Original Author: Biteye Core Contributor Wilson Lee

Original Translation: Biteye Core Contributor Crush

The first half of 24 years is about to end in the correction and consolidation of the cryptocurrency market. In this round of the cycle, BTC rose rapidly under the influence of ETF and the performance of altcoins was relatively average. Many retail investors who missed out on BTC often complained about "not feeling involved."

As the market continues to correct and consolidate, especially with many altcoins losing almost all of their gains from the past six months, new opportunities may be quietly brewing.

This article combines market hotspots and insights into future trends, taking stock of the tracks and targets we believe are worth paying attention to in the second half of the year. The views expressed represent current thoughts only.

01 Macro Perspective: The bull market is likely not over, with risks and opportunities coexisting

In the initial stage of this round of the cycle, the three core driving forces of ETF, BTC halving, and interest rate cuts have become deeply ingrained.

From the "ETF approval" farce reported by a well-known media last October, to the formal approval of BTC ETF in early January, the expectation gap for ETF has dominated the direction and game of the entire market;

The BTC halving in April did not cause drastic fluctuations in the market under the influence of geopolitical conflicts at that time.

With the landing of the first two core driving forces, it is difficult for them to become the fuel that ignites the market in the future.

Therefore, speculation around interest rate cuts and the improvement of liquidity due to interest rate cuts will be the biggest external driving force for the subsequent outbreak of the cryptocurrency market.

For most cryptocurrency investors, perhaps waiting for the release of core data each time to profit from short-term fluctuations is not the main way to make a profit. Therefore, we only need to be clear that over a longer time span, the market still has interest rate cut benefits to look forward to, which is enough to indicate that the bull market is likely not over, and the correction and consolidation imply the incubation of opportunities.

Comparing the consolidation range of this round with the previous one, we can see that the current technical form of BTC seems to present a frightening "M top," but the degree of correction is far less than the over 50% correction after the first high of the previous round, and the consolidation time is also much shorter than the previous round.

From a risk perspective, the depth of BTC's correction is relatively small compared to the previous round, and under the overlay of external negative factors, it may further test lower support levels;

From an opportunity perspective, the short formation time and small magnitude of the "M top," the existence of interest rate cut expectations, also indicate that the market is likely still gathering strength for the next climb, and the market has found support around 55,000.

Long-term opportunities probably exist, and the cost of chips and the preservation of principal will be the determining factors for the next wave of returns.

Source: https://www.tradingview.com/chart/mBmRDBZW/?symbol=BINANCE%3ABTCUSDT

02 Meme: The track with the highest odds in this round

2.1 Track Background and Core Logic

The myth of getting rich from Memecoins such as $DOGE and $SHIB has been enduring in the industry, and it has also been an opportunity for many users to enter the crypto space.

The status of Memecoins has been further highlighted in this round of the cycle, both in terms of asset market value and trading volume, and has gradually developed into one of the core tracks in the crypto space.

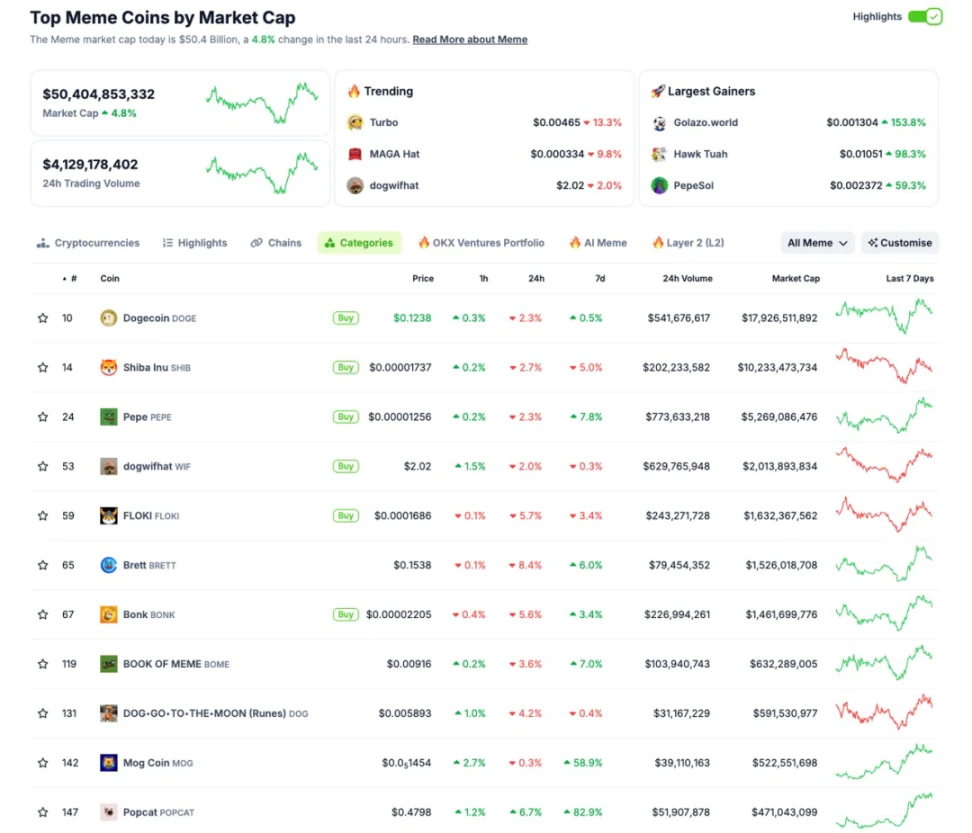

The total market value of Memes has exceeded 50 billion USD, accompanied by a trading volume of over 4 billion USD.

We can also see from the ranking of Memecoins that the memes following $DOGE and $SHIB are the new stars of this round, further proving the excellent performance of Memecoins in this round.

Source: https://www.coingecko.com/en/categories/meme-token

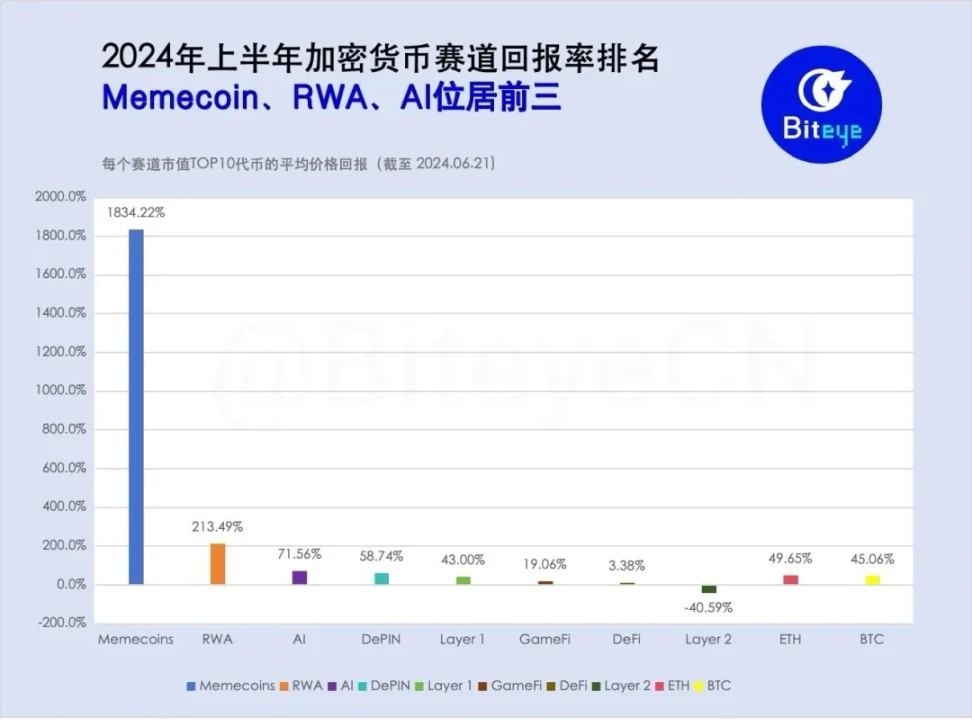

In terms of track returns, Memecoins also have the highest overall returns, surpassing popular narratives such as RWA, AI, and DePIN.

