Original Author: Unchained

Original Compilation: Peyton, SevenUp DAO Returnee Union

Nathaniel Popper has just published a new book, "The Trolls of Wall Street," exploring the phenomenon of Wall Street Bets. Interestingly, at the time of his book's publication, it coincided with the current meme coin frenzy in the cryptocurrency field. In this episode, Popper discusses the rise of online investment communities like Wall Street Bets and what they reflect about broader social changes, especially among young men. He also touches on the similarities between the playful culture within these communities and the rise of figures like Donald Trump, delving into the potential dangers and psychological impacts of meme-based investments in modern finance.

Translator's Note: Wall Street Bets (WSB) is a subreddit on Reddit that mainly discusses stocks, options trading, and financial market strategies. The forum is known for its bold investment methods and challenges to traditional financial markets, attracting many retail investors. WSB members often discuss high-risk, high-return trades, such as buying volatile stocks and engaging in options trading. The forum is considered a "non-traditional" financial investment culture due to its community members being mostly retail investors rather than traditional institutional investors or professional traders. It has gained widespread attention for driving unusual price fluctuations in some stocks, especially the dramatic volatility of GameStop (GME) stock in early 2021.

Shifting from traditional financial fundamentals to idea-based investments

Laura Shin: You recently released a book about Wall Street Bets, and the timing is perfect considering Roaring Kitty (@TheRoaringKitty) has recently returned to social media, and we're seeing the fervor for memecoins on Solana. I know that a few years ago, the Wall Street Bets phenomenon was at the forefront of public consciousness, but from your book, it's clear that the same forces that created it are still at play.

Nathaniel Popper: Yes, those forces are still at play today.

Laura Shin: Right. So, can you talk about what you think is driving this phenomenon and how it continues to exist in our culture?

Nathaniel Popper: Well, you know, I used to report on cryptocurrency as well. My previous book was "Digital Gold," which told the story of Bitcoin. In this book, I wanted to take a step back and look at the entire online currency phenomenon, including cryptocurrency, stock markets, options markets, and the new world they encompass. The cryptocurrency market has spread in various directions, and I'm particularly interested in the sociology aspect of it—the world of investment and trading mainly composed of young people. I wanted to understand the roots of these phenomena. My previous research on cryptocurrency was very helpful in this regard because I believe the idea of meme and community, as well as investment based on ideas and speculative potential rather than financial fundamentals, permeates the entire community. This investment approach is very evident when young people invest in stocks and cryptocurrencies. I'm very interested in how this world influences each other, how cryptocurrency affects the stock market, and how the stock market in turn affects cryptocurrency and the options market. People often tend to narrowly view these phenomena, thinking that meme stocks, Bitcoin, and meme coins exist independently. But I see it as a whole new online currency world that people are exploring, creating new communities online.

Young Men and Cryptocurrency and Online Financial Communities

Laura Shin: One surprising point at the beginning of your book was how you placed this activity in the context of the changing role of young men in American society. Initially, I was surprised and didn't understand how you arrived at this conclusion, but as I continued reading the book and listened to the stories of those founders, it became more reasonable. Could you talk a little about your argument? Do you think the same demographic changes have influenced the rise of cryptocurrency?

Nathaniel Popper: I'm glad you asked that question. I think it's a little-known point. Broadly speaking, young men in America are facing challenges. Our society is experiencing a loneliness epidemic, and people are spending more time on the internet. Specifically, young men are skeptical of established authorities and traditional sources of truth. This skepticism is particularly evident in the cryptocurrency field, where many feel alienated from mainstream culture and the financial world. They are seeking purpose and a sense of identity.

When I was writing about Bitcoin, I saw that many early adopters were young men seeking meaning, power, and influence, feeling disconnected from the broader world. This desire for identity and meaning often found its answer in cryptocurrency, sometimes even described in terms akin to religion. Many people join these online communities because they feel a certain lack in their real lives.

This online financial community is largely dominated by men. Traditional male values, which may be suppressed in the external world, find a thriving space here. It's a proactive community where traditional male values are freely expressed. This doesn't fully explain all the developments in cryptocurrency or meme stocks, but it satisfies the fundamental impulses of these young men.

