The data on Wednesday was more active compared to the previous two working days, especially with nearly 16,000 #BTC changing hands at the $40,000 position, which is quite rare. Upon reviewing the transfer data of the exchange, it seems that it is not related to the turnover of the exchange.

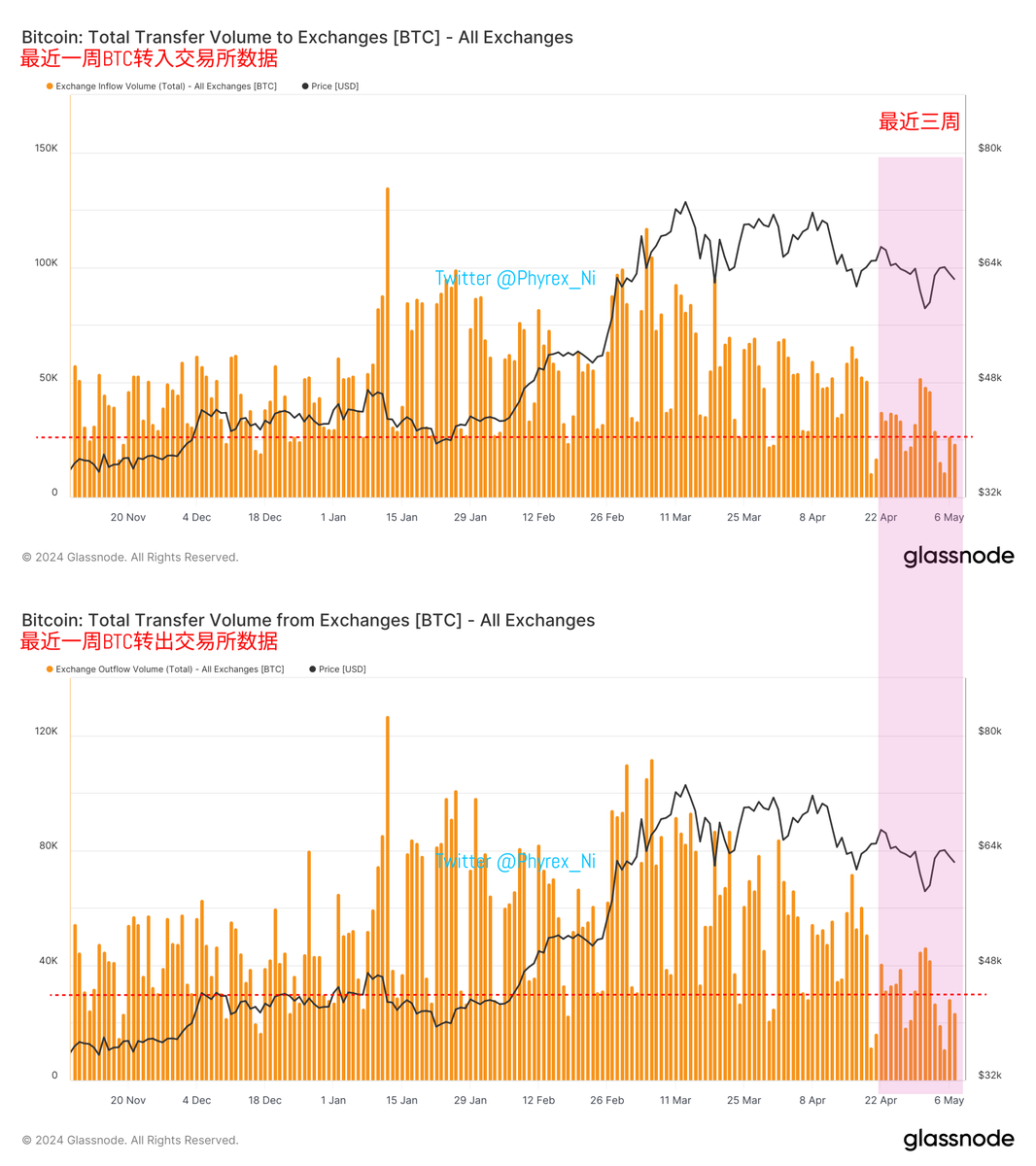

When I was looking at the exchange data, we used to say that the liquidity of BTC was low, and many investors were not willing to sell their chips. However, there was no quantitative standard. Even if we look at the on-chain fluctuations of BTC every day, it is difficult to know the actual interaction data with the exchange.

