May 29th Airborne: Waiting for the Next Waterfall After Bitcoin Adjustment

Some people, as they walk, disperse! Habit becomes nature, when losing a common goal, naturally diverge. My choice may not be the best, and your choice may not be the worst. Existence is reasonable, and only with reason does existence become necessary.

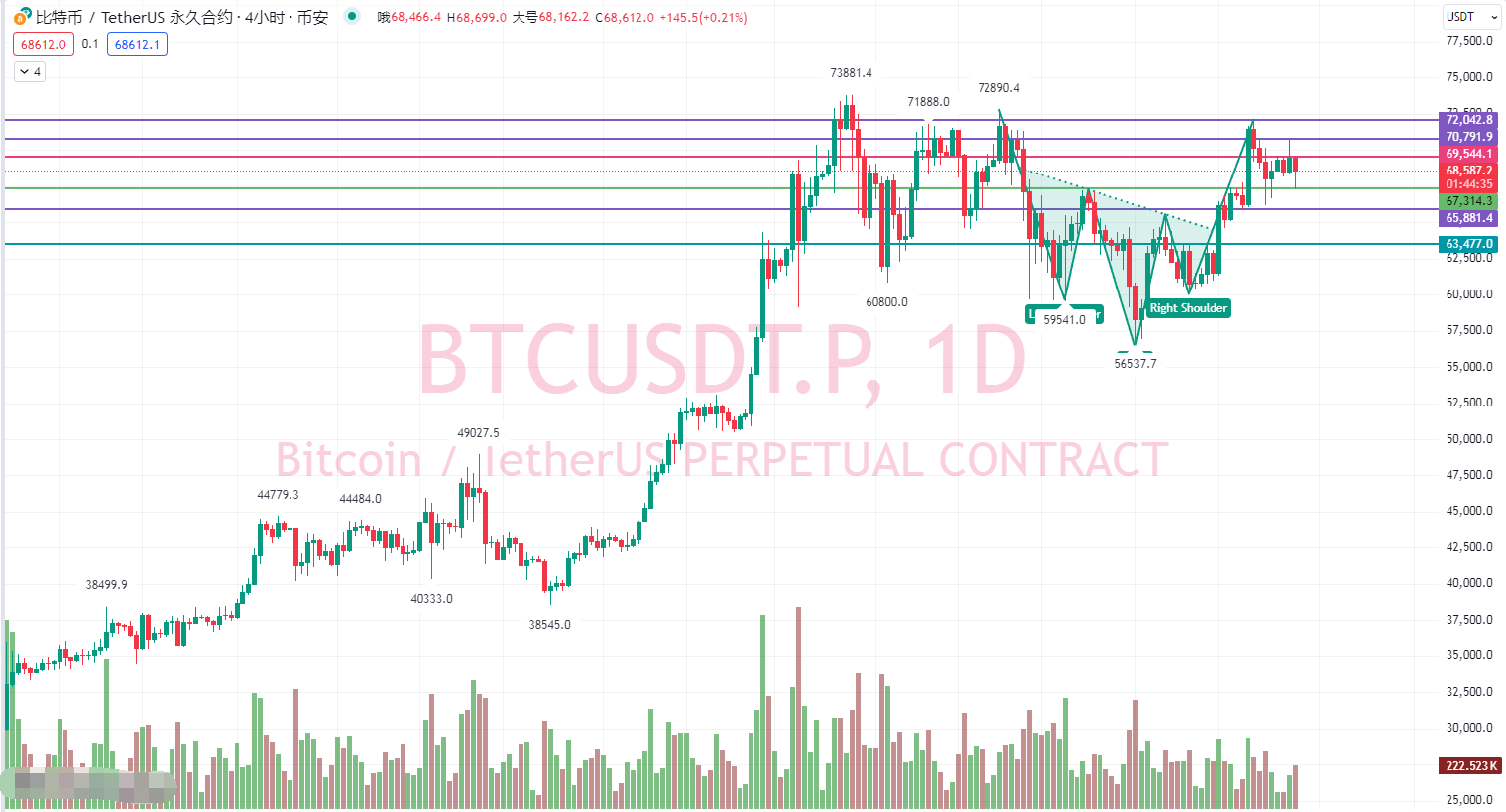

BTC/Daily Chart

From a daily perspective, the current price is above the middle band of the Bollinger Bands, close to the upper band, indicating a strong upward trend. The MACD indicator shows strong bullish momentum, with the DIF line above the DEA line and the red bars continuing to grow. The market may continue to rise, with the price fluctuating near various short-term moving averages, indicating a strong short-term trend.