Laura Shin: I completely understand what you mean. Initially, I thought your book was just recounting what happened with Wall Street Bets. However, in the preface, you talked about the impact of demographic changes on American men, which initially confused me. But as I continued reading, especially in their discussions on life, political beliefs, and viewpoints, it all started to make sense.

Nathaniel Popper: In recent years, it has been observed that young men are falling behind their female counterparts in areas such as education and income. Despite men still holding many positions of power, this is changing in the younger generation. It's inevitable to link this with the rise of young men in investment and cryptocurrency. In this world of investment, young men are almost omnipresent.

The connection between these cultural changes and the financial world is complex. While this isn't the sole explanation, it's hard not to see the connection when delving into the personal stories involved. Many people seek this online world to fill the void in their real lives. For example, one of the main characters in my book found a new world in these online communities while struggling with alcoholism.

Laura Shin: I don't think you're exaggerating. I was just surprised to see it linked to such widespread social changes. There's definitely more to discuss about the reasons behind this phenomenon, and we'll touch on other factors shortly.

Design and Controversy of Robinhood

Laura Shin: Nathaniel, you described in your book the rise of Robinhood and how it fueled this activity. Part of it stems from certain design choices made by Robinhood, which may lead to more losses for retail investors. Could you detail these choices and discuss how you think they might impact or have already impacted cryptocurrency, especially considering the popularity of cryptocurrency on Robinhood now?

Nathaniel Popper: Robinhood was launched at the end of 2014, during the period of Bitcoin's surge from 2013 to 2014, when Bitcoin first broke $1,000. Many people discussing Robinhood on the Wall Street Bets forum either made or lost money on cryptocurrency, or saw friends get rich in 2013 and didn't want to miss the next big event. This sparked an unprecedented FOMO as people saw ordinary individuals getting rich from the boom in Bitcoin.

At the time, Robinhood was a very simple app, initially only available on the iPhone. It stripped away all the charts, data, and analysis provided by traditional brokerages, leaving only price charts and a big green "buy" button. The designers wanted it to be like Tinder or Uber, where you could buy stocks with just a swipe. This was very different from the way brokerages had worked before, involving multiple steps, warnings, and fine print that made trading seem inaccessible.

The simplicity of Robinhood made investing more accessible. When you bought a stock, there were confetti effects and a ding sound, giving an extra dopamine hit. Many people talk about Robinhood eliminating trading fees, but the design choices were equally important. These changes made trading seem easy and accessible, quickly attracting a whole new generation of investors.

However, some criticized Robinhood for making investing too easy. Traditionally, investing should be a rational decision, considering a company's financials, potential price fluctuations, and cash flow. Robinhood set all of this aside, changing the philosophy of trading and investing. This new approach grew significantly from 2015 and eventually felt like it had taken over the entire market by the time of the COVID-19 outbreak.

The Potential Dangers of Meme in Modern Investments

Laura Shin: I'd like to ask you about the role of memes in investments as portrayed in your book. In cryptocurrency, we see meme coins representing some of the best-performing assets, yet critics often mock them as foolish or fraudulent. Through your research on Wall Street Bets and their investments in meme stocks, what do you think is the value of memes? How do retail investors' understanding of meme stocks or meme coins differ from what more "serious" investors might overlook?

Nathaniel Popper: This is a very complex and interesting question. The trend of meme-driven investments hides many dangerous factors, investment losses, and sad stories. Every stock and cryptocurrency carries some degree of meme factor. Investment always involves an understanding of the company and the community it represents. Even if we don't call it "meme," this aspect of psychological investment has always been present.

I believe the introduction of memes into investments began in the cryptocurrency world, highlighting how language connects us online. Social media is full of valuable communities, yet traditionally, we couldn't directly benefit from them. Meme monetizes the idea of community and identity, changing this status quo.

Memes touch on fundamental factors that have always existed in investments: you invest in a company not just because of its balance sheet, but because of something valuable it represents. Memes condense this idea into a purer form and transform it into an asset. However, the more you rely on memes rather than fundamental financial substance, the more speculative and dangerous the investment becomes.

