Original Author |Arthur Hayes

Compiled by | Nan Zhi (@Assassin_Malvo)_

Some people might say:

"The crypto bull market is over."

"I need to issue my tokens now because we are in the downturn of the bull market."

"Why hasn't Bitcoin risen like the large US tech companies in the Nasdaq 100 index?"

This comparison chart of the Nasdaq 100 index (white) and Bitcoin (gold) shows that the trends of these two assets are consistent, but since earlier this year when they hit historic highs, Bitcoin's rise has stalled.

However, the same people also put forward the following views:

"The world is transitioning from a unipolar world order dominated by the United States to a multipolar world order including leaders such as China, Brazil, and Russia."

"To fill government deficits, savers must be financially repressed, and central banks must print more money."

"The Third World War has already begun, and war will lead to inflation."

The opinions on the current stage of the Bitcoin bull market and their views on geopolitical and global monetary conditions confirm my point that we are at a turning point. We are transitioning from one geopolitical and international monetary order to another. Although I do not know which countries will rule at the end of the stable state, or the specific situation of trade and financial architecture, I have a general idea of what it will be like.

I want to detach from the fluctuations in the current crypto capital market and focus on the broader cyclical trend reversal we are in. I want to outline the three major cycles from the Great Depression of the 1930s to today. This will focus on the Pax Americana, as the entire global economy is a derivative of imperial financial policies. Unlike Russia in 1917 and China in 1949, the United States did not undergo a political revolution due to the two world wars. Most importantly, for the purposes of this analysis, the United States is relatively the best place to hold capital. It has the deepest stock and bond markets and the largest consumer market. Everything the United States does will be imitated and responded to by the rest of the world, leading to results relative to the flag on your passport. Therefore, understanding and predicting the next major cycle is crucial.

(Odaily note: Pax Americana, also known as theAmerican Century, refers to the peace established among major powers after the end of World War II, indicating the absolute advantage of the United States in terms of economy and military power due to its infrastructure being unaffected by war compared to other countries.)_

There are two types of periods in history: local and global. In local periods, authorities fund past and present wars by financially repressing savers. In global periods, financial regulations are relaxed, and global trade is promoted. Local periods are inflationary, while global periods are deflationary. Any macro theorist you pay attention to will use a similar classification to describe the major historical cycles of the 20th century and beyond.

The purpose of this history lesson is to make wise investments within the cycles. Assuming the average lifespan is 80 years, you can expect to experience two major cycles in that time. I categorize our investment choices into three:

If you believe in the system but not in the people managing it, you invest in stocks.

If you believe in the system and trust the people managing it, you invest in government bonds.

If you believe in neither the system nor the people managing it, you invest in gold or other assets that do not require the existence of a nation, such as Bitcoin. Stocks are a legal fiction maintained by the courts, which can dispatch armed personnel to enforce it. Therefore, stocks require a strong nation to exist and maintain value over the long term.

During a local inflationary period, I should hold gold and avoid stocks and bonds.

During a global deflationary period, I should hold stocks and avoid gold and bonds.

Government bonds generally do not hold value long term unless I am allowed to leverage them at low or zero cost, or am forced to hold them by regulators. This is mainly because politicians fund their political goals by printing money rather than resorting to unpopular direct taxation, which is a temptation that can easily distort the government bond market.

Before dividing the cycles of the last century, I want to describe a few key dates.

April 5, 1933 — On this day, US President Franklin D. Roosevelt (FDR) signed an executive order prohibiting private ownership of gold. Subsequently, he devalued the US dollar against gold from $20 to $35, breaking the US commitment to the gold standard.

December 31, 1974 — On this day, US President Gerald Ford restored the right of Americans to privately own gold.

October 1979 — Federal Reserve Chairman Paul Volcker changed US monetary policy, shifting to controlling the quantity of credit rather than the level of interest rates. He then fought inflation by restricting credit. In the third quarter of 1981, the yield on 10-year US Treasury bonds reached 15%, the highest in history, and the lowest point in bond prices.

