Source: Grayscale

Compiled by: Yanan, BitpushNews

In the field of cryptocurrency on smart contract platforms, there is a value accumulation mechanism called the "flywheel effect." This mechanism, like a snowball, tightly links transaction fees and network usage to the value of tokens, network security, and decentralization.

Different smart contract platforms adopt different strategies for fee income. Some platforms increase revenue by setting relatively high transaction fees, while others attract more trading volume by lowering transaction fees.

Grayscale's research shows that fee income can be seen as the main factor driving the growth of token value in this field. Of course, there are other important fundamental factors worth paying attention to, as they will have an impact on fee income over time.

Ethereum, as a leader in this field, has accumulated a huge amount of network fee income after years of successful operation, surpassing the $2 billion mark in 2023. Meanwhile, other smart contract platforms such as Solana are also rapidly rising, with fee income expected to reach about $200 million in 2024.

Many people mistakenly believe that cryptocurrencies have no substantial value and are difficult to evaluate using traditional investment methods. However, Grayscale's view is quite the opposite. They point out that smart contract platforms like Ethereum and Solana can generate income through economic activities on their networks. Grayscale suggests that a feasible way for investors to evaluate the value of cryptocurrencies on smart contract platforms is to see how much fee income they can generate over time.

Overview of Smart Contract Platform Fundamentals

Smart contract platforms such as Ethereum and Solana provide a network environment for developers to build various decentralized applications. These applications cover a wide range of areas, from gaming to finance, and even NFTs. The core function of these smart contract blockchains is to process various transactions for the hosted applications in a secure and censorship-resistant manner.

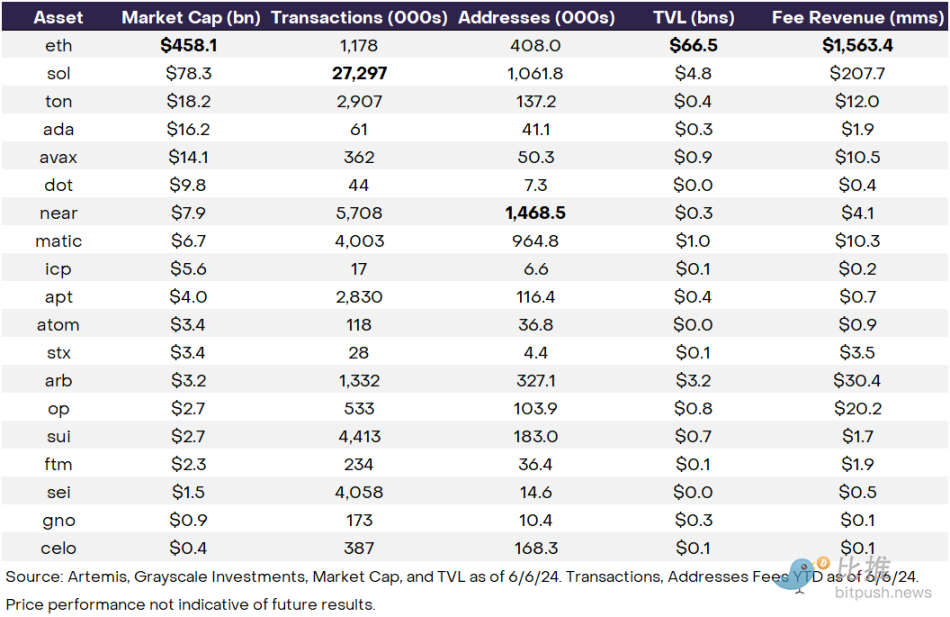

As a result, the value of smart contract platforms is closely linked to the activity level of their networks. Key indicators for measuring network activity include: the platform's transaction volume, the user scale it can support (usually measured by the number of daily active addresses), the total value locked (TVL) that the platform can support, and the platform's ability to monetize block space, reflected through fee income (to be detailed later).

Each indicator has its specific significance. For example, Ethereum's significant advantage in TVL (up to $660 billion, more than seven times that of its closest competitor) fully demonstrates the platform's liquidity advantage and unique value positioning in the financial application field (as shown in Figure 1). In addition, Ethereum's leading position in the number of ecosystem applications further fosters a strong network effect to attract new developers, applications, and users. Meanwhile, Solana's key indicator of daily transaction volume not only highlights its high throughput and low cost advantages, but also demonstrates that its blockchain technology is well suited to address large-scale application scenarios, such as DEPIN, as well as projects related to the retail market, such as NFTs and meme coins.

