Binance, as a leading global cryptocurrency exchange platform, not only provides trading services but also supports and funds potential blockchain projects through its investment incubation program. These incubation programs have not only brought substantial profits to Binance itself but also played a positive role in the prosperity of the entire blockchain ecosystem.

I. Positioning and Advantages of Binance Investments

Binance's external investments are mainly conducted through its venture capital and incubation department, Binance Labs, which was officially established in April 2018. Positioned as Binance's internal venture capital business unit, Binance Labs aims to discover founders with innovative ideas, provide support for their project construction, and co-create the future of the Web3 industry. Binance Labs' investments are not limited to specific blockchains and development stages, providing comprehensive support and resources for blockchain entrepreneurs and startups, aiming to help early-stage projects succeed through incubation programs.

Advantages of Binance Labs' External Investments

Global Influence: As the internal venture capital business unit of the leading exchange Binance, Binance Labs has strong reputation and resource support, giving it extensive influence and resources globally.

Integration Potential with Binance Ecosystem: A key advantage for projects receiving investment from Binance Labs is the potential to integrate with the Binance ecosystem and list on the Binance exchange. Startups can gain significant exposure and access to a large user base, enhancing their potential for success.

Value Creation Services: In addition to financial support, Binance Labs also provides general consulting, operational support, and technical/product joint development services. These services can help startups solve various problems, enhancing their competitiveness and sustainability.

Abundant Resources: As part of the world's largest cryptocurrency exchange platform, Binance Labs has abundant resources and a vast network, including technology, market, and business partners, providing valuable support and assistance to startups.

II. Criteria for Selecting Investment Projects

When selecting investment projects, Binance focuses on aspects such as project innovation, sustainability of the business model, market adoption, team quality, and technical feasibility. Its strict and comprehensive investment standards and evaluation process provide guarantees for the discovery and cultivation of high-quality projects.

1. Product Innovation: Innovation is one of the primary criteria for evaluating projects. Binance prioritizes the innovation of products when selecting investment projects, considering whether the project has built a new model that benefits users.

2. Sustainable Business and Token Models: Binance emphasizes the sustainability of the project's business and token models. It evaluates whether the project's business model is profitable in the long run and whether token incentive measures are constructed in the right way.

3. Adoption Rate: The project's traction is an important indicator of its value. The number of users and generated revenue are important factors in evaluating the project's traction.

4. Team Quality and Persistence: Binance emphasizes the quality and persistence of project teams. The stability and persistence of the team are crucial for the project's development if needed, whether the team can dedicate full-time efforts to the project.

5. Technical Feasibility: The final evaluation attribute is the technical feasibility, i.e., whether the technology adopted by the project is feasible and practical. Binance evaluates the project's technical feasibility based on its technical roadmap and existing content.

III. Channels for Binance Investments

In addition to direct investments, Binance Labs provides two main investment methods for blockchain startups: the Binance Labs Incubation Program and the Most Valuable Builder (MVB) Accelerator Program. Both incubation and MVB programs have two sessions per year, and since 2021, six sessions have been successfully held, with the current program at its seventh session.

1. Binance Labs Incubation Program

The Binance Labs Incubation Program is a long-term investment method that is not limited to a specific chain. It aims to provide comprehensive support and resources for early-stage blockchain startups, promoting the growth of Web3 startups and helping founders achieve long-term development and success in the ever-changing industry environment.

Long-term Support: The Binance Labs Incubation Program provides long-term support for startups, including support in various aspects such as funding, technology, marketing, and legal matters, helping them overcome various challenges in the early stages.

Comprehensive Services: The incubation program not only provides financial support but also offers various services to startups, such as advisory support, marketing promotion, and technical guidance, helping them establish and develop their projects.

Customized Support: The Binance Labs Incubation Program provides customized support and services based on the needs and characteristics of startups, helping them maximize their development potential.

2. Most Valuable Builder (MVB) Accelerator Program

MVB is an accelerator program initiated by Binance Labs, focusing on BNB Chain and jointly launched with BNB Chain. It aims to support outstanding builders and startups that have achieved outstanding results within and outside the BNB Chain ecosystem. Winners selected from the MVB evaluation will receive donations, technical support, potential investments from the official team, and the opportunity to list on the main Binance exchange, helping them achieve rapid expansion and growth.

Short-term Acceleration: The MVB program provides short-term acceleration services for startups, typically lasting 8-10 weeks, aiming to help them quickly solve problems, optimize business models, and achieve rapid expansion.

In-depth Support: The MVB program provides startups with deeper support and guidance, including guidance in technology, marketing, and business models, helping them achieve rapid business development.

Resource Concentration: The MVB program concentrates the resources and professional team of the Binance Labs Incubator, providing comprehensive support and services to startups, helping them achieve greater achievements in a short period.

Starting from the 7th session in 2024, the Binance MVB Accelerator Program will expand in two directions: startups and founders, focusing on incubating 100 new ideas on the BNB Chain. The startup track focuses on promoting the rapid development of early-stage cryptocurrency projects, while the founder track focuses on supporting and incubating builders to help them grow into successful founders.

