Original | Odaily Planet Daily

Author | Asher

Early this morning, Morpheus, an AI concept project with over 100,000 ETH staked, announced the opening of token MOR claiming and trading. Additionally, LayerZero Labs mentioned Morpheus on the X platform, stating that its native token MOR has become a token compliant with the OFT standard on Ethereum, Arbitrum, and other L2. As of now, over 200,000 MOR tokens have been claimed, and the trading volume has exceeded 10 million USD. With over 320 million USD in TVL, can this highly anticipated AI concept project become a leader in the new round of market trends? Below, Odaily Planet Daily will take everyone to understand Morpheus and its token economy.

Comprehensive Analysis of Morpheus

Project Introduction

Image Source: Official Twitter

Morpheus is an AI concept project aimed at incentivizing the development of personal general AI networks. Its goal is to provide services for ordinary users who want to simplify Web 3 interactions through AI agents and to provide a platform for developers to build and optimize intelligent agents. It also provides incentives for capital and computing resource providers. Additionally, Morpheus uses the NTT framework of Wormhole, making the MOR token native multi-chain. In summary, there are several innovations:

Intelligent agent concept: Morpheus provides a form of personal general AI, these AIs act as intelligent agents that can connect users' wallets, Dapps, and smart contracts.

SmartContractRank algorithm: This algorithm scores users and recommends the best smart contracts, increasing interaction transparency and efficiency;

Combination of decentralized cloud storage and local storage: By combining decentralized cloud storage and local storage, the long-term memory of user data and application connections can be preserved, providing richer background information for intelligent agent actions.