January 20, 1980 — Ronald Reagan was inaugurated as President of the United States. He subsequently actively relaxed regulation of the financial services industry. His other notable financial regulatory changes include making the capital gains tax treatment of stock options more favorable and abolishing the Glass-Steagall Act of 1933.

November 25, 2008 — The Federal Reserve began printing money under its quantitative easing (QE) program in response to the global financial crisis, which was triggered by losses on subprime mortgage assets on financial institutions' balance sheets.

January 3, 2009 — The Bitcoin blockchain, created by "Satoshi Nakamoto," released its genesis block. I believe that our Lord and Savior saved humanity from the evil control of the state by creating a digital cryptocurrency that can compete with digital fiat currencies.

1933–1980: Local cycle of US ascendance

1980–2008: Global cycle of US hegemony

2008–present: Local cycle of US confrontation with other major economies

1933–1980: Local cycle of US ascendance

Compared to the rest of the world, the United States suffered almost no substantial damage during World War II. Considering the casualties and property damage in the United States, the war was much less deadly and destructive than the Civil War of the 19th century. While Europe and Asia lay in ruins, the US rebuilt the world's industry and reaped enormous rewards.

Despite the advantage the war brought to the US, it still needed to fund the war through financial repression. Starting in 1933, the US prohibited private ownership of gold. In the late 1940s, the Federal Reserve worked with the US Treasury. This allowed the government to control the yield curve, resulting in the government being able to borrow at rates lower than the market, as the Federal Reserve printed money to buy bonds. To ensure depositors could not escape, bank deposit rates were capped. The government used marginal savings to pay for World War II and the Cold War with the Soviet Union.

If products such as gold and fixed-income securities with inflation rates were banned, what could depositors do to beat inflation? The stock market was the only choice.

