On May 8th, Vitalik Buterin proposed the new EIP-7702 proposal regarding "account abstraction," aiming to permanently solve the historical legacy issues of account abstraction and fundamentally change the way everyone interacts with Web3.

At the same time, the further development of "chain abstraction" since the beginning of the year has become a lifeline for many encrypted DApps and project parties seeking to break through homogenized competition: launching a full-chain version of a super DApp, creating a low-threshold Web3 product environment that is easy to get started with and offers an experience close to traditional Web2 applications, returning to a user-centric product paradigm, in order to capture the broadest underlying value.

If account abstraction aims to solve user experience issues, then "chain abstraction" undoubtedly represents the final mile for billions of users outside the circle to seamlessly enter Web3, which is also the core logic behind the potential revaluation accompanying the further advancement of Mass Adoption in 2024.

In this context, how do the leading projects in the full-chain track perform? Who might emerge victorious in this "chain abstraction" to "full-chain" covert war?

Entering 2024, under the expanding modular narrative, the increasingly fragmented L1&L2 gradually brings the full-chain narrative to a critical point where it can become attractive again.

Especially as modular expansion continues to disperse users and liquidity across more and more (alt-VM) execution layers, it is the biggest bullish signal for the full-chain narrative—based on full-chain services, any project that previously developed DEX, lending, and other on-chain applications can build a complete "full-chain version of a super application."