Source: https://mp.weixin.qq.com/s/uy6y45d9rinmxkoCj7d1EQ

The core reason why Memecoins have been sought after by investors in this round is that the odds of Memes are relatively better.

Retail investors are more likely to get early chips: With the expansion of the primary investment market in the crypto industry, the upward valuation of projects by VC institutions has to some extent squeezed the profit space of retail investors. In contrast, the chip distribution of Memes is relatively fair, giving retail investors more opportunities to acquire more chips, thus significantly reducing the price disadvantage.

Unlimited valuation, great imagination space: The vast majority of Memecoins do not have core businesses, and their valuation is entirely based on market imagination.

Low consensus threshold: Memecoins carry content that is more straightforward and easy to understand, not requiring investors to have a large amount of fundamental knowledge, and can accommodate the consensus of the widest range of investors; in addition, Memecoins can continuously capture various hot topics in reality, attracting attention and funds.

The risk of Memes lies in the excessively large token supply, making it difficult for investors to find certain targets, and Memecoins' volatility, which brings high returns but also comes with extremely high risks.

2.2 Focus Targets

It is difficult to value Memecoins and classify them from other perspectives, so below, we will select Memecoins with good odds based on their current market value.

Compared to the old blue chips $DOGE and $SHIB, the new blue chip Memes that have risen in this round of the cycle have better opportunities.

2.2.1 Blue Chip Level: $PEPE, $WIF

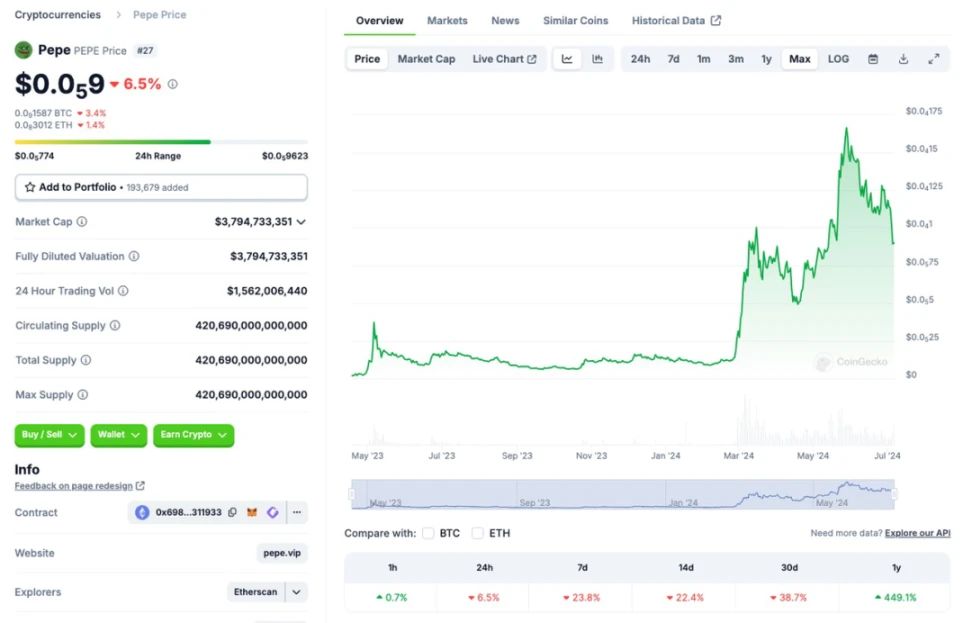

$PEPE, as one of the most eye-catching Memecoins in this round, has shown extremely strong price performance in this round.

In terms of $PEPE's own symbol, as a widely circulated Meme on major social media, it has a high degree of recognition.

From the perspectives of consensus and cultural consensus, $PEPE is undoubtedly the first choice for Memecoin investment.

In addition, $PEPE currently has a market value of about 5.3 billion USD, reaching the market value level of the peak period of $DOGE or $SHIB, which has certain odds and market acceptance.

Source: https://www.coingecko.com/en/coins/pepe

$WIF, as one of the most representative Memecoins of Solana, has also achieved outstanding performance in this round of the cycle.

The image of wearing a hat has become deeply ingrained, giving rise to various other Memecoins with hat-wearing images.

$WIF's strong rebound after a decline has also become the first choice for many investors to bottom fish.

Source: https://www.coingecko.com/en/coins/dogwifhat

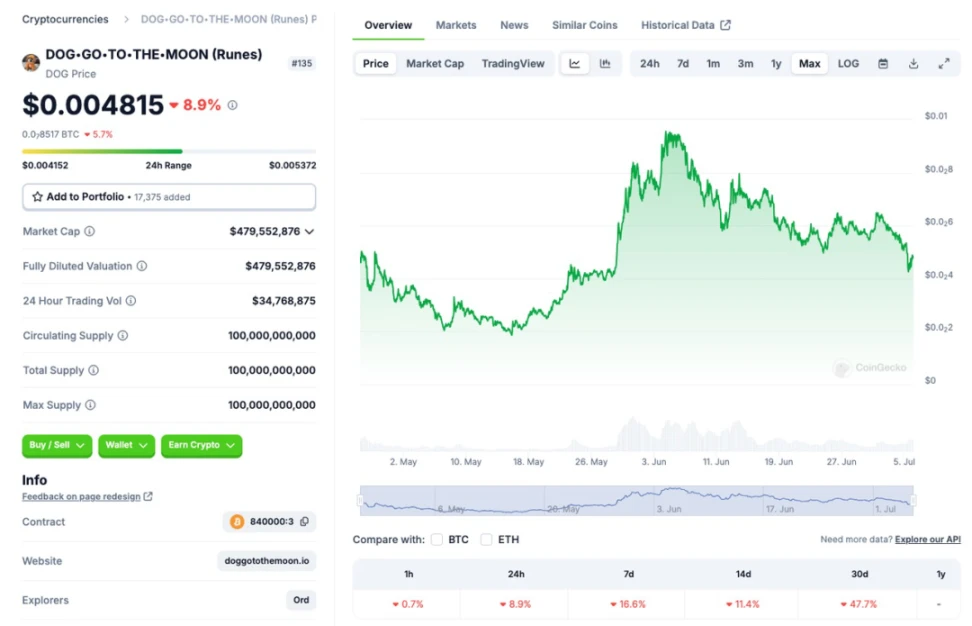

2.2.2 Small and Medium Market Value: $DOG, $BOME

$DOG, as the dragon of the Runes track, is highly likely to erupt with the rise of BTC in the future.

Runes, as an iterative upgrade solution for inscriptions, have a certain probability of reproducing the FOMO effect of inscriptions in the future, making it easier to ignite the enthusiasm of retail investors.