IV. Data Performance of Binance Investments

Since its establishment in 2018, Binance Labs' investment portfolio includes over 200 projects from more than 25 countries across six continents, with over 50 projects incubated by Binance Labs. According to The Block, as of the first quarter of 2024, Binance Labs has accumulated assets of over $9 billion. According to a Binance spokesperson, the theoretical return is more than 10 times the investment amount.

Number of Investment Projects

As of May 15, 2024, Binance has publicly announced 19 investment projects since 2024, with a total amount of approximately $364 million. These projects include Zest Protocol, UXUY, Movement, MilkyWay, BounceBit, StakeStone, Cellula, Derivio, QnA3, Privasea, Babylon, Renzo Protocol, Ethena, NFPrompt, Shogun, Analog, Puffer Finance, Memeland, and BracketX.

RootData has recorded a total of 193 external investment projects by Binance Labs, with 108 projects that have issued tokens and are operational. There are 65 projects selected from the 1st to 6th incubation programs and 36 projects selected from the 1st to 6th MVB Accelerator programs.

Image Source: RootData

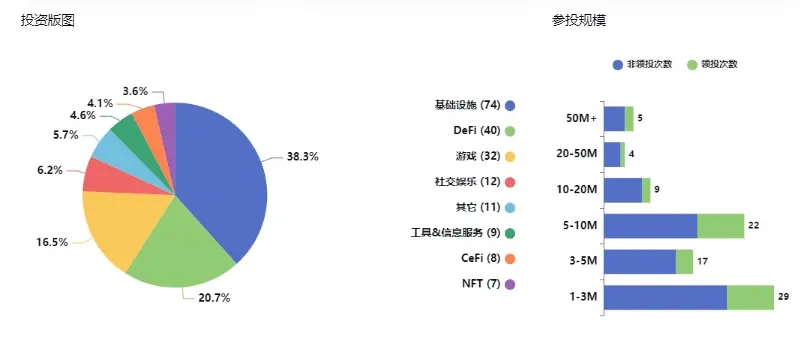

Binance Investment Layout and Scale

In terms of investment layout, Binance Labs' investment areas are very extensive, covering most of the Web3-related tracks, including public chains, protocols, infrastructure, NFT, blockchain games, metaverse, DeFi, and CeFi. Binance Labs particularly values infrastructure, on-chain applications, data analytics, and security. These areas are not only the core of the cryptocurrency industry's development but also the investment directions that Binance Labs prioritizes.

Image Source: RootData

- Infrastructure: Accounting for the largest proportion of Binance Labs' investment portfolio, reaching 38.3%, as the cornerstone of the blockchain and cryptocurrency industry.

- DeFi: Accounting for 20.7% of the investment proportion, it not only has enormous market potential but also leads the industry's innovation frontier.

- Gaming: Accounting for 16.5% of the investment proportion, it is at the forefront of industry innovation.

- Web3-related tracks: Accounting for approximately 24.5%, including social entertainment, tools & information services, NFT, etc., these areas are considered the next growth points for the cryptocurrency industry.

In terms of investment scale, Binance Labs' investment participation is mainly concentrated in the range of $1-10 million, with the most concentrated investment amount range being $1-3 million, followed by $5-10 million. Binance Labs primarily participates in external investment projects as a non-lead investor, with leading investments as a secondary approach.

Performance of Binance Investment Returns

In terms of investment returns, Binance Labs' investments in Web3 have supported well-known companies such as Polygon, Optimism, LayerZero, Celestia, Aptos, Mysten Labs, and Trust Wallet. According to Chain Broker platform data, there are 6 Binance investment projects with a return on investment (ROI) of over 100 times, including Polygon, Injective, Axie, Sandbox, MultiversX, and Merit Circle.

Image Source: Chain Broker

V. Inventory of Binance Investment Hot Projects

In previous MVB Accelerator programs, Binance Labs invested in decentralized domain name protocol Space ID, Web3 infrastructure Overeality, interoperable communication protocol Multichain Event Protocol (MEP), mobile strategy game Meta Apes, tokenized investment portfolio Velvet Capital, multi-chain open data analytics platform Web3Go, casual gaming platform Gameta, Ethereum scaling project AltLayer, perpetual DEX project KiloEx, lending protocol Kinza Finance, and AI blockchain-based virtual companion game Sleepless AI, among other high-quality projects.

On March 1st, Binance Labs announced 13 early-stage projects for the 7th season of the MVB Accelerator program, covering DeFi, infrastructure, and application layer tracks. These projects have innovation and potential in the blockchain and artificial intelligence fields, making them worthy of attention.

- BitU: BitU is a crypto-native collateralized stablecoin protocol that provides higher yields using off-chain liquidity and efficiency. Its Active Liquidity Management Module (ALMM) addresses the on-chain and off-chain stablecoin lending rate differential and introduces trusted custody institutions for safer fund storage and yield distribution to users.