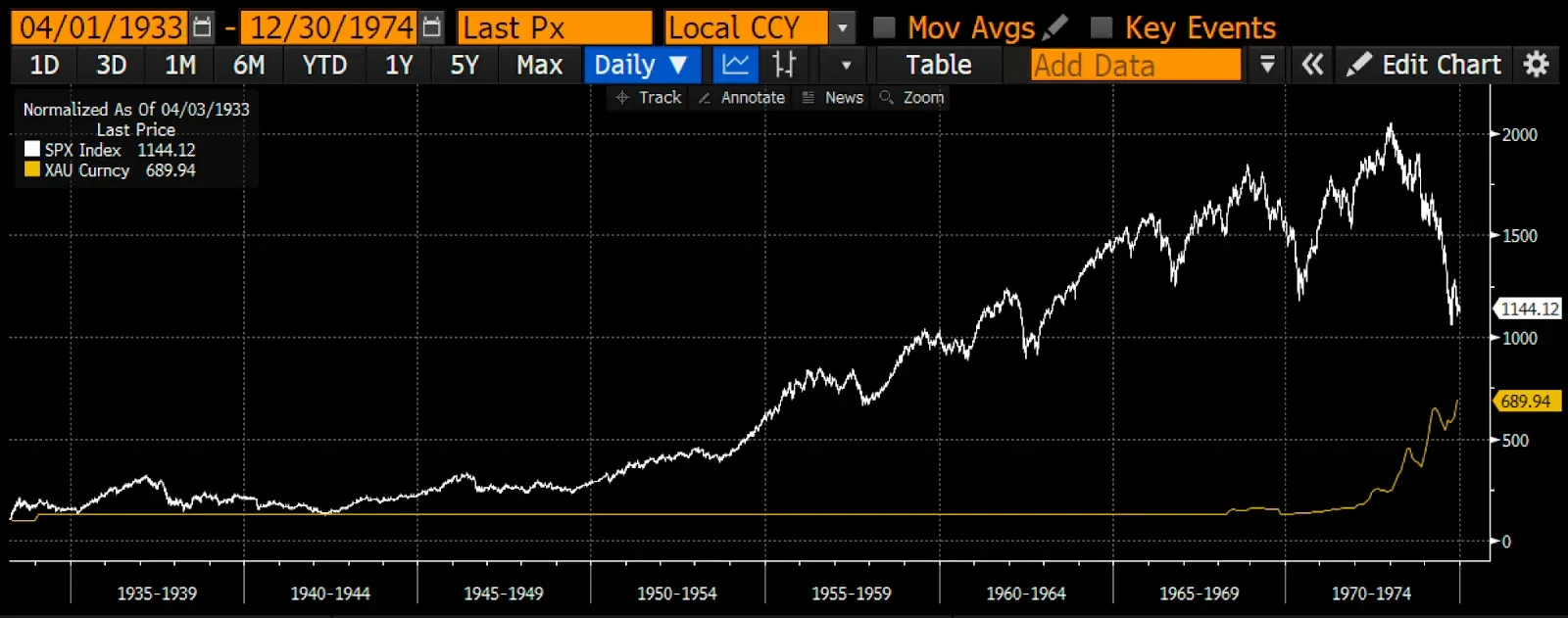

S&P 500 Index (white) vs. Gold (gold), with a base date of April 1, 1933 to December 30, 1974, with an index value of 100

Even with the rise in gold prices after US President Nixon ended the gold standard in 1971, it did not surpass the returns of stocks.

But what happens when capital can once again freely bet against the system and the government?

