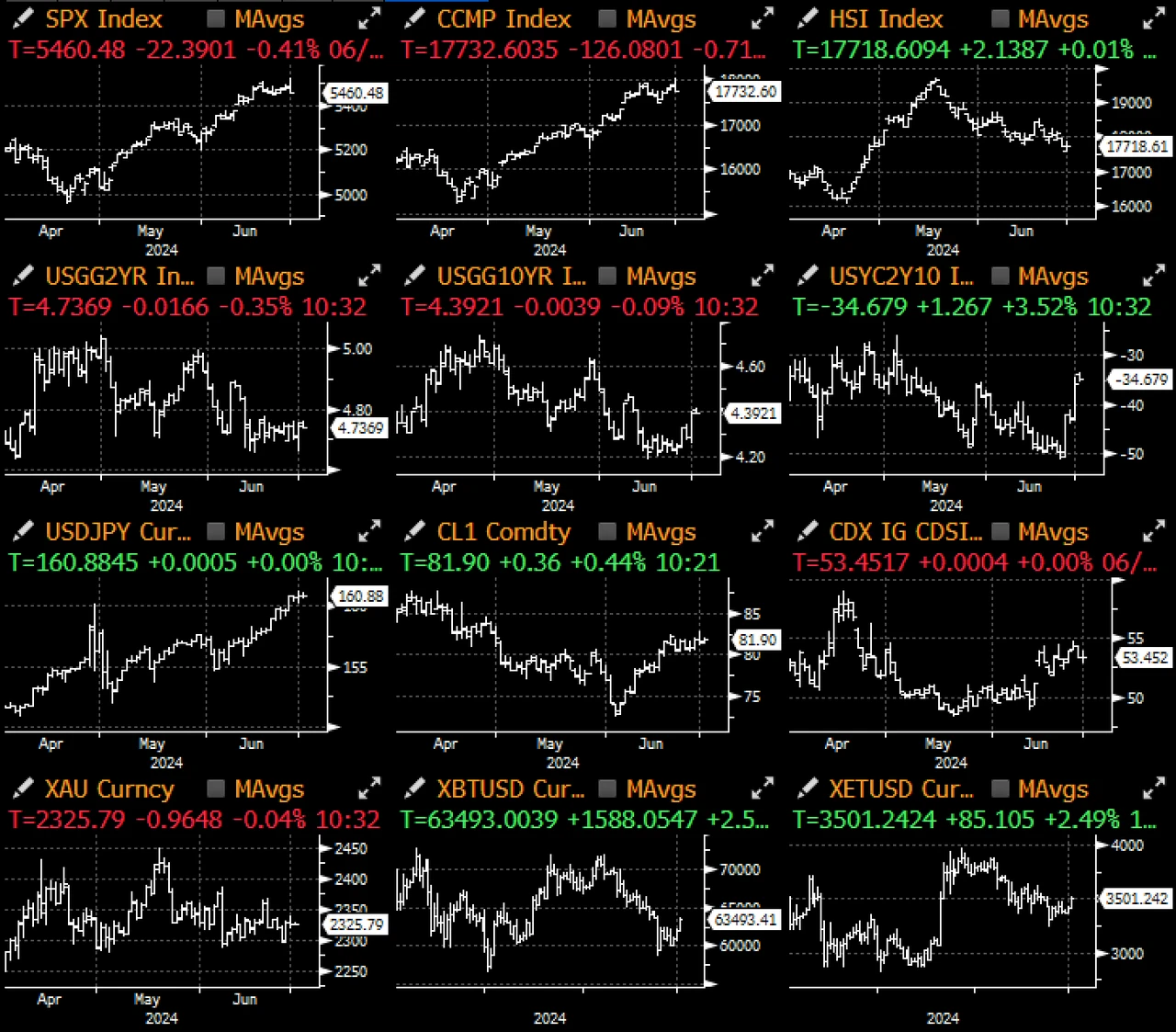

The unusually calm first half of the year has come to an end. Let's quickly review the situation in the first half of the year. The performance of the SPX, Nasdaq, Nikkei Index, and gold prices has been leading, while on the other hand, due to the Bank of Japan's continuous zero interest rate policy and the political risk of Macron's early election, the Japanese yen, Japanese government bonds, euro, and recently French government bonds (OATs) have lagged behind.