In addition to comparing and contrasting these basic indicators across assets, investors can also analyze these data in combination with the market value or market valuation of specific assets. For example, as shown in Figure 1, although Solana's TVL ($4.7 billion) currently exceeds that of Arbitrum ($3.2 billion), the market value-to-TVL ratio of Arbitrum (1x) is much lower than Solana's ratio (16x). These indicators provide investors with a way to gain in-depth understanding of the relative strengths and weaknesses of different assets, and also help them discover potential value investment opportunities.

Key Role of Fees

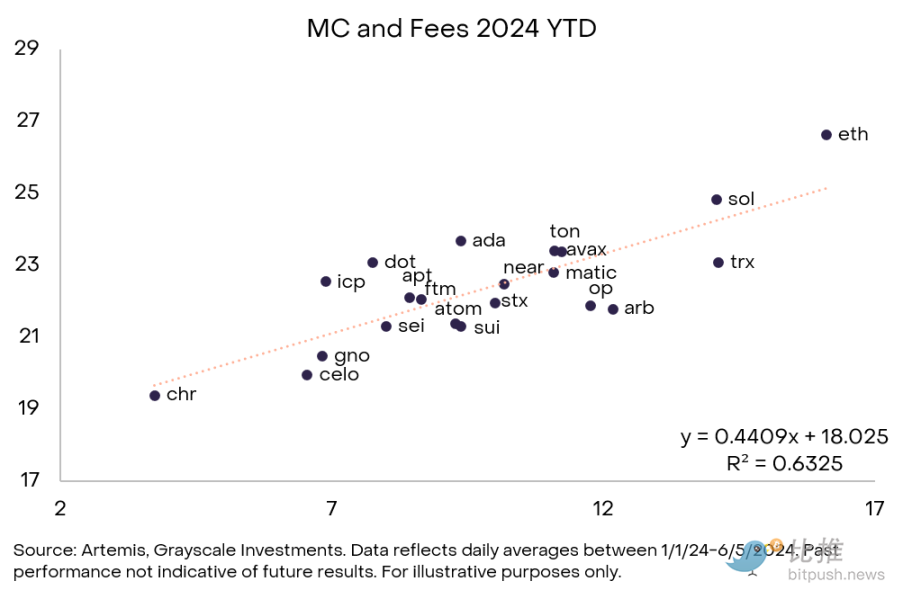

Although there are numerous means to evaluate platform network activity from theoretical and practical perspectives, fee income undoubtedly becomes a crucial fundamental indicator when evaluating the value of smart contract platforms (see Figure 2). This indicator can be understood as the total fees users need to pay to enjoy network services. Smart contract platforms may have various revenue models, but ultimately, they need to generate income through fees to create value for token holders.

Similar to centralized entities competing in traditional industries, decentralized networks also strive for fee income in various ways. For example, some smart contract platforms increase fee income by setting relatively high transaction costs, while others attempt to attract more trading volume by lowering transaction costs. Both strategies have the potential to succeed. Take two hypothetical blockchains as examples:

Example Chain 1: Few users and low transaction volume, high cost per transaction

5 users, 10 transactions, $10 per transaction: Network fee income = $100

Example Chain 2: Many users and high transaction volume, low cost per transaction

100 users, 100 transactions, $1 per transaction: Network fee income = $100

This case reveals a phenomenon: despite the far greater number of users and total transaction volume on Chain 2, the network fee income generated by both chains is roughly equal. Of course, metrics such as users and transaction volume are indeed crucial, but we also need to consider them in conjunction with transaction costs, as this directly determines the level of fee income.

The importance of fee income is evident both from practical experience and theoretical concepts. For example, Figure 2 shows the relationship between fee income and market value (using logarithmic scale) of our smart contract platforms in the cryptocurrency industry. Although the cryptocurrency market is still in the process of maturing, investors have been able to differentiate between different projects based on fundamental data. Grayscale's analysis indicates that the relationship between fee income and market value is quite stable, and compared to other fundamental measures of smart contract platforms, the correlation between fee income and market value is higher.

