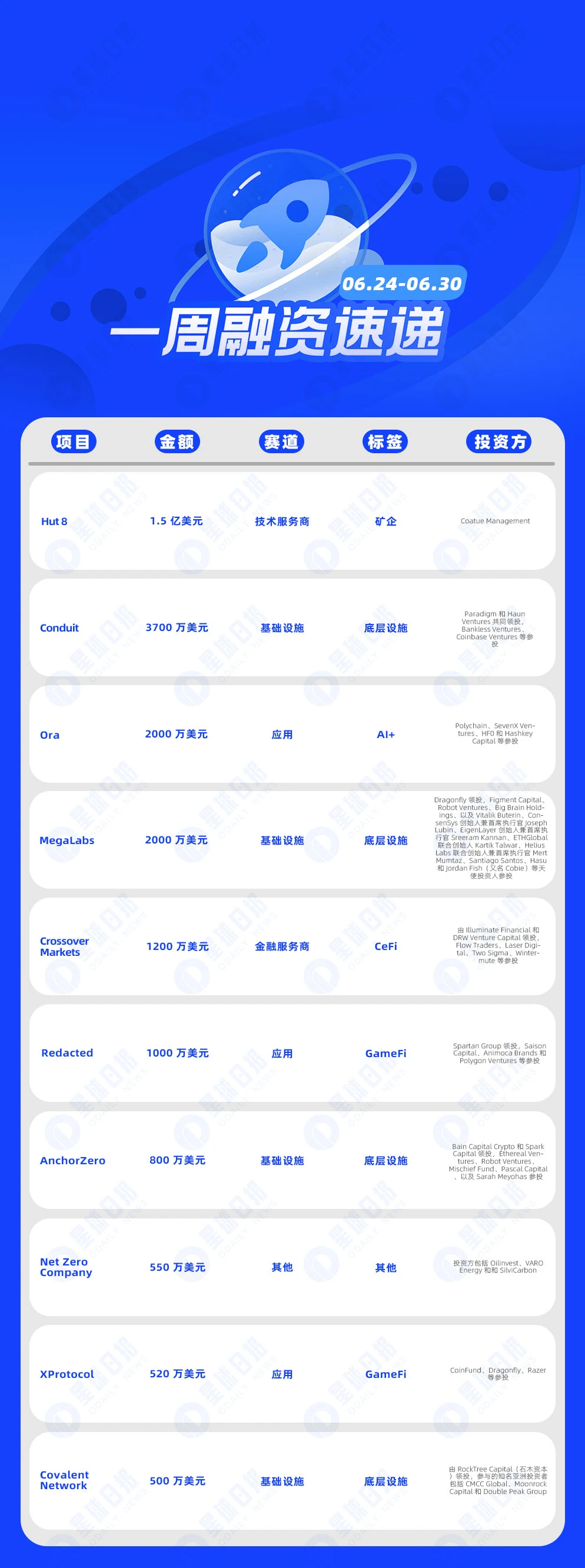

According to incomplete statistics from Odaily Star Daily, a total of 20 domestic and foreign blockchain financing events were announced from June 24th to June 30th, a decrease from the previous week's 21. The disclosed total financing amount is approximately $288 million, a significant increase from the previous week's $128 million.

Last week, the project with the most investment was the Bitcoin mining company Hut 8 ($150 million), followed closely by the Rollup deployment platform Conduit ($37 million).

The specific financing events are as follows (Note: 1. Sorted by disclosed amount; 2. Excluding fund-raising and M&A events; 3. * indicates "traditional" companies with some business involving blockchain):

Hut 8 announces completion of $150 million strategic financing, with Coatue participating

On June 24th, the Bitcoin mining company Hut 8 announced that it has reached a final agreement with Coatue Management, LLC ("Coatue")'s fund to invest $150 million in the company through convertible notes. Hut 8 plans to use this funding, along with Coatue's capabilities in developing and operating complex energy infrastructure, to vigorously develop the AI infrastructure market.

On June 26th, the Rollup deployment platform Conduit announced the completion of a $37 million Series A financing, led by Paradigm and Haun Ventures, with participation from Bankless Ventures, Coinbase Ventures, and others. It is reported that since its launch, Conduit has helped teams such as Degen and Proof of Play build their first L3.

On June 26th, the AI DApp project Ora announced the completion of a $20 million financing, with participation from Polychain, SevenX Ventures, HF0, Hashkey Capital, and others. Ora is a blockchain project that integrates artificial intelligence into decentralized applications (DApps).

MegaETH developer MegaLabs completes $20 million seed round financing, led by Dragonfly

On June 28th, MegaETH developer MegaLabs announced the completion of a $20 million seed round financing, led by Dragonfly, with participation from Figment Capital, Robot Ventures, Big Brain Holdings, as well as angel investors such as Vitalik Buterin, Joseph Lubin, and others.

