Introduction: Restaking and Layer2 are important narratives in the current cycle of the Ethereum ecosystem. Both aim to solve existing problems in Ethereum, but their specific paths differ. Compared to the underlying technical means such as ZK and fraud proof, which are extremely complex, Restaking is more about empowering downstream projects economically. It may seem like just staking assets and getting rewards, but its principles are far from simple.

It can be said that Restaking is like a double-edged sword. While empowering the Ethereum ecosystem, it also brings huge risks. People's attitudes towards Restaking are diverse. Some say it has brought innovation and liquidity to Ethereum, while others say it is too utilitarian and is accelerating the collapse of the crypto market.

Undoubtedly, to determine whether Restaking is a panacea or a poison, it is necessary to understand what it is doing, why it is being done, and how it is being done. This is essential for assessing the value of its token and has important reference significance.

When it comes to Restaking, Eigenlayer is an inevitable example. Understanding what Eigenlayer is doing means understanding what Restaking is doing. This article will take Eigenlayer as an example to introduce the business logic and technical implementation of Eigenlayer in the clearest and most understandable language, analyze the impact of Restaking on the technical and economic aspects of the Ethereum ecosystem, and its significance for the entire Web3.

Explanation of Restaking and related terms

POS (Proof of Stake)

Proof of Stake, also known as "POS," is a mechanism for probabilistically allocating the right to record transactions based on the amount of assets staked. Unlike POW, which allocates the right to record transactions based on the participants' computing power, it is generally believed that POW is more decentralized and closer to permissionless than POS. On September 15, 2022, the Paris upgrade officially transitioned Ethereum from POW to POS, completing the merge of the mainnet and the beacon chain. The Shanghai upgrade in April 2023 allowed POS stakers to redeem their assets, confirming the maturity of the Staking model.

LSD (Liquid Staking Derivatives Protocol)

It is well known that the interest rate for Ethereum PoS staking mining is quite attractive, but it is difficult for retail investors to access this part of the income. Apart from the requirements for hardware equipment, there are two reasons:

First, the amount of assets staked by Validators must be 32 ETH or a multiple thereof, making it unattainable for retail investors.

Second, before the Shanghai upgrade in April 2023, the assets staked by users could not be withdrawn, resulting in very low capital utilization efficiency.

To address these two issues, Lido emerged. It adopts a joint staking model, where users deposit their ETH on the Lido platform, which aggregates them as staked assets for running Ethereum Validators, solving the pain point of insufficient funds for retail investors.

Furthermore, users staking their ETH on Lido will receive stETH tokens anchored to ETH at a 1:1 ratio. stETH can be exchanged back to ETH at any time and can also be used as an equivalent token to ETH on mainstream DeFi platforms such as Uniswap and Compound to participate in various financial activities, addressing the low capital utilization efficiency of POS Ethereum.

Since POS involves staking highly liquid assets for mining, products led by Lido are called "Liquid Staking Derivatives" (LSD), which is what we commonly refer to as "LSD." As mentioned earlier, stETH and similar LST tokens are called Liquid Stake Tokens (LST).

It is easy to see that the ETH staked in the POS protocol is the actual native asset, while LST tokens such as stETH are created out of thin air. It is as if stETH has directly printed additional value based on ETH, which can be understood as a "financial leverage" in economics. The role of financial leverage in the entire economic ecosystem is not simply good or bad and needs to be analyzed in specific cycles and environments. It is important to remember that LSD adds the first layer of leverage to the ETH ecosystem.

Restaking

Restaking, as the name suggests, involves staking LST tokens as staked assets to participate in more POS network/public chain staking activities to earn rewards and help enhance the security of more POS networks.

After staking LST assets, a 1:1 staking certificate is obtained for circulation, called Liquid Restaking Token (LRT). For example, staking stETH will yield rstETH, which can also be used to participate in DeFi and other on-chain activities.

In other words, LST tokens created out of thin air in LSD are staked again, creating a new asset out of thin air through Restaking, which is the LRT asset. This adds a second layer of leverage to the ETH ecosystem.

