and over time, they have gradually transformed into Web2.5/Web3 users as they follow the project's development. Similar projects are not uncommon. We believe that every DePIN project is bringing incremental users to the Web3 world.

Speaking of DePIN companies that meet real demand, I would like to share two recent projects we have been in communication with. One of them is Staex, led by founder Dr. Alexandra K. Mikityuk. Staex is a zero-trust network for IoT devices that defaults to blocking all network traffic and enforces communication through mutually defined tunnels. The company was created at the blockchain research institute under Telekom Germany, the parent company of T-Mobile. The company's technology is currently being used in drones, EV charging stations, and other devices, and has achieved a balanced budget this year.

Another project is ROVR, a decentralized 3D data collection, processing, and storage platform primarily used for vehicle autonomous driving. Led by CEO Ling Guang, the team members are industry experts in the field. The founding team has led the technical development of Baidu Maps and NavInfo, and has led the cooperation between HD maps and Mercedes in China. They have also been deeply involved in the development of the Helium project as a major manufacturer. ROVR's 3D scene generation data and automatic annotation technology is industry-leading, and they have recently received confirmation of cooperation and encouragement from Baidu and Alibaba teams for their supported projects, and are encouraged to further develop their technology in this field. ROVR is also actively engaging with other leading players in the traditional automotive and autonomous driving fields, and will officially launch hardware to provide more opportunities in the future.

Of course, when it comes to DePIN projects entering the Web3 market, the biggest obstacle we currently see is that the DePIN project teams lack sufficient understanding of Web3 gaming. However, at the same time, this is also the part where the fund or industry practitioners can provide the most support. For the fund and practitioners, the teams behind these valuable projects have been deeply involved in niche technology for many years and have solid business landing capabilities.

Intent & Abstraction Track

After the concepts of Intent and Account Abstraction were proposed by Vitalik Buterin and officially entered the market's attention, many developers have entered this track to conduct product development research. Before Taobao entered the public eye, many investors were dismissive of it, and before Uniswap was born, most people questioned the possibility of DEX. Many people still believe that mass adoption is just talk on paper. But with the development of Intent & Abstraction, a more user-friendly experience and a more accessible crypto experience are imperative. In addition to the notable projects on the track, such as Biconomy and XION, our observations and conclusions about the primary Intent & Abstraction track projects are:

Account Abstraction is the starting point, and it is more imaginative for infrastructure-level content

At the infrastructure level, it significantly improves user experience, reduces cumbersome operations, and is more in line with modern user habits, making it easier for new users to enter

Intent & Abstraction is often combined with AI, and the implementation of automatic on-chain contract reading, calling, and operation will bring more development potential to cryptocurrency transactions and applications

Interoperability of multiple chains and applications based on Intent & Abstraction opens up new crypto experiences

The founders of the Intent & Abstraction track are young and multi-talented, with a deep understanding and awareness of Web3

One notable figure is Ash Ahmed, a 20-year-old recent Harvard graduate who is developing a project called Axal, an Intent Coordination Layer that provides a comprehensive solution for monitoring, calling, and executing multi-chain data and task automation to automate the trading needs of DeFi Protocol users. The market's replacement of user-executed Intent is still relatively simple, and Axal is still in a very early stage. It may not become the best Intent Coordination Layer, but it has created an imagination that represents the future, where crypto trading can be accessed by any platform (such as decentralized financial protocols, games, or social networks) through a coordination layer for cross-chain, swapping, and monitoring activities.

Another memorable project is Abstract, founded by Adair Kelley, a multi-talented individual with skills in music, development, and public speaking. Abstract provides developers with a technical solution for full-chain development, allowing users to discover, register, and use any application on the blockchain without needing to understand the underlying technology. Abstract is not the only project working on this solution, but its development is certainly the future trend.

Whether it's Axal, Abstract Money, or other Intent & Abstraction track projects, they are creating a more user-friendly and operable usage scenario. Just as internet products have been developed to provide a better user experience, should Web3 products also do the same?

I believe that both DePIN and Intent & Abstraction are catching our attention among many tracks. The main reason is that the characteristics of the tracks and projects are strongly correlated with capital conversion, user and market growth, which will bring more imagination to the cryptocurrency market.

The Future Pulse: How Will It Beat?

All crypto practitioners have been pondering one question: What has blockchain changed? Decentralization? Distributed ledger? Or has it provided a new playing field for everyone? In fact, everyone has their own answer.

From a financial perspective, the emergence of smart contracts has provided entrepreneurs with new financing methods, with the most significant change being the use of tokens instead of traditional equity. The benefits of this shift include effective control over issuance and preventing over-issuance, but the downside is the high cost of adjusting the interest structure as the project develops, making it difficult to achieve. In terms of rewards, token design is more about rewarding early contributors, while equity is more about rewarding continuous contributors. Therefore, tokens are more suitable for scenarios with clear rules and very clear interest distribution, making them highly compatible with the characteristics of token economy design in the DePIN scenario.

From a technical perspective, blockchain's main technologies are decentralization and smart contracts. The famous "impossible trinity" illustrates the dual nature of everything, so as a new technology, blockchain must have its limitations at the application level. Despite many years of technological development, the scale of blockchain has not yet achieved true exponential growth. Looking at the evolution of the internet industry, a more user-friendly, easy-to-use, and more usable technology and products are what can unleash astonishing power, leading to exponential breakthroughs in scale. This is why Abstract and Intent should be a core focus.

BTC, as digital gold, will continue to expand in terms of its intrinsic value and scale, but that does not mean that blockchain will grow in proportion. Currently, the innovative DeFi track in the financial sector has already shown its ceiling. Blockchain needs to seek breakthroughs in real industries, applying blockchain technology to real industries to provide technical services for true business, solving specific problems that can be addressed by technological advantages. Then, integrate existing DeFi content to create more wealth effects. In addition, looking to the future, AI seeks to combine machines and systems in business scenarios, using the technological characteristics of blockchain to address needs such as accounting and settlement.

The market in July seems to be more disappointing. Faced with the overall market situation, we may feel at a loss. But we believe that in both the traditional world and the crypto industry, there are technologies and products that can bring hope. The market may stagnate, but once technology is activated, it will never stop unless it is eliminated. The only thing we can do is to follow the footsteps of technology, continue to learn and improve, step into every needed field silently, and change the world quietly. We always believe that technology is benevolent, and technology and business make human life better.

Sources (1)Ben Bernanke and Olivier Blanchard (2023). What Caused the U.S. Pandemic-Era Inflation? (2)US Bureau of Labor Statistics. Consumer Price Index. 2024. (3)US Bureau of Labor Statistics. Non-farm employment data. 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。