The weekend's data still doesn't have much to look forward to. Although the price of #BTC rose to above $64,000 at one point over the weekend, the actual trading volume did not show a significant increase. It mostly continued the positive sentiment from Friday. Whether a real breakthrough in price can be achieved will depend on the trend after the opening of the US stock market on Monday.

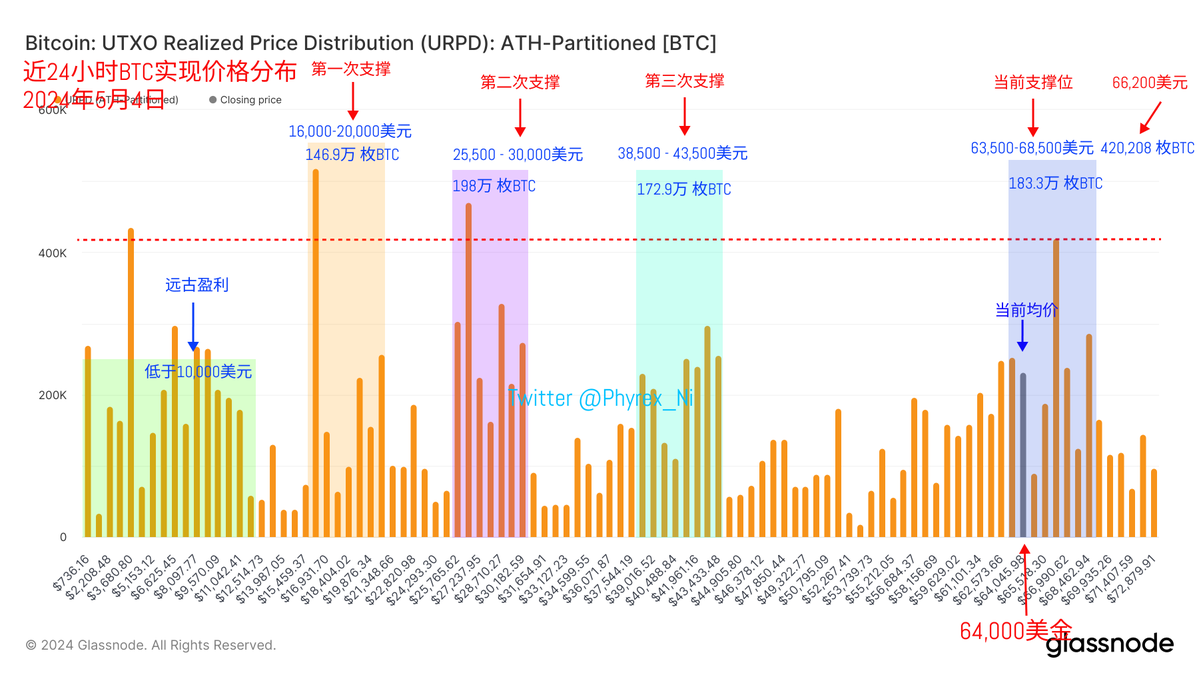

It is widely believed that the further reduction in liquidity in the weekend's data is a consensus. The conclusions drawn from the data remain the same: there is no clear sign of early profit-taking or loss-making investors exiting, and the majority of selling still comes from short-term bargain-hunting investors. The four support levels for BTC accumulation have not shown significant changes.

It's likely that many of you have become numb to hearing these things, and indeed, I have become numb as well. The fact is that early investors are indeed indifferent to the current price. They are not interested in $64,000, and they were not interested even when the price was $56,000. There has been no significant change in the $8,000 difference for early investors.

In the ETF data from Friday, we saw an increase in incremental data in the overall ETF market, including three ETFs in Hong Kong. Funds from the third tier, which had previously sold off a large amount, have now increased their BTC holdings by several hundred units. This, combined with Powell's speech and non-farm payroll data, has indeed provided a significant boost in sentiment. However, it is still unknown how long this sentiment boost can be sustained, and there is no clear change in liquidity. If the market wants to maintain an upward trend, it will need more liquidity stimulation.

Through this round of pullback and rebound, we have basically clarified one piece of information: more investors are not overly concerned about the short-term price changes of #BTC, whether it's betting on the halving cycle, the Fed's interest rate cuts, or the liquidity release of the US election. These are not short-term events. An important reference point is how long the purchasing power of the #Bitcoin spot ETF rebound can be sustained.

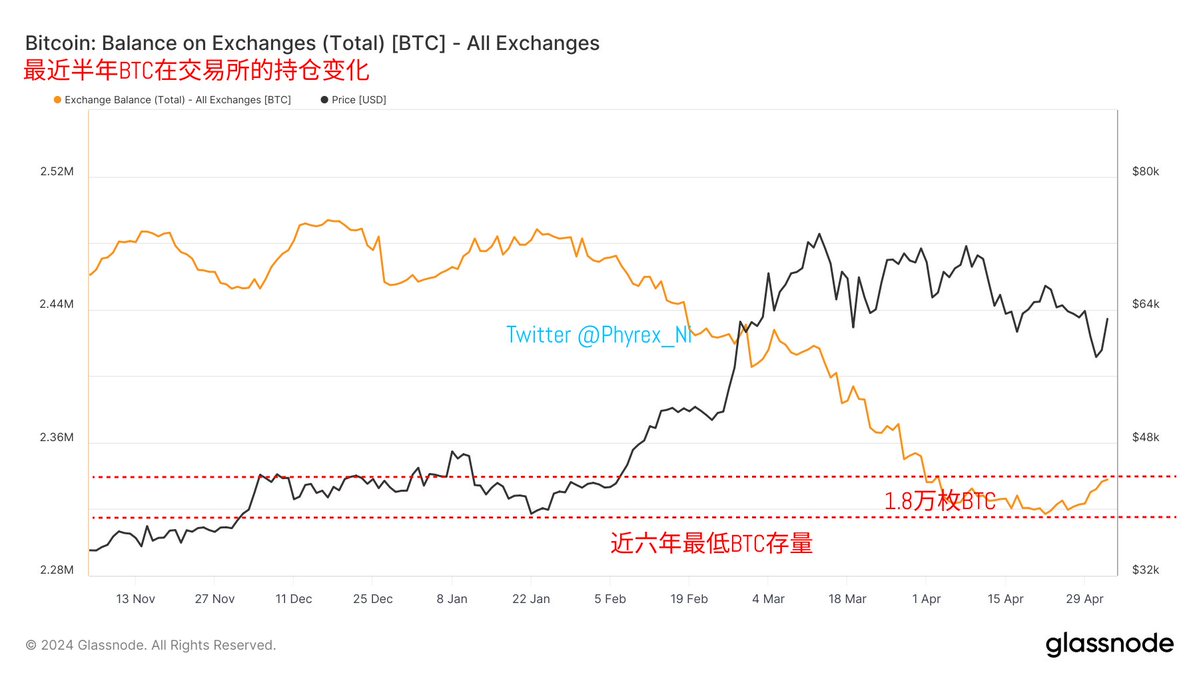

Compared to almost daily opportunities to refresh the lowest inventory of BTC on exchanges in nearly six years two weeks ago, the amount of BTC accumulated on exchanges in the past two weeks has been increasing. Today, the amount of BTC accumulated on exchanges has exceeded 18,000 BTC, which is the lowest inventory in nearly six years. In other words, these 18,000 BTC are all part of the accumulation on exchanges in the past two months that may not have been digested yet.

Whether this part of the inventory will be quickly consumed in the coming time or continue to accumulate more will become a sword of Damocles hanging over the market, depending on the purchasing power in the future.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。