Recently, the biggest regulatory event in the cryptocurrency field is the sentencing of Binance founder CZ to four months in prison. On the day CZ's verdict was announced, another figure who had a significant impact on the cryptocurrency industry appeared in the "cryptocurrency regulation" topic. Compared to his previous influence, there has been too little discussion about the news of his arrest.

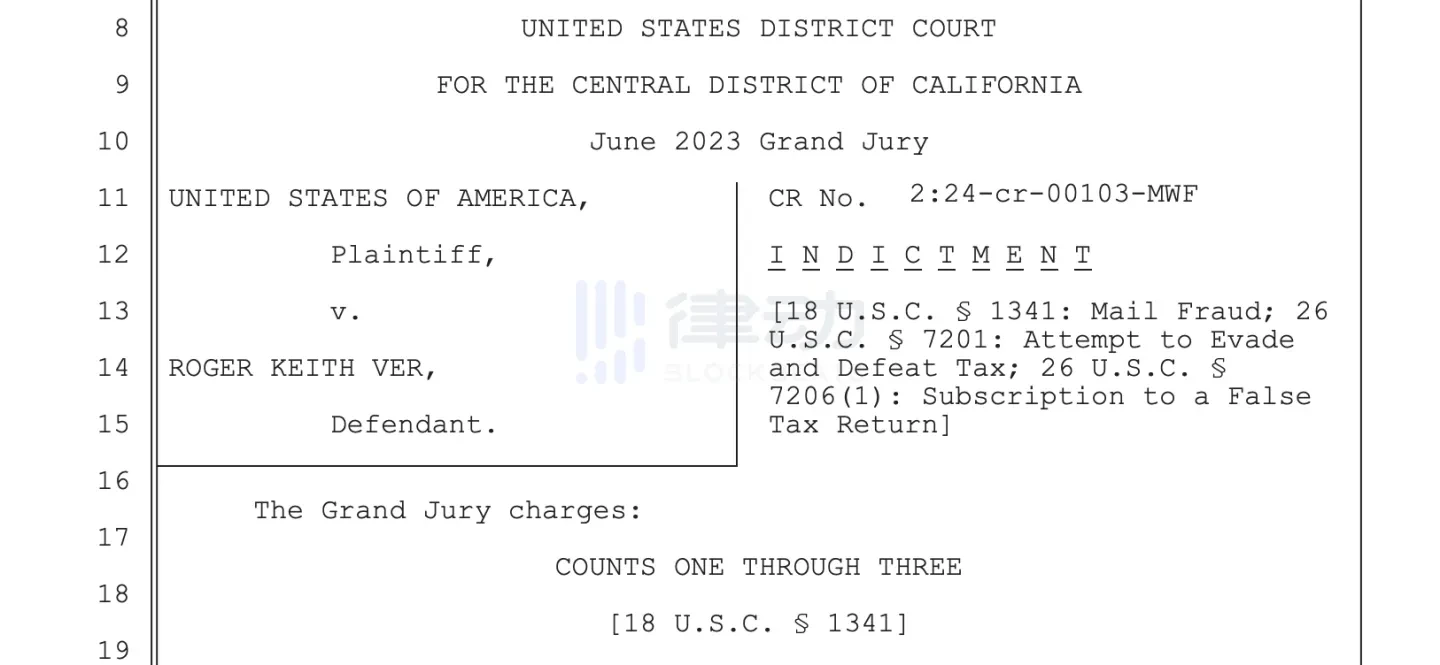

A week ago, the U.S. Department of Justice released a document accusing 45-year-old American citizen of Saint Kitts and Nevis descent, Roger Keith Ver, of evading nearly $50 million in taxes, involving email fraud, tax evasion, and filing false tax returns. Since Roger Ver was arrested in Spain at the end of April, the U.S. is seeking to extradite him to face trial in the U.S.

Roger Ver's name may be unfamiliar to the current cryptocurrency community, but in the short history of Bitcoin's development of over twenty years, the role played by Roger Ver has been extraordinary. He was once referred to as the "Bitcoin Jesus."

The suspicion of large-scale tax evasion charged by the U.S. Department of Justice stems from Roger Ver's concealment of the amount of Bitcoin he held when he renounced his U.S. citizenship in 2014. At that time, the price of Bitcoin was only a little over $800, and it later dropped to around $300. Roger held 131,000 Bitcoins at the time, which is undoubtedly a huge asset today. Three years after leaving the U.S., Roger sold 70,000 Bitcoins. The notice issued by the U.S. Department of Justice stated, "Roger Ver caused the Internal Revenue Service to lose at least $48 million."

The "Bitcoin Jesus" with hundreds of thousands of BTC

Born in Silicon Valley, USA in 1979, Roger Ver is a well-known libertarian and anarchist. After attending a community college in the U.S. for a year, he dropped out to start his own company, Memorydealers, an online sales company for electronic parts and equipment. At the age of 21, he also ran as a candidate for the Libertarian Party in the California Assembly elections, but was sentenced to 10 months in federal prison for illegally selling explosives on eBay after being reported by someone.

In 2011, Roger discovered Bitcoin and became a devout believer in it. Roger first integrated Bitcoin payments into his company's website, allowing customers to pay with Bitcoin. At that time, the value of each Bitcoin was less than $1, and it is estimated that Roger collected over 400,000 Bitcoins through such efforts.

Over the past decade, with the roller-coaster fluctuations in Bitcoin prices, Roger Ver, who was able to discover and hold tens of thousands of Bitcoins from the $1 position, now appears to be surrounded by a halo of wealth. However, this is not the only reason why Roger was called the "Bitcoin Jesus." As a devout believer in Bitcoin, Roger spent over $100,000 to broadcast Bitcoin advertisements on radio stations across the U.S. in the early days of Bitcoin's birth.