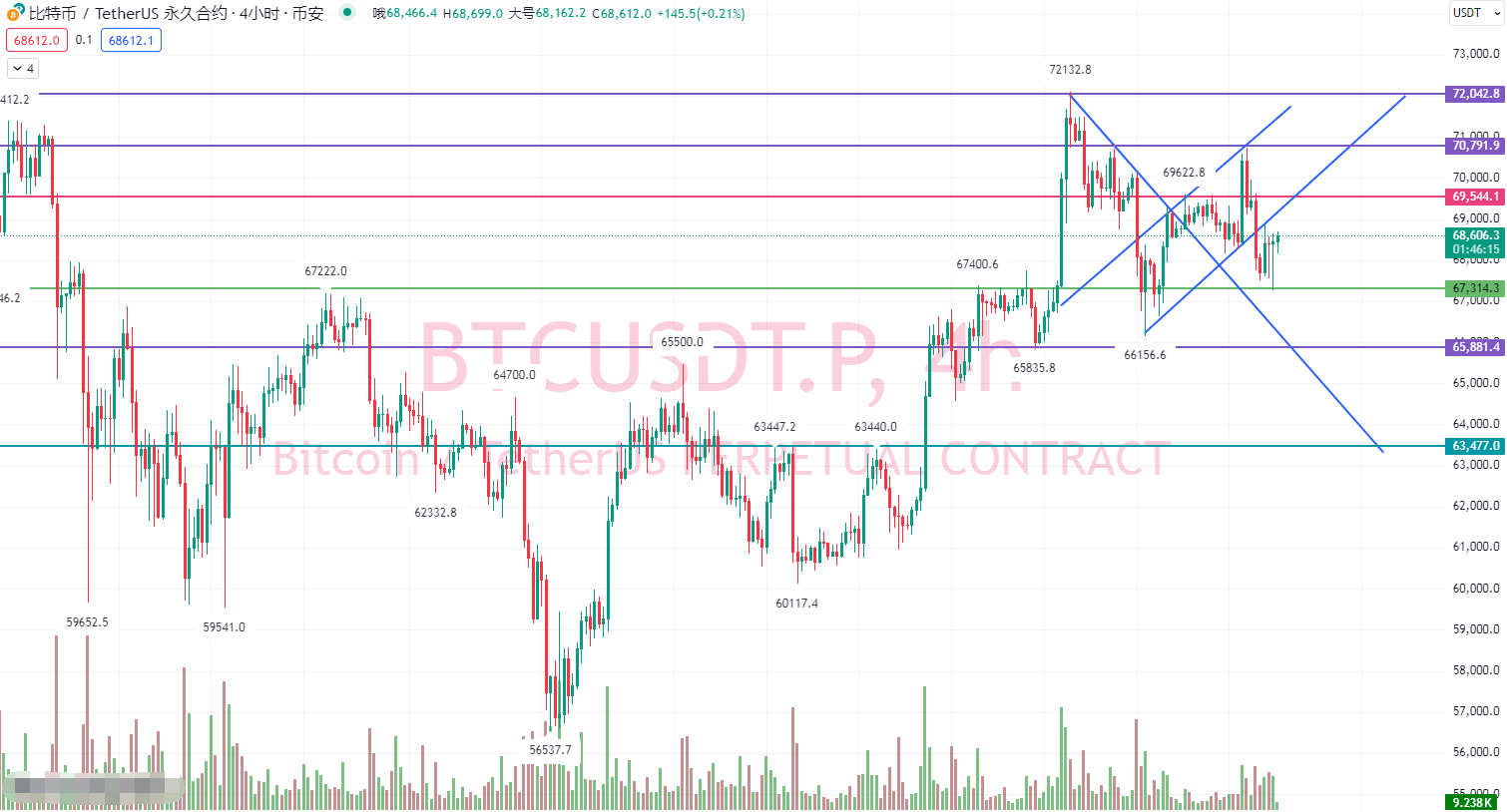

BTC/4-hour Chart

From a 4-hour perspective, the current price is between the middle band and the lower band of the Bollinger Bands, close to the middle band. The band width of the Bollinger Bands is narrow, indicating low market volatility and a possible trend of oscillation and consolidation. The MACD indicator shows strong bearish momentum, with the DIF line above the DEA line, but the appearance of green bars may indicate downward pressure. The MA price fluctuates near the MA20 and MA60, indicating a possible trend of oscillation and consolidation in the short term.

In summary, Bitcoin violently surged from around $66,800 on May 20th to reach $72,000, then encountered resistance near $66,300, and subsequently oscillated upwards to around $70,700 before encountering resistance again. Last night's trend should be a second attempt to reach the top. The analysis yesterday suggested that shorting below $69,500 in the article, and it is estimated that many who chased after going long have suffered losses. This is not a matter of yin and yang circulation, but the trend itself is a large range oscillation biased towards downward movement. The morning pierced the $67,300 level below, but before forming a bottom, it is expected to break the low point again, but not now. Subsequently, there is a high probability of a correction, followed by a decline. Today, attention is still focused on the $69,500 level.

Strategy 1: It is recommended to go long in batches at $68,300 to $67,900, with a stop loss at $67,500 and a target around $69,000 to $69,300.

Strategy 2: It is recommended to short in batches near $69,200 to $69,450 on the rebound, with a stop loss of 400 points and a target around $67,000 to $66,500.

Investment Philosophy

Emphasis: The cryptocurrency market is different from other financial investments. It is crucial to grasp the news. Without professional analysis of the news and relative technical analysis skills, entering the market rashly, how many retail investors can avoid losses? However, after suffering losses, you need to find a way. Failure is the mother of success. In