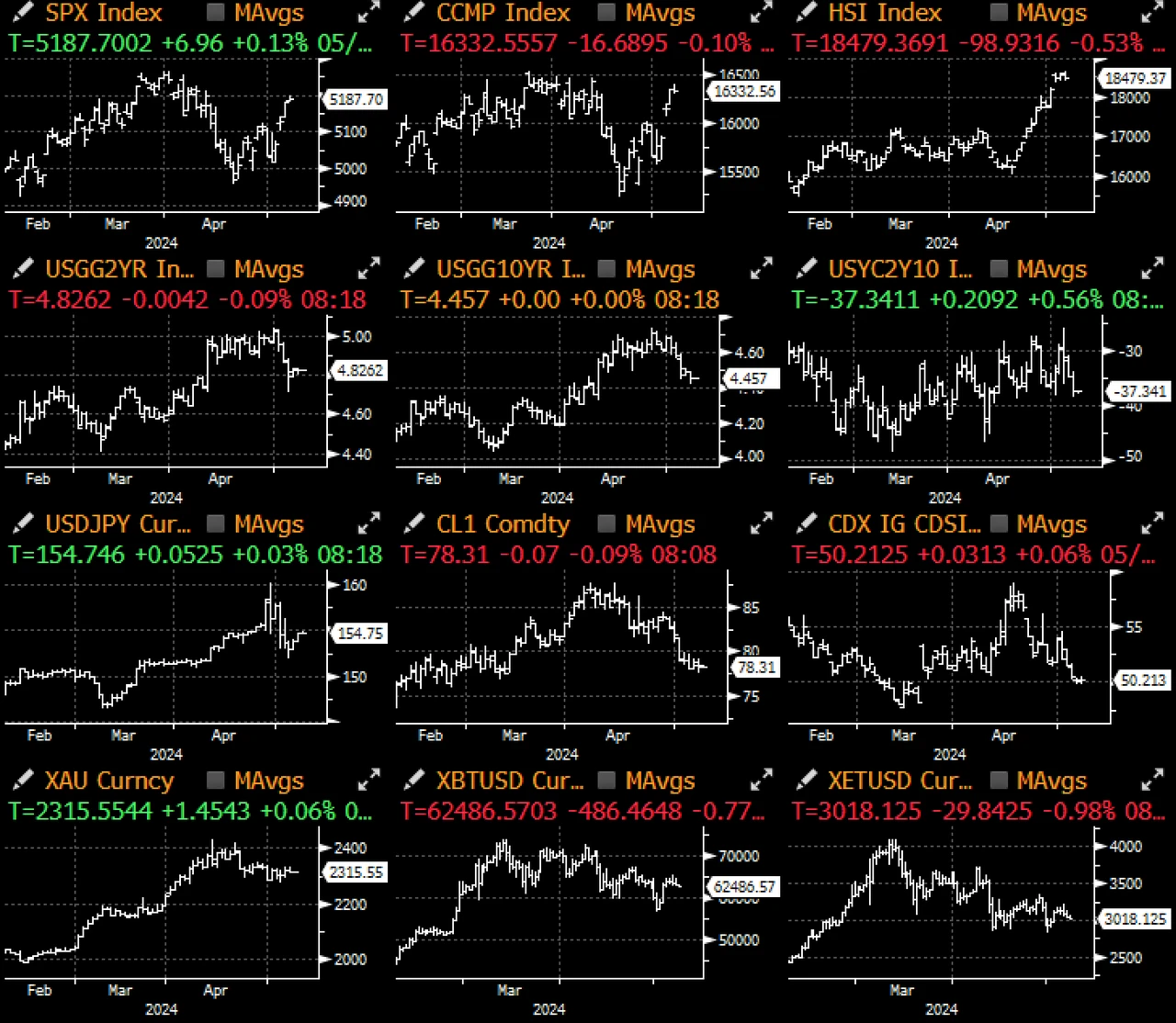

Macro assets experienced another calm trading day, with prices remaining relatively stable. Several Federal Reserve officials made remarks, showing divergent views. New York Fed's Williams (leaning dovish) echoed Powell's view, stating that the Fed's interest rate policy will be determined by "overall data, not just CPI or employment data." Additionally, he reiterated "we will eventually cut interest rates," but monetary policy is currently in a "very good place," and the labor market is achieving "better balance" following the release of non-farm employment data. On the other hand, Minneapolis Fed's Kashkari (hawkish) stated that interest rates may need to remain at current levels for "a considerable period" and "we may well need to stand pat for longer than expected until we know what the effects of monetary policy are." He also sought to retain the option to raise rates, saying "I think the threshold for raising rates is quite high, but not infinite. There is always a line when we say 'okay, we need to do more,' and that line is inflation stubbornly staying around 3%."