The above is the background of the Restaking track. At this point, there is certainly a question: the more leverage there is, the more unstable the economic system becomes. The first layer of leverage added by LSD can be understood, as it solves the problems of retail investors' inability to participate in POS and the low capital utilization efficiency. However, what is the necessity of the second layer of leverage introduced by Restaking? Why stake LST tokens created out of thin air again?

This involves both technical and economic aspects. In response to this question, the following text will briefly outline the technical structure of Eigenlayer's products, analyze the economic impact of the Restaking track, and finally provide a comprehensive evaluation from both technical and economic perspectives.

(Up to this point, there have been many English abbreviations in this article, among which LSD, LST, and LRT are core concepts that will be mentioned multiple times later. Let's reinforce our memory: the ETH staked in Ethereum POS is the native asset, while stETH staked on Restaking platforms after staking ETH is the LRT)

Eigenlayer's product features

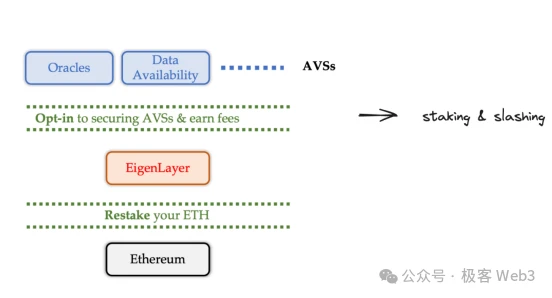

We first need to clarify the core issues that EigenLayer's product features aim to solve: providing economic security from Ethereum for some underlying security-based POS platforms.

Ethereum has high security due to its substantial amount of staked assets. However, for services executed off-chain, such as Rollup sequencers or Rollup verification services, their off-chain execution is not under Ethereum's control and cannot directly benefit from Ethereum's security.

To obtain sufficient security, they need to build their own Actively Validated Services (AVS). AVS is a "middleware" that provides data or verification services for end products such as DeFi, games, and wallets. Typical examples include "oracles" that provide data quoting services and "data availability layers" that can provide users with stable access to the latest data status.

However, building new AVS is quite difficult because:

- The cost of building a new AVS is very high and takes a long time.

- The staking of a new AVS often uses the project's own native tokens, which have much lower consensus than ETH.

- Participating in staking for a new network's AVS will cause stakers to miss out on the stable returns from staking on the Ethereum chain, resulting in opportunity costs.

- The security of a new AVS is much lower than that of the Ethereum network, and the economic cost of attacks is very low.

If there is a platform that allows early-stage projects to directly lease economic security from Ethereum, the above problems can be solved.

Eigenlayer is such a platform. Eigenlayer's whitepaper is titled "The Restaking Collective," with two main characteristics: "Pooled Security" and "free market."

In addition to ETH staking, EigenLayer collects Ethereum's staking certificates to form a security leasing pool, attracting stakers who want to earn additional income to restake. It then provides the economic security provided by these staked funds to some POS network projects, which is the "Pooled Security."

Compared to the unstable and potentially fluctuating APY in traditional DeFi systems, Eigenlayer clearly specifies the staking returns and penalty rules through smart contracts, allowing stakers to freely choose and earn income in a transparent and open market, which is the "free market."

In this process, project teams can lease economic security from Ethereum without having to build their own AVS, while stakers receive stable APY. In other words, Eigenlayer not only enhances ecosystem security but also provides income for ecosystem users.

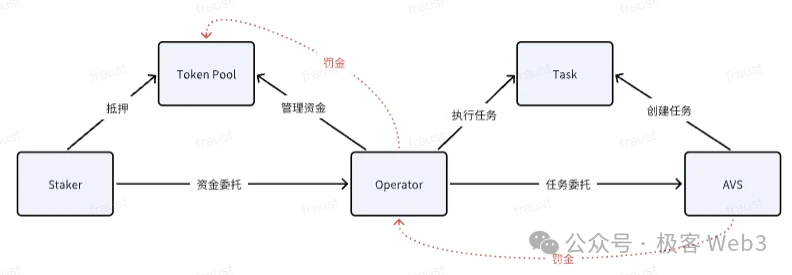

The security provided by Eigenlayer is completed by three roles:

Secure lender - Staker (staker). Stakers stake funds to provide security.