- Blum: Blum is a hybrid CeDeFi exchange where users can trade cryptocurrencies through a Telegram mini-program. It offers off-chain order books, on-chain settlement, and centralized or self-custody options, while also supporting derivative trading services.

- Surf Protocol: Surf Protocol is a Base-based perpetual contract trading platform that provides leverage trading, premarket trading, and point trading services for low market cap tokens.

- Vooi: Vooi is a cross-chain perpetual contract DEX aggregator that supports multiple DEXs, allowing users to conduct gas-free transactions after connecting their wallets, with leverage of up to 100x.

- Aggregata: Aggregata is a DePIN-driven AI data storage project that creates and prices high-quality data for AI, allowing users to share, sell, and find AI datasets on its marketplace.

- Nesa: Nesa is a lightweight Layer1 for AI that uses on-chain ZKML for highly private, secure, and trusted query execution of AI inferences. It proposes a privacy-centric decentralized inference protocol that commits computation inference results through a secure committee and sends them on-chain.

- Nimble Network: Nimble Network is a composable AI protocol that allows AI agents, data providers, and computing resources to combine and use ML models and data. It is creating atomic components for the protocol to expand into areas such as IP, creators, advertising, personalization, and chatbots.

- Aspecta: Aspecta is an AI-driven digital identity ecosystem platform that has built an AI-generated identity system, Aspecta ID, for developers and others to demonstrate, connect, and explore. It also provides access to exclusive DAOs, ecosystems, and applications.

- Holoworld: Holoworld is a decentralized AI virtual character marketplace and social platform, allowing anyone to create intelligent AI robots with just a few clicks.

- Opinion Labs: Opinion Labs is a dynamic public opinion and continuous prediction market, creating a full-chain social infrastructure, with its first product being the full-chain opinion market and content community DApp AlphaOrBeta.

- Side Quest: Side Quest is a gaming social platform that aims to provide various gaming, rewards, food, and networking opportunities.

- Story Chain: Story Chain is an AI story-writing NFT application that allows users to create unique stories with LLM and image AI, and mint them as NFTs.

- Tilted: Tilted is a game asset marketplace for buying, selling, and trading game assets, skins, and NFTs on-chain, achieving cross-game compatibility.

VI. Challenges and Opportunities for Binance Investments

With the support of Binance Labs, many blockchain startups have achieved remarkable achievements. These projects cover areas such as DeFi, NFT, blockchain infrastructure, etc., providing strong validation for the effectiveness of Binance Incubator's investment strategy and incubation methods. With the rise of narratives such as AI, DePIN, and LSD, as well as the emergence of ecosystems like Bitcoin and Solana, Binance investments face a series of opportunities and challenges.

Challenges and Difficulties

Regulatory Uncertainty: The blockchain industry faces uncertainty in regulatory policies in different countries and regions, which brings certain risks and challenges to Binance investments. In the future, Binance needs to closely monitor changes in regulatory policies and formulate corresponding risk management strategies.

Security and Trust Issues: The blockchain field faces challenges in security and trust, such as smart contract vulnerabilities, network attacks, etc. Binance needs to strengthen due diligence and security reviews of investment projects to ensure the safety and reliability of user assets.

Intensified Competition: With the intensification of competition in the blockchain industry, Binance faces competitive pressure from other exchanges and investment institutions. To maintain a competitive advantage, Binance needs to continuously enhance its technological capabilities and service levels, and seek innovative and promising projects for investment and incubation.

Positioning and Opportunities

Ecosystem Development and Open Innovation: Binance can continue to increase its investment and support for the blockchain ecosystem, actively participate in ecosystem development and open innovation, and promote the widespread application and popularization of blockchain technology.

Community Governance and Co-governance Mechanism: Binance can establish a more sound community governance and co-governance mechanism to promote the participation and contribution of community members, achieving co-construction and sharing of the ecosystem.

Global Layout and Strategic Cooperation: Binance can further expand its global business layout, establish closer cooperation with projects and institutions worldwide, and jointly promote the development of the blockchain industry.

Innovative Technology and Application Scenarios: Binance can continue to focus on the development of innovative technologies and application scenarios such as AI, DePIN, liquidity staking, etc., actively explore the application of blockchain technology in areas such as DeFi, gaming, Web3, education, etc., and promote the deep integration and innovative development of blockchain technology.

In conclusion, as a leading cryptocurrency trading platform, Binance's investment portfolio leads the investment boom in the cryptocurrency industry, occupying a pivotal position in the industry. By continuously optimizing investment strategies, strengthening ecosystem development, and technological innovation, Binance is expected to further consolidate its leading position in the blockchain ecosystem and promote the development and growth of the entire industry.

Hotcoin pays close attention to the development dynamics of Binance's investment portfolio and will continue to monitor and list related high-quality assets. For cryptocurrency investments, choose Hotcoin for early access to the hottest and highest-quality assets!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。