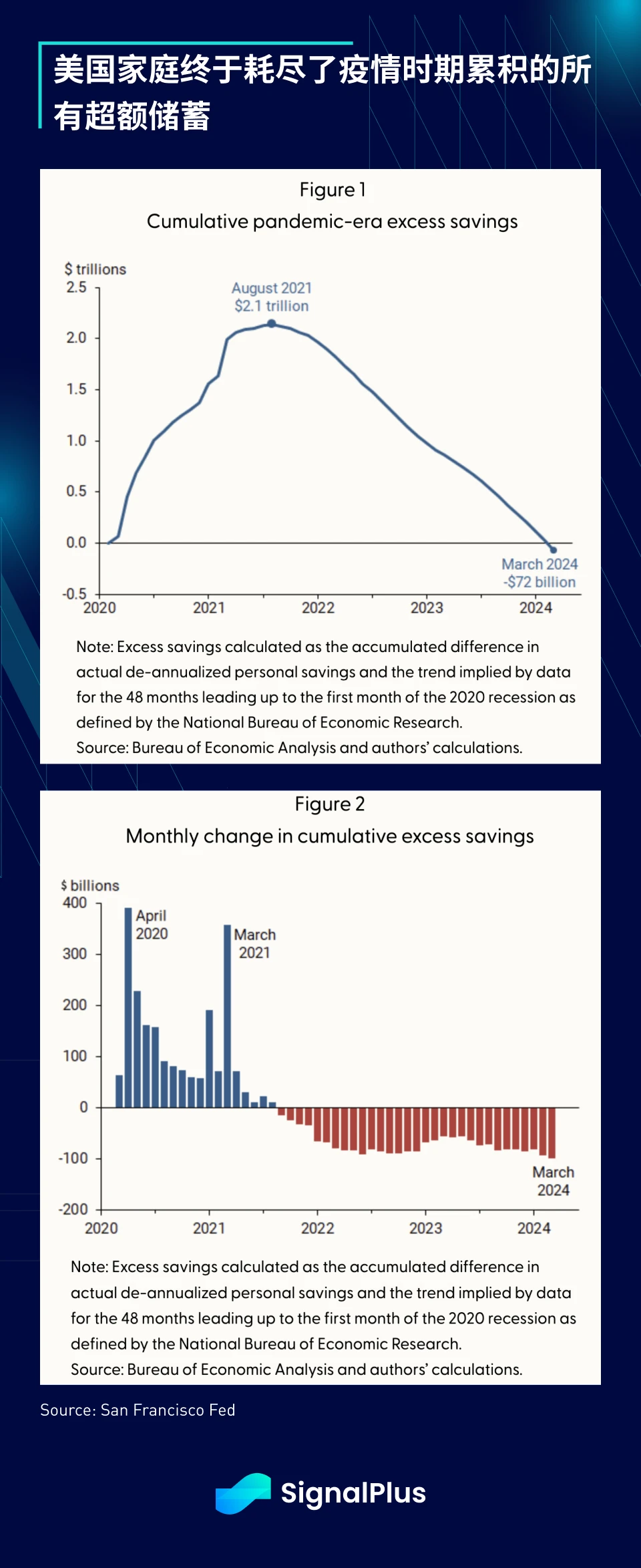

In terms of data, a commentary released by the San Francisco Fed over the weekend stated that the accumulated excess savings during the pandemic era have been depleted, dropping from a peak of $21 trillion in August 2021 to -$720 billion in March this year. Quoting directly from the Fed's commentary: "As long as they can support their spending habits through sustained employment or wage growth… and higher debt, even the depletion of excess savings is unlikely to lead to significant cuts in household spending." While the current situation may indeed be as such, this phenomenon, combined with higher interest rates and a slowing job market, will certainly prompt macro observers to pay more attention to signs of economic slowdown.