Grayscale emphasizes that there is a close connection between fees and market value, partly because network fee income plays a crucial role in the value accumulation of tokens. Value accumulation means that the way protocols build tokens can link network activity to the long-term sustainable value of tokens. We can observe different stages of value accumulation through three examples: Ethereum, Solana, and Near.

Ethereum: A Proven Value Accumulation "Premium Chain"

Ethereum is not only the first smart contract blockchain, but also the one with the highest market value. However, since 2022, it has been facing severe scalability challenges. With the increasing usage frequency, network congestion issues have become increasingly prominent, leading to a significant increase in user transaction fees: on May 1, 2022, the average network fee per transaction once reached $200.

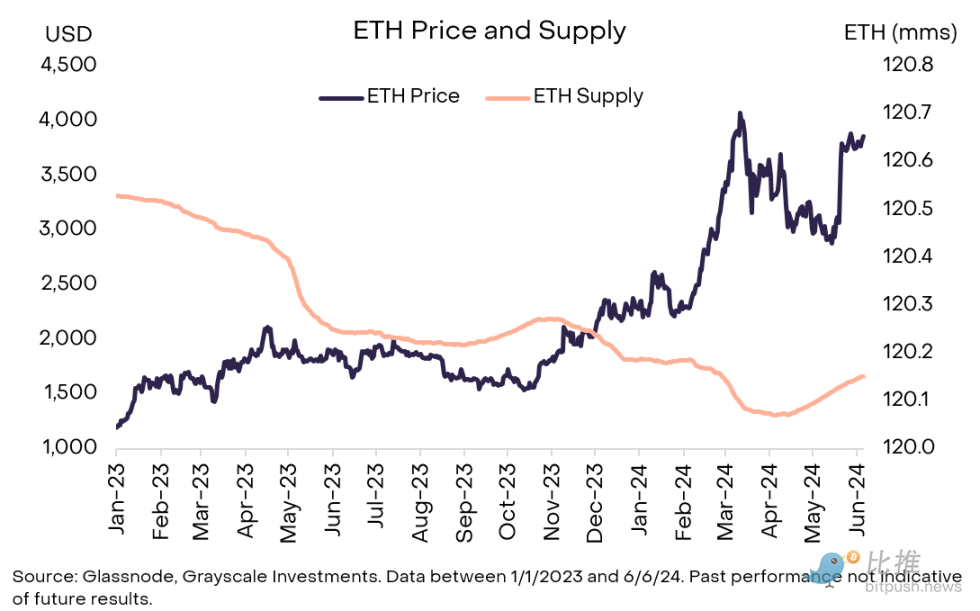

Nevertheless, the surge in usage and high average transaction fees has brought significant value accumulation to Ethereum. In 2023 alone, Ethereum's total network fee income exceeded $2 billion. Each time a user makes a transaction, the base fee is "burned," meaning that this portion of the tokens will permanently disappear from the network, reducing the total supply. Meanwhile, the fees paid by users will be used to prioritize processed transactions, and these fees will be rewarded to validators and participants in securing the network through staking.

Therefore, in 2023, the Ethereum network achieved the "burning" of 2 million Ethereum tokens (accounting for 1.7% of the supply) through huge income, creating value for Ethereum holders and rewarding validators and staking participants with up to $390 million to incentivize them to work harder to enhance network security.

Ethereum has entered a mature stage and has fully demonstrated its ability to accumulate value. On the Ethereum mainnet, users are willing to pay high prices to obtain high-quality products—here, "products" refer to block space supported by a smart contract platform with top-notch network security. This is particularly important for applications involving large transactions and highly valuing network security, such as stablecoins or tokenized financial assets. As of June 6, 2024, the platform's valuation has reached a staggering $4.58 trillion, almost six times that of any other smart contract platform. This significant advantage undoubtedly highlights its outstanding ability in user monetization and market maturity.

