Original | Odaily Planet Daily

Author | Fan Jiabao

Recently, Coinbase released its financial report for the first quarter of 2024.

The report shows that Coinbase's revenue for the first quarter was $16.4 billion, higher than the analysts' average expectation of $13.4 billion; net profit was $11.8 billion, or $4.40 per share, compared to a loss of $78.9 million, or 34 cents per share, in the same period last year, achieving an amazing financial turnaround. This profitable performance comes after the company announced its first profit in two years in February this year.

It is worth noting that the profit for this quarter includes a $650 million gain from the valuation of the held investment crypto assets due to the adoption of new accounting standards.

I. Sharp increase in transaction fees: Market recovery combined with the approval of Bitcoin ETF

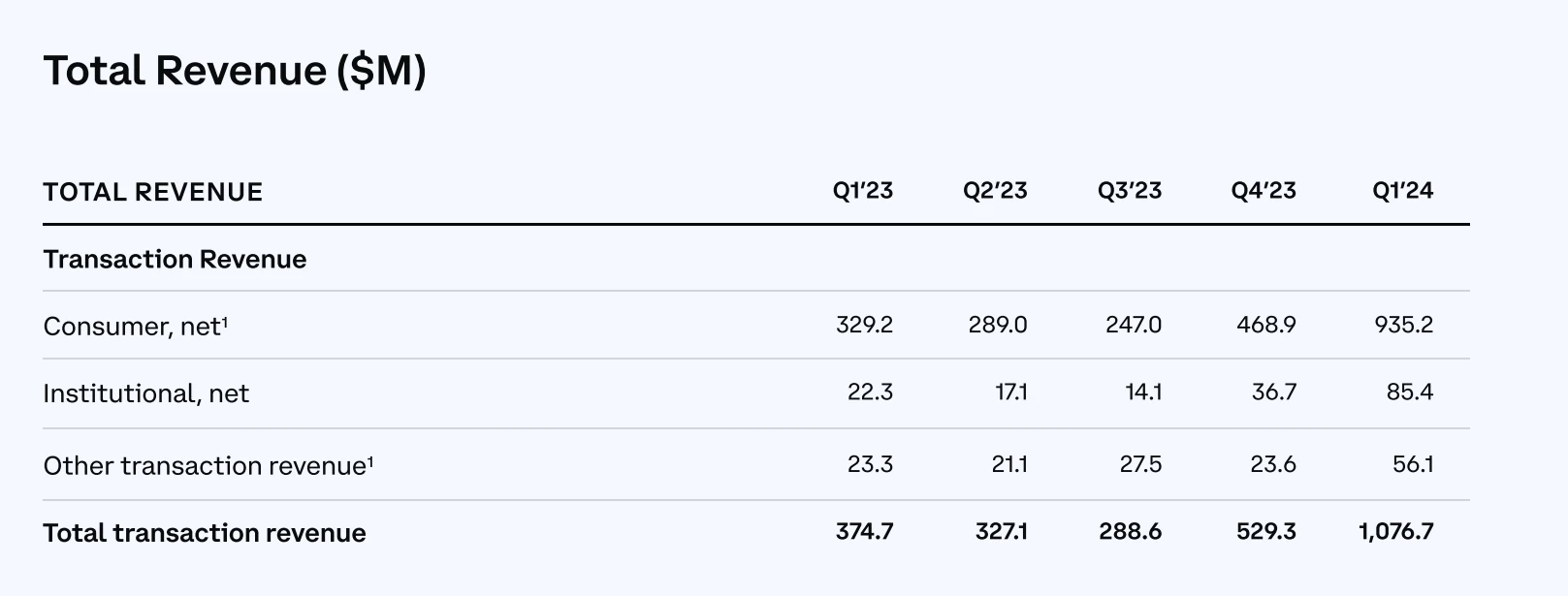

In terms of business types, the total transaction fee income for 2024 Q1 was $1.077 billion, an increase of 103.42% compared to the previous quarter and 187.35% year-on-year, accounting for 65.75% of the revenue and becoming the main source of revenue.

The significant increase in transaction fee income is mainly due to the substantial increase in trading volume by retail and institutional investors.

Details of transaction fee income (in million US dollars)

Retail transaction fee income

The retail transaction fee income for 2024 Q1 was $935 million, an increase of 99.45% compared to the previous quarter and 184.08% year-on-year. The retail trading volume for 2024 Q1 was $56 billion, an increase of 93.10% compared to the previous quarter and 166.67% year-on-year. Coinbase's CFO pointed out in a conference call that the significant increase in transaction fees is due to the growth of new users, the recovery of trading volume by existing users, and the increase in average trading volume per user.

Institutional transaction fee income

The institutional transaction fee income for 2024 Q1 was $85 million, an increase of 132.70% compared to the previous quarter and 282.96% year-on-year. The institutional trading volume for 2024 Q1 was $256 billion, an increase of 104.8% compared to the previous quarter and 106.45% year-on-year.

