⚡️Let's talk about "DWF" from the perspective of a market maker | Is it an innovative tool or a harvesting machine?

When you hear the name "DWF," some people may feel a sense of alarm, as if facing a formidable enemy, while others may light up with excitement!

Some people grit their teeth at it, while others can't get enough of it!

This is the market maker DWF Labs @DWFLabs @DWFVentures, which is both in the limelight and deeply divisive.

So why do people have such conflicting views on a market maker? Today, let's delve into its past, present, and the reasons behind it—

1️⃣ Indispensable Market Maker in the Cryptocurrency Industry

Many friends have been trading coins for a long time, but they may not know what a market maker is, why it exists, and why some people consider market makers as manipulators because some of their actions may be seen as attempting to influence or manipulate market prices.

It's important to note that not all market makers engage in manipulation. Their actions usually play a crucial role in market liquidity and efficiency. However, because they operate beneath the surface, for most people, market makers seem like a mysterious organization hidden in the corner—

1) Let's understand what a market maker does:

The most important thing in finance is liquidity! Liquidity is the force that keeps the entire financial system running smoothly; the ability to buy and sell assets quickly and efficiently is crucial for traders, investors, and the entire market.

Market makers, as important participants in the financial market, play a unique role in providing market liquidity and market efficiency.

In the cryptocurrency industry, market makers are an indispensable part of the entire Crypto ecosystem and are the guardians of cryptocurrency liquidity!

Traditional securities market makers are licensed traders who provide liquidity to the securities market by continuously quoting buying and selling prices for specific securities, accepting buy and sell requests from the public at those prices, and trading securities with their own funds and securities.

In the coin circle, market makers are liquidity providers—cryptocurrency market makers refer to institutions or individuals that provide liquidity and quotes for cryptocurrency trading platforms or projects. They use algorithms and strategies to profit from market fluctuations and demand differentials.

Market makers play an important role in the cryptocurrency industry. They not only reduce trading costs and improve trading efficiency but also promote the development and promotion of new projects.

The business of cryptocurrency market makers is not fundamentally different from traditional finance, but there are significant differences in operational mode, technology, risk management, and regulation—

First, the scale of market makers in the cryptocurrency industry is relatively small;

Second, the liquidity of the cryptocurrency market is relatively low, and the volatility is high, so market makers need to be more cautious in risk management;

In addition, because the trading process in the cryptocurrency market is difficult to regulate and there is no strict market maker system to constrain it, the relationship between exchanges, projects, and market makers becomes more complex.

Finally, in terms of technical architecture, the cryptocurrency industry requires higher technical capabilities to ensure the security of transactions.

Market makers use various trading strategies to provide liquidity and make profits. Some of these strategies include statistical arbitrage, order flow trading, and market-neutral strategies. These strategies aim to exploit market inefficiencies and price differentials.

2️⃣ DWF: Global Cryptocurrency Market Maker and Multi-stage Web3 Investment Company

DWF Labs was officially launched by Web3 venture capital and market maker Digital Wave Finance in September 2022.

The DWF website homepage states:

DWF Labs is a new generation of Web3 investors and market makers, one of the world's largest high-frequency cryptocurrency trading entities, conducting spot and derivative market trading on over 60 top exchanges.

They position themselves as "a global cryptocurrency market maker and a multi-stage Web3 investment company."

Moreover, DWF is one of the world's largest high-frequency cryptocurrency traders, with partners including Binance, ByBit, KuCoin, OKX, Gate, http://Crypto.com, and Huobi, conducting spot and derivative market trading on over 40 top exchanges.