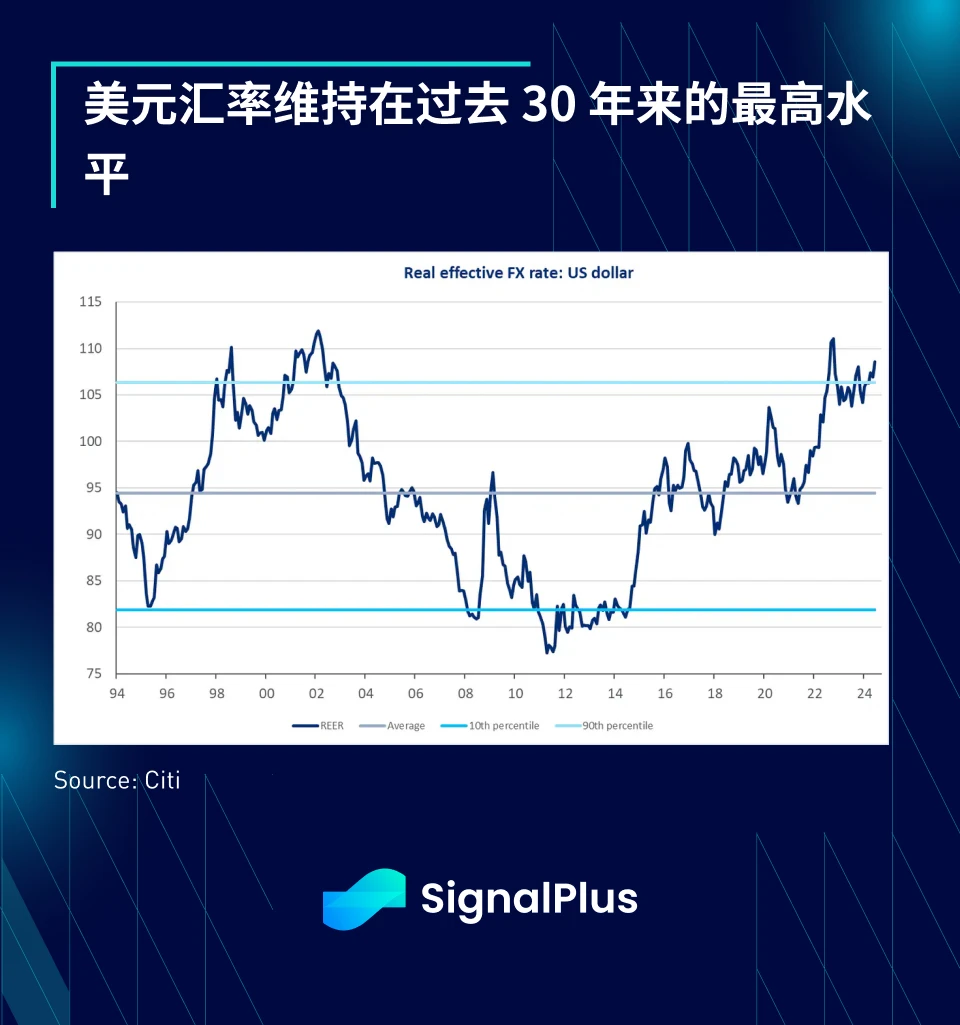

The US dollar is also not to be outdone. Due to continuous capital inflows driven by AI, strong economic conditions, and high benchmark interest rates, the US dollar has also remained near its highest level in the past 30 years. This year, the outstanding performance of the US capital market continues to exceed the expectations of most skeptics.

As capital continues to flow out of China, India maintains a leading position in emerging markets. Over the past 1.5 years, the Indian market has risen by 30% (in US dollars), while the Chinese stock market has fallen by about 15%, resulting in a performance gap of 45% between the two.

In the second half of the year, the US presidential election will be the focus, and market performance may still exceed expectations, although it may be different from the style of the first half of the year. We have long believed that the main theme of this election is about the unsustainable US fiscal policy, which will be reflected in the bond market, leading to higher yields and a steeper yield curve. However, overall, US clients consider tariff policy to be more important and believe that a stronger US dollar is a better choice. Although we basically agree with this view, we are not sure how much upside potential there is, as the US dollar index is currently only a few percentage points below its peak of the past 30 years.

Some clear themes that will emerge in the second half of the year:

US economic momentum is slowing, although overall growth levels remain healthy

US economic recession is rarer than a unicorn

Inflation pressure is slowing towards the Fed's target, but not enough in the short term to support rapid rate cuts

Although the US market has undergone some rotation/adjustment, AI continues to drive overall sentiment

With the Fed in a passive state and the economy on autopilot, the focus will shift to politics, the US election, fiscal spending, new tariff policies, and government bond supply will dominate the investment narrative

From an economic data perspective, the US economy has slowed from its peak of the past two years, with the economic surprise index falling to multi-year lows. High-frequency consumer data shows a significant decrease in savings during the pandemic, and consumer debt has increased worrisomely.