Solana: Exploring Value Accumulation "High-Performance Chain"

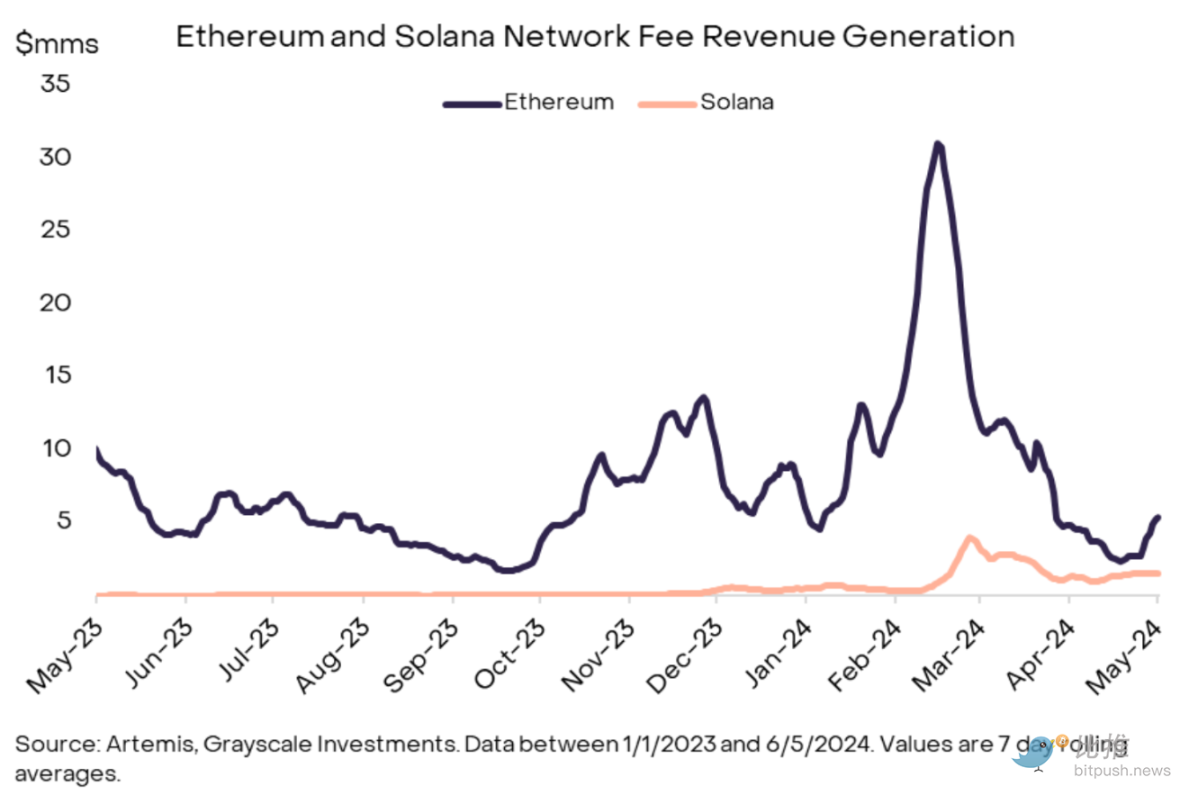

Different from Ethereum's fee income model, Solana has chosen a unique path and has gradually narrowed the gap with the market leader in recent times. As the second-ranked smart contract platform by market value, Solana has been seen as a faster and more economical alternative to Ethereum, with a remarkable speed of 335 transactions per second and an average transaction cost of only $0.04. Although in 2023, Solana processed a much higher transaction volume than Ethereum, its network fee income was only $13 million, compared to Ethereum's $2 billion (a difference of 154 times).

In the past, this lack of value accumulation reflected Solana's relative shortcomings; however, in 2024, this situation is changing. So far, the fees generated by Solana have been six times that of the entire year of 2023, reducing the fee gap between Ethereum and Solana from 154 times in 2023 to 16 times (see Figure 4). This shift indicates that Solana's model—low transaction costs combined with high throughput—can also create significant economic value.