In addition, the label of a new asset and the expected launch of Pionex may also become core factors driving the rise of $DOG.

Source: https://www.coingecko.com/en/coins/dog-go-to-the-moon-runes-2

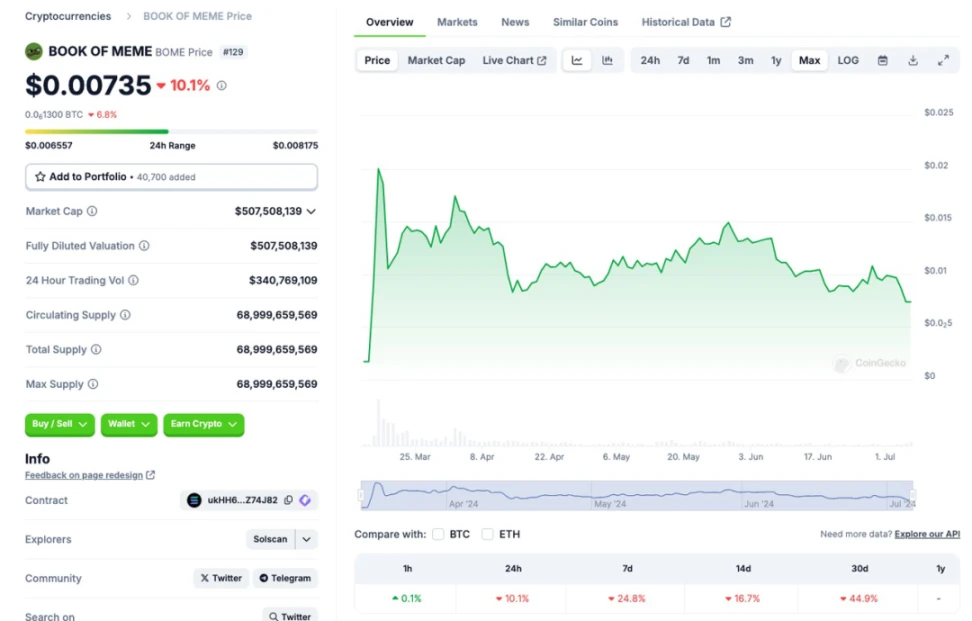

$BOME is also a representative asset of this cycle, breaking Binance's record and surpassing a market value of over 1 billion USD in 3 days, initiating a new trend of presale payments, and holding an important position in the minds of investors.

$BOME still belongs to the cultural category of PEPE, with a current market value of approximately one-tenth of $PEPE. Although it peaked at its debut, it has not started a second market, so $BOME has a certain potential for eruption.

Source: https://www.coingecko.com/en/coins/book-of-meme

03 AI /DePIN: Riding the AI Development Trend

3.1 Track Background and Core Logic

The skyrocketing popularity of ChatGPT has completely ignited the entire AI industry, and the impact of AI on humanity has been elevated to the level of the "Fourth Industrial Revolution." The skyrocketing of AI is directly and profoundly affecting the cryptocurrency industry through the core logics of digital economy and hardware demand.

As the penetration of AI into people's daily work and life continues to increase, the issue of computing power becomes increasingly prominent, and the market continues to raise the pricing of computing power companies such as NVIDIA.

Computing power equipment is also a core pillar of the cryptocurrency industry. Before the skyrocketing of AI, the cryptocurrency industry's demand for computing power had long fueled the rapid development of companies like NVIDIA.

With the development of the cryptocurrency industry, computing power has become surplus, and AI has gradually become the demand side for this idle computing power.

In addition, AI's task execution, resource allocation, and data input behaviors all occur entirely in the digital world, and the distribution of benefits behind it is difficult to define clearly within traditional frameworks, temporarily referred to as digital economic disputes.

The cryptocurrency industry's characteristics such as accounting and Proof of Work naturally lend themselves to resolving these digital disputes and coordinating the interests behind AI software and hardware.

The skyrocketing of AI has brought a clear direction for the development of Crypto in the bear market, and various distributed AI computing power, algorithm projects, etc., have emerged, forming the current AI/DePIN track.

As the binding of the AI/DePIN track with AI deepens, the actions of companies like NVIDIA and OpenAI begin to influence the market for related tokens. With the emergence of hotspots due to the advancement of AI technology, the cryptocurrency industry will develop in tandem with the trends and hotspots of the AI market.

3.2 Focus Targets

Currently, Crypto x AI projects have penetrated various aspects of AI. Below, we will analyze targets worth paying attention to from the perspectives of computing power supply, algorithms, and the AI economy.

3.2.1 Computing Power Supply

The AI products we currently use rely on the underlying large language models, and the construction of large language models depends on underlying GPU computing. The cryptocurrency industry not only has a reserve of computing power equipment but can also build a computing power market through blockchain incentives to provide additional sources of computing power for AI.

Keywords such as distributed and idle computing power are characteristics of the cryptocurrency industry's provision of computing power, with the corresponding core narrative being cost reduction.

3.2.1.1 Arweave/AO

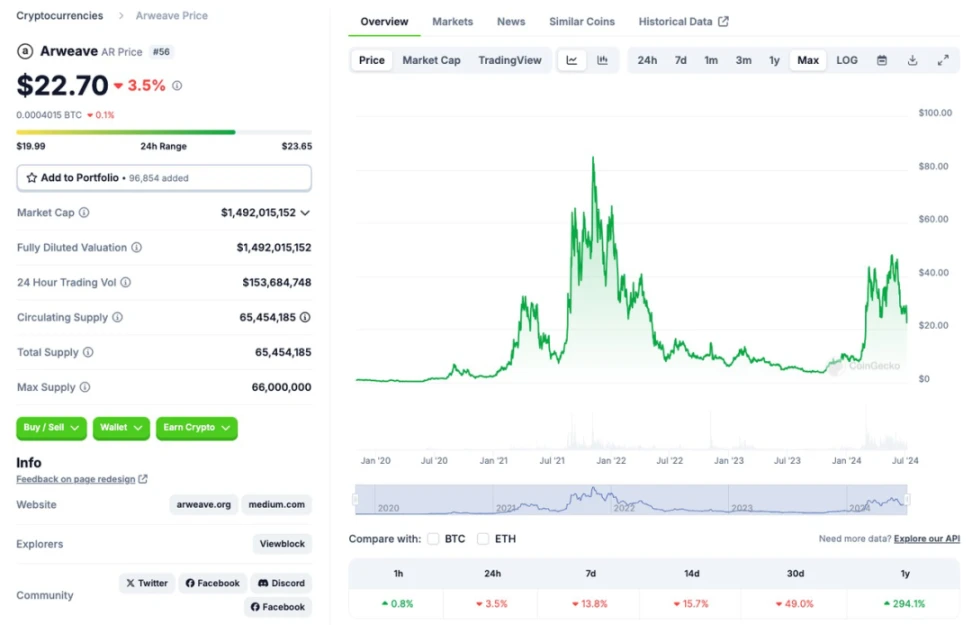

Arweave, as a veteran storage project, has firmly occupied a leading position in the storage track with its excellent ecosystem and cost-effectiveness.

With the launch of the computing platform AO, Arweave has officially entered the distributed computing market, becoming the concept token for computing power.

Compared to other computing power projects, AO can naturally leverage Arweave's existing storage advantages to achieve high coordination between the computing layer and the storage layer, which is crucial for on-chain large models.