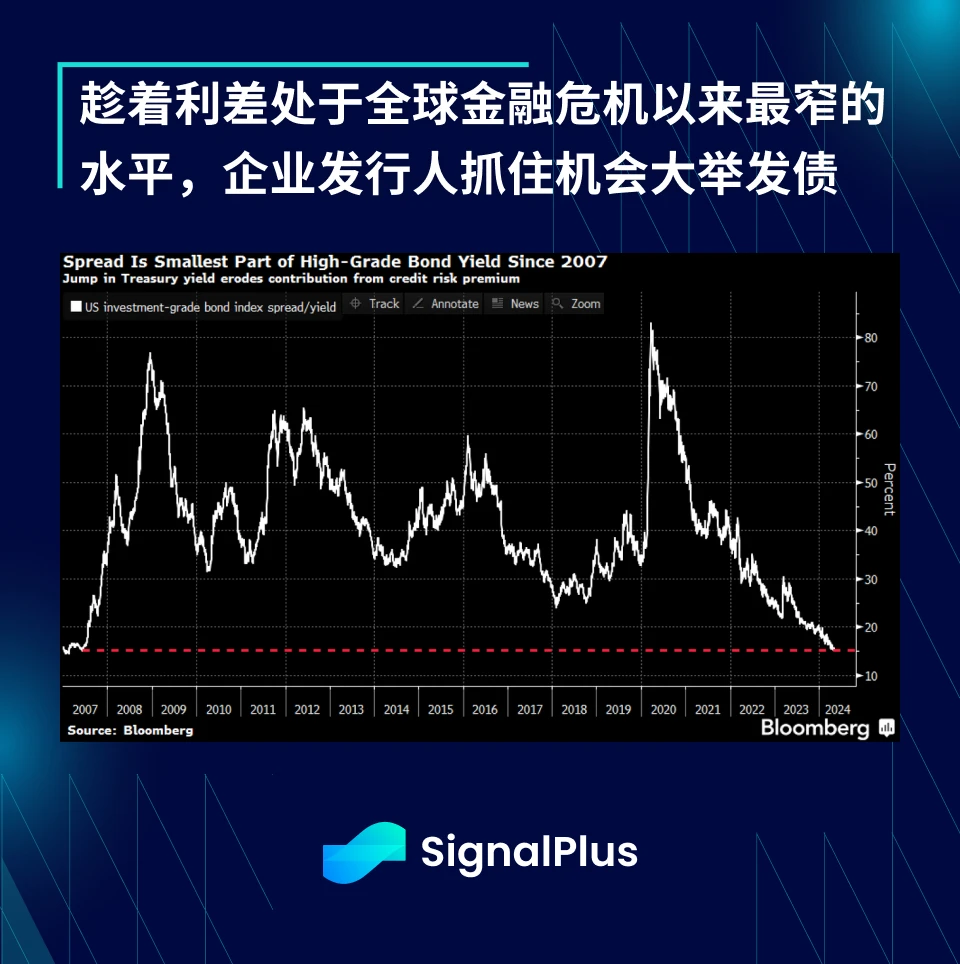

There isn't much noteworthy in terms of asset prices, but companies are taking advantage of the current lull in activity to launch another round of bond issuance. On Tuesday, as many as 14 companies announced bond issuances, with over $34 billion in new bonds priced in just the past two days, far exceeding previous expectations. Despite corporate bond spreads being at their narrowest levels since 2007, demand remains quite strong, with oversubscription exceeding 4.4 times.