fact, most people do not succeed at the beginning of doing business or investing. I believe that including you, who are reading this article now, must have suffered from the reality at the beginning of doing business. Later, because you spent a lot of effort studying how to do business well, through constantly absorbing new information, constantly absorbing the advice of others, and constantly learning, you have achieved what you have now. Similarly, in spot investment, there is no undefeated general who enters the market. Only through continuous reflection during the process of profit and loss, summarizing your own shortcomings, and then correcting them is the most important. The market is not scary, what is scary is your fear of it.

Message: Investment is a long-term matter. Only by approaching investment with a mindset full of learning can your investment journey go further. If you are a retail investor, you might as well communicate with Airborne, adding an analyst friend will not cause you any loss, on the contrary, it will greatly help you. If you think your teacher is very professional, do not blindly pursue making trades. You might as well ask him for more advice on techniques and trading skills, market judgment. I believe your teacher will be happy to teach you. Furthermore, add Airborne to communicate with me, and I will be happy to help you. If you are losing in your investment journey, or if you have recent trapped positions, I will help you get out of the trap to the best of my ability and formulate a profitable plan suitable for you.

The above is a personal suggestion, for reference only. Investment involves risks, and trading should be cautious, prioritizing risk and then planning for profit. There is no chicken soup, no exaggeration, only a solid foundation of practical combat to create stable returns for everyone. Posting articles has delayed market changes, and the points mentioned in the article do not serve as a basis for following orders. For more real-time market analysis, please follow the official account above to discuss and exchange ideas together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。