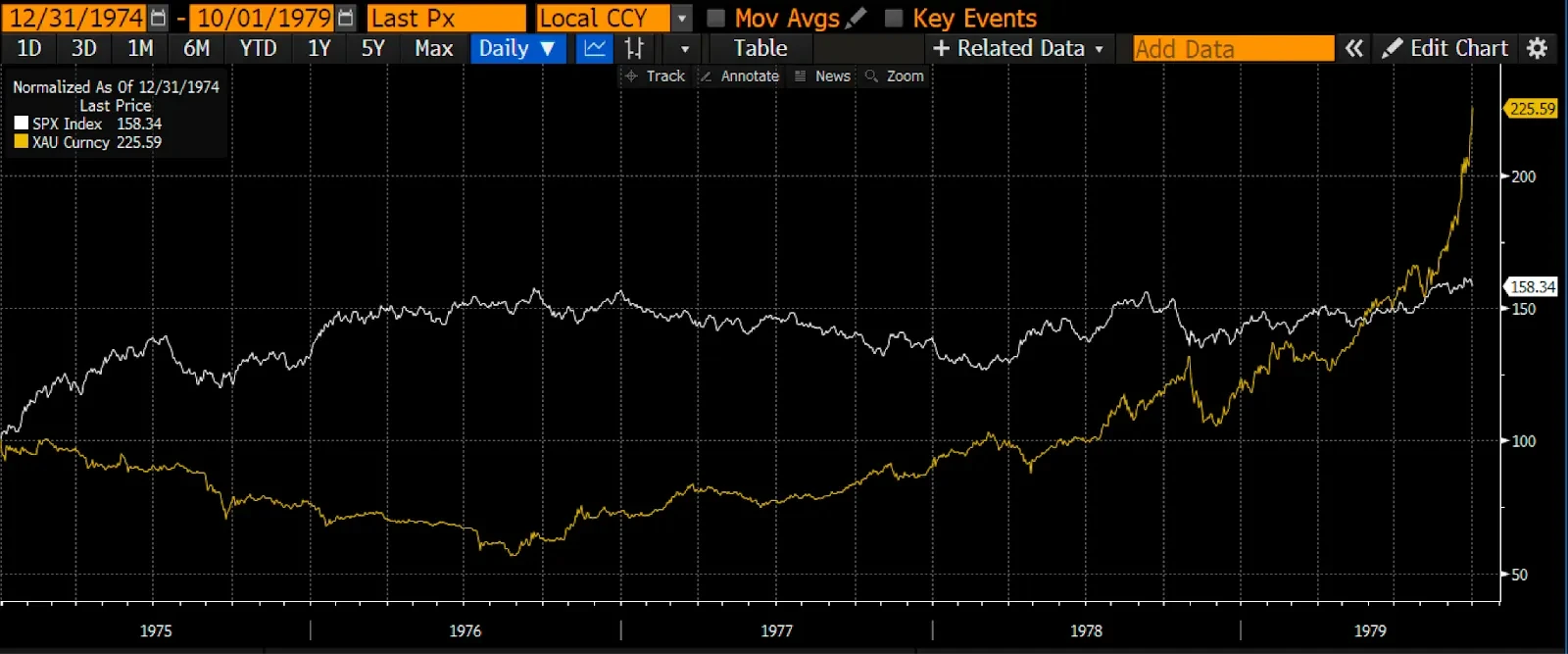

S&P 500 Index (white) vs. Gold (gold), with a base date of December 31, 1974 to October 1, 1979, with an index value of 100

Gold outperformed stocks. I stopped the comparison in October 1979, as Volcker announced that the Fed would begin a significant credit tightening, restoring confidence in the US dollar.

1980–2008: Peak of the US global cycle

As confidence grew in the US's ability and willingness to defeat the Soviet Union, the political winds shifted. It was time to transition from a wartime economy, remove the financial and other regulatory shackles of the empire, and allow market dynamism to flourish.

Under the new petrodollar currency system, the US dollar was supported by the surplus from the sale of oil by Middle Eastern oil-producing countries (such as Saudi Arabia). To maintain the purchasing power of the dollar, it was necessary to raise interest rates to suppress economic activity and thus control inflation. This is what Volcker did, causing interest rates to soar and the economy to slump.