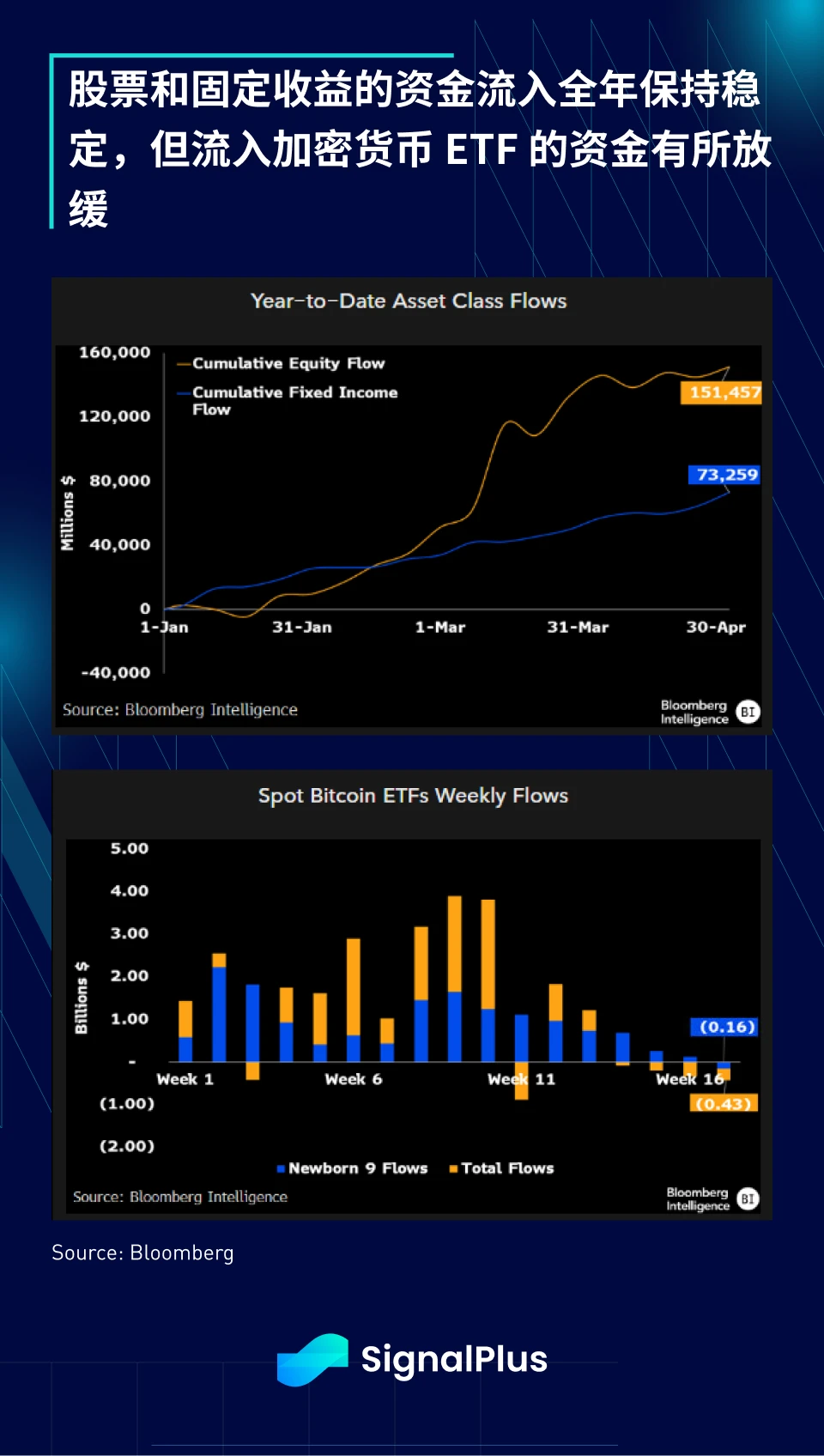

In terms of fund flows, despite current high valuations, equity and fixed income funds have maintained stable inflows this year, showing no signs of stopping. In the cryptocurrency realm, ETFs have seen outflows for three consecutive weeks, with Grayscale withdrawing a massive $459 million (IBIT data not yet updated), causing BTC prices to drop by 2-3% in the New York session.

On the positive side, according to FTX's restructuring plan, "98% of FTX creditors will receive at least 118% of the claim amount within 60 days of the plan taking effect," and "other creditors will receive 100% of the claim amount, with billions of dollars in compensation to make up for the time value of their investment." After disposing of all assets, FTX expects to have as much as $16.3 billion in cash available for distribution, far exceeding the total amount owed to creditors of $11 billion. Ironically, this may become the largest single liquidity 'off-ramp' event in cryptocurrency history. Will creditors reinvest these recovered funds in cryptocurrencies, or will they return to traditional assets? It's an interesting time indeed.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant's WeChat: SignalPlus123), Telegram group, and Discord community to interact and engage with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。