In this current upward cycle, Tether has printed tens of billions of USDT, so why is the liquidity in the cryptocurrency market still very poor?

This is due to the consistent financial behavior of the market, which is particularly conservative and hesitant. We are in a period of stagflation and recession in the US economy, and stablecoins remain the best asset to outperform the market during this phase.

Although the year-to-date returns of cryptocurrencies and US stocks have significantly outperformed USD returns, as Warren Buffett expressed at the 2024 Berkshire Hathaway annual meeting, there will be a global financial system risk event triggered by a US banking crisis, leading to a significant reversal or even negative returns for cryptocurrencies and US stocks. The black swan could arrive at any time, and savvy investors in the market are well aware of this.

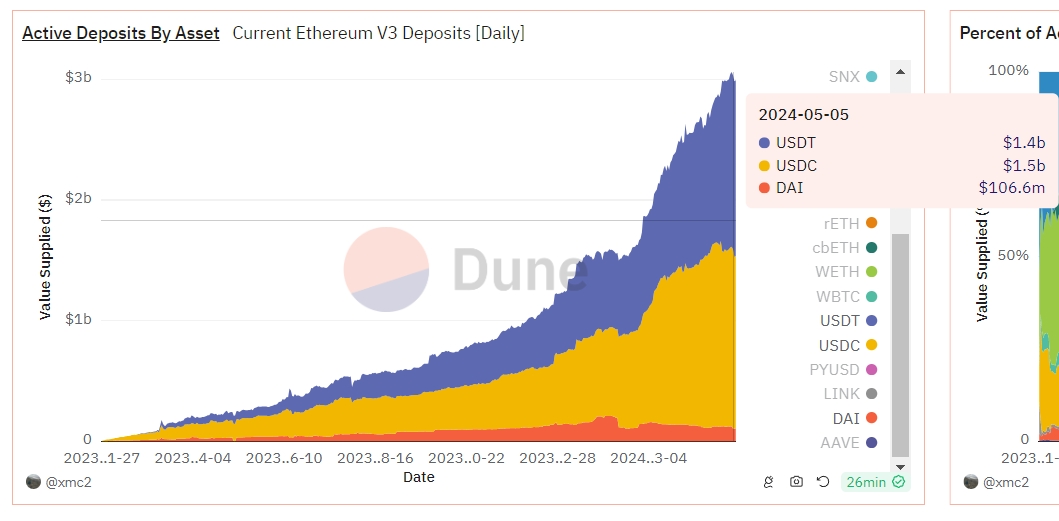

From February 15 to the present, in less than three months, the stablecoin deposits on the Ethereum chain for AAVE V3 have grown from around $15 billion to around $30 billion, representing a 100% increase in deposit size.

Based on the above data, cashing out at the high and then depositing to earn high interest is a form of market consensus behavior during the post-Chinese New Year rally.

The funds flowing into Bitcoin spot ETFs have stayed in the US stock market rather than entering the cryptocurrency market. In a sense, Bitcoin spot ETFs have intercepted some of the funds that should have flowed into the cryptocurrency market.

Under the combined influence of these internal and external factors, the current poor liquidity in the cryptocurrency market is an inevitable result.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。