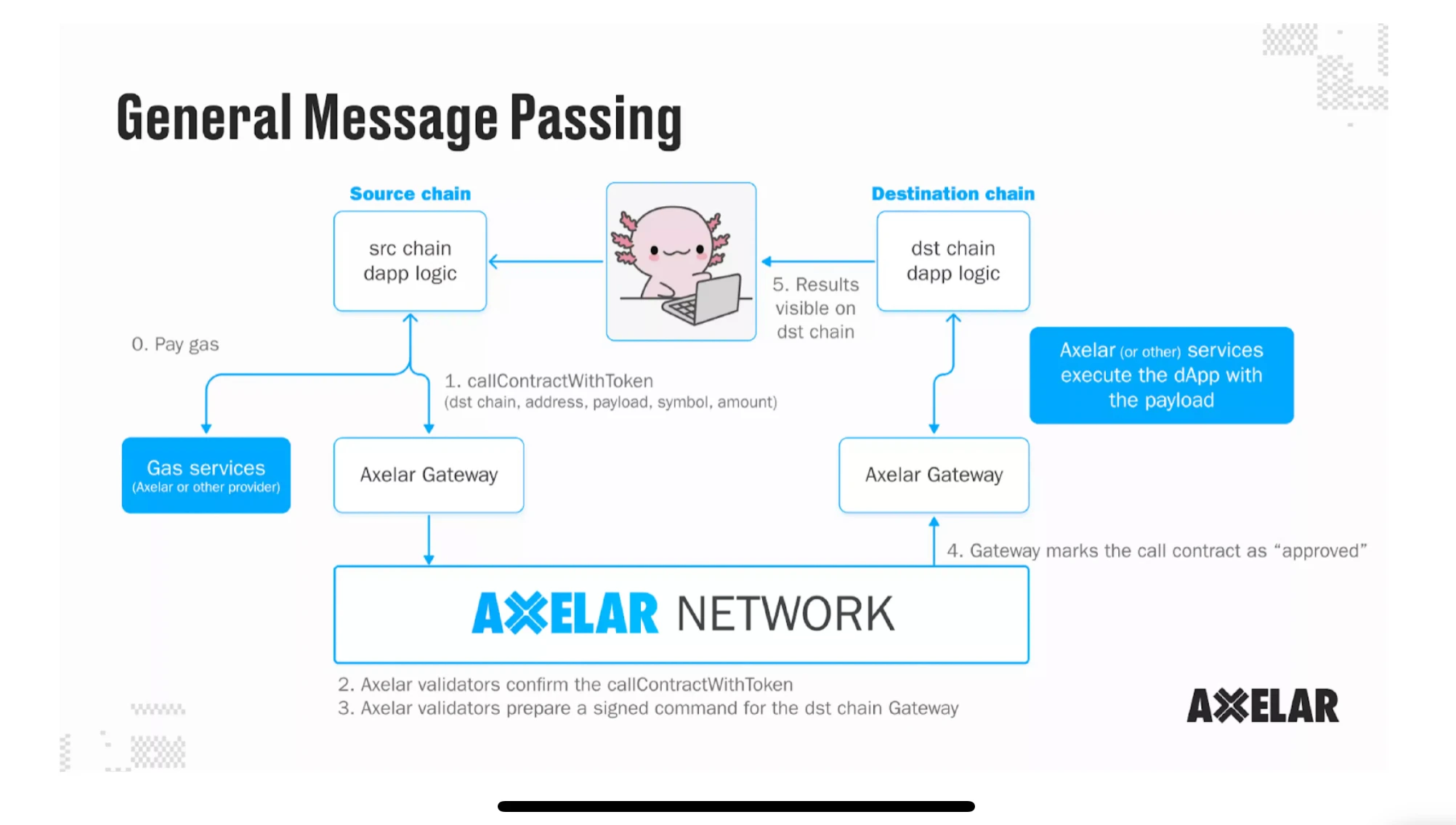

Taking Axelar's universal message passing technology GMP as an example, it enables developers to build native cross-chain applications, abstracting the chain for users to perform cross-chain function calls and state synchronization: users and liquidity are no longer limited to Ethereum, nor do they need to switch networks, but can operate in a one-stop manner, conducting transactions such as exchanging ETH for native assets on other chains and providing liquidity.

This means that on-chain applications only need to showcase the services themselves, without needing to display which chain the token assets or NFTs are on. For example, users can use ETH to exchange assets on the BNB Chain and buy/sell NFTs on Polygon, allowing creators to focus on creation and project development, and users no longer have biases due to the location of liquidity, NFTs, or the use of a specific token for trading.

From this perspective, as a further Web3 large-scale adoption solution after account abstraction, the greatest potential of chain abstraction lies in separating blockchain from users and hiding the complex logic of the backend of the blockchain in a "sandbox" form, allowing users to enjoy the frontend experience.

After all, from a product perspective, to become mainstream, it is necessary to make it easy for people to use Web3 functions and services with low barriers, even if many people understand what Web3 is.

Most people will not know about the existence of Web3, so removing the barriers for users outside the circle to seamlessly enter the Web3 world by creating a low-threshold Web3 product environment that is easy to get started with and offers an experience close to traditional Web2 applications represents a significant potential for growth.

To achieve such a smooth "chain abstraction" experience, the key lies in achieving seamless and smooth cross-chain transmission of assets and information on different chains—compared to simple asset cross-chain bridges, the full-chain utilization of message passing abstracts the chains themselves, allowing users to use any on-chain DApp without being aware of the chain.

This also means that the competition in the full-chain is directly aimed at capturing the broadest underlying user value in the Web3 world: DApps and project parties are responsible for competition and customer acquisition, for full-chain infrastructure, regardless of which track or which product emerges, they can directly face end users, capture the value of end users, and thus share the massive adoption dividends of the entire Web3 ecosystem.

Therefore, in the context of the 2024 modular expansion and the explosive growth of the multi-chain era, "chain abstraction" is destined to gradually become a common practice, and ultimately all struggles will point to the "full-chain" as the ultimate covert war—as the full-chain track of underlying infrastructure, it is essentially another grand narrative, namely the indispensable key component of "chain abstraction."

Examining the full-chain track: Axelar is gaining momentum

Currently, looking at the entire full-chain interoperability competition, Axelar, Wormhole, and LayerZero undoubtedly belong to the absolute dominant players, and except for LayerZero, which has not yet issued coins, AXL and W have already been listed on major exchanges such as Binance.

As a veteran leader in the full-chain narrative, Axelar's greatest advantage lies in the full-chain deployment of DApps—based on the "Interchain" concept, it provides a unified development environment for all Web3 applications, supporting users from various chains by accommodating various on-chain logics.

On this basis, it further introduced the Interchain Token Service (ITS), specifically addressing the needs of project parties when deploying tokens on multiple chains. Its automated deployment and maintenance services make it easy for any project team to manage token deployment processes:

It can not only be used to link native tokens and meet diverse blockchain network deployment needs, but also maintain complete interoperability with native tokens, helping developers and project parties easily manage token deployment processes and achieve rapid cross-chain token flow.

