Original | Odaily Planet Daily

Author | jk

On June 18, the U.S. Securities and Exchange Commission (SEC) announced the end of its investigation into Ethereum 2.0 and stated that no enforcement action would be taken against Consensys. For Ethereum developers, technology providers, and the Ethereum ecosystem, this is undoubtedly a milestone victory.

It has been a week since the discussion on this matter, and many legal professionals have written detailed legal opinions on the issue. However, there are different opinions on the interpretation of this decision. Some lawyers believe that the end of this investigation means that all future topics related to Ethereum as a security (except for staking) will no longer be investigated, while others believe that this is only a temporary "truce" for Consensys.

This article will summarize the reactions of all parties, especially the different views of the legal community on this event.

Background

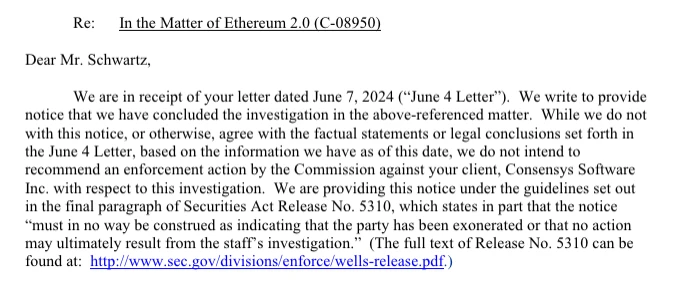

On June 18, the U.S. Securities and Exchange Commission (SEC) issued a notice ending the investigation into Consensys. The investigation was initiated after Consensys sued the SEC (for more details, refer to "ConsenSys Countersues SEC, May Affect Ethereum ETF Approval"). Although the wording of the notice was somewhat reluctant, it still expressed the end of the investigation into Ethereum 2.0. The SEC used ambiguous language: "While we do not agree with the facts or legal conclusions stated in the June 4 letter in this notice or in any other circumstances, based on the information available to us as of now, we do not intend to recommend enforcement action to the Commission against your client Consensys Software Inc." However, "this notice should not be construed as an indication of innocence or that no action will be taken as a result of the staff's (termination) of the investigation."

Original notice from the SEC. Source: SEC

On the day of the incident, Consensys immediately published an article, portraying it as a significant milestone victory. The article mentioned, "On June 7, we sent a letter to the SEC requesting confirmation that the approval of the Ethereum ETF in May (based on Ethereum as a commodity) means that the agency will end the investigation into Ethereum 2.0. Today, the SEC's enforcement division notified us that they are ending the investigation into Ethereum 2.0 and will not take enforcement action against Consensys." Consensys also insisted that the SEC must abandon its arbitrary and opaque enforcement regulation and provide much-needed regulatory clarity for the industry.

What do the lawyers say?

Consensys' lawyers' stance is consistent with the company's. Laura Brookover, Consensys' Senior Legal Counsel and Head of Litigation and Investigations, expressed her views on X platform. She posted, "The entire investigation (not just against Consensys) has ended. The letter indicates that no charges will be brought against Consensys, but the end of the investigation means no charges will be brought against anyone. It covers the entire Ethereum, so anyone contributing code or trading ETH is within the scope of the investigation. Now, the entire investigation has ended, not just against Consensys, but against everyone."

She also cited the SEC's enforcement manual, "An investigation that has led to enforcement action can only be closed after all enforcement actions are completed." Therefore, the end of this investigation means no enforcement action will be taken against anyone.

Furthermore, an important point is that Laura Brookover and Sam Enzer, a partner at Cahill Gordon & Reindel, attended an interview with the podcast media Unchained yesterday, where they shared many details not mentioned on the X platform. They believe that this letter to some extent represents internal disagreements within the SEC:

"It indicates that the enforcement officers have convinced Gensler that if they bring an enforcement action, charging the merged Ethereum (ETH) as a security offering or sale, they will fail and be embarrassed. I think Gary Gensler believes in his heart that ETH is a security, or because of the validation staking mechanism, ETH is offered and sold as a security. He thinks it's a security, right? Because people deposit something of value and get rewarded. In his view, this makes it a security, or he really wants the power to regulate it. But I think his staff told him we will lose this case."

However, this statement has also raised a lot of questions, especially since the ETF has not yet been finalized, and other exchanges and crypto institutions are still involved in litigation related to Ethereum. David Barrera, founder of Enumma, posted that there is no part of the SEC's letter indicating that the investigation has "ended." This decision only means that the SEC will not bring lawsuits against others who provide or sell Ethereum, but according to the SEC's enforcement manual, the staff's conclusion of the investigation and the decision not to bring a lawsuit against one party does not mean the investigation has "ended," nor does it mean that lawsuits will not be brought against other parties. In other words, Uniswap or other institutions may still be involved in legal cases related to Ethereum.

David further stated, "The phrase 'we do not agree with your factual statements and legal conclusions' is not the common or standard language in a letter indicating the discontinuation of an investigation. In other words, the SEC only mentioned this in the case of Consensys, which does not necessarily mean that they will completely abandon the lawsuit in the future."

Sam also mentioned in the podcast,

"In the letter closing the investigation, the SEC has discretion, right? Prosecutors have discretion to prosecute, and regulatory enforcement agencies have discretion to enforce. When they reject a case, it does not necessarily mean that the conduct is legal or compliant. It may be because the SEC does not have resources this year, or they have other more important things to deal with… But they are not bound and cannot turn back. Unfortunately, the SEC often changes its position."

At the same time, Laura made a point that the end of the SEC's investigation into Ethereum 2.0 is not related to Liquid Staking and Restaking, which is a completely different matter:

"The investigation into those activities by the SEC actually belongs to a separate independent scope of investigation and is not part of the Ethereum 2.0 investigation. Therefore, the end of the Ethereum 2.0 investigation does not actually indicate the SEC's view on liquid staking, restaking services, and collective staking."

Will it affect the final approval of the ETF and other lawsuits?

At present, the approval of the ETF is unlikely to be affected. Coindesk reported that SEC Chairman Gary Gensler told senators at a budget hearing on the 13th that the final approval of the Ethereum ETF will be completed this summer.

During a budget defense hearing before a subcommittee of the Senate Appropriations Committee, Gensler said that after a group of ETFs received preliminary approval, the process is "operating smoothly." The agency had previously granted preliminary applications, but he said that the final registration requirement—submission of the S-1 form—is now being handled "at the staff level."

As for other litigation cases, there have been no updates as legal cases generally progress slowly. Odaily will continue to track and report on this.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。