Recently

Many risk market price indices are hovering near historical highs, waiting for new indications of US dollar interest rates. Tonight's May non-farm data may shed light on the market. Traders and economists expect a slight slowdown in US May non-farm data, with wages and unemployment rates expected to roughly align with recent trends.

The ADP employment data released on Wednesday fell short of expectations, showing that the private sector added 152,000 jobs in May, below the expected 175,000 and lower than the 188,000 in April. Data released by the US Department of Labor on Thursday showed that the seasonally adjusted initial jobless claims rose to 229,000 for the week ending June 1, higher than the market's expected 220,000, reaching a 4-week high.

Based on this, it is predicted that US May non-farm job growth may be between 175,000 and 225,000, despite significant uncertainty in the current global context. A significant shortfall in the non-farm employment report could potentially lead to the US dollar falling below 104.00, but as long as the employment report is close to expectations, the dollar may rebound.

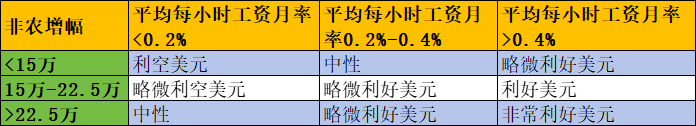

The following chart shows the potential impact of the May non-farm report on the US dollar.

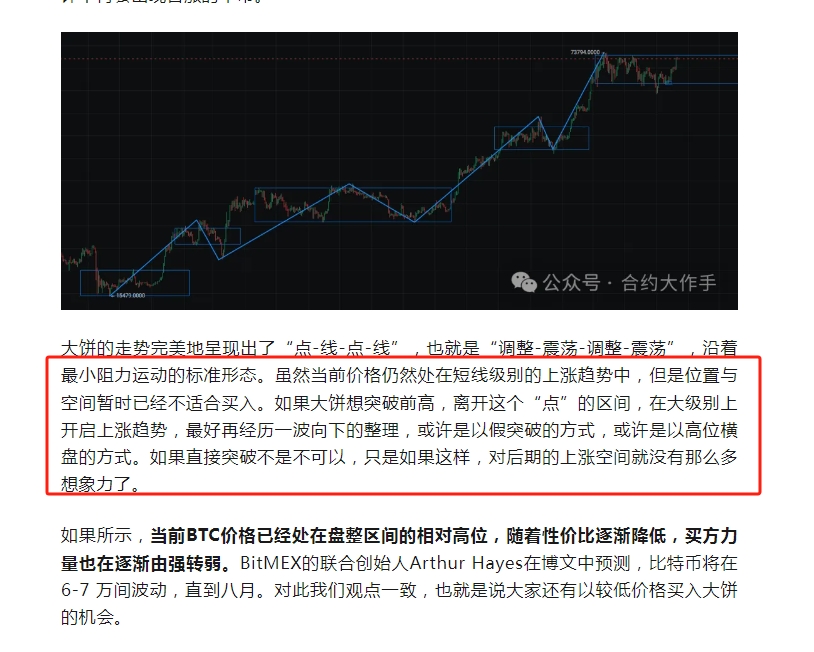

As early as May 21, in the article "Bitcoin breaks through $70,000 again, the US may approve Ethereum ETF this week," it accurately predicted that 72,000 was the rebound high point, and that this level and space are temporarily not suitable for buying.

The current judgment remains the same. If the decline from March 13 to May 1 is considered a retracement of the previous uptrend, then the breakout space at this time will not be significant, and the price is expected to stop within $100,000.

If in the coming days, the short-term stops near the previous high or experiences a false breakout, followed by a monthly retracement and consolidation, forming a larger central structure over the past 3 months (whether it breaks the previous low or not), it will allow for more comprehensive chip exchange for the year-long uptrend. When it breaks out again, the future price will rise to at least above $100,000.

This seems more reasonable

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。