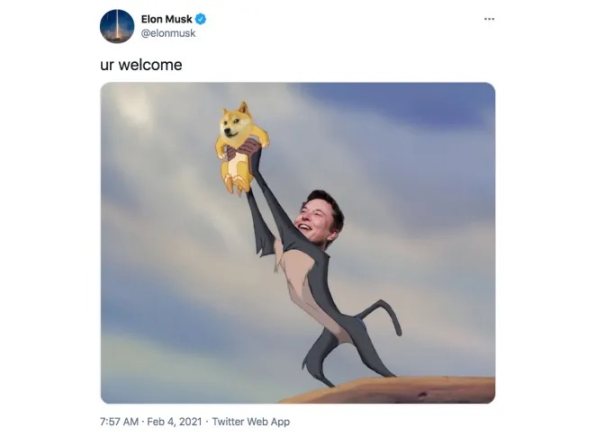

An important issue is that the communities promoting meme coins often elevate the reputation of those who stand to profit the most, overlooking those who lose money. This is particularly evident in actions related to Elon Musk and Dogecoin, Bitcoin, and even his own stocks. Social media amplifies the voices of those making money, overshadowing the losses experienced by others. This imbalance poses significant dangers because we often overlook those who ultimately lose out in these speculative situations.

The Relationship Between Trump and the Cryptocurrency Community

Laura Shin: There are indeed some similar stories in your book. I have to ask about Trump because many of the things you talked about in the book are now in the news. Trump accepted Bitcoin and cryptocurrency during his campaign, which sharply contrasts with his previous statement as president that "Bitcoin is a fraud against the dollar." Now, a part of the crypto community supports Trump because he is courting crypto voters. Can you find some similarities between the shift of the Wall Street Bets community towards Trump and the current shift of the crypto community towards Trump?

Nathaniel Popper: In my view, a large part of this new online investment world is fundamentally about trolling. That's why the word "troll" appears in the book title. I'm not using this term entirely pejoratively. It's about people who fundamentally see themselves as trolls. It's worth pausing to think about what trolling is: it's a universe where everything seems like a joke. When Trump announced his candidacy, it seemed like a joke, and most people treated it that way. However, beneath that joke, he touched on many things deep within American voters. He was willing to say things that no one else dared to say, and people wanted to hear them.

This serious yet playful stance has been present from the beginning in Bitcoin, Trump, and GameStop. It's easy for people to get lost in the surface comedy and overlook what truly resonates with people. Bitcoin, Trump, and GameStop are all like that. People always treat them as jokes and dismiss them, but they keep coming back into view because there's something deeper behind them that resonates with people.

Even when these things are successful, they are often overlooked. Bitcoin was successful in 2013 and 2014, reaching $1,000, but when its price fell, people thought it could be ignored. The same happened with Trump after January 6, 2021, and with GameStop. People thought they could ignore these phenomena after the initial frenzy, but years later, they still hold significant meaning. There's something deeper that resonates with people, and that's the essence of trolling.

Whether Trump acknowledges it or not, he has a lot in common with the mindset of the Wall Street Bets community. They see him as one of their own, someone who can smile and unexpectedly defeat opponents. This dual presence of humor and serious intent deeply influences our culture.

Laura Shin: Yes, your book reflects what's happening now very well.

Nathaniel Popper: Think about the person holding the "buy Bitcoin" sign behind Janet Yellen. It's just a joke, but nothing gets Bitcoin's attention more than that. In the attention economy of the internet, the bigger the joke, the more attention it gets, and the more real it becomes.

Laura Shin: This is why we see the value of meme coins constantly rising. This is related to how the internet works, where people make money through advertising, and advertising depends on attention.

Nathaniel Popper: People used to make money through advertising, but advertising doesn't necessarily make someone lose money. However, with meme coins like Dogecoin, we see more invisible losers.

Laura Shin: Yes, of course. I've talked to some people who bought Dogecoin at the peak.

Nathaniel Popper: Even Elon Musk promoted it on Saturday Night Live until he admitted it was just a joke. Trolls are always willing to eventually admit they're not serious.

Laura Shin: Yes, but he probably made a lot of money from it. Anyway, Nathaniel, this was a great conversation. Your book is very timely as these events are back in the headlines.

Nathaniel Popper: The history of the internet is very cyclical and periodic. Bitcoin is a typical case, and we see this cycle continuing time and time again.

Laura Shin: Yes, we are entering another bull market cycle, so we will see how these events unfold this year. Thank you very much for joining "Unchained."

Nathaniel Popper: Thank you for inviting me, Laura.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。