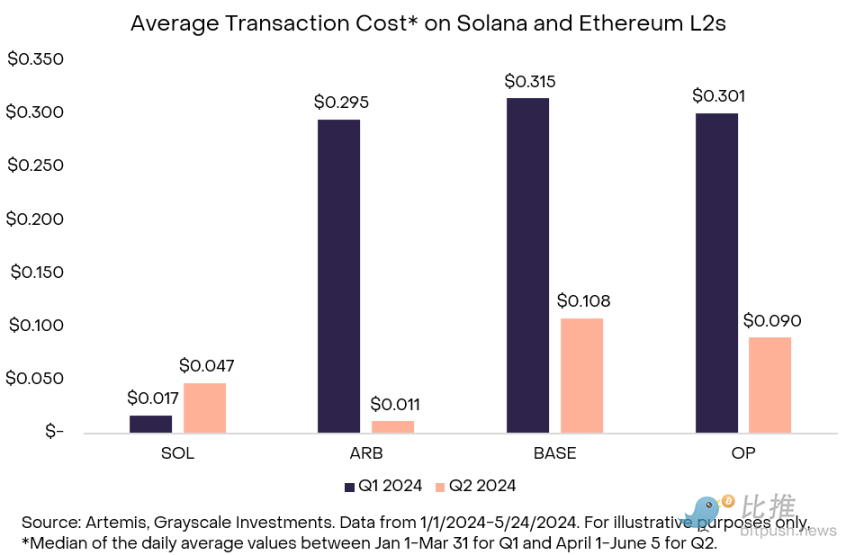

The significant growth in network fee income is mainly due to a substantial increase in average transaction fees (37 times higher than last year), rather than relying solely on overall transaction volume growth (which increased by only 33% compared to last year). Interestingly, while Ethereum's L2 transaction fees have decreased due to the Ethereum Cancun upgrade, the average fees for SOL, traditionally known as the "budget option," have increased. Since April 1, despite Solana's average transaction fee per user ($0.04) still being lower than Ethereum's ($4.80), it is higher than L2's Arbitrum ($0.01).

Compared to Ethereum's L2 solution Arbitrum, Solana's per-transaction fees have increased for users, which may have a certain impact on its brand image as a low-cost, high-efficiency chain. However, Grayscale points out that from an overall perspective, the fee increase is still a positive signal. It not only reflects high user activity but also demonstrates the continuous growth of value for staking participants and token holders.

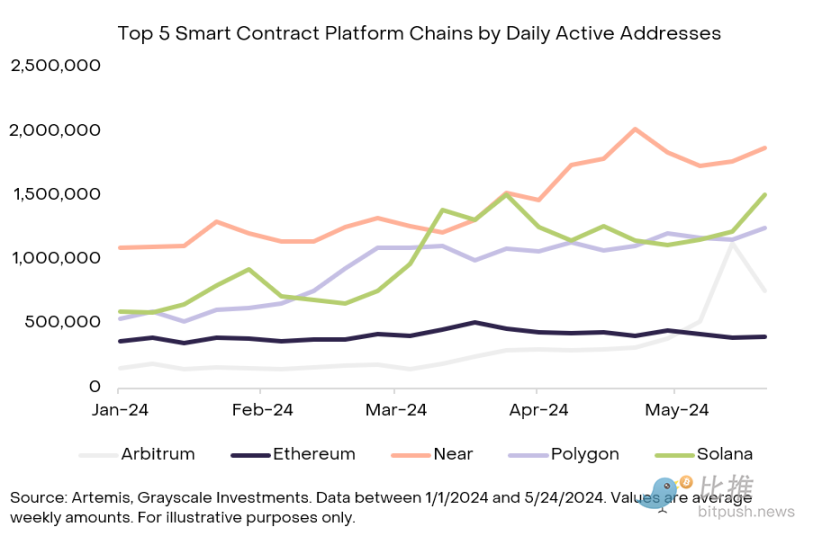

Near: Leading the Entry into Cryptocurrency, Network Monetization Emerging

In stark contrast to the previous two cases is Near, a smart contract platform that has recently seen significant application in non-speculative scenarios but has not yet shown significant value accumulation. Near is the underlying platform for KaiKai and Hot Protocol, the two largest decentralized applications (dApps) in terms of user base in the cryptocurrency field. Among all smart contract platforms, Near's performance is particularly outstanding, with a daily active user base of 1.4 million and throughput comparable to the fastest chains in the industry such as Solana (see Figure 6).

Despite its significant user base, Near's performance in user monetization lags far behind its competitors, having generated only $4.1 million in fees over the past year. This reflects that it is currently in a relatively immature development stage, which can also be seen from its market value relative to its competitors (market value of $7.9 billion, compared to Ethereum's $4.58 trillion and Solana's $780 billion). Although the Near network has demonstrated the ability to process transactions at high speed, it has not yet created enough value accumulation for token holders or depositors to prove that its market value can reach the level of large competitors.

Although Near has not achieved significant results in monetization so far, its extensive application base is undoubtedly a good start. If the Near network can continue to expand its application scope or increase average transaction fees without reducing network activity (similar to Solana's recent progress), it has the potential to achieve significant value accumulation.