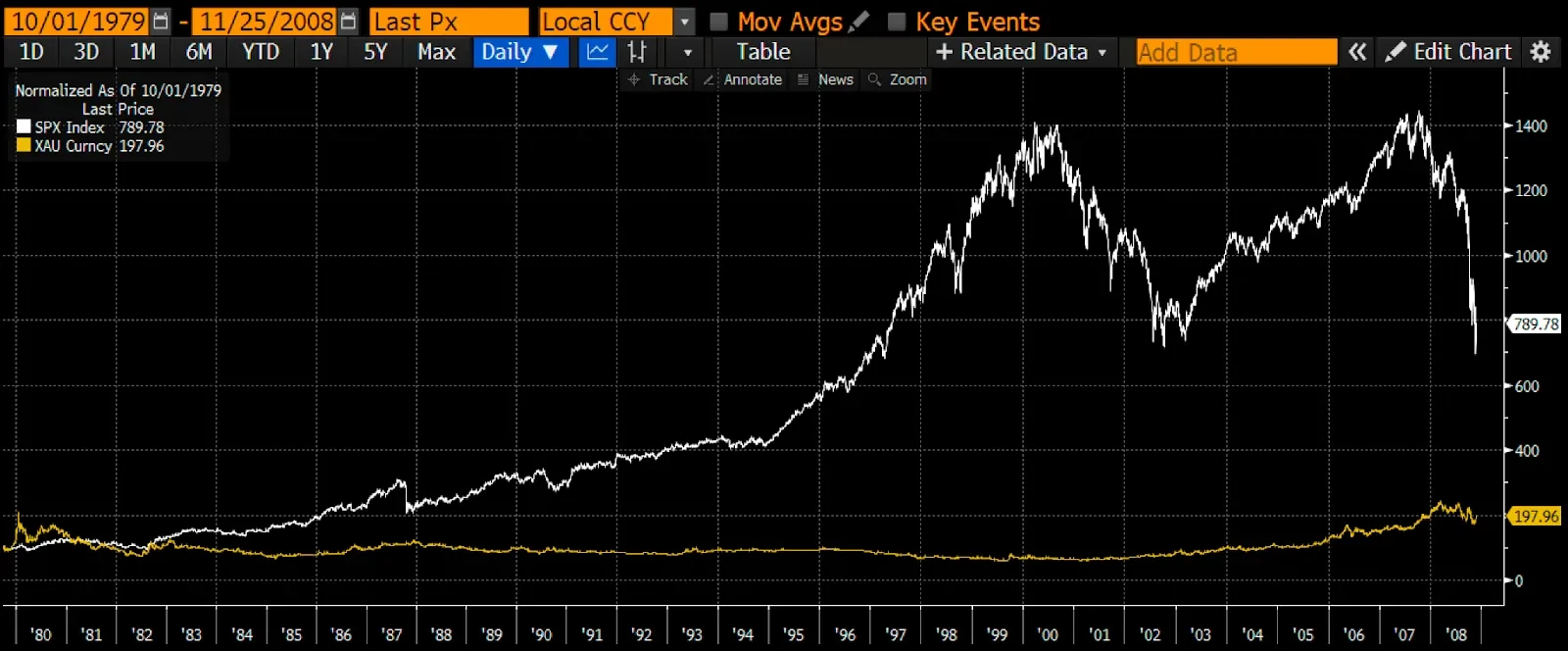

The early 1980s marked the beginning of the next cycle, during which the US, as the sole superpower, engaged in trade with the world and strengthened the dollar due to monetary conservatism. As expected, gold did not perform as well as stocks.

S&P 500 Index (white) vs. Gold (gold), with a base date of October 1, 1979 to November 25, 2008, with an index value of 100

Apart from bombing some Middle Eastern countries back to the Stone Age, the US did not face any war with military forces of equal or near-equal strength. Even after spending over $10 trillion in failed wars in Afghanistan, Syria, and Iraq, confidence in the system and the government did not waver.

2008–present: Local cycle of US confrontation with other major economies

Faced with another deflationary economic collapse, the US defaulted and devalued once again. This time, the Fed did not ban private ownership of gold and then devalue the dollar against gold, but decided to print money to buy government bonds, euphemistically called quantitative easing. In both cases, credit based on the dollar rapidly expanded to "save" the economy.

Proxy wars between major political groups officially began again. A significant turning point was Russia's invasion of Georgia in 2008, in response to NATO's intention to grant Georgia membership. Preventing NATO, armed with nuclear weapons, from advancing and encircling Russia's homeland was a top priority for the Russian elite led by President Putin.

Currently, there is intense proxy warfare between the West (the US and its satellites) and the Eurasian continent (Russia, China, Iran) in Ukraine and the Levant (Israel, Jordan, Syria, and Lebanon). Any of these conflicts could escalate into a nuclear exchange between the two sides. In anticipation of what seems to be an inevitable war, nations are turning inward and ensuring all aspects of their economies are prepared to support war efforts.

For the purposes of this analysis, this means that depositors will be required to fund the country's wartime expenses. They will face financial repression. The banking system will allocate most credit to the state to achieve specific political goals.

The US once again defaulted on the dollar to prevent a deflationary collapse similar to the Great Depression of 1930. Subsequently, protectionist trade barriers were erected, just like in 1930-1940. All nation-states are looking out for themselves, which can only mean experiencing financial repression while suffering severe inflation.

S&P 500 Index (white) vs. Gold (gold) vs. Bitcoin (green), with a base date of November 25, 2008 to the present, with an index value of 100

This time, as the Fed devalued the dollar, capital could leave the system freely. The difference is that at the start of the current local cycle, Bitcoin provided another form of currency without a national background. The key difference between Bitcoin and gold is that, in the words of Lynn Alden, Bitcoin's ledger is maintained through encrypted blockchains, and the speed of currency movement is at the speed of light. In contrast, gold's ledger is naturally maintained, and the speed of movement is limited to the physical transfer speed of gold by humans. When compared to digital fiat currencies that move at the speed of light but can be infinitely printed by governments, Bitcoin is superior, while gold is inferior. That's why from 2009 to the present, Bitcoin has stolen some of gold's thunder.

Bitcoin has performed so well that on this chart, you cannot discern the difference in returns between gold and stocks. Gold's performance lagged behind stocks by nearly 300%.

End of Quantitative Easing

Although I am extremely confident in the background and description of the financial history of the past 100 years, this does not alleviate people's concerns about the end of the current bull market. We know we are in an inflationary period, and Bitcoin has shown its rightful function: surpassing stocks and fiat currency devaluation. However, timing is crucial. If you bought Bitcoin at the recent historic highs, you might feel like a loser because you are extrapolating past results into an uncertain future. That being said, if we believe that inflation will persist and that a cold war, hot war, or proxy war is imminent, what can the past tell us about the future?