Crossover Markets completes $12 million Series A financing, led by Illuminate Financial

On June 26th, digital asset trading company Crossover Markets completed a $12 million Series A financing, led by Illuminate Financial and DRW Venture Capital, with participation from Flow Traders, Laser Digital, Two Sigma, Wintermute, and others.

On June 26th, Web3 entertainment and gaming ecosystem Redacted completed a $10 million financing, led by Spartan Group, with participation from Saison Capital, Animoca Brands, Polygon Ventures, and others.

On June 28th, decentralized oracle network developer AnchorZero announced the completion of an $8 million seed round financing, led by Bain Capital Crypto and Spark Capital, with participation from Ethereal Ventures, Robot Ventures, Mischief Fund, Pascal Capital, and Sarah Meyohas. Specific valuation information has not been disclosed.

On June 24th, Swedish carbon removal startup Net Zero Company announced the completion of a $5.5 million seed round financing, with investors including Oilinvest, VARO Energy, and SilviCarbon. The company will use this funding to support global expansion and launch new product suites, including real-world asset-backed tokens for "carbon removal tokens."

On June 27th, the modular entertainment blockchain XProtocol announced the completion of a $5.2 million strategic round financing on the X platform, with participation from CoinFund, Dragonfly, Razer, and others. XProtocol is built on Superchain technology and has also launched Xardian Nodes, which will contribute to the decentralization of the XProtocol network.

On June 27th, Covalent Network (CQT) announced the completion of a $5 million strategic financing round to drive market growth in the second half of 2024. This round of financing was led by RockTree Capital, with participation from prominent Asian investors including CMCC Global, Moonrock Capital, and Double Peak Group.

On-chain abstract intent engine ENSO completes $4.2 million financing, led by Ideo Ventures

On June 25th, the on-chain abstract intent engine ENSO announced the completion of a $4.2 million financing round, led by Ideo Ventures and Hypersphere, with participation from over 60 angel investors. The raised funds will be used to launch a Cosmos-based L1 blockchain this year and for ongoing product development.

ZK proof-of-stake network NovaNet completes $3 million financing, led by Finality Capital

On June 25th, the ZK proof-of-stake network NovaNet announced the completion of a $3 million financing on the X platform, led by Finality Capital, with participation from Arrington Capital, Avalanche Foundation, Builer Capital, Caballeros Capital, and other institutions.

On June 25th, Allora Labs (formerly known as Upshot, focusing on NFT valuation) completed a $3 million strategic financing round, with participation from Archetype, Delphi Ventures, CMS Holdings, ID Theory, and DCF God.

Bitcoin analytics startup Rebar completes $2.9 million seed round financing, led by 6th Man Ventures

On June 27th, the Bitcoin analytics startup Rebar announced the completion of a $2.9 million seed round financing, led by 6th Man Ventures, with participation from ParaFi Capital, Arca, Moonrock Capital, and UTXO Management. The new funds will be used to build the first MEV product based on Bitcoin.

On June 27th, the Solana ecosystem golf project GolfN announced the completion of a $1.3 million financing, with participation from CitizenX, Fourth Revolution Capital, Nom, and others. The project aims to create a P2E mechanism for real-world golf.

Solana ecosystem DePIN project Shaga completes $1 million angel round financing, led by Arca

On June 25th, the Solana ecosystem DePIN project Shaga announced the completion of a $1 million angel round financing on the X platform, led by Arca, with participation from Skybridge20 Ventures, Quotient Ventures, MARIN DIGITAL VENTURES, and angel investors such as Helium founder Amir Haleem and Bluzelle co-founder and CEO Pavel Bains.

Blast ecosystem trading market Fenix completes $300,000 seed round financing, led by Orbs

On June 27th, the Blast ecosystem trading market Fenix completed a $300,000 seed round financing, led by Orbs. Fenix stated that it will soon deploy the Orbs L3-driven Fenix Liquidity Hub, allowing Blast users to optimize token swap prices by combining on-chain and off-chain liquidity.

Infrared completes new round of financing, with participation from Binance Labs

On June 24th, the Berachain ecosystem liquidity staking protocol Infrared Finance announced the completion of a new round of financing, with participation from Binance Labs. The specific amount has not been disclosed.

On June 25th, the cross-chain esports metaverse game Elfin Metaverse completed strategic round financing, with participation from the Manta Foundation. The specific financing amount has not been disclosed. Elfin Metaverse is also a successful applicant for Manta's $50 million ecosystem fund.

On June 27th, the cryptocurrency trading solution TradeDog Market Management (TDMM) announced the completion of seed round financing, with participation from Blockchain Founders Fund (BFF) and prominent Wall Street investor Anthony Scaramucci. The specific amount has not been disclosed. TDMM primarily provides cryptocurrency yield and investment exit services to institutional clients, involving liquidity, funds, and inventory management in the DeFi, GameFi, and infrastructure sectors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。