In addition, AO has made aggressive designs in parallel computing, message passing, and other aspects, giving AO relatively stronger performance compared to other distributed computing projects. Therefore, AO actually has a natural advantage in terms of computing power.

The launch of the AO platform and related public relations activities (PR) have jointly driven the price of $AR, which is enough to show the market's recognition of AO.

With the continued development of Crypto x AI, $AR/AO will become one of the most promising AI tokens.

Source: https://www.coingecko.com/en/coins/arweave

3.2.1.2 io.net

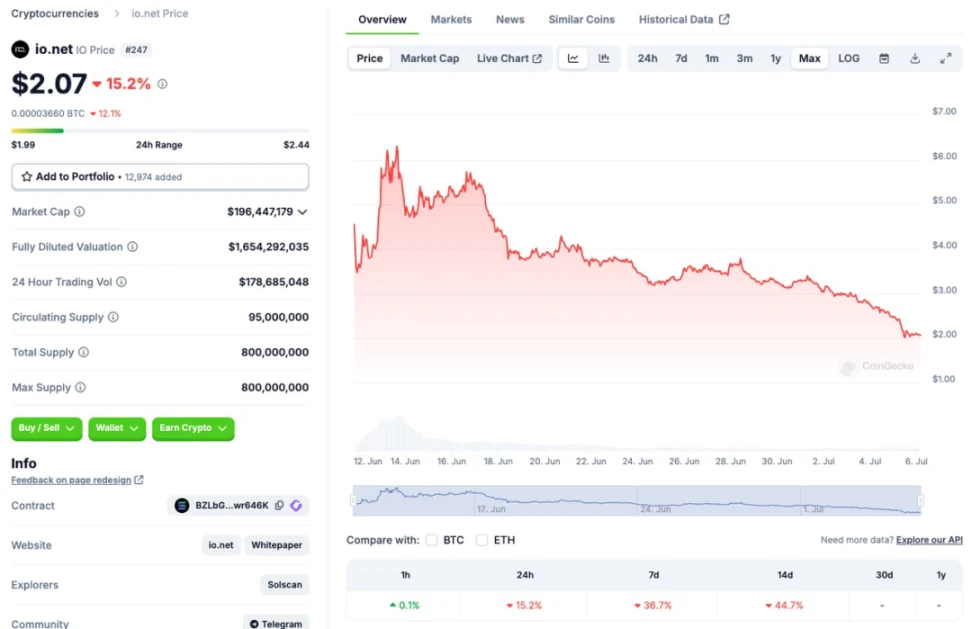

io.net, which recently launched on Binance, is currently a hot commodity in this track. io.net is a decentralized GPU network designed to provide massive computing power for machine learning applications.

Their vision is to unlock fair access to computing power by assembling over a million GPUs from independent data centers, crypto miners, and projects like Filecoin, making computing more scalable, accessible, and efficient.

io.net offers a completely different approach to cloud computing, utilizing a distributed and decentralized model to provide users with more control and flexibility over computing power, with services that are permissionless and cost-effective.

According to io.net, their computing power is 90% lower than centralized service providers like Amazon AWS, making io.net a leader among decentralized providers.

Source: https://www.coingecko.com/en/coins/io-net

3.2.2 Algorithms

3.2.2.1 Bittensor

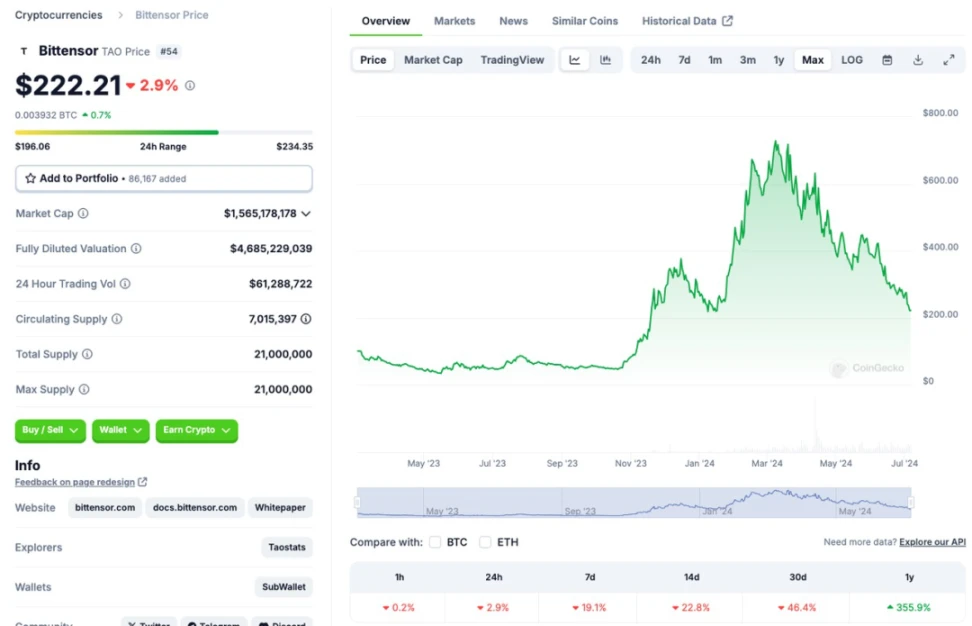

Bittensor is a decentralized network that connects global machine learning models, improving the accuracy and efficiency of solving complex problems by collaborating multiple specialized AI models. This method combines the unique advantages of various models to produce more precise and comprehensive results, which are more outstanding compared to traditional single-model methods.

Bittensor also gains scalability through ecosystem building, and currently, it can accommodate 32 subnets to serve various vertical scenarios.

Bittensor's innovative practices in algorithms and ecosystems fully utilize decentralization to stimulate AI. With a market value close to 6 billion, it is a relatively reliable target.

Source: https://www.coingecko.com/en/coins/bittensor

3.2.3 AI Economy

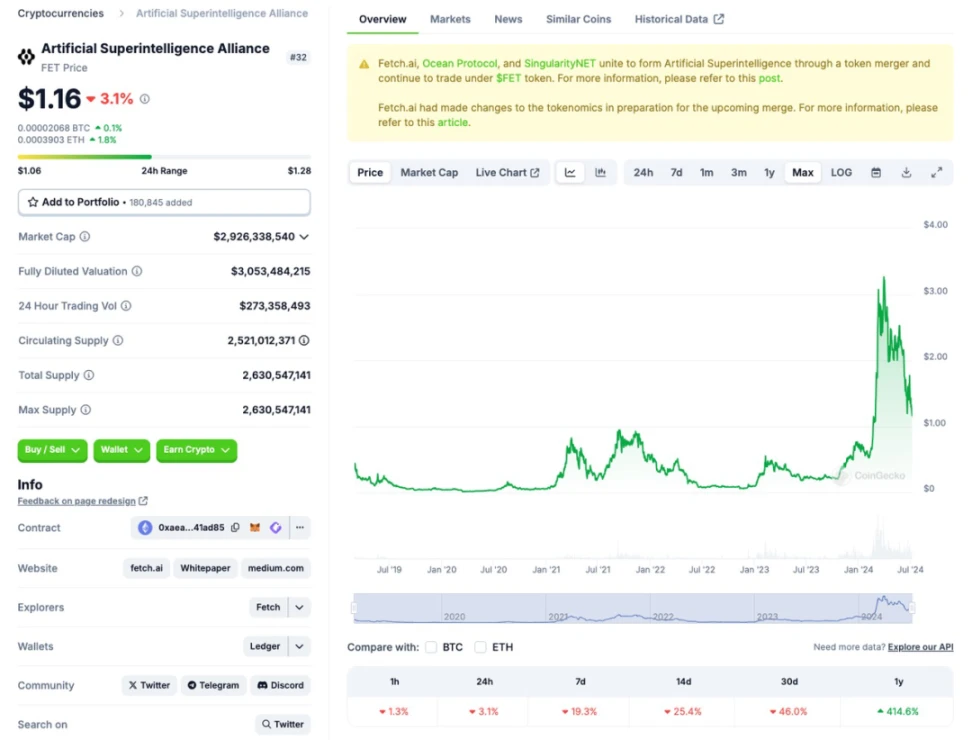

3.2.3.1 Artificial Superintelligence Alliance ($ASI)

ASI is a merger of three Crypto x AI projects that have been deeply involved in related fields for many years: Ocean Protocol ($OCEAN), SingularityNET ($AGIX), and Fetch.ai ($FET).

