Weekly Capital Situation 5/6

In terms of funds this week, stablecoins increased by $400 million, but there was a net outflow of $280 million from mainstream exchanges.

BTC saw a net inflow of 12,000 coins to exchanges, marking the first net inflow in nearly two months, which is worth close attention.

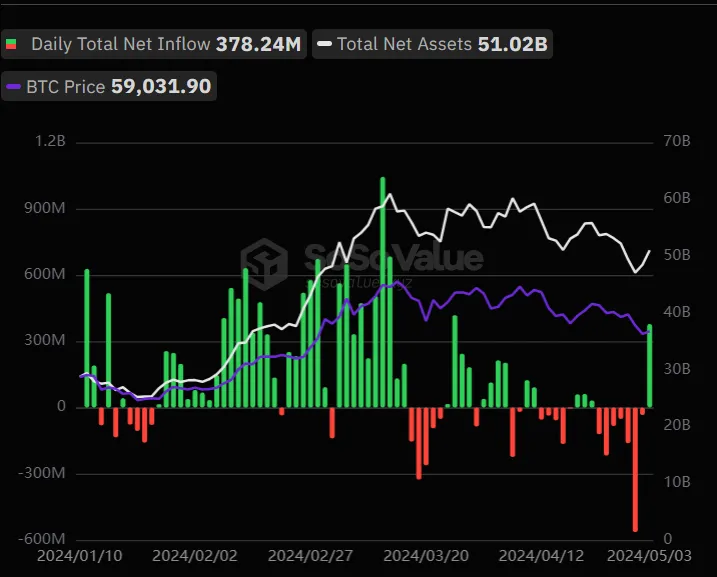

The fund situation for Bitcoin and Ethereum can be described as a tale of two extremes. On May 1st, there was a record net outflow of $560 million, totaling $563 million. However, on May 3rd, there was a net inflow of $378 million.

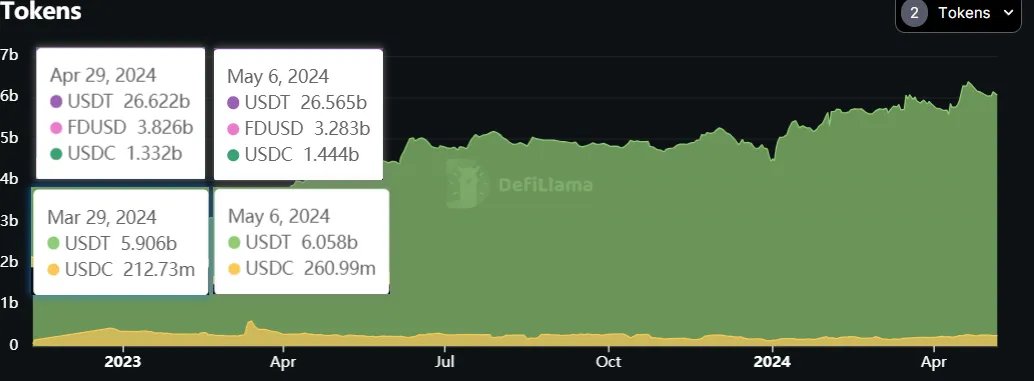

Total Market Value of Stablecoins

Over the past week, the total market value of stablecoins increased from $150.2 billion to $150.6 billion, with the market issuing an additional $400 million. For mainstream stablecoins, USDT increased from $110.5 billion to $110.8 billion, issuing an additional $300 million. As for USDC, it increased from $33.4 billion to $33.5 billion, issuing an additional $100 million.

Stock of Mainstream Exchange Stablecoins

On Binance, USDT decreased from $26.62 billion to $26.56 billion, with a net outflow of $60 million. Fdusd decreased from $3.82 billion to $3.28 billion, with a net outflow of $530 million. USDC increased from $1.3 billion to $1.4 billion, with a net inflow of $100 million.

On OKEx, USDT increased from $5.90 billion to $6.05 billion, with a net inflow of $150 million. USDC saw an inflow of $40 million.

Overall, there was a net outflow of $280 million from Binance and OKEx combined.

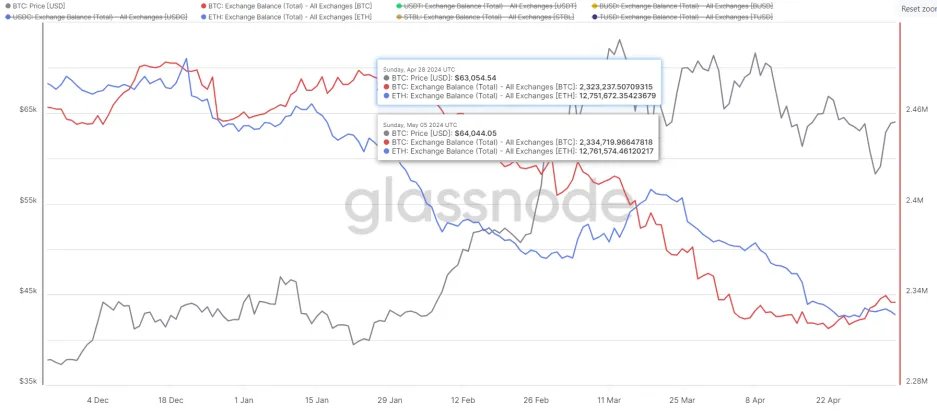

BTC/ETH Stock on Exchanges

Over the past week, the stock of BTC on exchanges increased from 2.323 million to 2.334 million, with a net inflow of 11,000 coins. ETH increased from 12.75 million to 12.76 million, with a net inflow of 10,000 coins.

ETF Data Situation

Over the past week, the fund situation for ETH can be described as a tale of two extremes. First, on May 1st, there was a record net outflow, totaling $563 million. Then, on May 3rd, there was another record net inflow in the past month, totaling $378 million. It can be seen that there is a significant divergence in ETF funds for the future market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。