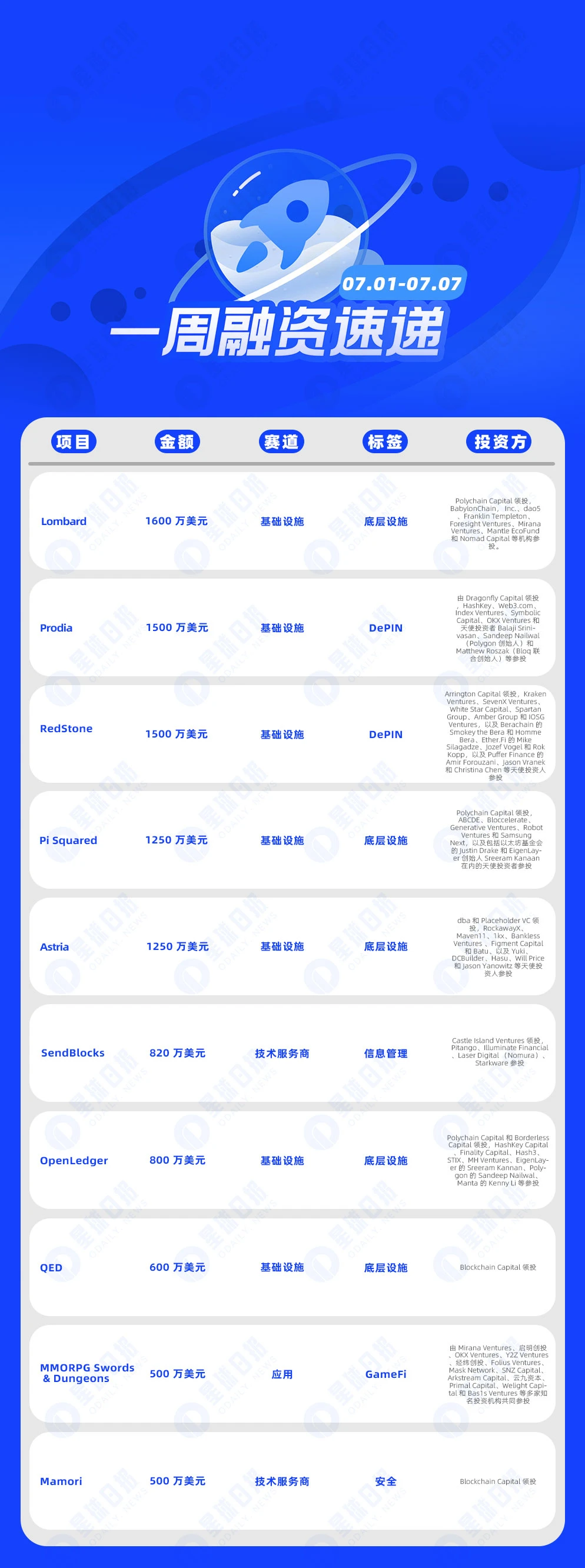

According to incomplete statistics from Odaily Star Daily, there were a total of 26 blockchain financing events announced at home and abroad from July 1st to July 7th, which is an increase from the previous week's 20. The disclosed total financing amount is approximately $122 million, a significant decrease from the previous week's $288 million.

Last week, the project with the most investment was the Bitcoin re-pledge protocol Lombard ($16 million), followed closely by the distributed GPU network Prodia ($15 million).

The specific financing events are as follows (Note: 1. Sorted by the disclosed amount; 2. Excluding fund-raising and M&A events; 3. * indicates "traditional" companies with some business involving blockchain):

On July 2nd, the Bitcoin re-pledge protocol Lombard completed a $16 million seed round financing, led by Polychain Capital, with participation from BabylonChain, Inc., dao5, Franklin Templeton, Foresight Ventures, Mirana Ventures, Mantle EcoFund, and Nomad Capital, among others.

Lombard will use this financing to develop the Bitcoin re-pledge ecosystem and promote the subsequent development of the Bitcoin pledge protocol Babylon.