After the merger, the three projects will establish a team called the Superintelligence Collective, with SingularityNET founder Ben Goertzel serving as the CEO. The three projects will continue to operate as independent entities but will closely collaborate in the shared $ASI token ecosystem and the operations of the Superintelligence Collective.

The merger announcement from the three teams did not provide much information about the new business to be conducted after the merger.

According to Ben Goertzel's social media posts, the future direction of work after the merger will focus on AGI (Artificial General Intelligence) and ASI (Artificial Superintelligence), which is also the reason for the merged token being named $ASI.

Token conversion information:

Fetch.ai's token $FET will be converted to $ASI at a 1:1 ratio.

SingularityNET's $AGIX and Ocean Protocol's $OCEAN will be converted to $ASI at a ratio of approximately 1:0.433.

$FET, as the foundational token of the alliance, will be directly renamed to $ASI and an additional 1.48 billion tokens will be minted, with 867 million $ASI allocated to $AGIX holders and 611 million $ASI allocated to $OCEAN token holders.

Fetch.ai already has mature experience in AI agents. On February 20th, Deutsche Telekom announced a partnership with the Fetch.ai Foundation, becoming Fetch.ai's first corporate ally, and Deutsche Telekom's subsidiary MMS will also serve as a validator for Fetch.ai.

Fetch also announced the launch of the $100 million infrastructure investment project "Fetch Compute" earlier this month, deploying Nvidia H200, H100, and A100 GPUs to create a platform for developers and users to utilize computing power.

Ocean Protocol has built many modular services in decentralized data sharing, access control, and payments. It is reported that its product Predictoor has generated sales of over 800 million USD in the six months since its launch.

SingularityNET was the most exploratory in the AGI direction among the three projects before the merger. Its AGI team, in collaboration with partners TrueAGI and the OpenCog community, has been focused on developing the AGI framework OpenCog Hyperon since 2020. SingularityNET will also launch a decentralized artificial intelligence platform this year to create a foundational environment suitable for running AGI systems.

The merger of ASI, which is the result of the merger of three long-standing strong projects, can be described as a product of a strong alliance. With the synergy of business and economic systems, ASI is expected to achieve a new leading position in the Crypto x AI field and maximize the "attention" increment brought by external AI technological developments.

Source: https://www.coingecko.com/en/coins/artificial-superintelligence-alliance

04 RWA: The Inevitable Path for Large-Scale Blockchain Applications

4.1 Track Background and Core Logic

RWA is a key track that closely connects blockchain with the real world. In the long term, it is a necessary requirement for the large-scale application of blockchain. In the short term, it can introduce a large amount of funds and liquidity to both the cryptocurrency market and the real market.

RWA involves tokenizing illiquid real-world assets and introducing them into the cryptocurrency market. The introduction of RWA assets to the cryptocurrency market means more value support for real-world assets, potential overflow funds, and the interest-bearing assets in RWA can also provide enhanced returns for the cryptocurrency market.

For traditional assets, it provides a new way of settlement, allowing illiquid assets to be arbitrated or liquidated quickly.

The influx of funds brought by BTC ETFs has fully demonstrated the interest of external funds in the cryptocurrency market. With the emergence of representative cases in the RWA track, the track is expected to further erupt.

4.2 Focus Targets

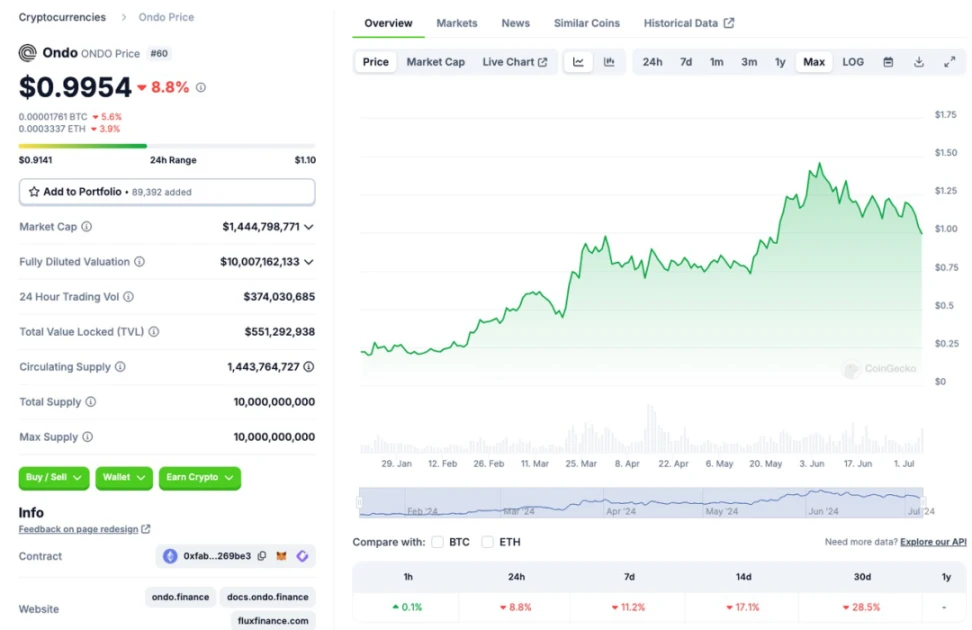

4.2.1 Ondo Finance

Ondo Finance is a decentralized financial platform for RWA. Through blockchain technology, Ondo Finance creates a transparent investment infrastructure for institutional investors, aiming to become an on-chain investment bank, providing various RWA products including bonds, real estate, and commodities to meet the needs of different investors.

With the rapid growth of the RWA market, Ondo Finance, as a pioneer in the industry, has tremendous development potential.

Its transparent and efficient investment platform will continue to attract more institutional investors, further driving the development and maturity of the market.

Source: https://www.coingecko.com/en/coins/ondo

4.2.2 Swarm Markets

Swarm Markets is a blockchain platform that provides digitalization and trading solutions for traditional finance.

It encrypts physical assets, including U.S. Treasury bonds and stocks, and provides a legal trading infrastructure.

Swarm Markets is the world's first DeFi platform to obtain a license from BaFin (German Federal Financial Supervisory Authority), ensuring that its operations comply with financial market regulatory standards.

As more and more traditional financial assets are tokenized, Swarm Markets' compliant and diversified trading platform is expected to gain more market share in the future.