Institutional transaction fee income benefited from the approval of Bitcoin spot ETFs and product innovation by the company. Since the approval of a series of new US spot Bitcoin exchange-traded funds by the US Securities and Exchange Commission, a large influx of institutional investors has been attracted. Many exchange-traded funds have chosen Coinbase as their custodial partner, attracting over $50 billion in funds by the end of the first quarter.

The institutional platform Coinbase Prime achieved record-high trading volume and active customer numbers in 2024 Q1. The Prime platform provides custody, trading, financing, and staking services for institutional clients, and due to the approval and listing of the Bitcoin ETF in January 2024 and the rise in Bitcoin prices in the first quarter, the participation of clients in the Prime product suite significantly increased.

Benefiting from the stimulus of ETF issuance on trading behavior, as the custodial partner of exchange-traded funds, Coinbase Prime's trading volume in the first quarter reached a record high, increasing by 115% year-on-year to 312 billion times, and revenue in the first quarter surged from $22.3 million in the same period last year to $85.4 million, with loans increasing to $797 million.

Other transaction income

The other transaction income for 2024 Q1 was $56 million, an increase of 137.71% compared to the previous quarter and 140.77% year-on-year. Other transaction income benefited from the increase in revenue from the Layer2 solution Base provided by Coinbase.

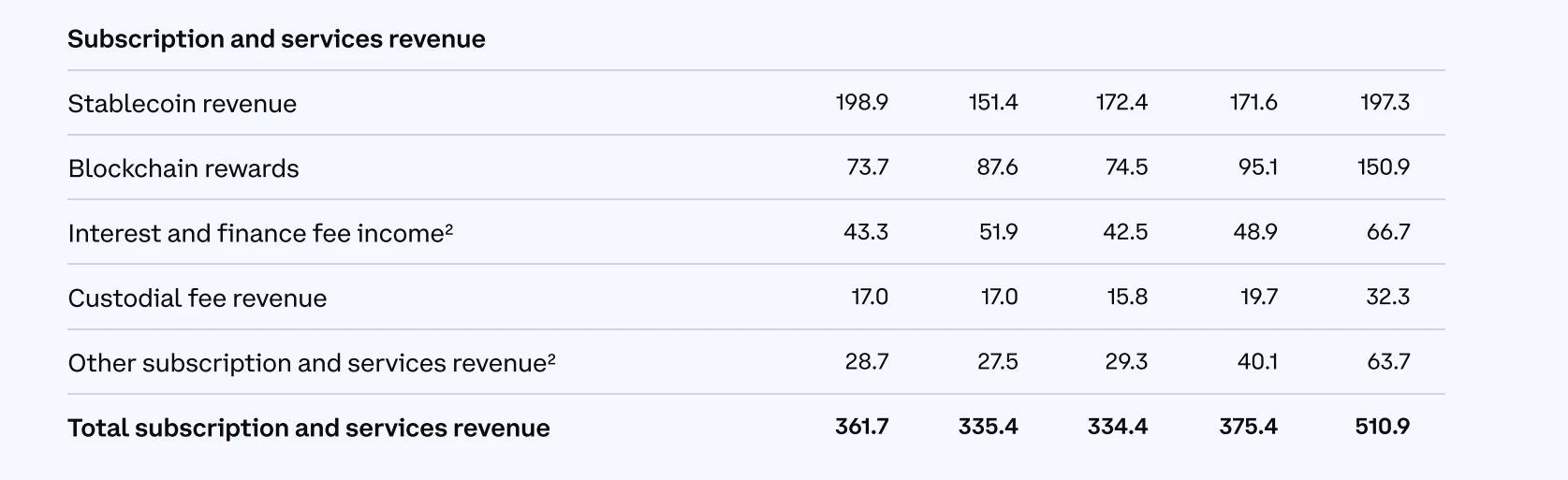

Subscriptions and service income growth is impressive

Subscription and service income reached $511 million in the first quarter, an increase of 36.09% compared to the previous quarter and 41.25% year-on-year, accounting for 31.20% of the revenue, mainly driven by the growth of blockchain reward income, custody fee income, and other subscription service income.

Details of subscription and service income (in million US dollars)

Stablecoin income

The stablecoin income for 2024 Q1 was $197 million, an increase of 14.98% compared to the previous quarter and a decrease of 0.8% year-on-year. Stablecoin income benefited from the increase in the market value of USDC. The value of USDC on the platform was $5.5 billion, approximately twice the value at the end of Q4 2023.

It is worth noting that in the first quarter, USDC had the highest growth rate among all US dollar stablecoins.

Reward income

The blockchain reward income for 2024 Q1 was $151 million, an increase of 104.75% year-on-year and 58.68% compared to the previous quarter. Blockchain reward income benefited mainly from the significant increase in the value of crypto assets, especially the approximately 60% increase in the price of Ethereum from December 31 last year to March 31 this year.

Custody fee income

The custody fee income for 2024 Q1 was $32 million, an increase of 63.96% compared to the previous quarter and 90.00% year-on-year. Custody fee income benefited from the increase in the price of crypto assets and the increase in custody business of Bitcoin spot ETFs. Of the 11 Bitcoin spot ETFs approved by the SEC in January 2024, Coinbase served as the custodian for 8 of them, and the company's custody assets at the end of Q1 2024 were approximately $171 billion.

