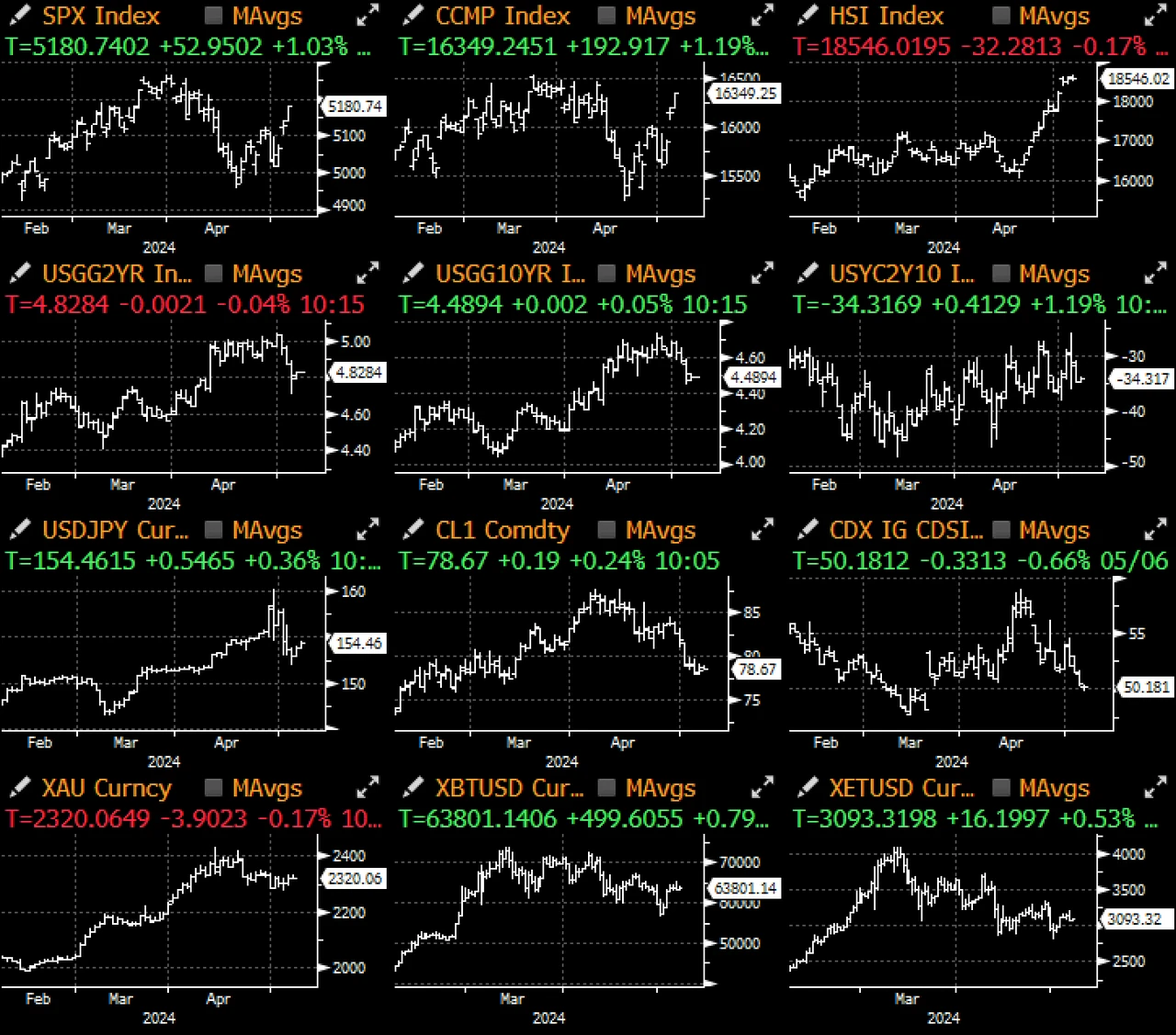

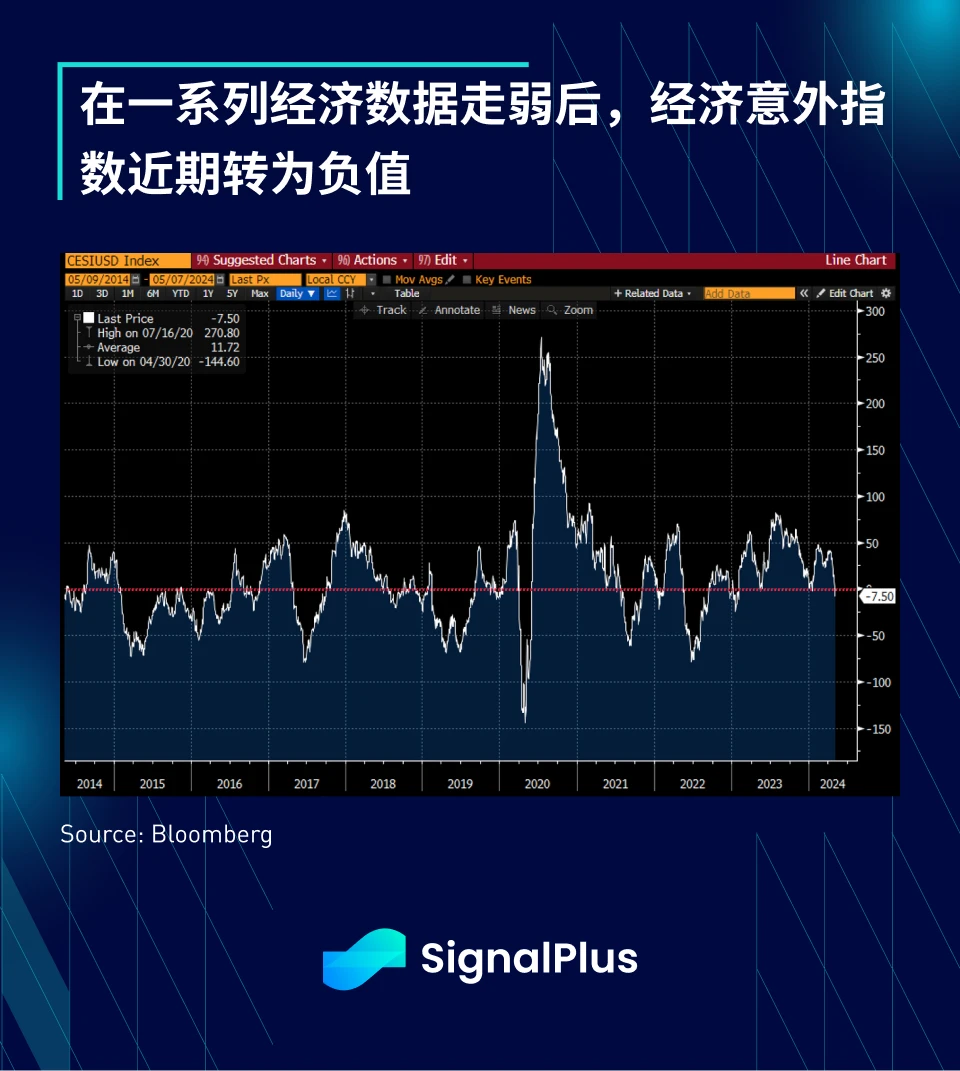

The market experienced a calm trading day yesterday. After last week's dovish developments (Fed policy leaning towards a soft job market, JOLTS/non-farm data slowing down, weakening economic data, and a large number of fixed income short positions in the market) boosted risk sentiment, the market continued to maintain momentum this week. Due to the lack of first-line economic data before the release of CPI data on May 15 (one week later), and with the companies releasing financial reports accounting for only about 7% of the SPX market value, and heavyweight Fed officials such as Powell and Waller waiting to make speeches, the market is more likely to be dominated by technical factors in the near term.