Its innovative financial solutions will continue to attract institutional and retail investors, driving the continuous development of the platform.

Source: https://www.coingecko.com/en/coins/swarm-markets

05 Social: User Increment Potential and Ecosystem Incubation

5.1 Track Background and Core Logic

Whether in Web2 or Web3, social networking is the most important and core track.

For the industry, social networking can onboard new users and retain existing users through their own relationships.

For various services and applications, social networking also plays an important role in growth, retention, and increasing user stickiness.

Currently, the penetration rate of the Web3 industry still needs to be improved, and increasing user retention and stickiness are also core issues it faces, with social networking being the main solution to the above problems.

In previous cycles, many social projects have made attempts, but they have not yet produced phenomenal applications.

In this cycle, various technologies and infrastructures that lower the user threshold, ensure performance, and enhance user experience have matured unprecedentedly. The social track is likely to present significant opportunities in this cycle.

5.2 Focus Targets

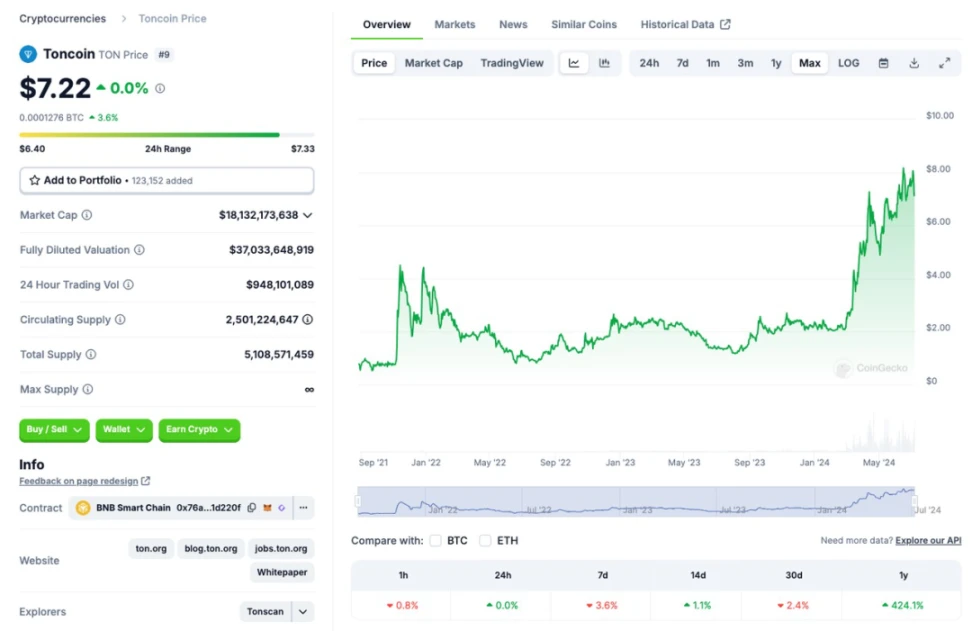

5.2.1 Ton and Projects within the Ecosystem

TON (The Open Network), as the official public chain supported by the social giant Telegram, has leveraged Telegram's massive 900 million monthly active users to create a unique narrative in payments, social networking, and mini-programs.

TON does not require additional user migration costs and can reconstruct Web2's business model in a Web3 manner using Telegram's existing social network.

Currently, the TON ecosystem is still in the early stages of development, but high-traffic projects such as Notcoin and Catizen have emerged, demonstrating the support of Telegram's massive user base.

Therefore, TON and its ecosystem are likely to further stimulate Telegram's user vitality in the future, nurturing a more prosperous ecosystem.

For more analysis, refer to Biteye's previous article: "From Web2 to Web3: How TON Chain Reshapes the Future of Social and Payments"

Source: https://www.coingecko.com/en/coins/toncoin

5.2.2 Farcaster

Farcaster is a decentralized social networking protocol that uses smart contracts and hybrid storage technology to facilitate social connections, content sharing, and data ownership among users, while supporting diverse and flexible client and application development.

Farcaster is not a new social project but has emerged as a leader after enduring market tests. It opened for registration just last October and has garnered market attention this year with multiple advancements in data, ecosystem, and financing, solidifying its position as a leader in the social track.

For more analysis, refer to Biteye's previous article: "Can the $1 Billion Valuation Social Leader Farcaster Become a New Hotspot in the Bull Market?"

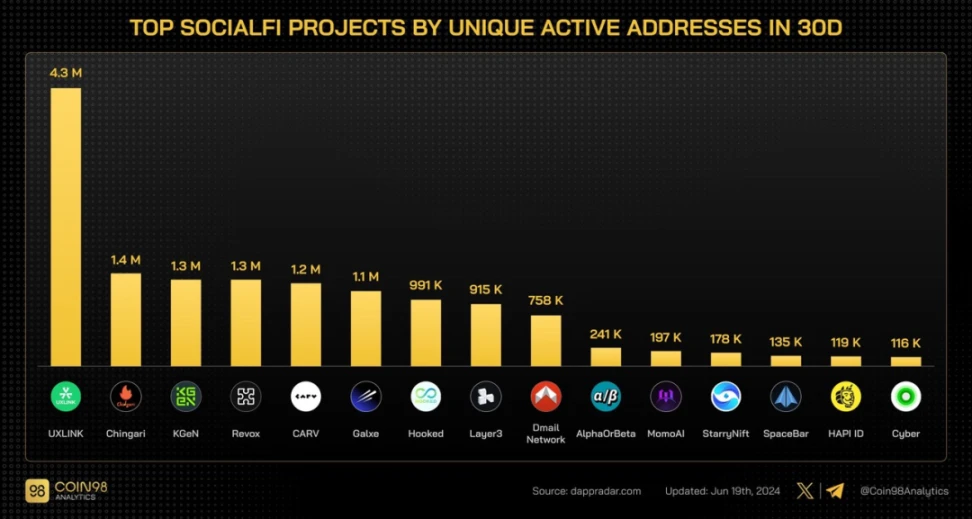

5.2.3 UXLINK

UXLINK is a dApp focused on social networking among acquaintances. Leveraging Telegram's excellent user experience and a clear strategy for "acquaintance relationship fission," UXLINK has achieved significant results in data. In the second half of the bull market, UXLINK has enormous potential for user growth.

For more analysis, refer to Biteye's previous article: "Understanding the Web3 Social Monster: UXLINK"

Source: https://x.com/Coin98Analytics/status/1803363935875375499

06 LSD/LSDfi: Landing Point for Incremental Funds

6.1 Track Background and Core Logic

LSD/LSDfi is a core component for building basic income in the ETH ecosystem. With the imminent approval of ETH ETFs, we expect a large influx of funds into ETFs, driving up the price of ETH. LSD/LSDfi is likely to become a growth point for business, directly driven by incremental funds.