However, even at a lower level overall, economic activity remains relatively active compared to previous cycles. This week's non-farm payroll data is expected to remain around 190,000, with an unemployment rate of 4%, and there is still a chance of a 0.4% positive growth in average hourly earnings. At the current pace, the 3-month average employment growth is still at 249,000, compared to an average of only 181,000 before the pandemic from 2010 to 2019.

In terms of inflation, price pressures seem to finally be slowing after multiple disappointments. The PCE for May released last Friday increased by 0.08%, below market expectations, and the "super core" PCE increased by only 0.1%, helping to clarify the Fed's plan to cut rates in September.

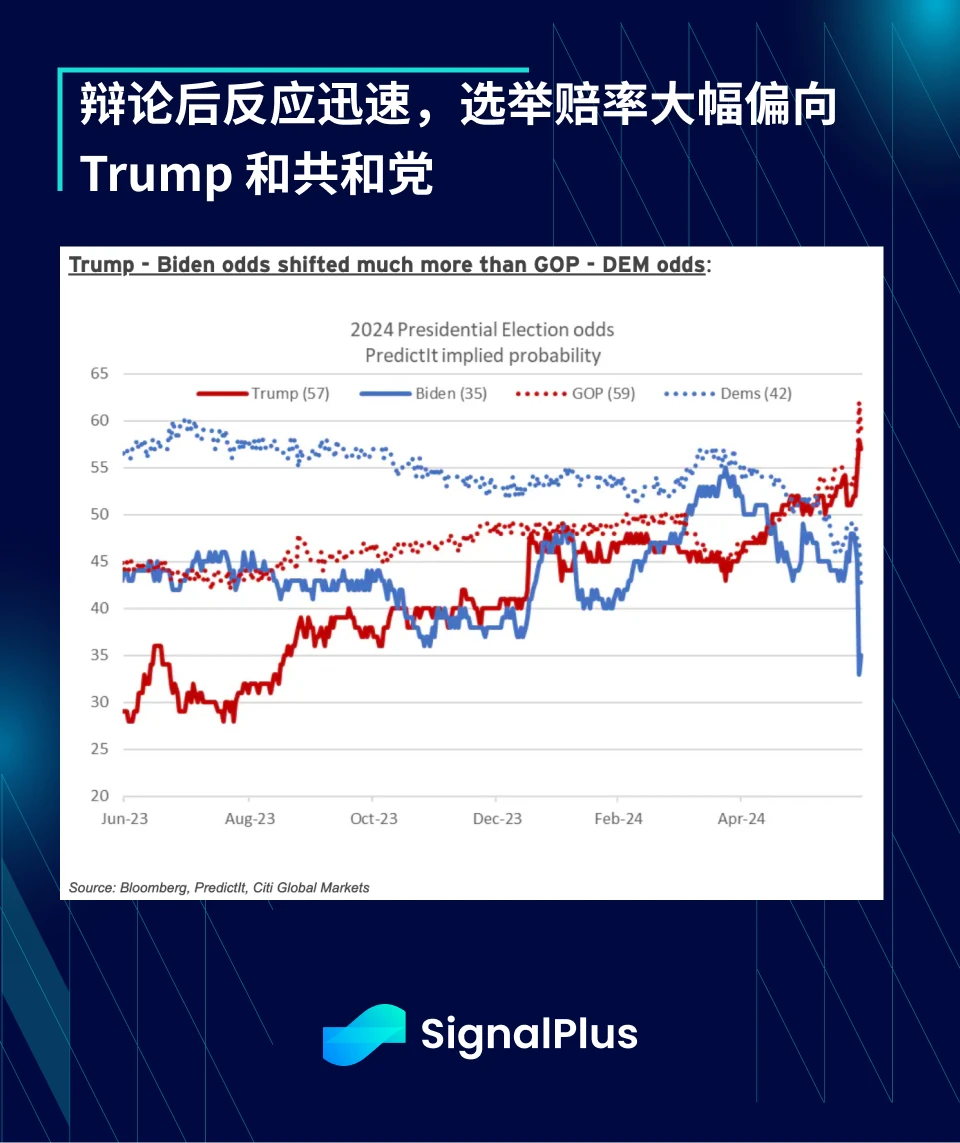

On the political front, President Biden's performance in the first presidential debate was below expectations, raising concerns about his age and health. On the other hand, former President Trump's performance was relatively stable (by his standards), and the reaction after the debate was rapid and significant. The gap in the odds of winning between Trump and Biden expanded from +10 points before the debate to +22 points. In addition to the head-to-head confrontation, Biden's chances of winning (35%) are now lower than the Democratic Party's chances of winning (42%) by 7%, while Trump and the Republican Party's chances of winning now greatly exceed 50%.