In simple terms, DApps developed on Axelar can be deployed on all public chains it supports—adding that Axelar supports the most public chains among the three (64 chains), DApps using Axelar naturally have the advantage of full-chain deployment in terms of quantity and user experience.

Wormhole consists of on-chain components and off-chain components, with on-chain components mainly including the emitter, Wormhole core contracts, and transaction logs; off-chain components mainly consist of 19 guardian nodes and a message transmission network.

As it originated from the cross-chain bridge between Ethereum and Solana, its main advantage lies in the cross-chain connectivity between the Solana ecosystem and other public chains, and due to the current rapid development of the Solana ecosystem, it holds a certain advantage in specific cross-chain data dimensions.

LayerZero's feature is lightweight cross-chain message transmission, choosing to use oracles and relay networks to complete data transmission. Its V2 version has four components: an immutable endpoint that can resist censorship, an only-attached set of on-chain verification modules (MessageLib registry) for cross-chain verification data, a decentralized verification network (DVN) for cross-chain verification data, and a permissionless executor (independent of cross-chain message verification context execution logic).

From a process perspective, LayerZero is divided into execution and verification layers, with the verification layer securely transmitting data between chains, and the execution layer interpreting this data to form a secure, censorship-resistant message transmission channel. This means that it is not responsible for verifying information itself, but rather ensures security by both parties involved in the cross-chain process, greatly simplifying the process of cross-chain information interaction and improving efficiency.

In short, Axelar is unparalleled in coverage and product applicability, Wormhole has an advantage in Solana-X cross-chain connectivity, and LayerZero has a slight edge in cross-chain efficiency. These are the differences and personalized features of the three in terms of technical architecture and product logic.

So, from a more specific data perspective, how do Axelar, Wormhole, and LayerZero perform in terms of data dimensions?

First, Axelar currently leads in terms of the number of blockchain networks covered and the number of DApps (GMP contracts) deployed with full-chain services, reaching 64 chains and 666 DApps respectively. In comparison, Wormhole covers 28 chains and over 200 DApps, while LayerZero covers over 50 chains.

In terms of on-chain transaction volume, Axelar's monthly transaction volume has consistently been above $250 million since the beginning of the year, with an average of $310 million, showing steady growth.

During the same period, Wormhole's average monthly transaction volume reached $1 billion, but since the issuance of W, the transaction volume has significantly declined to around $700 million in the past 30 days, likely due to the realization of airdrop expectations and some capital outflows. LayerZero, on the other hand, is expected to have a transaction volume of less than $600 million this month, a significant decrease from the previous month's $2.5 billion, further indicating that most of the transaction volume and on-chain activity were closely related to community airdrop expectations.

In terms of on-chain user numbers, Axelar experienced a significant increase in active users in March and April (likely related to its AVM upgrade and expectations for token economics), reaching a historical high of 66,000.

Overall, Axelar leads by a large margin in network coverage and applicability, and its on-chain data, such as transaction volume, continues to rise steadily despite the impact of Wormhole's coin issuance. This indicates that it has begun to occupy a leading position in the "chain abstraction" narrative, and this first-mover advantage is expected to continue to expand, becoming a key lever for Axelar to lead the full-chain + chain abstraction integration narrative this year.

More importantly, Axelar's actual transaction volume has already reached nearly half of Wormhole's share. From the perspective of market value to transaction volume, AXL's fully circulating market value is only equivalent to 20% of W's, undoubtedly placing it in a significantly undervalued range.

It is worth noting that Axelar's performance in terms of data dimensions has also shown a clear recovery this year, with the staked AXL quantity soaring to approximately 750 million, accounting for 66% of the total supply, representing a nearly 100% increase year-to-date.

Combined with the upcoming implementation of a new token economic model that will reduce the total inflation rate from 11.5% to 6.7%, and the recent plan to change AXL tokens from inflationary to deflationary through gas burning, the fundamental supply/demand dynamics of AXL have undergone a thorough change, likely to boost deflation expectations for AXL and have a strong stimulating effect on the secondary market in the near future. This may also be a core factor in AXL's recent resilience and rebound.