6.2 Focus Targets

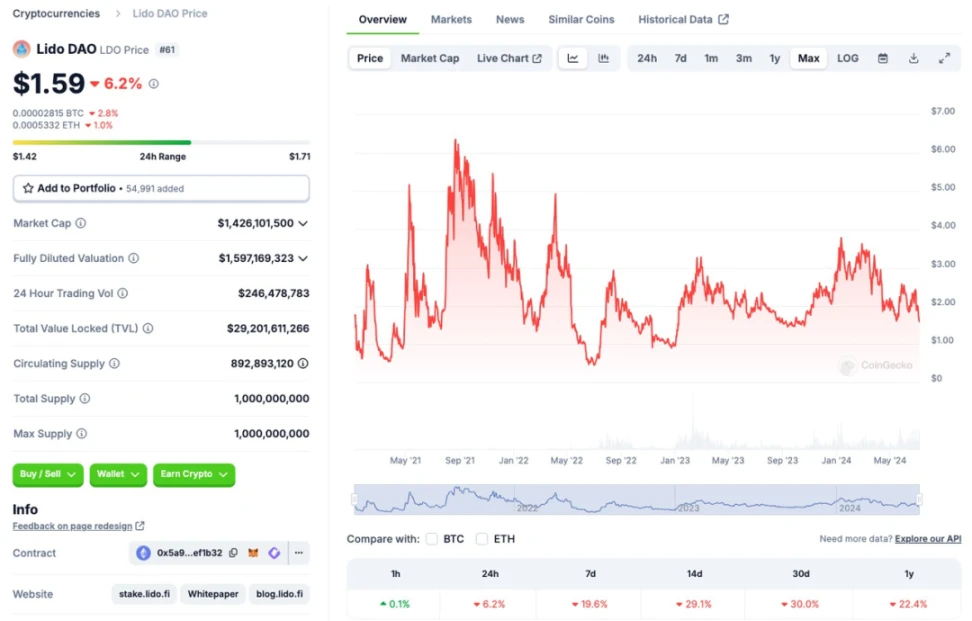

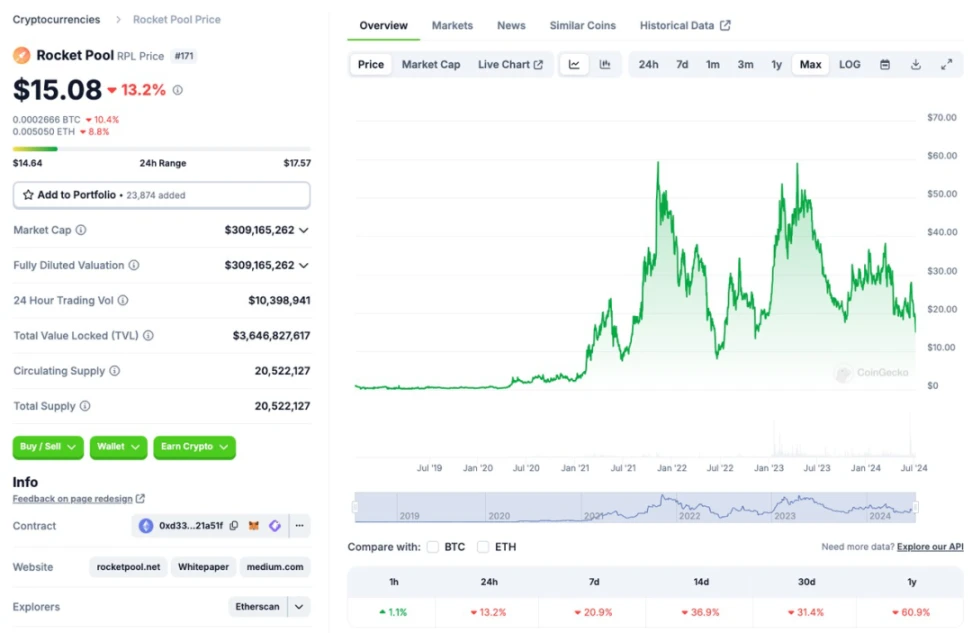

6.2.1 Lido/Rocket Pool

As two leading players in the LSD space, their brands are highly trusted by large holders, and they are likely to dominate the market share in ETH staking increments.

Source: https://www.coingecko.com/en/coins/lido-dao

Source: https://www.coingecko.com/en/coins/rocket-pool

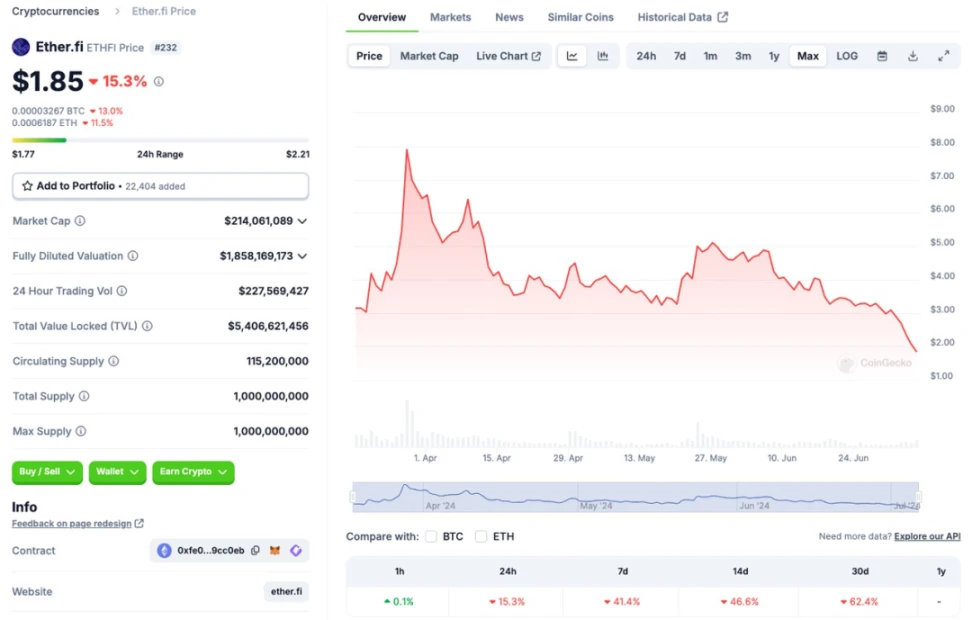

6.2.2 Ether.fi

Ether.fi is a fully self-custodial and decentralized LSD protocol. Unlike other liquidity staking protocols, Ether.fi allows participants to retain control of their keys when staking tokens and can withdraw their ETH from validators at any time.

While ensuring full self-custody, Ether.fi can automatically re-stake users' deposits with Eigenlayer to generate income, further safeguarding users' economic interests.

With complete self-custody and income guaranteed by EigenLayer, Ether.fi also has significant potential to capture a significant market share in the next round of growth in the track.

Source: https://www.coingecko.com/en/coins/ether-fi

6.2.3 EigenLayer

As the pioneer of Restaking, EigenLayer has propelled LSD into LSDfi, further adding a layer of income sources to the Ethereum ecosystem.

The LST ecosystem built around EigenLayer is expected to enjoy the incremental dividends brought by ETH ETFs. The distribution of EigenLayer tokens has already been determined, and its official launch should not be too far off.

