In the market trend, we often see the appearance of a doji candlestick pattern. Many people may not understand the meaning behind it. Today, I will talk about the types and application of the doji candlestick pattern.

First, let's talk about what a doji candlestick is.

A doji is a special candlestick pattern. Its appearance indicates that the bulls and bears are "intensely fighting," but they are evenly matched. The body of the candlestick represents the price difference between the opening and closing prices. If it rises, it's a bullish candle, otherwise, it's a bearish candle. This is the usual distinction between bullish and bearish, but in practical terms, it is not as important as the position of the doji itself.

Now let's talk about the various types and their application.

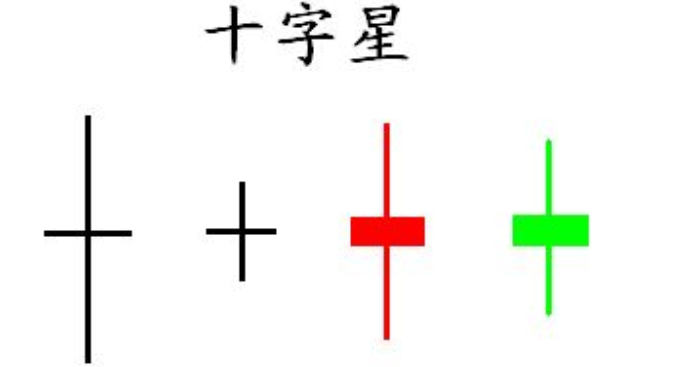

1. Ordinary Doji Candlestick Pattern

An ordinary doji has only upper and lower shadows, with no body of the candlestick. This means that the opening and closing prices are the same, indicating a temporary balance of power between the bulls and bears in the market. At this time, we should adopt a cautious approach and wait for a clear trend before making a move.

2. Long Doji Candlestick Pattern

The long doji candlestick is similar to the ordinary doji, but the difference is that both the upper and lower shadows are relatively long, with the distance between the highest and lowest points and the closing price being greater than 3%. When this pattern appears with a significant amplitude, it usually indicates a change in the market structure and a change in the market trend. Especially when the long doji appears at high or low points, it often indicates a possible sudden reversal.

3. "T" Doji Candlestick Pattern

The "T" doji is divided into "┬" doji and "┴" doji, representing a doji with only a lower shadow and a doji with only an upper shadow, respectively. The "┬" doji indicates that during this period, the opening price, closing price, and highest price are all at the same position, indicating strong support below. If there is another opportunity for long positions, consider entering the market and exiting above the "T" shape. If it appears at a certain level of upward movement, it cannot be ruled out that a potential top has formed.

The "┴" doji is the opposite, indicating that during this period, the opening price, closing price, and lowest price are all at the same position, indicating strong resistance above. Therefore, it is prudent to consider short positions near the high point of the "┴" doji, and exit near the low point. If the "┴" doji appears at a certain level of downward movement, it cannot be ruled out that it may be forming a bottom.

4. One-Line Doji Candlestick Pattern

A one-line doji indicates that the closing price, opening price, highest price, and lowest price are all equal during a certain period, indicating low trading volume and little price fluctuation. At this time, it is best to observe the market and wait for the trend to emerge before making a decision. However, it generally indicates a continuation of the existing trend.

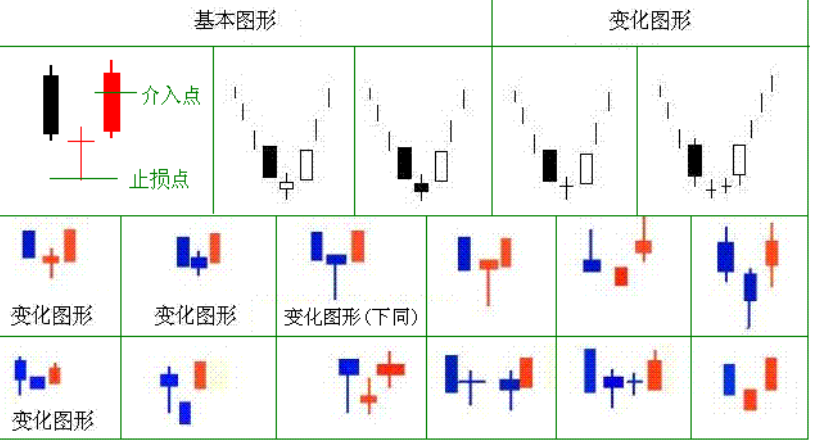

5. Morning Doji Star Pattern

The morning doji star, also known as the morning star, is a pattern composed of three candlesticks: (1) the market is in a downtrend, with a bearish candlestick; (2) the body of the candlestick gradually decreases, forming the main part of the star, but note that the low point is still moving downward, with only the tail of the candlestick being bullish; (3) the market resumes an uptrend, and a long bullish candlestick forms, returning to the range of the first bearish candlestick. This pattern is a strong trend reversal signal, indicating a clear reversal trend. Subsequent market trends will enter a period of oscillating upward trend, so this is a signal to consider entering long positions, but be sure to take profits in a timely manner.

6. Evening Doji Star Pattern

The evening doji star is the opposite of the morning doji star, also composed of three candlesticks. As the name suggests, "the sunset is infinitely good, just near dusk," indicating that the brightness is about to pass, and darkness is about to come. When this pattern appears during an uptrend, it is a relatively reliable reversal signal. Therefore, it is a signal to consider entering short positions, with the potential to capture profits in a timely manner.

7. Continuous Doji Star Pattern

This type can be divided into many different patterns based on the number and arrangement of consecutive doji stars, but generally, the most meaningful ones are the two-line doji and the three-line doji. The consecutive doji star pattern is the most complex and uncertain, and also the most difficult type of doji star pattern. The significance of the trend varies with different patterns, so personally, I think it is best to observe and wait when encountering a consecutive doji star pattern.

The above are the types and application of the doji candlestick pattern shared by Mr. Bi. It may not be comprehensive enough. If you have different opinions or need other trading techniques, you are welcome to come and exchange and learn. At the same time, I hope that in this market, all coin friends will continue to learn and progress, so that our investments can be helpful. In the future, Mr. Bi will move forward with everyone.

This article is exclusively written by the senior analyst Mr. Bi. The author has been studying financial market investments for many years, mainly analyzing and guiding operations in the BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV and other cryptocurrency contract and spot markets. The mentor has a solid theoretical foundation and practical experience, excels in technical and fundamental analysis, emphasizes capital management and risk control, and has a steady and decisive operating style, which is recognized by the majority of investment friends. If you need to know more real-time investment strategies, trading techniques, operational skills, and candlestick knowledge, you can follow the mentor.

- This article is written by Mr. Bi in the cryptocurrency circle, refusing to plagiarize, and respecting originality!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。