Token Economic Model

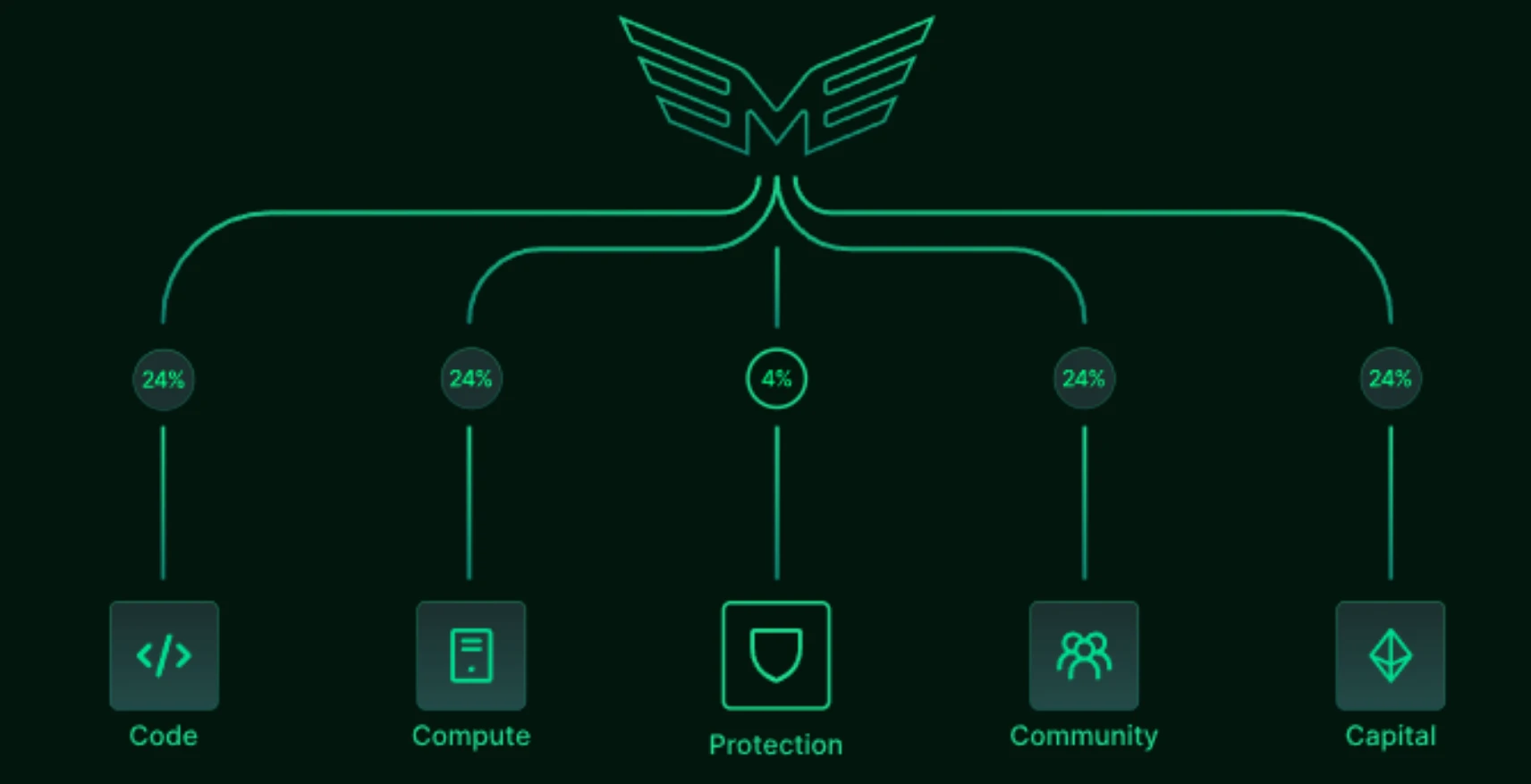

According to the documentation, the total supply of Morpheus' native token MOR is 42,000,000, with the specific allocation ratio as follows:

Coder rewards: 10,080,000 MOR, accounting for 24% of the total supply;

Capital provider rewards: 10,080,000 MOR, accounting for 24% of the total supply;

Compute provider rewards: 10,080,000 MOR, accounting for 24% of the total supply;

Community rewards: 10,080,000 MOR, accounting for 24% of the total supply;

Protection funds reserve: 1,680,000 MOR, accounting for 4% of the total supply.

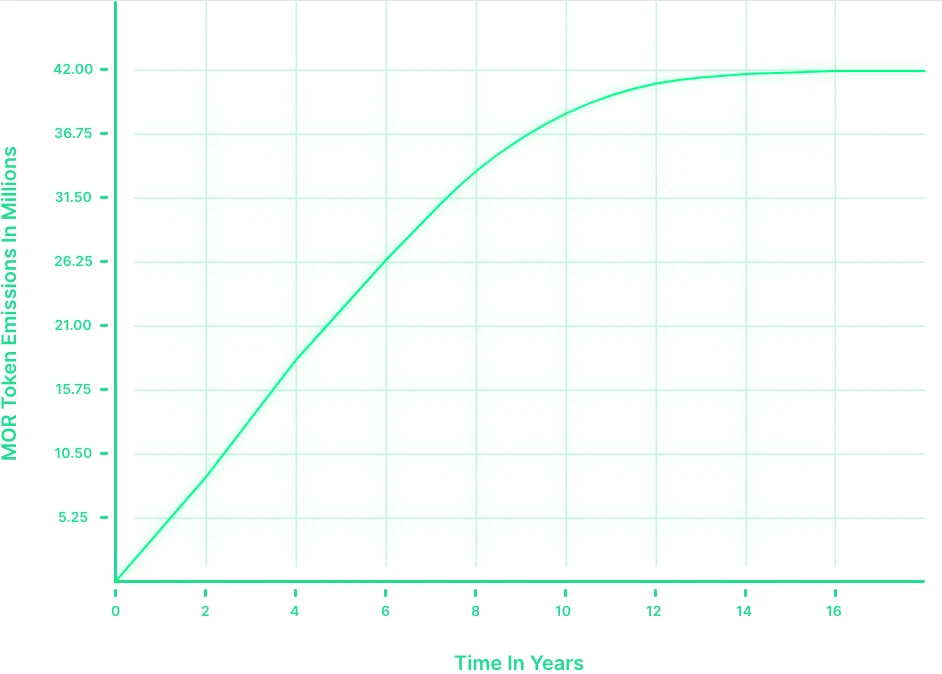

Regarding the release of MOR tokens, the block reward starts at 14,400 MOR tokens per day and then decreases by 2.468994701 MOR tokens per day until day 5833 (approximately 16 years) when the reward becomes 0. After that, the team believes that as long as Morpheus is widely used, fees will become the main incentive. Paying data fees to users, paying fees to compute providers, paying fees to capital providers, and paying fees to coders.

stETH Staking and MOR Claiming Details

Morpheus started its fair launch of MOR tokens on February 8th this year, allowing users to earn MOR token rewards by staking stETH. Since MOR tokens are non-transferable within the first 90 days, MOR officially entered the secondary market only last night.

For users who did not participate in the early stage, it is still possible to earn MOR token rewards by staking stETH, with a minimum deposit amount of 0.011 stETH per transaction. Users can request to withdraw staked stETH at any time, but it requires a 7-day unlocking period.

Regarding MOR token rewards, for example, if user A deposits 1 stETH and at the same time there are only 9 other people each depositing 1 stETH in the entire network, then user A will receive a 10% token reward during the deposit period. To claim token rewards, users need to click "Claim MOR" on the dashboard.

