Lending is the most critical part of DeFi. Aave alone has $15B in deposits and is the main infrastructure protocol in DeFi along with Uniswap.

Lending markets enable the flow of money between lenders and borrowers, leverage, and economic sense in the space.

Have you wondered what is the biggest market inside the Lending protocols?

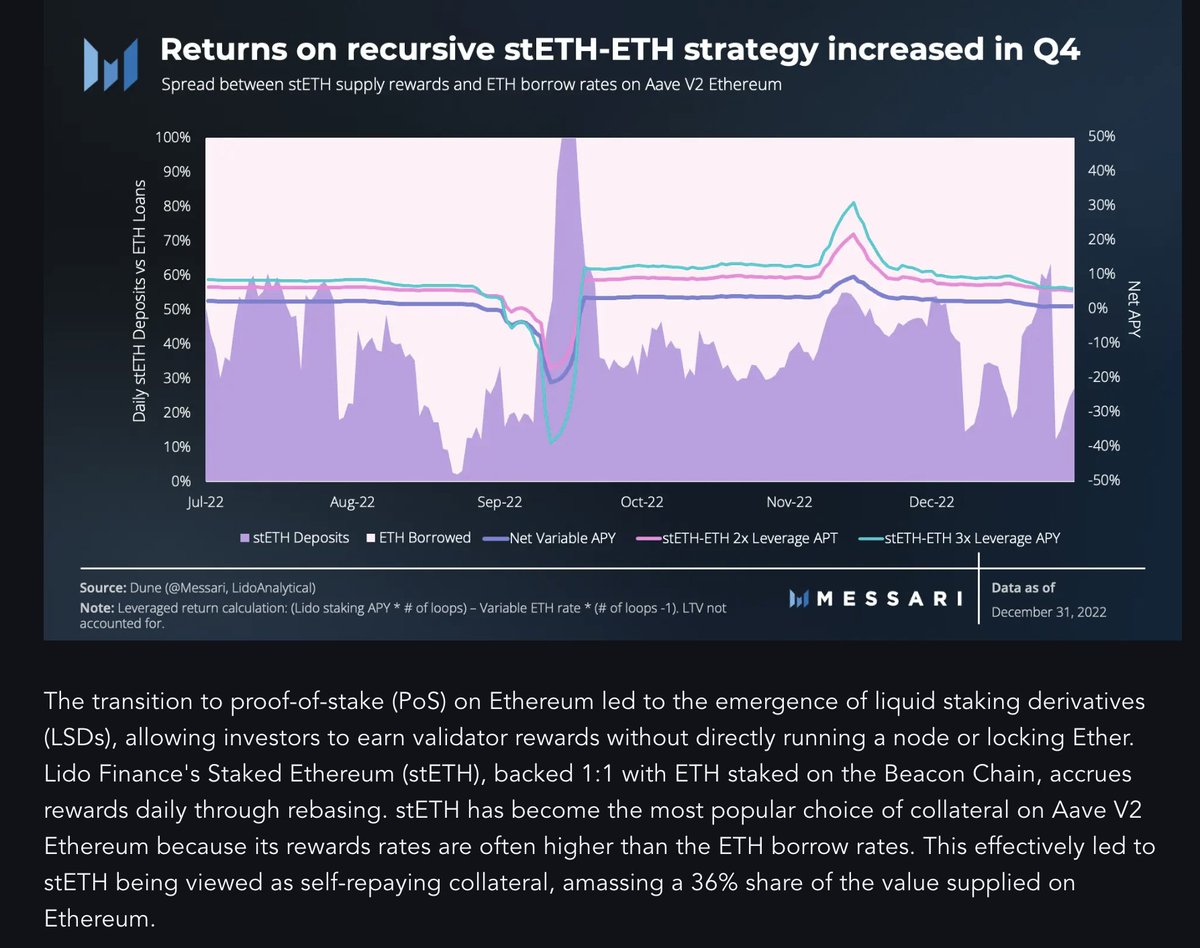

Approx 1/3 of the Aave Ethereum market is wstEth<>Eth looping strategy. To make this market sustainable, ETH borrowing rate has to be lower than stEth staking APR.

Here comes the dilemma:

• To maintain the biggest market you need to have low ETH borrowing APR

• Low borrowing APR makes ETH lenders the least compensated

Obviously, it makes more sense to enable the biggest market and ETH lenders won't get a much better deal in other places anyway.

At @0xfluid we thought that we can make a better deal for both parties!

Since wstEth on Fluid has high utilization, we have a high lending and borrowing APR for ETH. However, it requires a lot of management of the interest rate curves to maintain the balance between the markets when the sentiment changes.