Governments have always repressed domestic depositors to fund wars, support the winners of past cycles, and maintain system stability. In the era of modern nation-states and large integrated commercial banking systems, the primary way governments fund themselves and key industries is by controlling bank credit allocation.

The problem with quantitative easing is that the market allocates free funds and credit to businesses that do not produce physical goods needed for a wartime economy. The US is the best example of this phenomenon. Volcker ushered in the era of the all-powerful central banker. Central bankers created bank reserves by buying bonds, thereby lowering costs and increasing credit limits.

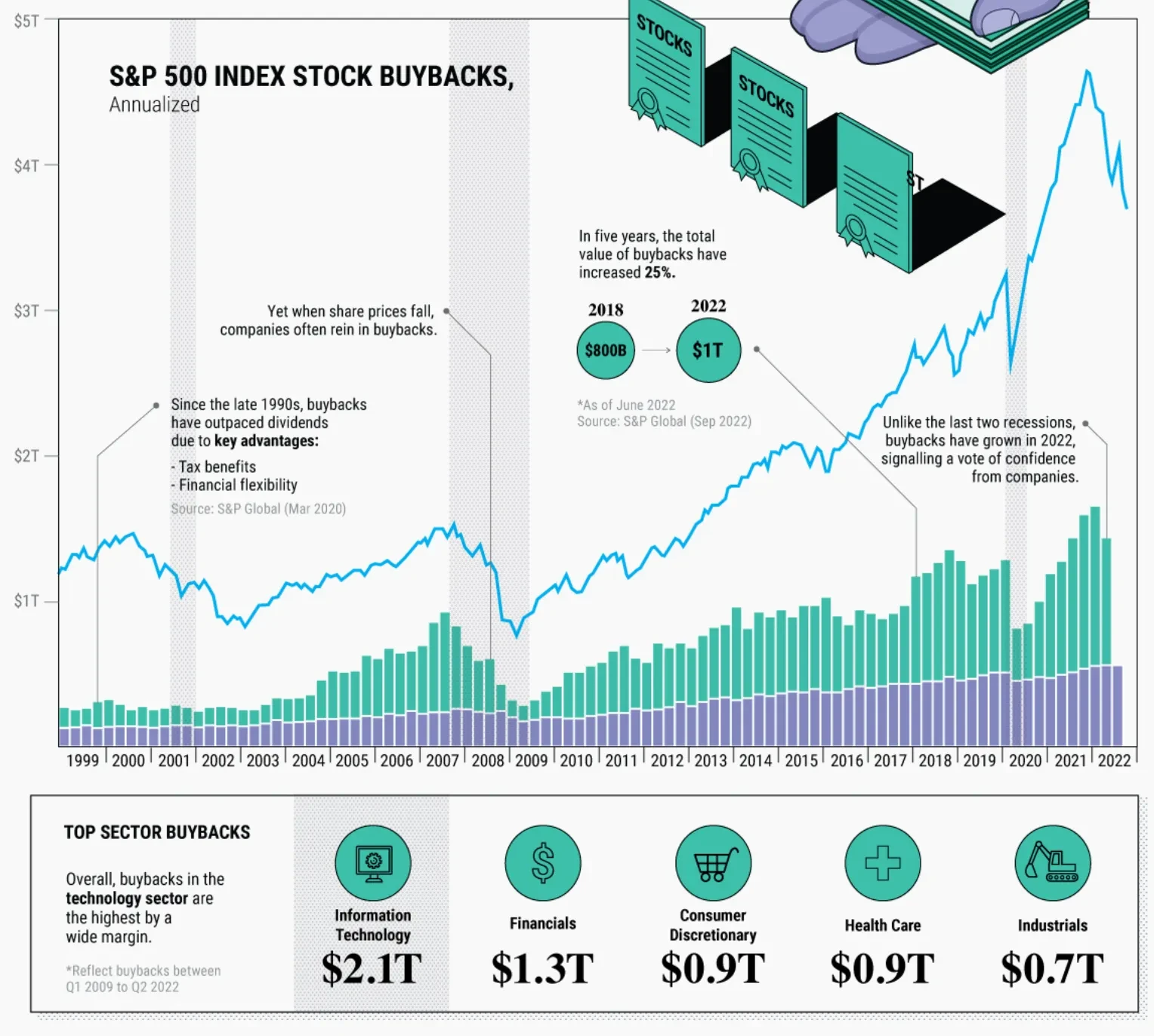

In the private capital markets, credit is allocated to businesses that maximize shareholder returns. The simplest way to boost stock prices is to reduce outstanding shares through buybacks. Companies with access to cheap credit borrow money to buy back their own stock, rather than borrowing to increase capacity or improve technology. Improving the business to expect more revenue is challenging and does not necessarily boost stock prices. But through mathematical calculation, reducing outstanding shares increases stock prices, and since 2008, large companies with cheap and abundant credit have done just that.

Another simple way is to increase profit margins. Therefore, stock prices are not used to build new capacity or invest in better technology, but to reduce labor input costs by moving jobs to China and other low-cost countries. The US manufacturing sector is so weak that it cannot produce enough ammunition to defeat Russia in Ukraine. Additionally, China is a better place to manufacture goods, and the US Department of Defense's supply chain is filled with critical inputs produced by Chinese companies. These Chinese companies are mostly state-owned enterprises. Quantitative easing policies, combined with shareholder-centric capitalism, have made US military power dependent on its "strategic competitors" (their words, not mine).