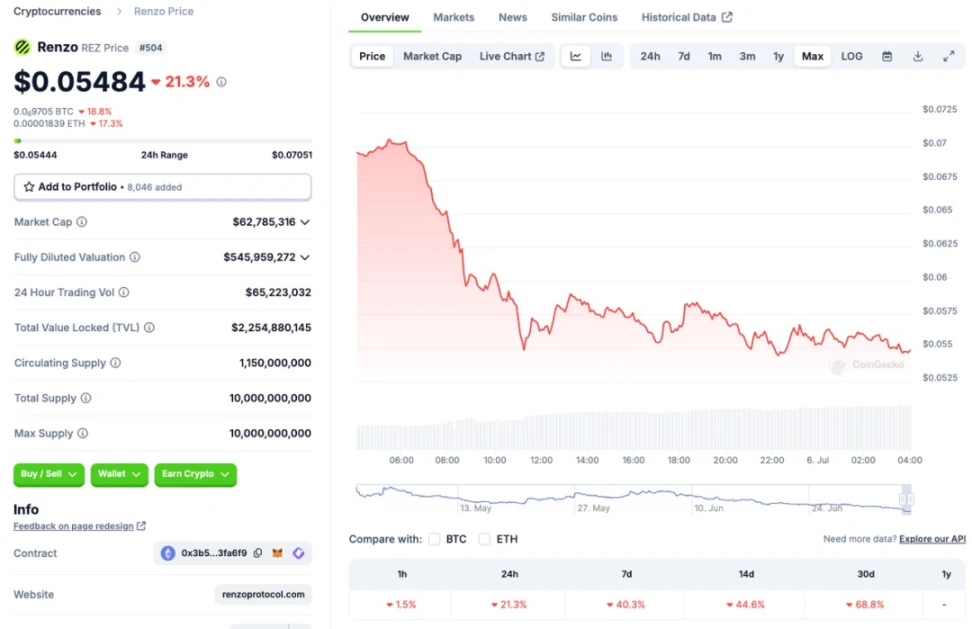

6.2.4 Renzo

Renzo is a re-staking protocol based on EigenLayer, aiming to simplify the complex process of final user re-staking.

By introducing the liquidity re-staking token ezETH, it allows stakers to not worry about the active selection and management of operators and reward strategies, providing higher returns and liquidity.

As an important project in the LRT ecosystem, and with investment background from Binance, Renzo's current market value is quite attractive.

Source: https://www.coingecko.com/en/coins/renzo

6.2.5 StakeStone

StakeStone is a comprehensive LSD/LSDfi project. By integrating mainstream staking pools, Re-Stake, and blue-chip DeFi strategy income, StakeStone provides a highly adaptable staking income base asset for all protocols requiring LSD liquidity.

Users can stake ETH to obtain STONE tokens, thereby gaining native staking and blue-chip DeFi strategy income.

In addition, StakeStone also supports multi-chain operations, further enhancing liquidity and adaptability, and has a unique advantage in supporting new ecosystems and obtaining early rewards.

As a project invested in by Binance, StakeStone is expected to have a significant increase in value after its launch on Binance, and with business growth, StakeStone presents a significant potential opportunity.

6.2.6 Karak

Karak Network is a Restaking network similar to Eigenlayer and other Restaking projects, using a point system to incentivize users to restake and earn multiple returns.

In December 2023, Karak announced a $48 million Series A financing round, led by Lightspeed Venture Partners, with participation from Mubadala Capital, Coinbase, and other institutions. Mubadala Capital is the second largest fund in Abu Dhabi, and with this round of financing, Karak's valuation exceeds $1 billion.

The strong team and impressive investment background indicate that Karak has the strength to compete with EigenLayer and will likely generate corresponding opportunities.

For more analysis, refer to Biteye's previous article: "Is Karak the Vampire Attack on Eigenlayer in Restaking?"

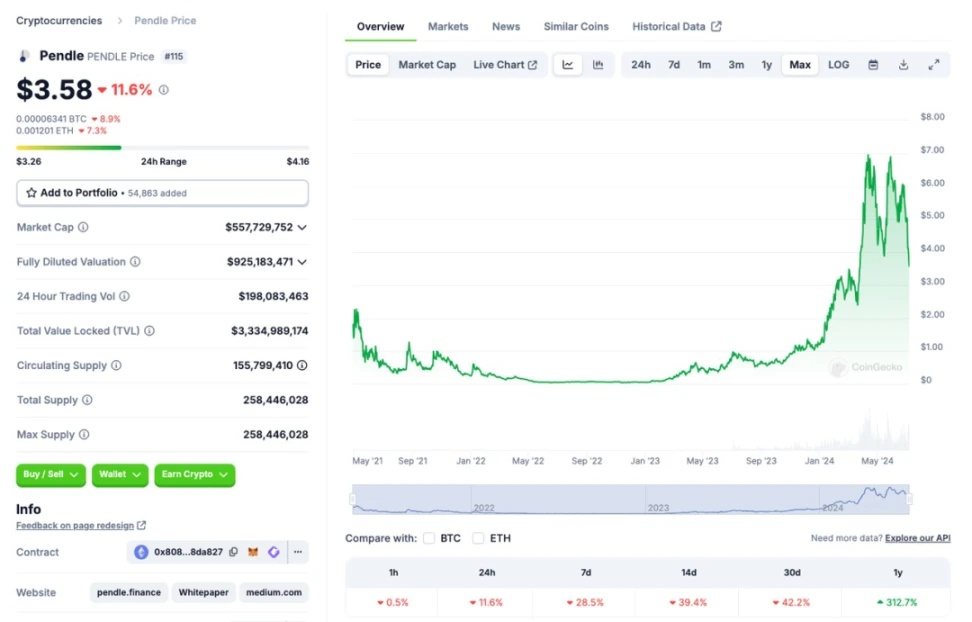

6.2.7 Pendle Finance

Pendle introduces income tokenization and trading, splitting the interest-bearing assets' volatility and principal, bringing a new participation paradigm to the entire LSD.

Pendle's multiple collateral pools and risk management features allow users to more effectively manage risk and hedge potential losses, reducing volatility and risk in the DeFi market.

With the approval of ETH ETFs, a large amount of funds will flow into ETH, driving the development of the LSD/LSDfi ecosystem. As part of this ecosystem, Pendle is expected to benefit from this development.

Source: https://www.coingecko.com/en/coins/pendle

07 BTC Ecosystem

7.1 Track Background and Core Logic

The explosion of the BTC ecosystem is one of the most eye-catching features of this cycle. Inscriptions have ignited market enthusiasm for the BTC ecosystem, and BTC L2 and various assets have emerged like mushrooms after the rain. BTC staking/restaking has gained a certain market position in the fiery BTC ecosystem assets. Runes, as a new type of ecosystem asset, have also shone brightly during the halving.

Behind these attempts is a common starting point: to activate a large amount of BTC funds and create a more prosperous ecosystem.

However, with the pullback of BTC and the wealth creation of inscriptions raising market expectations, the current BTC ecosystem is relatively quiet.

As the market improves, we believe that the BTC ecosystem will once again produce phenomenal ecosystem assets, bringing huge opportunities.

7.2 Focus Opportunities

7.2.1 Runes: $DOG

Analysis can be found in the Meme section. Runes' performance, influenced by inscriptions, can be described as "peaking at debut." As the leader in the Runes sector, $DOG has odds and defensive attributes, so for now, only $DOG is recommended in the Runes sector.

7.2.2 Others

Many BTC L2 solutions have not formed active ecosystems, and opportunities related to BTC staking are still unclear. We recommend waiting for the market to make a choice.

08 Summary and Outlook

The crypto market is no longer a separate market but is gradually integrating into the real economy. When analyzing opportunities in the crypto market, we increasingly feel the importance of external driving factors.

During market changes and adjustments, it is essential to first clarify where we are in a cycle and which internal and external factors are driving the next sub-cycle.

During market consolidation and pullbacks, we should not be dominated by panic, but rather focus on the opportunities behind the decline.

We have summarized the tracks and opportunities worth paying attention to in the second half of this year, hoping to provide readers with useful references.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。