In 2012, Roger Ver co-founded the Bitcoin Foundation (bitcoinfoundation.org) with other founders, dedicated to promoting Bitcoin globally. In addition to collecting Bitcoin, Roger Ver actively sought out and funded early-stage companies dedicated to promoting Bitcoin, making him one of the "angel investors" of the first batch of Bitcoin startups (he called himself the "second participant" in these projects). In the early days of Blockchain.com, Roger Ver found the founder of Blockchain.com, who had just graduated from high school, and provided funding for him to purchase dedicated servers to operate the project without relying on his family's Mac mini.

In addition to Blockchain.com, Roger Ver also invested in many cryptocurrency projects, including Kraken, purse.io, Bitpay, and Ripple. After Roger Ver's arrest, Ripple's Chief Technology Officer David Schwartz commented, recalling, "Ver is one of the best and most sincere people I have ever met, and his actions are based on a firm belief in his own moral principles."

In 2014, Roger Ver acquired control of the Bitcoin.com domain and leased it to Blockchain.info, and later to OKCoin. In 2015, Roger's Bitcoin rose from $1 to over $200, and he was still advising others to buy Bitcoin, "It's not too late to buy Bitcoin now, just like some people later thought it was too late to enter the Internet…"

No longer surrounded by a halo, "owing" $47 million

In the history of cryptocurrency development, Roger Ver is not a completely positive figure. After gaining the halo of the "Bitcoin Jesus" through his strong support for Bitcoin in the early days, Roger Ver's recent activities have sparked controversy rather than admiration.

In 2017, at the crossroads of the Bitcoin hard fork, Roger Ver chose BCH, which was advocated by Bitmain founder Jihan Wu. His mining pool, Bitcoin.com, also played a crucial role in the hash power battle after the BCH fork. Since then, Roger Ver has become a staunch advocate for BCH, repeatedly expressing that "BCH is the real Bitcoin." Because BCH did not experience the same wealth effect as Bitcoin, Roger was called a "fraud" by many investors who bought BCH in large quantities.

Roger is also known in the community for his debt disputes and the resulting verbal battles. In 2022, news of Roger Ver suing Smart Vega, a subsidiary of Jihan Wu, became the focus of community discussion at the time. Roger Ver claimed that the company froze $8 million of his funds, but Jihan Wu demanded that Roger first repay the debt to CoinFLEX.

The debt dispute stemmed from the collapse of Luna, which resulted in huge losses for Roger on the CoinFLEX trading platform in which he was involved. Jihan Wu is a creditor of CoinFLEX, and according to Mark Lamb, CEO of CoinFLEX, Roger Ver owes CoinFLEX $47 million worth of USDC. However, Roger Ver denied these accusations on Twitter, calling the debts rumors and counter-accusing CoinFLEX of owing him a large sum of money.

Charged with "false tax filing," awaiting extradition trial

Unlike other important figures in the cryptocurrency industry who have been charged with crimes, the "criminal activities" for which Roger Ver is accused by the U.S. Department of Justice stem from the tens of thousands of Bitcoins he sold when he renounced his U.S. citizenship ten years ago. The official notice stated, "Ver provided false or misleading information to law firms and appraisers, concealing the true amount of Bitcoin he and his company owned. As a result, the law firm submitted false tax returns that significantly undervalued the value of two companies and their 73,000 Bitcoins, and did not report any Bitcoin owned by Ver personally."

After leaving the U.S., Voger Ver sold 70,000 Bitcoins for $240 million in cash in November 2017. This transaction is seen as problematic by the U.S. Department of Justice: "Although Ver was not yet a U.S. citizen at the time, the law still required him to report and pay taxes on certain allocations to the IRS."

Since Roger Ver discovered Bitcoin, it has grown by over 60,000 times in the past 13 years. Looking back, it is clear that Roger Ver's mythological status has nothing to do with his investment ability. His support for Bitcoin stems from his belief in economic freedom, and his decision to choose BCH was also based on monetary economic considerations. He believes that "only by increasing the block size can Bitcoin possess all the economic characteristics that a currency should have and be accepted by the mainstream." In a YouTube interview in 2022, Roger Ver stated, "Many people think I am a BCH maximalist, but I am not. What I want to promote is peer-to-peer electronic cash, or more precisely, a tool that can maximize economic freedom on a global scale."

From dropping out of school to starting a company to becoming the "Bitcoin Jesus" with billions in assets, to being labeled a "BCH fraud," getting involved in debt lawsuits, and now being arrested, in the huge wealth myth brought about by the rise of cryptocurrency over the past decade, Roger Ver's stage belongs only to the very early period. But even though his main cryptocurrency activities were in the very early days, Roger Ver cannot escape the iron fist of U.S. regulation.

After the approval of the U.S. ETF, many institutions believe that Bitcoin will surpass $100,000 in this bull market. The amount of funds in the cryptocurrency world is increasing, but Roger's vision of cryptocurrency challenging traditional economic systems and promoting anarchism remains a distant prospect. Today, the total market value of cryptocurrencies has exceeded $2.5 trillion, and its influence on traditional finance is gradually increasing. The tightening regulatory policies in the U.S. not only affect the present and future, but also events that the cryptocurrency industry has experienced in the past are being scrutinized and settled one by one.

Since last year, U.S. regulatory agencies have initiated a series of lawsuits against cryptocurrency industry institutions/figures. In addition to FTX's former CEO SBF and Terra's DoKwon, the sued cryptocurrency institutions also include ConsenSys, Kraken, Gemini, Celsius Network, Ripple Labs, Uniswap, and Coinbase. With CZ being sentenced to 4 months in prison and Roger Ver being "caught," the regulatory pains that the cryptocurrency industry will have to endure will continue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。