From the introduction, it is clear that DWF's main business is market making and investment—

3️⃣ Non-mainstream Market Maker | Controversial DWF

Compared to the established identity of Jump Trading, the rapid development of Wintermute, and the advanced algorithms, @DWFVentures' approach seems slightly more non-mainstream—

Clearly, this is a company whose main business is market making, but when viewed in its entirety, DWF seems somewhat unconventional:

In addition to being a market maker, DWF is also a full-fledged investment institution and "market manipulator"—

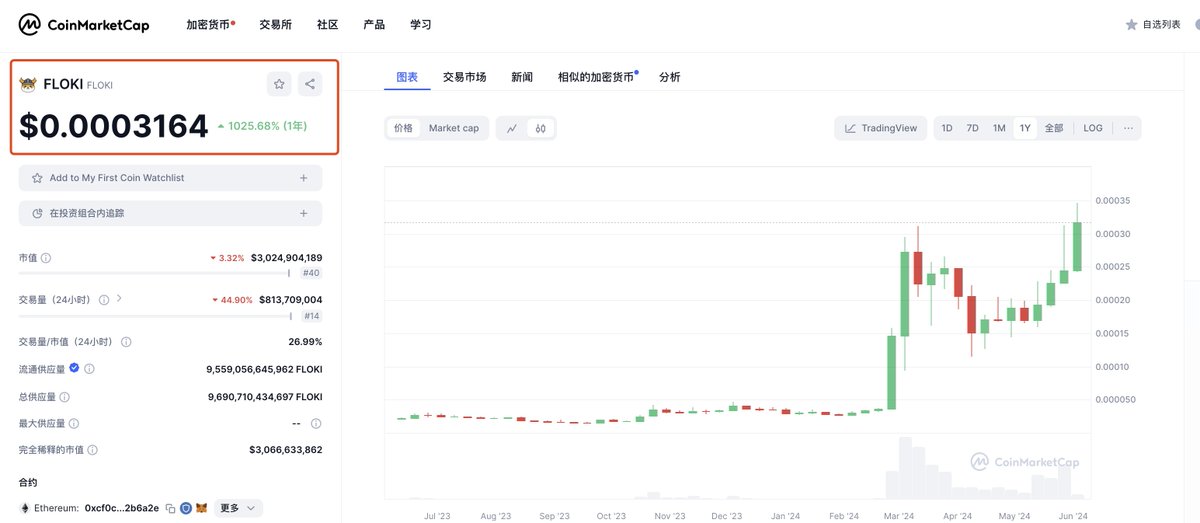

DWF Labs gained fame for its extravagant actions during the bear market phase, investing in over 140 cryptocurrency projects with high frequency and large sums of money, causing short-term price fluctuations in the tokens after the investments were announced, leading to a love-hate relationship with DWF Labs among investors in the market.

A half month ago, DWF Labs co-founder @ag_dwf stated on X platform that DWF Labs has invested in over 740 projects, and the number of investment projects has increased significantly since November 2023.

DWF Labs' executive founder Andrei Grachev has long admitted that DWF is also an investment company and stated, "We usually invest in SAFT before and during the seed stage. If the token is already listed and tradable, we will also invest based on the unlocking schedule and lock-up period or in batches.

In addition to investments, we also provide additional support, such as public relations, marketing, and fundraising."

This undoubtedly sparked controversy—market makers' involvement in project investments makes it difficult to avoid market manipulation to some extent, raising suspicions of being both a referee and a player, so DWF has long been controversial—

In early August 2023, after C98, YGG, and DODO announced or were invested by DWF Labs, the token prices experienced significant fluctuations, which easily led to substantial losses for retail investors.

As both a venture capital institution and a market maker, DWF Labs inevitably raises suspicions of market manipulation.

4️⃣ DWF Founder: We are proud of the controversy

Regarding the controversy itself, I prefer to hear from those in the midst of the storm. Previously, @Foresight_News conducted an interview with the founder of DWF Labs;

He stated: We are proud of the controversy. Andrei Grachev, as a Russian, also said assertively: Innovators do not adhere to orthodoxy, and the "Nokia era" of market makers is long gone, showing a strong national spirit.

In addition to investment and market making, DWF Labs is also committed to guiding cooperation among the projects in its investment portfolio, sparking new chemical reactions. For example, in 2022, Orbs Protocol collaborated extensively with TON, developing multiple Layer3 Apps for TON, such as TON-Access, TON Minter, and TON Verifier. This year, Orbs Protocol has become the main sponsor of two TON hackathons.