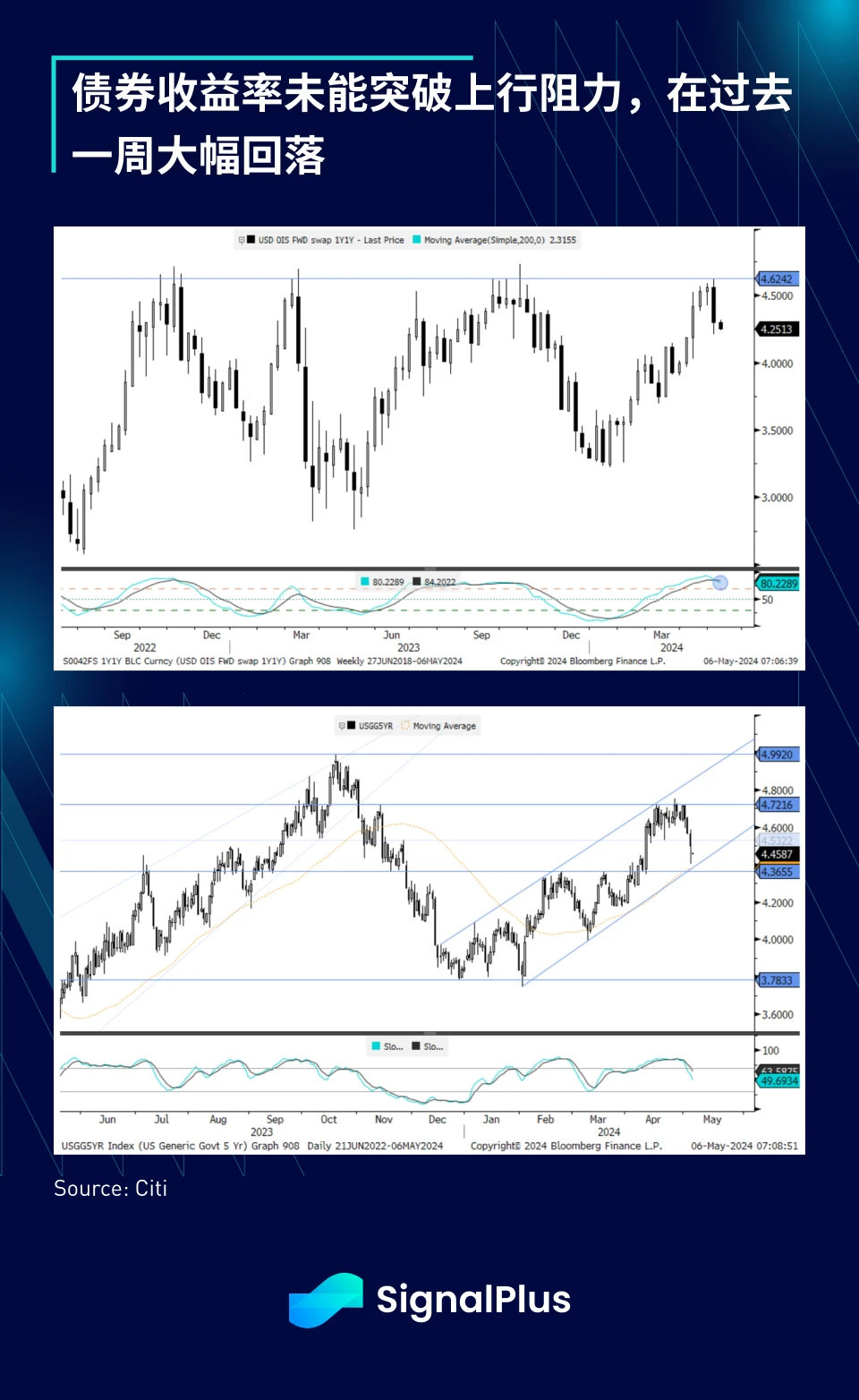

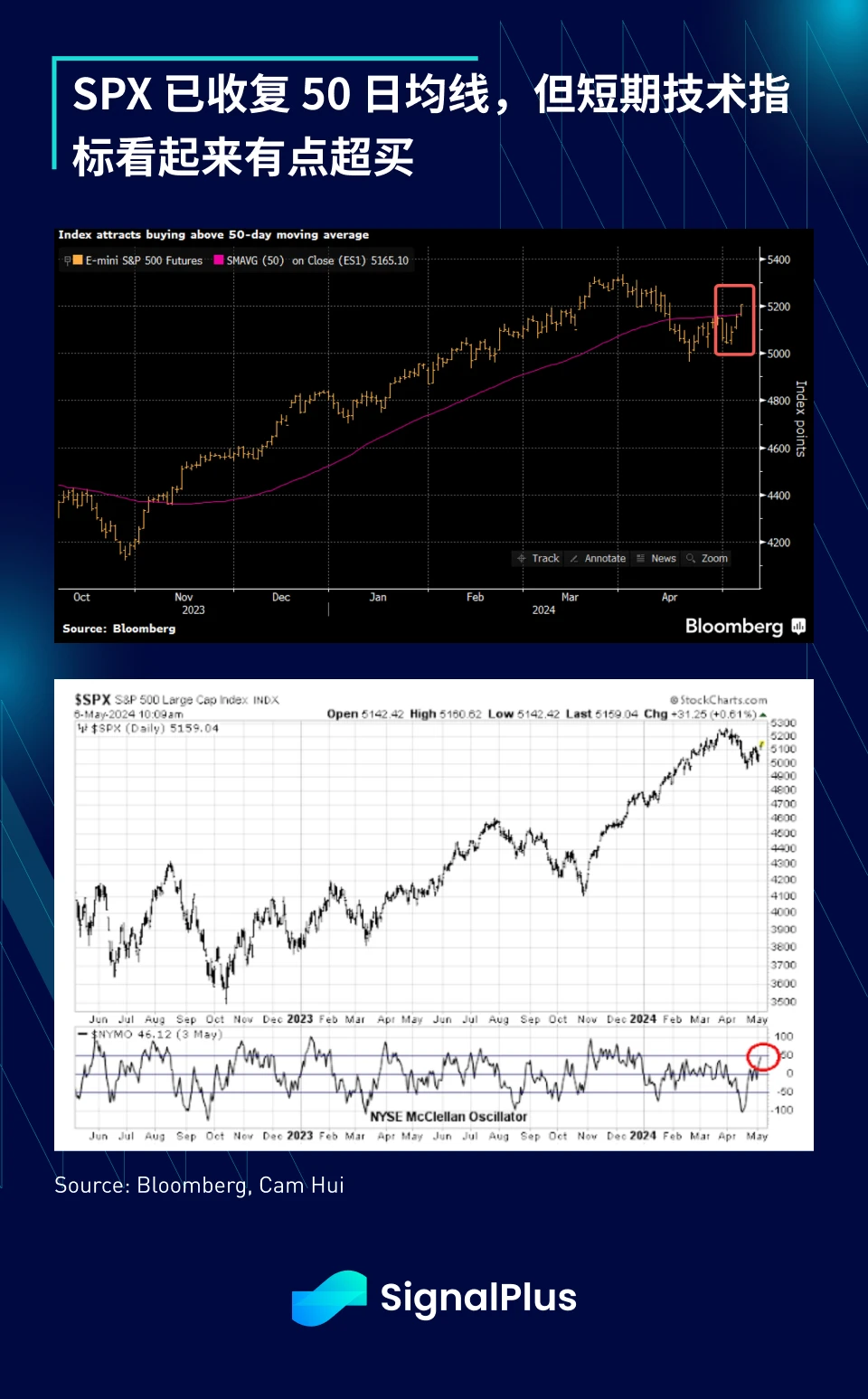

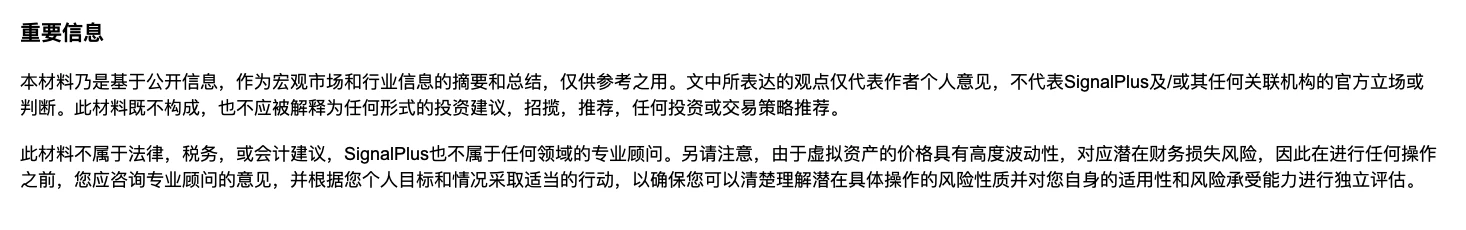

Speaking of momentum, bond yields sharply fell after testing upper resistance over the past week, dropping by 20-30 basis points. In the stock market, SPX futures have reclaimed the 50-day moving average, bringing recent historical highs back into view, although the short-term technical outlook does appear somewhat overbought. Cross-asset volatility has also decreased, with stock market volatility falling to cyclical lows, followed closely by interest rate and foreign exchange volatility, especially the USD against offshore RMB and USD against JPY, which have fallen to recent ranges. Our view remains unchanged that the market may slowly rise in the short term until it ultimately decides to clearly view "bad (economic) news" as "bad news" for future profits and growth.

In the cryptocurrency sector, apart from more litigation actions taken by the SEC, there isn't much news, with the SEC's actions mainly targeting Robinhood's cryptocurrency division. The price of BTC continues to reflect the fluctuations in the stock market sentiment, with the trends of SPX futures and BTC showing amazing similarity over the past month. We expect that in the absence of new catalysts (where did the halving discussion go?), cryptocurrency prices will remain in sync with stocks. However, considering that a large number of leveraged long positions were liquidated in April, cryptocurrency prices still tend to trend upward. Wishing everyone successful trading.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。