If Trump achieves an overwhelming victory, it could have far-reaching implications for US-China tariff policy, fiscal spending and tax relief extensions, monetary policy and Fed independence, and possibly even the cryptocurrency framework.

At the same time, as expected, the first round of voting in the French election was won by Le Pen's National Rally, the far-right party, which won 34% of the vote and is expected to win a majority of seats.

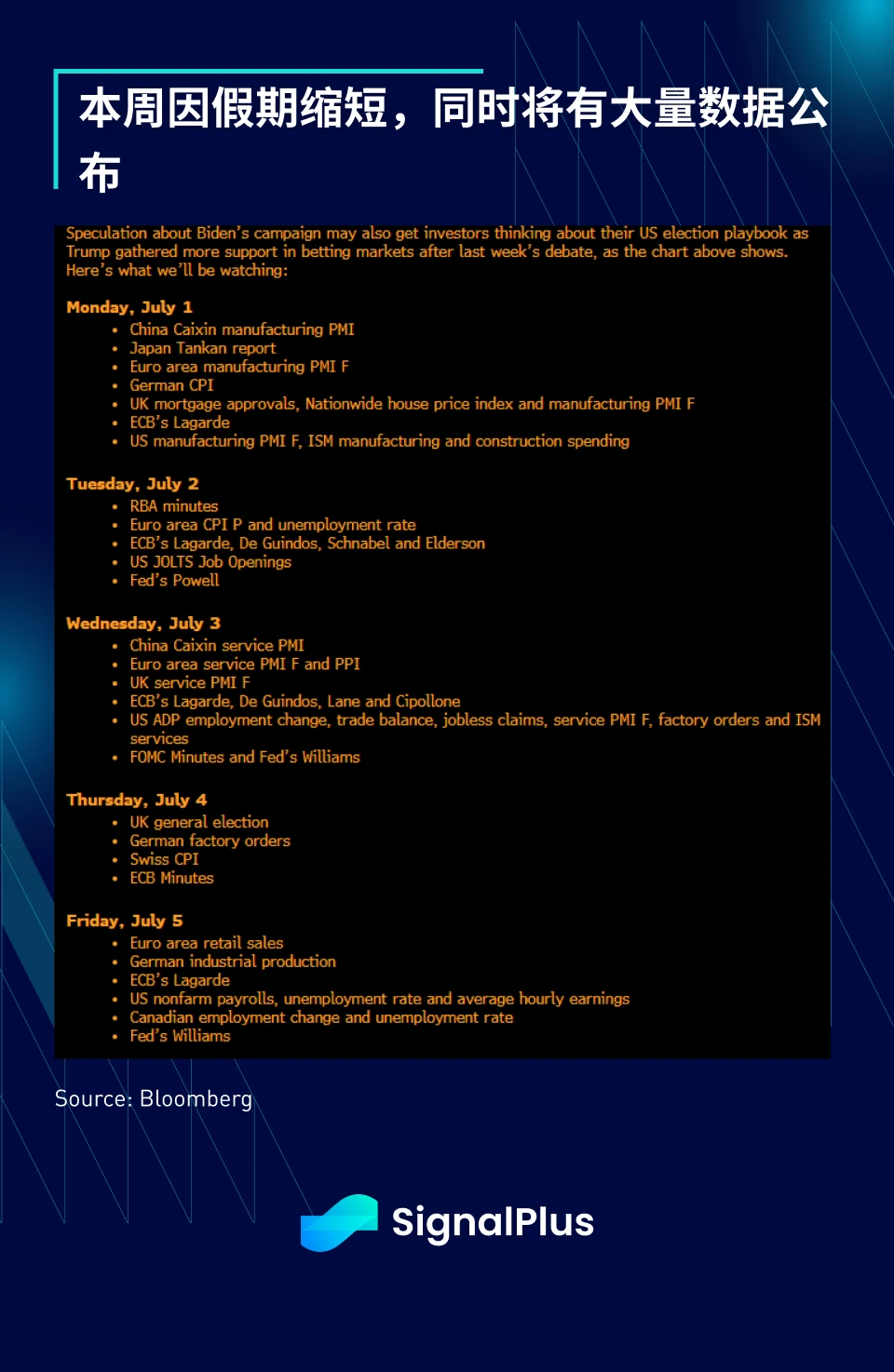

This week will be shortened due to the holiday, with only 3.5 trading days. Wednesday will see a large amount of data