Secure intermediary - Operator (node operator). Responsible for helping stakers manage funds and helping AVS perform tasks.

Secure recipient - AVS of middleware such as oracles.

(Source: Twitter @punk2898)

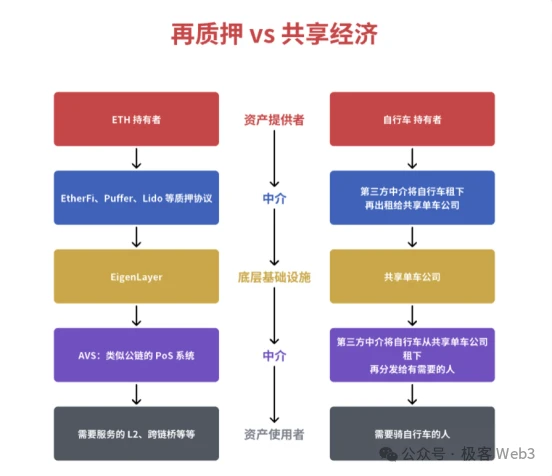

Someone has made an apt analogy for Eigenlayer: comparing it to the upstream and downstream of a bike-sharing system. The bike-sharing company is equivalent to Eigenlayer, providing market services for LSD and LRT assets, similar to how a bike-sharing company manages bicycles. The bicycles are equivalent to LSD assets, as they are both assets that can be leased. Riders are similar to middleware requiring additional verification (AVS), just as riders rent bicycles, AVS rents LSD and other assets to obtain network verification services to ensure their own security.

In the bike-sharing model, deposits and default responsibilities are used to constrain users to pay deposits, preventing malicious damage to the vehicles. Similarly, Eigenlayer prevents malicious behavior by participants in verification through staking and penalty mechanisms.

Smart Contract Perspective of EigenLayer Interaction Process

The core idea of security provided by Eigenlayer involves staking and forfeiture. Staking provides basic security for AVS, while forfeiture increases the cost of malicious behavior for any party.

The interaction process of staking is shown in the following diagram.

In Eigenlayer, the main interaction with stakers is through the TokenPool contract. Stakers can perform two operations through TokenPool:

Staking - Stakers can stake assets in the TokenPool contract and specify a specific Operator to manage the staked funds.

Redemption - Stakers can redeem assets from the TokenPool.

Staker redemption of funds involves three steps:

1) Stakers add the redemption request to the request queue, requiring a call to the queueWithdrawal method.

2) The Strategy Manager checks if the Operator specified by the Staker is in a frozen state.

3) If the Operator is not frozen (detailed description follows), the Staker can initiate the complete withdrawal process.

It is important to note that EigenLayer gives Stakers full freedom. Stakers can liquidate their staked funds back to their own accounts or convert them into staking shares for restaking.

Based on whether Stakers can personally operate node facilities to participate in AVS networks, Stakers can be divided into regular stakers and Operators. Regular stakers provide POS assets for each AVS network, while Operators are responsible for managing the staked assets in the TokenPool and participating in different AVS networks to ensure the security of each AVS. This is somewhat similar to Lido's approach.

The relationship between Stakers and AVS is like a fragmented security supply and demand. Stakers often do not understand the products of AVS project teams, cannot trust them, or do not have the resources to directly operate equipment to participate in AVS networks. Similarly, AVS project teams often cannot directly reach Stakers. Although they have a supply-demand relationship, they lack an intermediary to connect with each other, and this is where the role of the Operator comes in.

