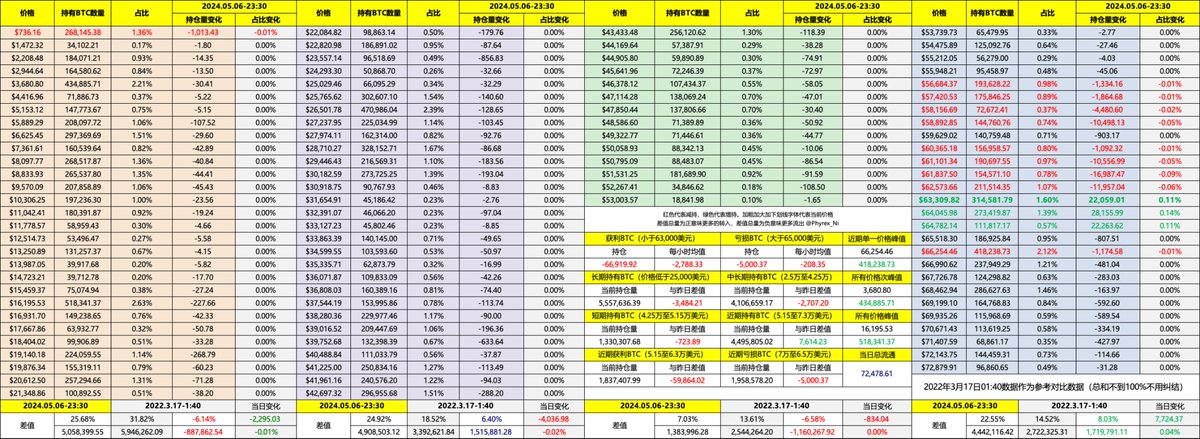

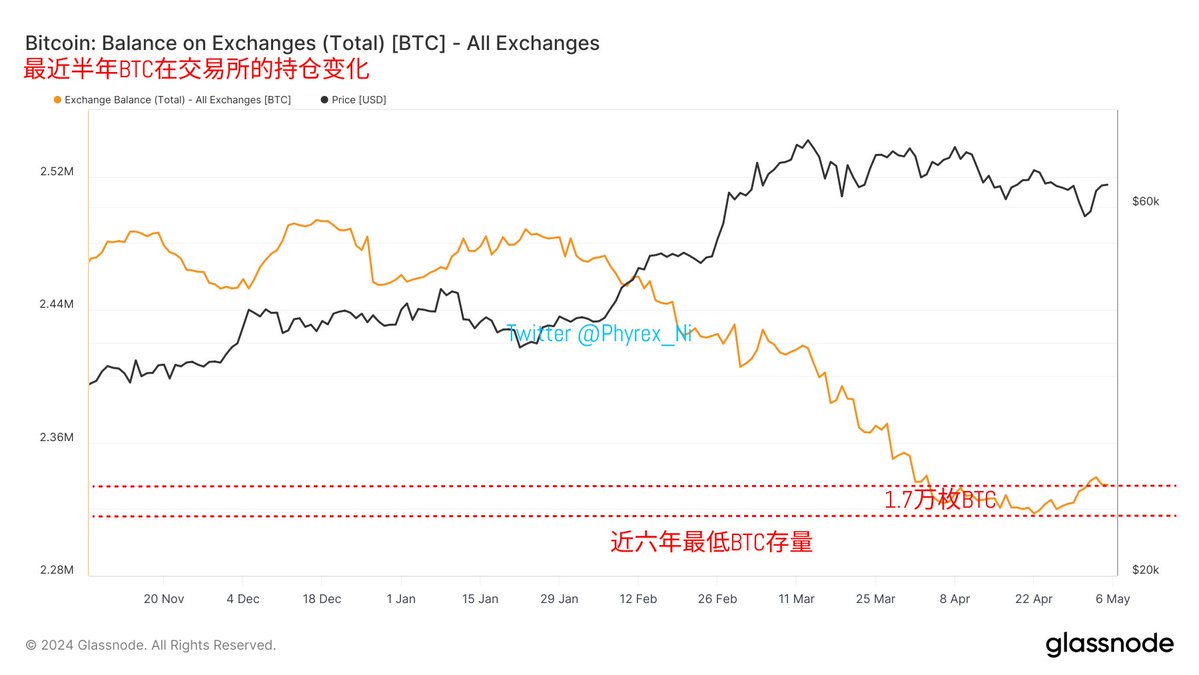

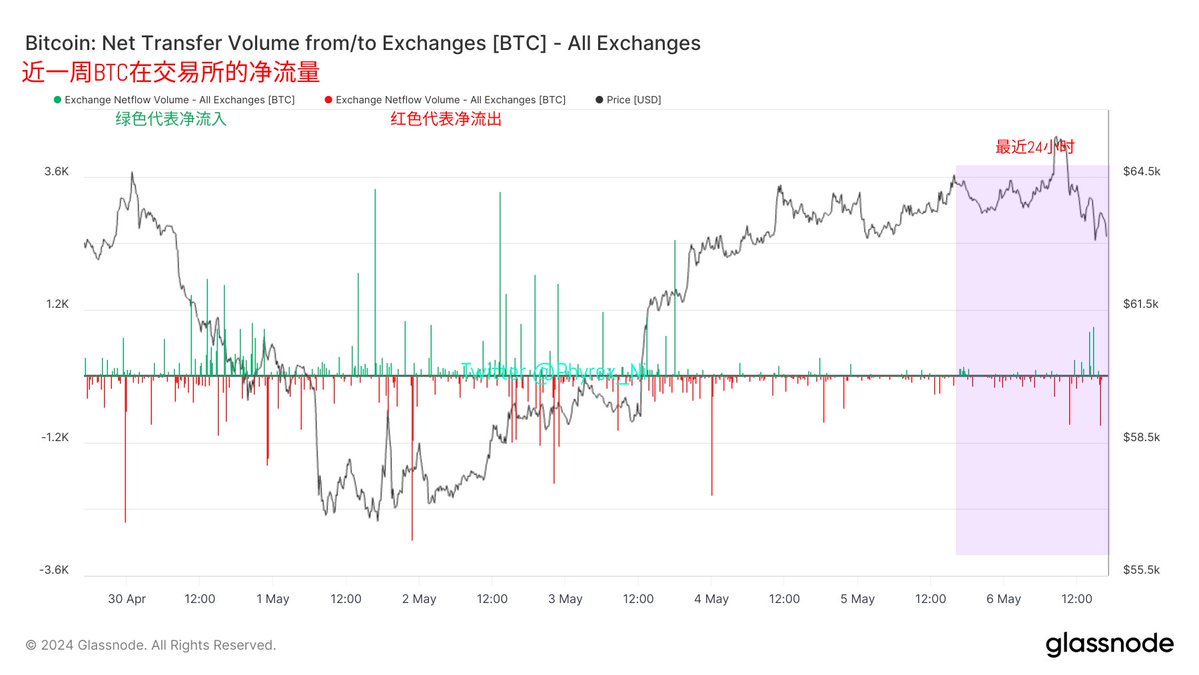

Although today's data is already Monday, for investors in the United States, who are still in a holiday state due to the peak activity, it can be seen that even on the first working day, the actual on-chain flow of #BTC is very limited. This is also why I have been saying that the current on-chain liquidity is very much like that in a bear market. The liquidity of a bear market refers to the indifference of more investors to the current price, with only a small number of short-term holders and short-term traders actively trading. The recent 24-hour data shows that investors with a holding cost below $56,000 and above $67,000 still do not show a clear trend of turnover. This represents the early profit and loss investors, and the lack of significant turnover of these chips indicates that most investors are indifferent to the current price. This is not just something we casually say. At least we can see that from $56,000 to the current $64,000, there is no clear difference. The investors who are truly participating in turnover every day are still those short-term investors. Especially when the macro sentiment is relatively stable now, the market's expectation of the Fed's interest rate cut has been raised from once in 2024 to twice, which has helped the sentiment in a market with already low liquidity. However, how long this positive sentiment can last still depends on the macro data and the Fed's attitude in the coming week. The most critical data this week should be the preliminary value of the University of Michigan Consumer Sentiment Index for May and the one-year inflation rate expectation in the United States, which will be released on Friday. Other data still needs to be interpreted in combination with liquidity, macro sentiment, and on-chain data. After a weekend, although the selling pressure did not continue to rise, the exchange's inventory of #BTC is still about 17,000 coins higher than the lowest value in nearly six years, and there is still no clear sign of reduction. Looking at more detailed data, nearly 1,800 BTC were transferred to the exchange before the opening of the US stock market today, and now only about 1,000 BTC have been transferred out. The remaining amount will depend on whether it can be digested around 4 am. The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。