released, including ADP, initial jobless claims, ISM services index, and FOMC. After the holiday ends on Thursday, non-farm payroll data will be released immediately on Friday, and it is expected to be very busy.

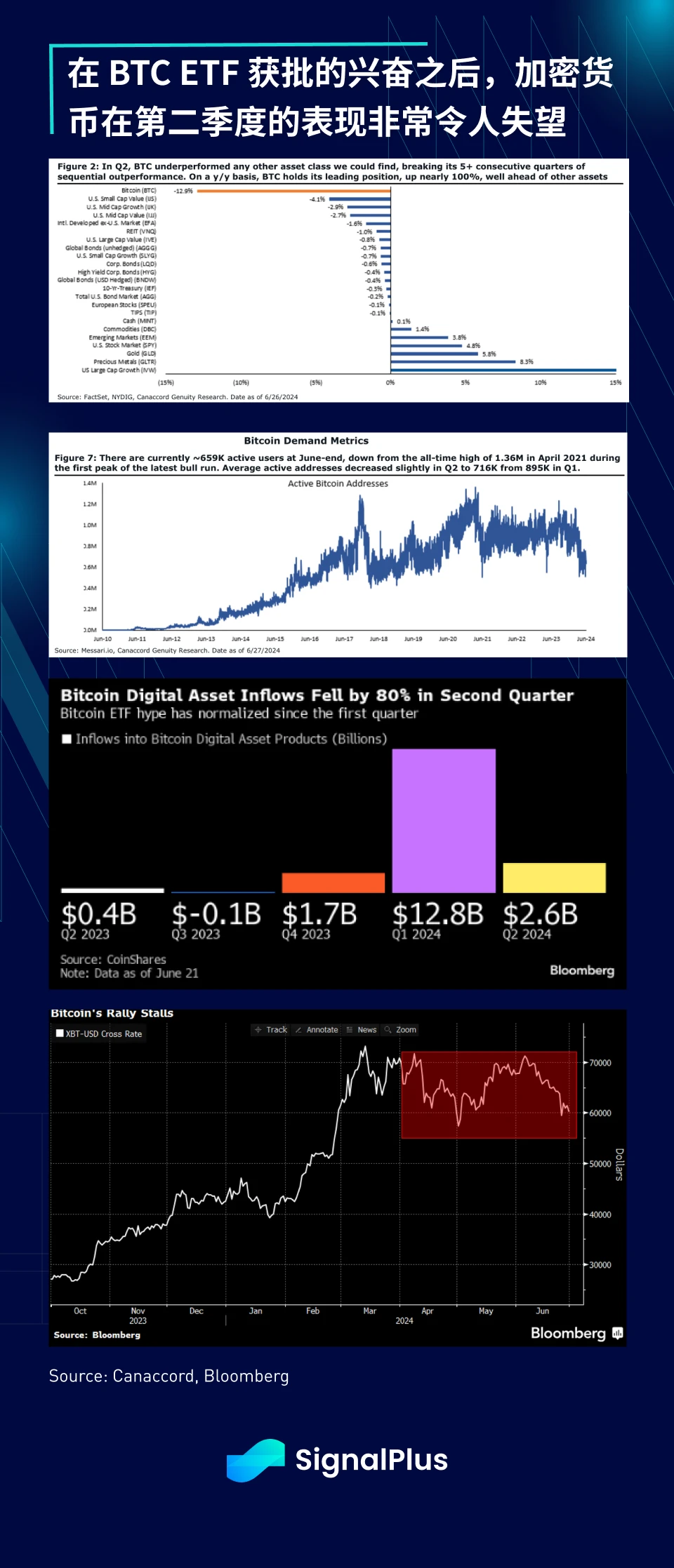

In terms of cryptocurrency, a very disappointing quarter ended last Friday, with BTC falling by 13% in the second quarter, slowing inflows of funds, lack of substantial mainstream technological innovation, declining demand indicators, and concerns on the supply side, all exacerbating the plight of cryptocurrencies, as BTC failed to break through the 60-70k range.