Distributed GPU network Prodia completes $15 million financing, led by Dragonfly Capital

On July 2nd, the distributed GPU network Prodia, used for AI inference solutions, raised $15 million, led by Dragonfly Capital, with participation from HashKey, Web3.com, Index Ventures, Symbolic Capital, OKX Ventures, and angel investors Balaji Srinivasan, Sandeep Nailwal (Polygon founder), and Matthew Roszak (Bloq co-founder).

On July 2nd, the blockchain oracle service RedStone completed a $15 million Series A financing, led by Arrington Capital, with participation from Kraken Ventures, SevenX Ventures, White Star Capital, Spartan Group, Amber Group, IOSG Ventures, as well as angel investors Smokey the Bera and Homme Bera from Berachain, Mike Silagadze, Jozef Vogel, and Rok Kopp from Ether.Fi, and Amir Forouzani, Jason Vranek, and Christina Chen from Puffer Finance.

On July 2nd, ZK technology verification company Pi Squared completed a $12.5 million seed round financing, led by Polychain Capital, with participation from ABCDE, Bloccelerate, Generative Ventures, Robot Ventures, Samsung Next, as well as angel investors including Justin Drake from the Ethereum Foundation and Sreeram Kanaan from EigenLayer. The new round of financing will be used to expand the products planned by the company.

Shared Sorter Network Astria completes $12.5 million financing, led by dba and Placeholder VC

On July 1st, the shared sorter network Astria announced the completion of a $12.5 million financing, led by dba and Placeholder VC, with participation from RockawayX, Maven11, 1kx, Bankless Ventures, Figment Capital, Batu, as well as angel investors Yuki, DCBuilder, Hasu, Will Price, and Jason Yanowitz. The new funds will be used to continue building the Astria sorting layer and Astria Stack.

On July 2nd, blockchain data management startup SendBlocks announced the completion of an $8.2 million seed round financing, led by Castle Island Ventures, with participation from Pitango, Illuminate Financial, Laser Digital (Nomura), and Starkware. SendBlocks allows blockchain enterprises, ecosystems, protocols, and applications to define data that is important to them, and its platform supports customization.

On July 2nd, blockchain company OpenLedger announced the completion of an $8 million seed round financing, led by Polychain Capital and Borderless Capital, with participation from HashKey Capital, Finality Capital, Hash3, STIX, MH Ventures, Sreeram Kannan from EigenLayer, Sandeep Nailwal from Polygon, and Kenny Li from Manta.

ZK-native protocol QED completes $6 million financing, led by Blockchain Capital

On July 4th, Web3 multi-chain MMORPG Swords & Dungeons announced the completion of a $5 million financing, with participation from Mirana Ventures, Mirae Asset Venture Investment, OKX Ventures, Y2Z Ventures, We Capital, Folius Ventures, Mask Network, SNZ Capital, Arkstream Capital, Cloud Nine Capital, Primal Capital, Welight Capital, and Bas1s Ventures.

Web3 security company Mamori completes $5 million seed round financing, led by Blockchain Capital