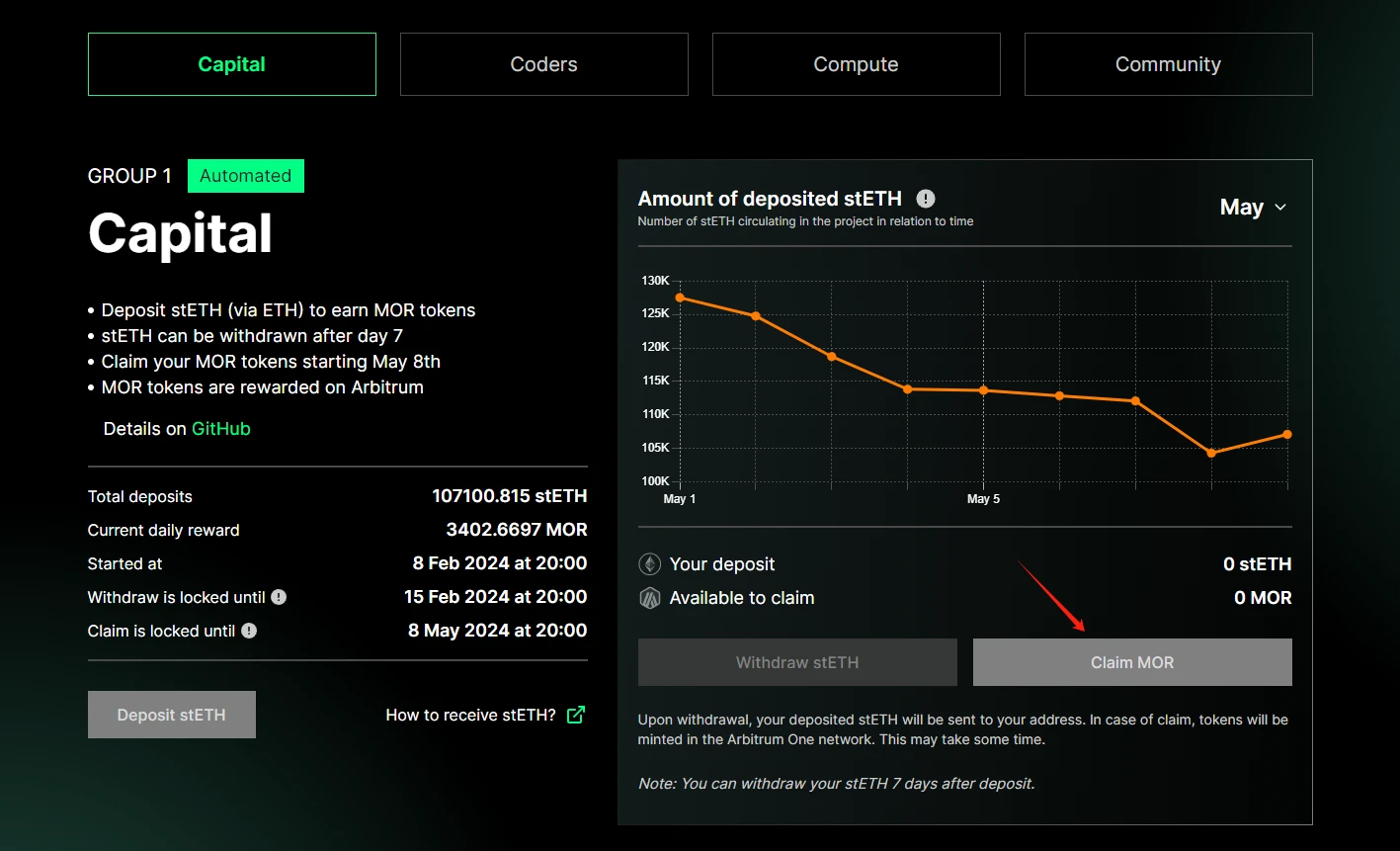

From the data on the dashboard in the above image, at the current open claiming of MOR tokens, there are still 107,000 stETH staked, and the current daily MOR token reward quantity is approximately 3400, with the current coin price, valued at around 282,000 USD.

Secondary Data of MOR

Currently, MOR token claiming has been launched and can be traded on the secondary market simultaneously. The MOR contract code is: 0x092bAaDB7DEf4C3981454dD9c0A0D7FF07bCFc86; the trading pair providing liquidity for MOR/ETH is: 0xE5Cf22EE4988d54141B77050967E1052Bd9c7F7A.

DEXscreener data shows that excluding initial insufficient liquidity issues, after the MOR token was open for trading on the Arbitrum chain, the price reached a high of over 170 USD and a low of below 60 USD, with the current price at 81 USD, a 3.7% decrease in the past hour, and a total market value exceeding 19 million USD.

Image Source: DEXscreener

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。