The way the US and the collective West allocate credit will be similar to the practices of China, Japan, and South Korea. Either the state directly instructs banks to lend to a certain industry or company, or banks are forced to buy government bonds at yields below market rates so that the state can provide subsidies and tax breaks to "appropriate" businesses. In either case, the return on capital or savings will be lower than the nominal growth rate or inflation rate. The only way to escape this (assuming there are no capital controls) is to purchase value storage outside the system, such as Bitcoin.

For those who are fixated on observing the changes in the balance sheets of major central banks and concluding that credit growth is not sufficient to drive further increases in cryptocurrency prices, they must now focus on the total amount of credit created by commercial banks. Banks achieve this by lending to non-financial businesses. Fiscal deficits also release credit, as deficits must be financed through borrowing in the sovereign debt market, and banks will faithfully purchase these bonds.

In short, in the previous cycle, we focused on the size of central bank balance sheets. In this cycle, we must focus on the total amount of fiscal deficits and non-financial bank credit.

Trading Strategy

Why am I confident that Bitcoin will regain its vitality?

Why am I confident that we are in a new large-scale, nationally-driven inflationary cycle?

Look at this news:

According to data from a federal agency, the projected budget deficit for the US fiscal year 2024 is expected to soar to $1.915 trillion, surpassing last year's $1.695 trillion, marking the highest level outside the COVID-19 era. The agency attributes the 27% increase from its earlier forecast to increased spending.

For those worried that Biden will not pass more spending to keep the economy running before the election, this is undoubtedly good news.