Ethereum, Solana, and Near, these three smart contract platforms, represent different stages of maturity in network fee income for decentralized networks. Ethereum has stable income and growth over many years. Solana has a solid user base and is just beginning to generate substantial income. Near, while demonstrating the attractiveness of its products, partly due to its low cost, has not yet achieved substantial income.

Fees and Valuation: Key Points and Subtle Differences to Consider

The issue of fees and valuation for smart contract platforms in the cryptocurrency field indeed contains many key points and subtle differences to consider. First and foremost, each protocol has its unique value accumulation method, accompanied by different token issuance rates (inflation) and consumption rates (deflation). For tokens with a high inflation rate, the value accumulation effect brought about by fees may be significantly weakened due to the large consumption of tokens.

Furthermore, different protocols have their own fee structures. Take Ethereum, for example, where transaction fees not only contribute to the destruction of tokens, indirectly benefiting all token holders, but priority fees are also allocated to validators and stakers. In contrast, Solana's fee allocation mechanism has its own characteristics: 50% of transaction fees are burned, and the remaining 50% belongs to stakers. Recently, a vote decided that Solana's priority fees will be 100% allocated to validators. This strategy to some extent reflects Solana's higher hardware requirements for validators.

It is worth noting that the high level of Miner Extractable Value (MEV) activity on Solana has brought additional rewards to validators and market participants, but this reward may constitute an "indirect" cost for token holders. Therefore, from a certain perspective, Ethereum's fee structure seems to provide more value feedback to ordinary token holders, while in Solana's system, validators and market participants may receive more substantial returns.

Valuation of traditional assets typically involves discounting future cash flows to the present, and the valuation of crypto assets may also involve discounting future expected network fee income to the present. This approach considers the potential growth of a specific network in terms of adoption, usage, or monetization, and its evaluation method differs from the current overall fee generation situation. For example, we may have reason to believe that Ethereum's valuation of $4.58 trillion is not solely based on its current fee generation, but also takes into account its ability to leverage network effects, as well as the adoption rate, usage frequency, and potential growth of fee income from Layer 2 technologies in the future.

Additionally, the valuation of certain crypto assets may also include a component of "monetary premium." In other words, users may be willing to hold a certain asset because it serves as a medium of exchange or store of value, and this value often surpasses the ability of the network to generate fee income. This concept of "monetary premium" is particularly important when considering the valuation of Ethereum, especially when the token is widely used as collateral within the industry.

Conclusion

If a protocol implements a value accumulation mechanism properly, the growth in network usage will not only incentivize users to hold tokens, encourage them to be staked, and potentially increase the token's value, but it will also further encourage users to become validators or token holders, thereby enhancing the network's security. In addition to contributing to network security, fee collection can also stimulate more validators to participate in the project, thereby increasing the network's decentralization and resistance to censorship. Therefore, value accumulation is like a flywheel, closely linking fees, network usage and token valuation, as well as the security and decentralization of the network.

We need to recognize that while fees can serve as an indicator of network maturity, there are many other factors within this flywheel that can affect the growth and valuation of the network. For example, when the adoption rate of a particular application increases, it will attract more users to join, thereby attracting more developers to work within the same ecosystem. Therefore, when evaluating network fees, we should consider other fundamental indicators and the relative valuation (market value) of specific ecosystems for a comprehensive assessment.

Looking ahead, it is crucial to continue monitoring the development dynamics of these growth "myths." Despite the relatively high average transaction cost for users (reaching $4.80), will Ethereum be able to further increase its fee income on the mainnet through high-value transaction scenarios such as tokenized financial assets? Will the fee income of Ethereum increase with the increasing frequency of L2 activities? And how will Solana find a balance between monetization and maintaining low on-chain costs to prevent users from turning to other low-cost, high-throughput competitors? Will Near attempt to monetize or continue to forgo meaningful revenue opportunities in favor of prioritizing user expansion?

These dynamic changes emphasize the importance of continuous monitoring of key indicators such as fees, transaction volume, active users, and total value locked (TVL). Grayscale firmly believes that as the crypto asset class gradually matures and adoption rates continue to grow, the significance of these core indicators will become increasingly prominent. They can provide a deeper reflection of the relative advantages and opportunities of smart contract platforms, helping investors to gain a more detailed understanding of network value and thereby providing them with wiser decision support.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。