So, I happened to find this data today and discovered that the data in the past two weeks is indeed quite "bearish." It is clear from the transfer data in and out of the exchange that the data of the past three weeks interacting with the exchange is at a relatively low level in the past six months, especially the data of the past two working days, which is the lowest daily transfer data in and out of the exchange in the past year.

This indicates that currently, more investors are indeed unwilling to sell their chips, and there is almost no interest in buying. Even though the sentiment for buying and selling seemed good last Friday, with net inflows for #Bitcoin spot ETF for two consecutive days, the actual purchasing power is still at the lowest level in the past year. This represents a lack of liquidity and low sentiment. The price fluctuations we see are actually caused by very few chips circulating. If more BTC were to participate in circulation, the situation might be even worse.

Of course, the "bearish" data does not necessarily mean that the price will definitely fall. After all, the data we see now indicates that although the purchasing power is very weak, the selling pressure is also very low, and it can still maintain a barely balanced oscillation. The "bearish" data represents the current mentality of many investors lying flat.

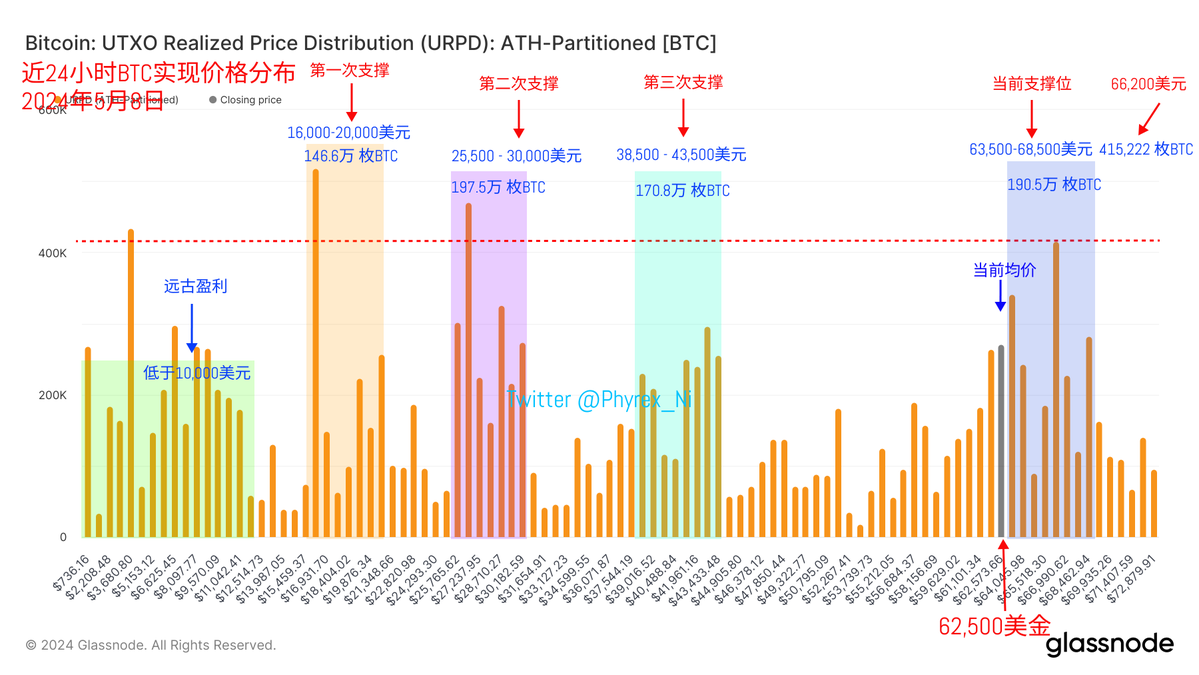

Currently, the profit chips below $60,000 have been almost washed out. The investors who made profits last week between $56,000 and $60,000 have mostly left, and the remaining turnover is getting lower and lower. However, the turnover between $63,000 and $65,000 continues to be high, and these short-term investors are the main reason for the current price fluctuations.

On the contrary, the degree of turnover for investors holding prices above $65,000 is gradually decreasing. Currently, the strongest support is still gathering over 415,000 #BTC at the $66,200 level, and investors at this level still maintain a very small amount of exit.

From the exchange's inventory data, there are still nearly 17,000 #BTC stranded on the exchange, and there are no obvious signs of exit for the time being. It is estimated that these investors are also waiting for a better opportunity.

The data has been updated, and the link is: Data Link

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。