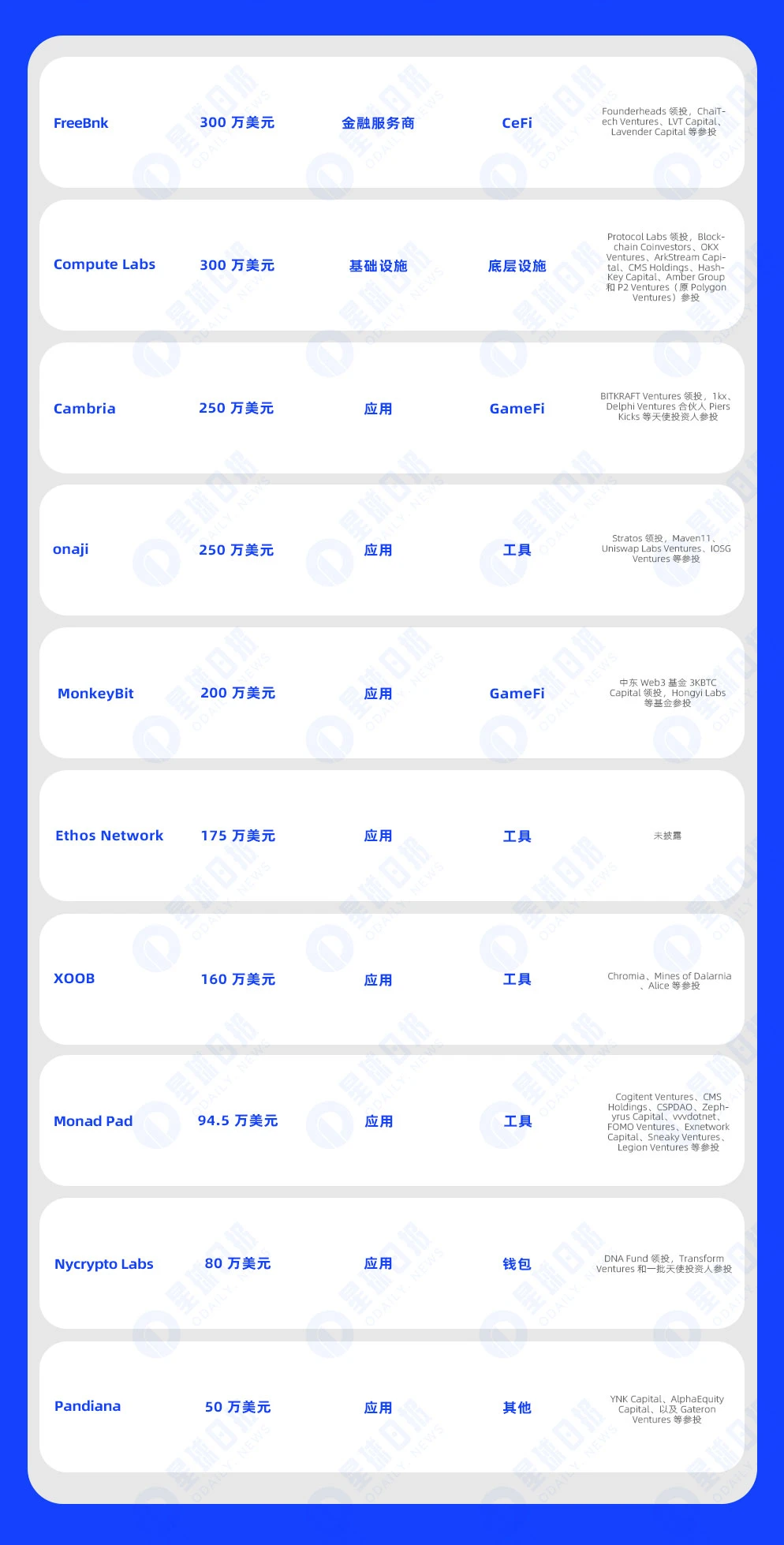

Blockchain fintech company FreeBnk completes $3 million financing, led by Founderheads

Chain game Cambria completes $2.5 million seed round financing, led by BITKRAFT Ventures

On-chain reputation network Ethos Network completes $1.75 million Pre-Seed round financing

XOOB completes $1.6 million financing, with participation from Chromia

Monad Pad completes $945,000 financing, with participation from Cogitent Ventures

On July 3rd, blockchain development project Nycrypto Labs, dedicated to simplifying the transition from Web2 to Web3, announced the completion of an $800,000 Pre-Seed round financing, led by DNA Fund, with participation from Transform Ventures and a group of angel investors. Specific valuation data has not been disclosed. The new funds will support the launch of the Tidus Wallet, a multi-chain wallet that enables cross-chain lending and staking without leaving the application, to reduce the risks associated with bridging (the process of transferring assets between different blockchain networks).

DePIN oracle project Nubila initiates new round of financing, led by IoTeX

DePIN project U2U Network completes seed round financing, led by IDG Blockchain

UniSat completes Pre-A round financing led by Binance in May this year, specific amount undisclosed

Pac Finance completes million-dollar financing, led by Manifold and Mapleblock

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。