On the afternoon of June 13th, AICoin researchers conducted a live graphic and text sharing on "How to view ETH ETF? (Free membership)" in the AICoin PC-end-Group Chat-Live. Here is a summary of the live content.

I. Current Progress of ETH ETF: 1. Compared with BTC, the trend of ETH is slightly sluggish Currently, ETH's impact on the market is much weaker than BTC.

2. A positive for ETH at present is the future listing of spot BTC and ETH On May 23, the SEC approved 19b-4 rule changes for eight spot ETH ETFs, but has not yet approved the applicant's S-1 registration statement.

3. ProShares submitted an S-1 registration statement for Ethereum spot ETF on June 11. If approved, the New York Stock Exchange will list and trade ProShares Ethereum spot ETF shares.

4. The view given by institutions is: Bloomberg ETF analyst Eric Balchunas stated that spot ETH ETFs could start trading around the end of June or July 4. JPMorgan believes that these funds will start trading before November. Currently, most institutions have listed documents about ETH ETF on DTCC. Although they have been listed, it does not mean that the ETF will be listed. However, we can see the inclination of institutions—Belde, Grayscale, Fidelity, and Invesco are all optimistic about this direction. These institutions have been pushing for spot BTC ETFs in the past, and the attitude of institutions is positive. However, the listing time requires SEC approval, which is crucial.

5. The issue of staking rewards

The annualized staking yield on Lido is around 3%, and ETFs do not support staking rewards. The yield of holding coins will be about 3% higher than holding ETFs. For the security of the entire ETH network, ETH imposes requirements on validators, and validators earn staking rewards through staking ETH. Holding coins will have slightly higher returns than holding ETFs, so the attractiveness of ETFs will decrease slightly. However, ETFs are more compliant with stock markets, providing better safeguards for fund compliance, which is a natural advantage.

II. Differences between ETH ETF and BTC ETF 1. Expected scale: Market value: The market value of BTC is around 13.297 trillion USD, and the market value of ETH is around 419 billion USD, roughly in a ratio of 2.7:1.

Spot ETH ETFs have already been launched in Hong Kong.

The AUM (assets under management) of BTC ETF is 274 million USD, and the AUM of ETH ETF is 49.4 million USD, roughly in a ratio of 5.5:1.

The current AUM of spot BTC ETF in the US stock market is 53.735 billion USD. According to a blogger, the scale of ETFs in Canada is also roughly 6:1. If estimated according to this ratio, the future AUM of spot ETH ETF will be around 9-10 billion USD.