We will propose a new interest rate curve for wstETH<>ETH market exclusively where the ETH borrowing rate is capped wrt the wstEth lending rate.

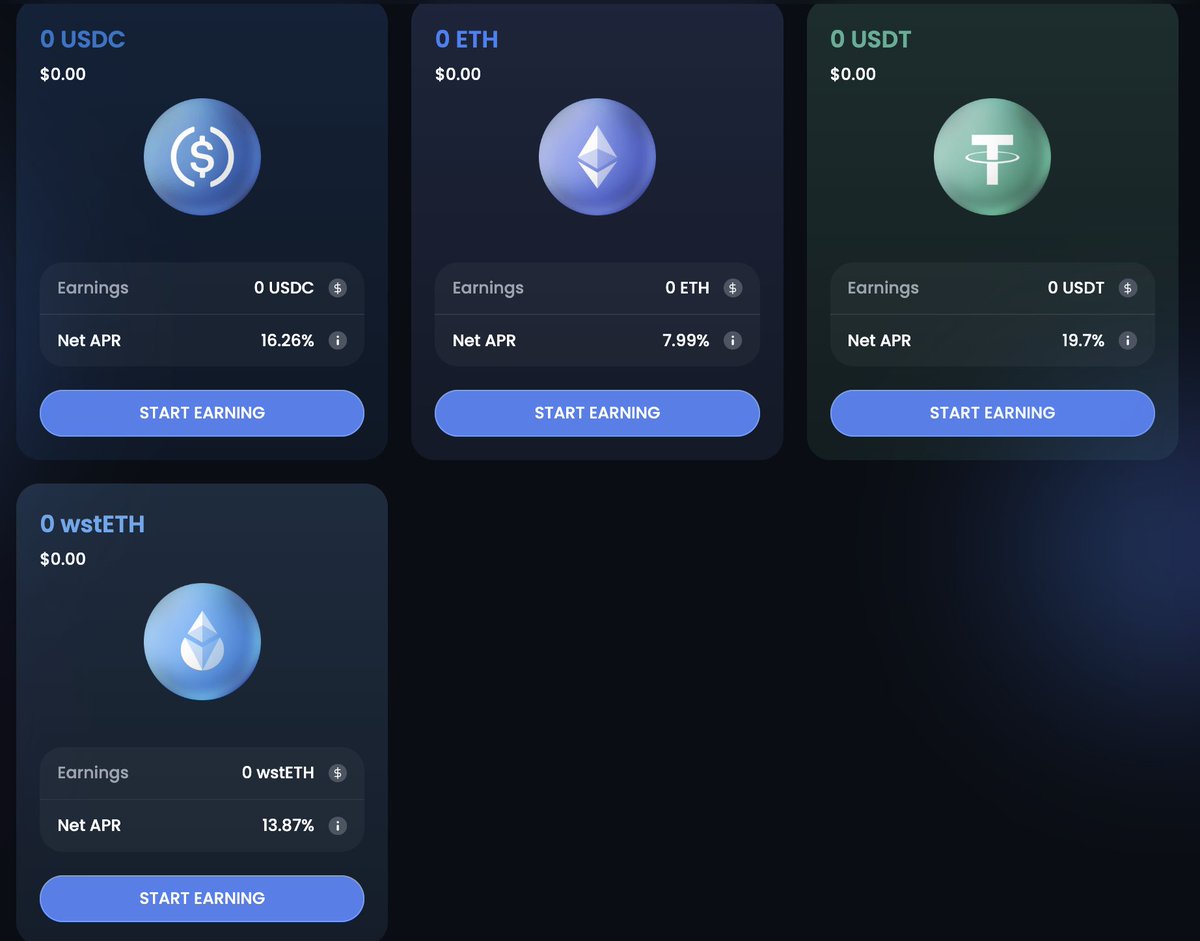

For example, wstETH lending APR is 8% +3% staking APR, then we can make a fixed ETH borrowing at lending APR + 2% = 10%.

In this case, leveragers will get up to 15% APR (1% at 15x leverage) instead of the basic 3% staking yield.

Combined with Fluid oracles that track contract backing rather than market price, leveragers will have the highest risk-adjusted returns on the market.

We are enabling the best stEth leveraging conditions and at the same time, we are not capping ETH rates for other markets. This solution will serve as the perfect balance between wstETH loopers, ETH lenders, and protocol interests:

• wstEth leveragers get the best and most stable conditions

• Eth lenders can get better compensation

• Protocol secures the biggest market and generates more revenue

Especially after the Fluid DEX is live, lenders will be able to get trading fees on top of the lending fees increasing their lending and decreasing borrowing APR and enabling Fluid to have the most favorable rates by design (we already have great rates, btw).

Fluid design is so flexible that I keep finding new features on a daily basis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。