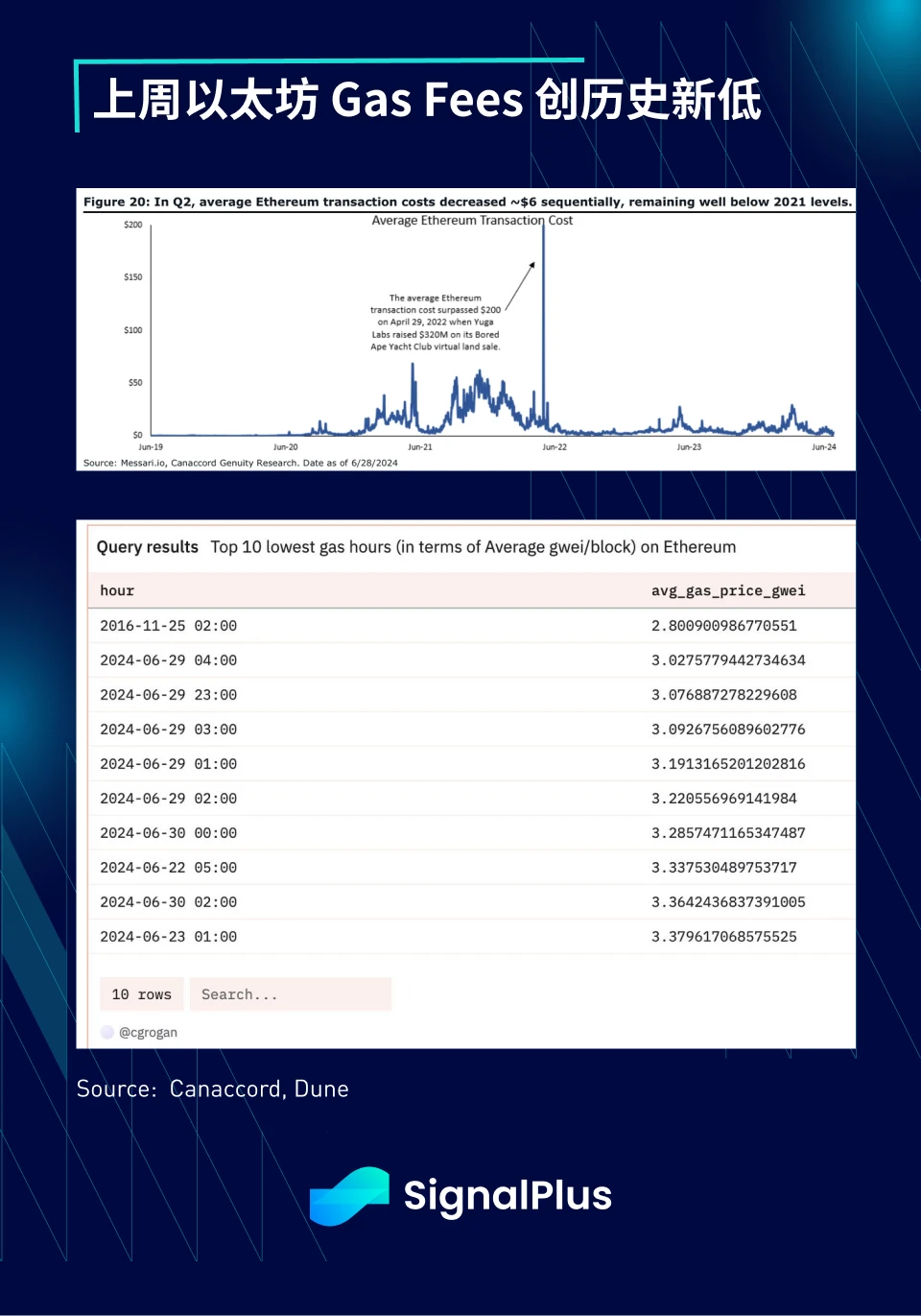

Ethereum has also been disappointing, as the anticipation of ETF approval has failed to generate excitement for the mainnet. Concerns about L2 scaling and fee reduction/supply increase (L1 fees fell to historic lows last week) persist, and the community continues to question the Ethereum Foundation regarding long-term structural issues.

Will the expected ETF approval in the third quarter, along with a lawsuit victory against the SEC (regarding staking), change the fate of ETH? Will a Trump victory solve the issues facing mainstream industry applications? Only time will give us the answers…

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto news. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and engage with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。