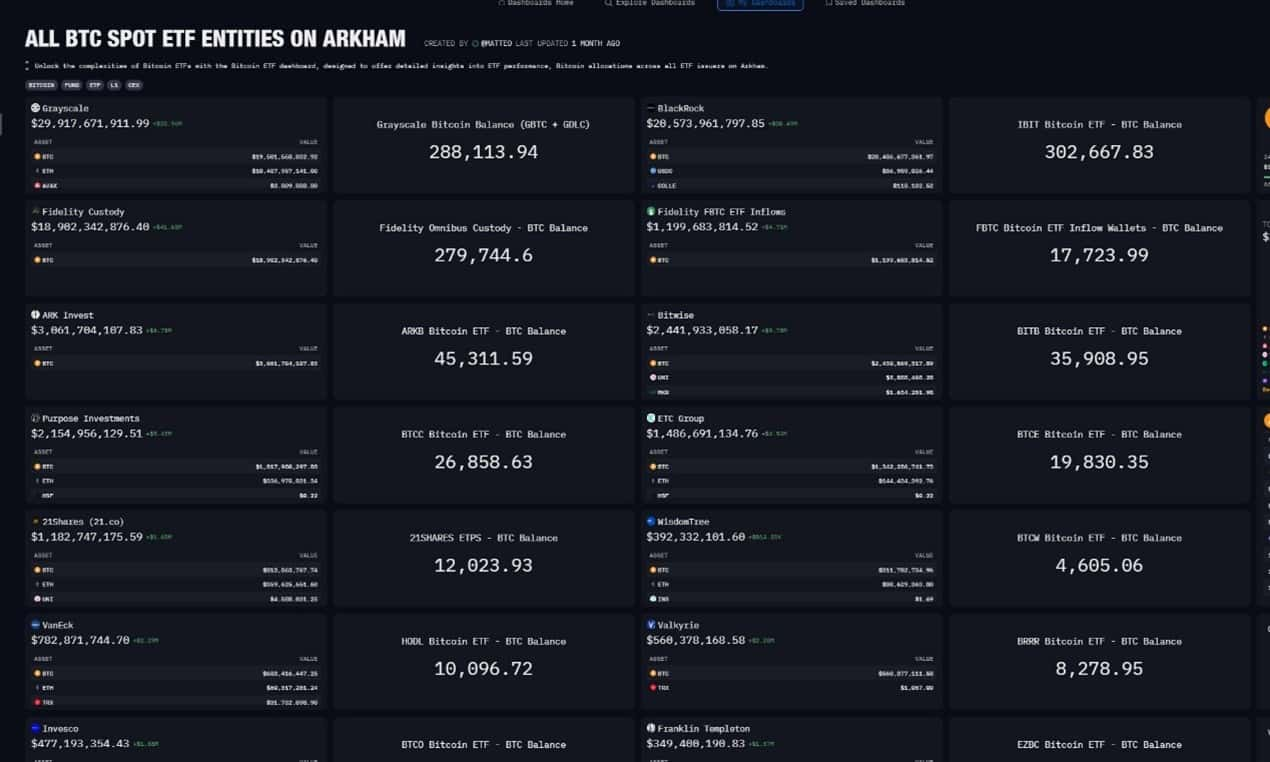

2. From on-chain holdings data (1) The dashboard data shown below is the amount of Bitcoin held by ETFs in the US stock market and the corresponding USD value.

US stock ETFs collectively hold 880,000 BTC (valued at approximately 59.3 billion USD), accounting for 4.47% of the current BTC supply.

By checking on Dune, three ETFs in the Hong Kong stock market hold 40,741.3 BTC (valued at approximately 274 million USD), accounting for 0.16% of the current BTC supply, and hold 14,030 ETH (valued at approximately 49.4 million USD), accounting for 0.09% of the current BTC supply.

(2) You can go to Arkham to see the overall position of institutions after the spot ETF is listed.

III. How will ETFs affect the future trend of ETH? 1. The key to ETFs and listing is the influx of incremental funds. Take a look at the data for BTC.

After the approval of BTC ETF on January 11, there was a slight pullback, and two months later, it reached a new high. There is no problem with the influx of incremental funds from ETH ETF bringing new highs, but the increment is also a process, and net inflow data needs to be observed.

2. Why is RWA promising? Mainly the connection between traditional institutions and crypto From the perspective of the public chain ecosystem, ETH itself has great advantages. Currently, the concept of RWA speculation mainly includes three: LINK, ONDO, TRU. Link is for oracle, related to RWA, because it has cooperated with SWIFT, Real World Asset concept. PolyX was popular for a while, you can check the dynamics. ONDO is mainly backed by Belde, and IBIT is under Belde. TRU is said to have government cooperation.

Institutional holdings: Arkham, Dune can be searched.

The advantages of the ETH ecosystem are evident, as LINK, ONDO, and TRU are all deployed on the ETH chain, giving it a first-mover advantage.

3. How will ETFs affect the trend of ETH? The main concern is the correlation of volatility. The yellow line represents the price of BTC, and the blue line represents the price of ETH. You can check the overall trend of Coinbase, copy the link to the browser and open it. A VPN is required:

In my personal observation, the overlap between the intraday trading direction of BTC and Coinbase is increasing, but for the US stock market, you need to look at the night trading time, which is not friendly to users in the Asian time zone. Arkham has fewer regional restrictions, and it can be accessed from Singapore.

4. Understanding the flow of funds from ETFs The incremental funds from ETFs flow from the stock market to the currency market, inevitably affecting the volatility of the crypto market. Coinbase is the largest compliant cryptocurrency exchange in the United States, which is Coinbase's advantage and core. In addition, Coinbase has also done a lot of institutional cryptocurrency custody business. Another point is that ETH is in a deflationary state, which is a positive factor for the coin price.

You need to look at the differences between the two markets. The stock market is not open all day, while the cryptocurrency market trades all day, so some data will not completely overlap. You can check the pre-market data of Coinbase, but the trading volume is too low for high reference. In addition, the leverage and volatility of the cryptocurrency market are much greater than those of the stock market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。