Here are a few of his statements that we can refer to:

1) Foresight News: In your frequent and substantial investments for quite some time, what has left many people, including myself, astonished is the source of DWF Labs' funds and whether there has been any financing?

Andrei Grachev: We have never been involved in fundraising, and there are currently no plans. DWF has always been financially stable, especially having made a lot of money during the bull market from 2020 to 2022. While we continue to be profitable, we also use these funds. Although I cannot disclose specific numbers, I can assure you that we have the financial capacity to easily invest tens of millions of dollars in startups every month. Our main goal is not to invest 10 million and make 200,000; we prefer to invest 10 million, be patient, and then make 50 million.

2) Foresight News: Since March, your "investment + market making" hybrid operating model has been in the midst of public opinion whirlpools. Traditional cryptocurrency market makers such as Wintermute have been extremely disdainful of your investment approach, believing that you are only "trading" and not worthy of being called "investment." So, what kind of relationship do you currently maintain with these traditional market makers, and do you have any business connections with them?

Andrei Grachev: I think there aren't many ways to cooperate with them. Perhaps the only way I can think of is to hire some of their talent for DWF. But in the business world, it's like you, a media person. Suppose you are a pioneer in the media industry, and another media begins to complain about your interviewing style, saying that your style is not traditional enough, would you care? I don't think so. You might be happy because you have innovation, and you can attract more attention.

For us, the focus is on legality. As long as we operate within the correct and legal framework, if a method is proven to be effective, we will use it without worrying about what others say, and we are not afraid of criticism or complaints from competitors.

3) Foresight News: The secondary market also believes that you are manipulating the market. Data companies and the media are reporting the flow of your on-chain funds, and your fund flow has become a directional indicator for institutions, retail investors, and market judgments. How do you view this?

Andrei Grachev: I often encounter such discussions. In terms of trading volume, we handle billions of dollars in transactions every day. However, compared to the overall trading volume, our volume is relatively small, and importantly, we do not engage in hedging trades. Although the media and people may speculate and comment, we do indeed have an impact. When people observe our behavior, they may buy or sell, but these are their own decisions, and we cannot control them. We play the long game, not the short game.

Engaging in cryptocurrency trading and investment, depositing and withdrawing cryptocurrencies to and from exchanges is a crucial part of our business. We do not engage in trades conditional on market manipulation; our approach remains unique.

Market manipulation is not attractive to us. As the industry moves towards more regulated and legal directions, our focus is on long-term gaming rather than short-term gains. Ultimately, whether their trading choices follow us or go against us varies from person to person, but our goal is to engage in strategic long-term gaming in the ever-changing market environment.

Overall, compared to the traditional world, being both a market maker and an investor is clearly a false proposition and undoubtedly violates securities laws. However, in the cryptocurrency field, the legal framework is not clear, and this behavior, apart from raising questions, does not cause a stir.

5️⃣ Future Prospects of the Cryptocurrency Big Shark

Every field needs some "mavericks" to be interesting, and every industry needs its own "sharks" to stir up greater interests;

Undoubtedly, DWF belongs to this category—

The controversy surrounding DWF will not stop, and it can be foreseen that it will only intensify in the future. DWF Labs, as a charming and intriguing antagonist, is seen by some as an innovative pioneer in the Crypto industry, while others see them as a harvesting machine, a creator of market instability.

In a market full of opportunities and challenges, market makers need to constantly adapt and innovate to maintain their advantage and influence. Regardless of how the debate continues, every move by DWF Labs deeply affects the coin circle, making them an indispensable player.

The future direction of DWF is unknown to us, but from the path of the past few years, DWF is undoubtedly successful. They have gained fame, wealth, and industry influence.

Personally, I appreciate the appearance of "big sharks" in the industry—

But I also hope that this shark can better serve the industry, steadily abide by industry norms and ethics, uphold its reputation and trust, and based on this, break free from the constraints of the rules and grow into a great and immortal presence!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。