Interest and financing income

Prime financing income was reclassified from other subscription service income to interest and financing income for 2024 Q1, with interest and financing income of $67 million, an increase of 36.40% compared to the previous quarter and 54.04% year-on-year.

Other subscription service income

Prime financing income was reclassified from other subscription service income to interest and financing income for 2024 Q1, with interest and financing income of $67 million, an increase of 36.40% compared to the previous quarter and 54.04% year-on-year.

New growth poles support continued expansion of performance

In the foreseeable future, the passage of the stablecoin bill will bring in stablecoin income for Coinbase.

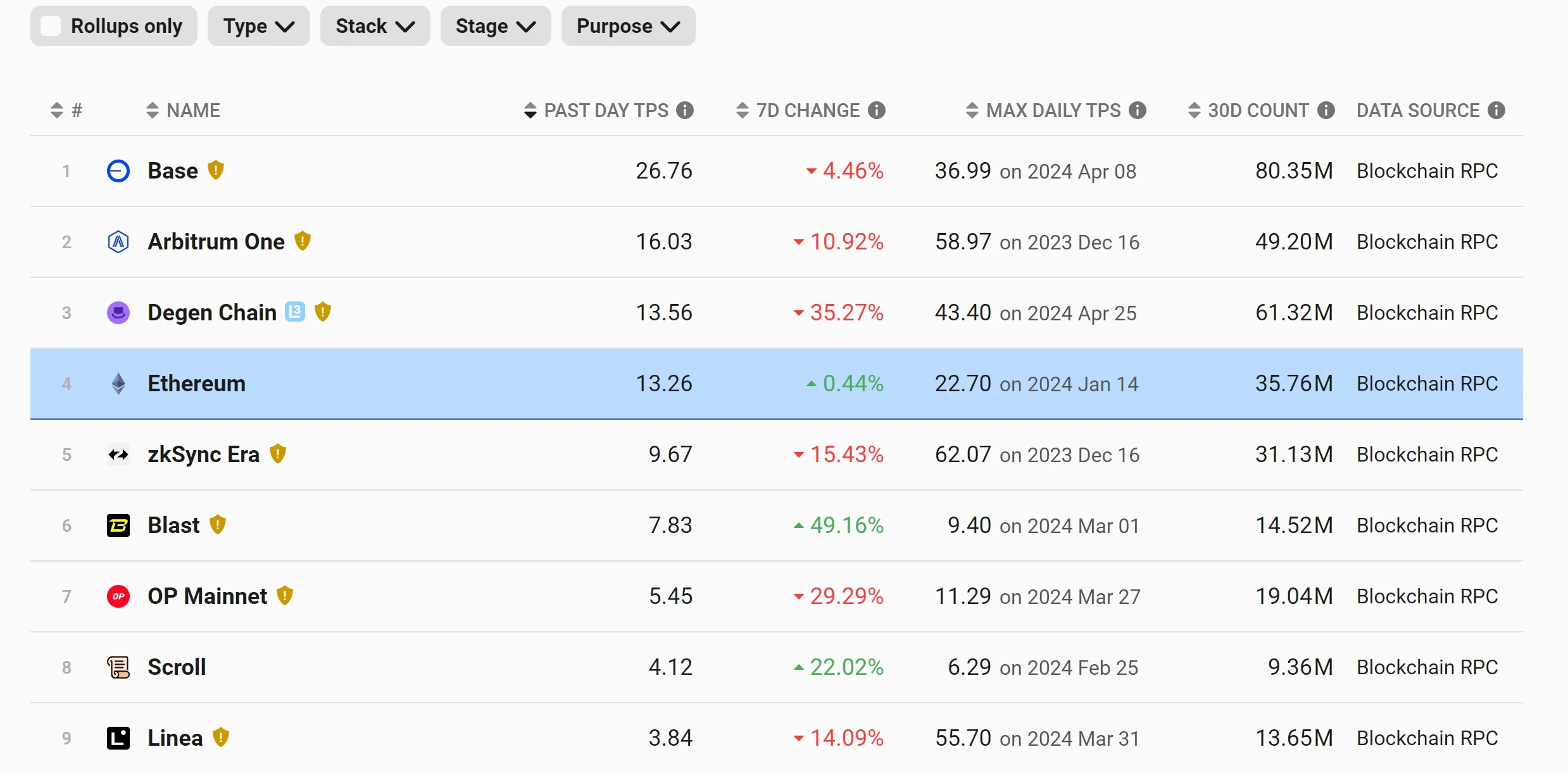

Furthermore, Base Chain, as Coinbase's L2 beat, performed well in the past quarter, as the trading of a large number of meme tokens was active on Base, far exceeding other L2 chains in the past few months.

Comparison of second-layer network transaction overview

In addition, according to Wall Street analysts' estimates, the revenue from Coinbase's new business derivatives will reach hundreds of millions of dollars in the next two years. In the long run, Coinbase's expansion of its main platform into the derivatives field has increased its upward potential.

Finally, the continuous growth of Coinbase's international platform and the acquisition of regulatory licenses for crypto assets in more countries will also drive the continuous expansion of its business scale.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。