Double Buff of the RWA Narrative

In addition, Axelar has an exclusive advantage that other full-chain projects find difficult to match, which could potentially become a future growth point sufficient to reshape Axelar's market value:

The RWA narrative, a key channel for traditional financial institutions to inject trillions of dollars into the on-chain space.

On April 26, Grayscale published a research report titled "Public BlockChains and the Tokenization Revolution," which detailed the analysis of four categories that can capture dividends from the upcoming tokenization wave:

- Tokenized protocols, such as Ondo Finance (ONDO), Centrifuge (CFG), Goldfinch (GFI), etc.

- Tokenized general smart contract platforms, such as Ethereum (ETH), Solana (SOL), Avalanche (AVAX), etc.

- Related tokenized infrastructure, such as ChainLink (LINK), Axelar (AXL), Biconomy (BICO), etc.

- Smart contract platforms designed specifically for tokenization, such as Mantra (OM), Polymesh (POLYX), etc.

Compared to the fiercely competitive upper-layer projects in the categories of tokenized general/specialized smart contract platforms and tokenized protocols, tokenized infrastructure such as Axelar (AXL) is the true winner, as long as the overall market size of RWA continues to grow. This allows infrastructure providers like Axelar, which provide the most fundamental cross-chain liquidity support, to enter the RWA market, which could reach hundreds of billions or even trillions of dollars, directly capturing incremental value.

Behind this, Axelar's first-mover advantage is unparalleled in the entire full-chain interoperability track, overshadowing Wormhole and LayerZero (which have not yet ventured into the RWA field):

Centrifuge has long integrated Axelar's cross-chain solution, using Axelar's interoperability layer as the underlying infrastructure for its "Centrifuge Everywhere" multi-chain strategy, enabling the introduction of native Centrifuge RWA into Arbitrum, Base, Celo, and Ethereum. In November last year, Axelar also collaborated with Ondo Finance to launch the innovative cross-chain liquidity solution Ondo Bridge for RWA. Recently, traditional financial giants and alternative asset management companies represented by Apollo have also cooperated with JPMorgan's digital asset platform Onyx, Axelar, and others to deliver Project Guardian, a new generation POC for managing its $5.5 trillion investment portfolio.

This exclusive advantage of Axelar may become a future growth point sufficient to reshape its market value.

This essentially means that Axelar, as the underlying infrastructure, has provided innovative support for traditional financial giants to enter tokenized investments, and Axelar will also directly benefit from the hundreds of billions of dollars of non-tokenized liquidity in the traditional financial system, by introducing it onto the chain through Axelar's full-chain architecture in the form of Real World Assets (RWA), thereby unleashing its liquidity completely.

For example, traditional financial giants such as Franklin Templeton and BlackRock can freely deploy tokenized funds on different chains based on Axelar, and allow the tokens of various fund products to be traded across chains supported by Axelar, thereby transferring liquidity freely on the chains connected by Axelar.

At the same time, in the long run, this first-mover advantage will undoubtedly continue to expand—JPMorgan's choice of Axelar objectively amounts to an endorsement, introducing Axelar to a broader range of off-chain funds and traditional resources. At least, when other traditional Wall Street financial giants enter the market, they are likely to consider Axelar first, which is also a first-mover advantage and ecosystem dominance that other projects find difficult to replicate.

So looking back now, large funds themselves are the most sensitive indicators: according to Grayscale's consistent style, the new tokens specifically mentioned in their new report are likely to be the targets they have quietly accumulated. Therefore, AXL may very well be the new seed player that Grayscale Trust has not yet disclosed.

Conclusion

Overall, in the narrative of "chain abstraction" aimed at incremental users, the ultimate and greatest beneficiaries may actually be the projects in the full-chain track, and among them, Axelar is gaining momentum and is currently at a significant undervalued and gradually rising turning point.

Furthermore, based on this, for the demand for tokenization of assets reaching trillions of dollars, Axelar, which took the lead in the RWA track, is like holding another reserve cake worth hundreds of billions or even trillions of dollars, providing objective conditions for it to lead the full-chain track and launch a counterattack.

From this perspective, the dual positioning of "chain abstraction" + "RWA" is undoubtedly challenging and has the most imaginative space. As for the ultimate attempts that Axelar will make in this direction, it is definitely worth continuous attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。