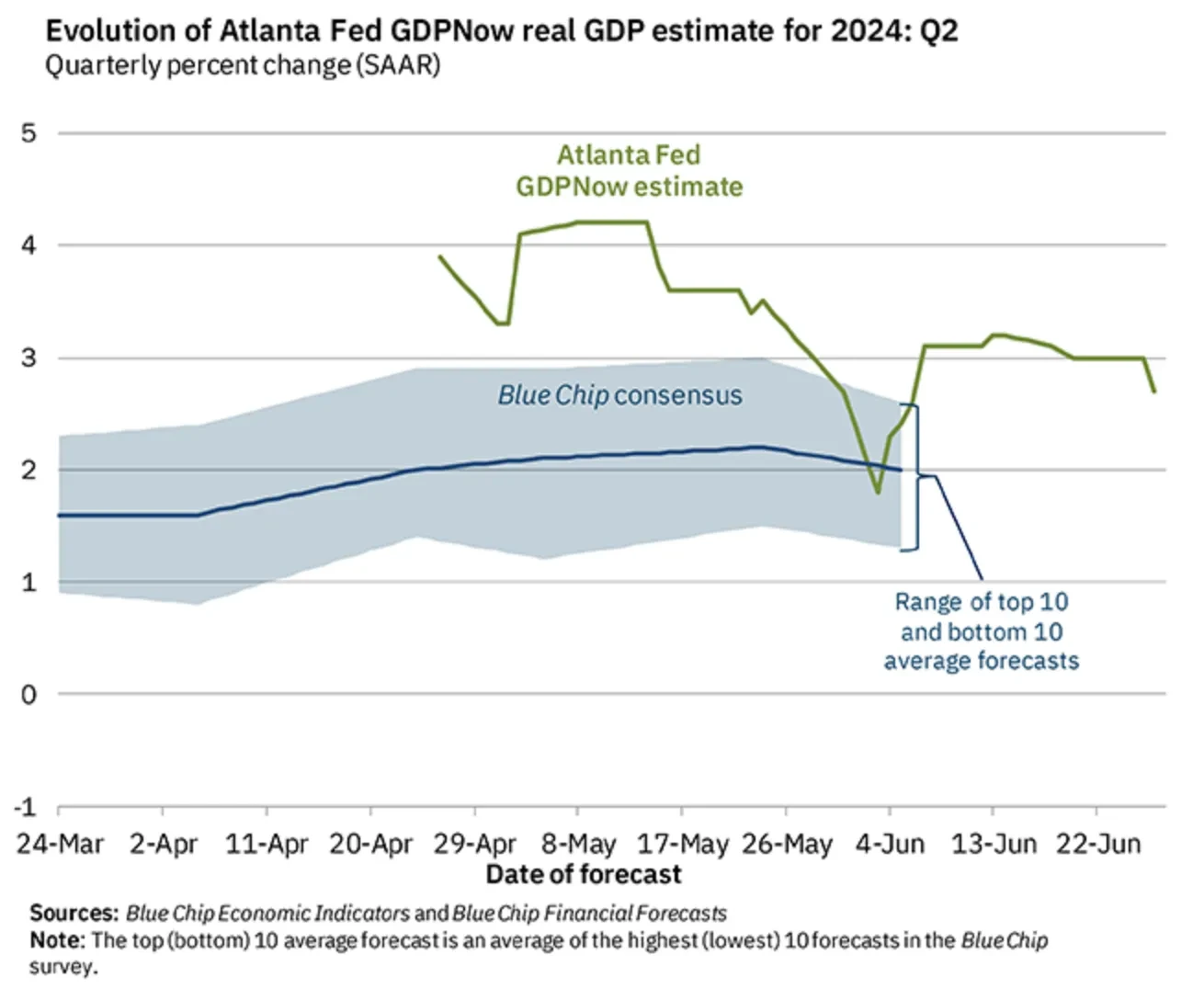

The Atlanta Fed expects a staggering 2.7% real GDP growth rate in the third quarter of 2024.

For those worried about the US entering a recession, it is mathematically very difficult for a recession to occur when government spending exceeds tax revenue by $2 trillion, which accounts for 7.3% of the GDP in 2023. As a comparison, the US GDP decreased by 0.1% in 2008 and by 2.5% during the global financial crisis in 2009. Even if a global financial crisis similar to the previous one occurs this year, the decline in private economic growth will still not exceed the amount of government spending. There will be no recession. This does not mean that a large number of ordinary people will not face financial difficulties, but the US will continue to move forward.

I point this out because I believe that fiscal and monetary conditions are loose and will continue to be loose, so holding cryptocurrency is the best way to preserve value. I am confident that today's situation is similar to the 1930s to the 1970s, which means that since I can still freely move from fiat currency to cryptocurrency, I should do so, because devaluation caused by the expansion and centralization of credit allocation through the banking system is imminent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。