On the one hand, Operators help stakers manage funds, and stakers often have a trust assumption towards Operators. EigenLayer's official explanation of this trust is similar to the trust stakers have in the LSD platform or Binance staking. On the other hand, Operators help AVS project teams operate nodes. If an Operator violates the restrictions, malicious behavior will be slashed, making the cost of malicious behavior far exceed the benefits, thereby establishing trust between AVS and Operators. In this way, Operators act as a trust intermediary between stakers and AVS.

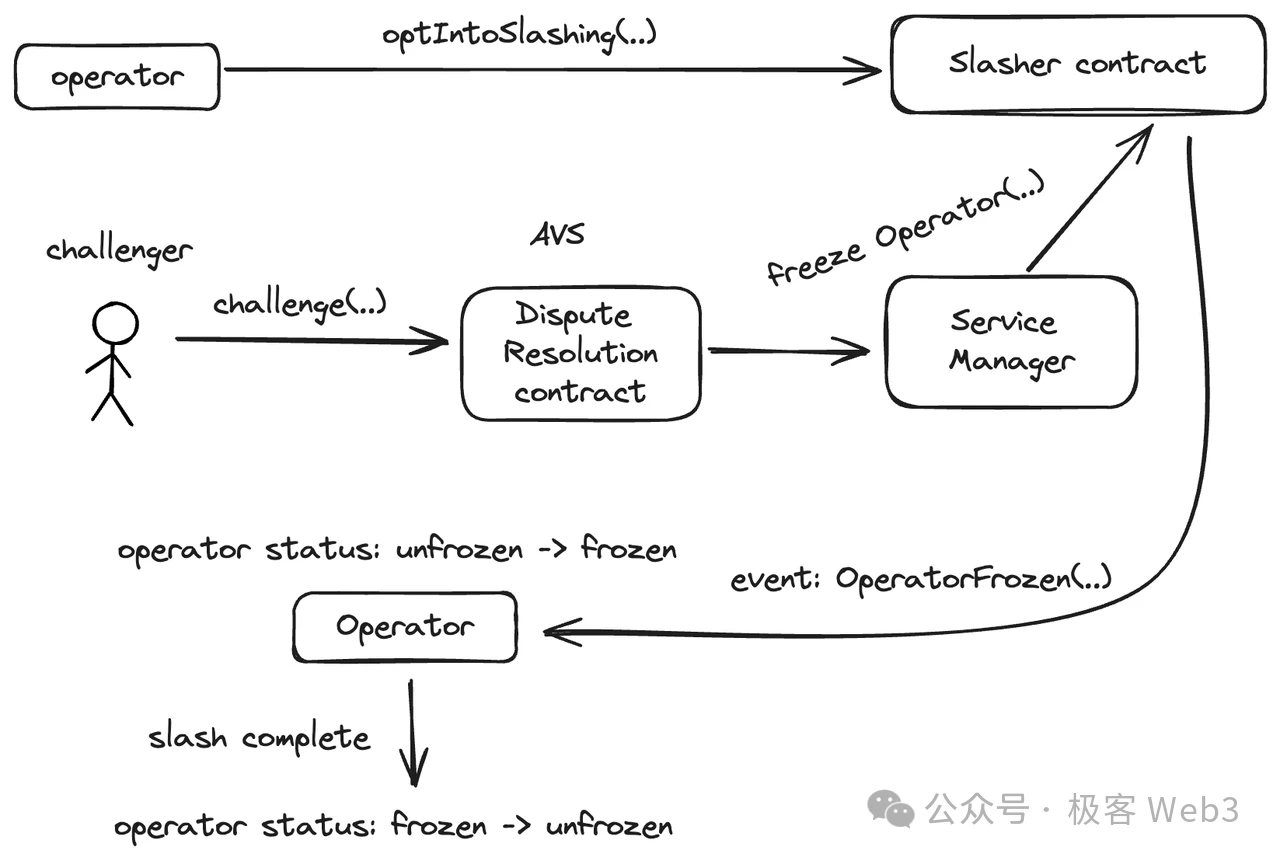

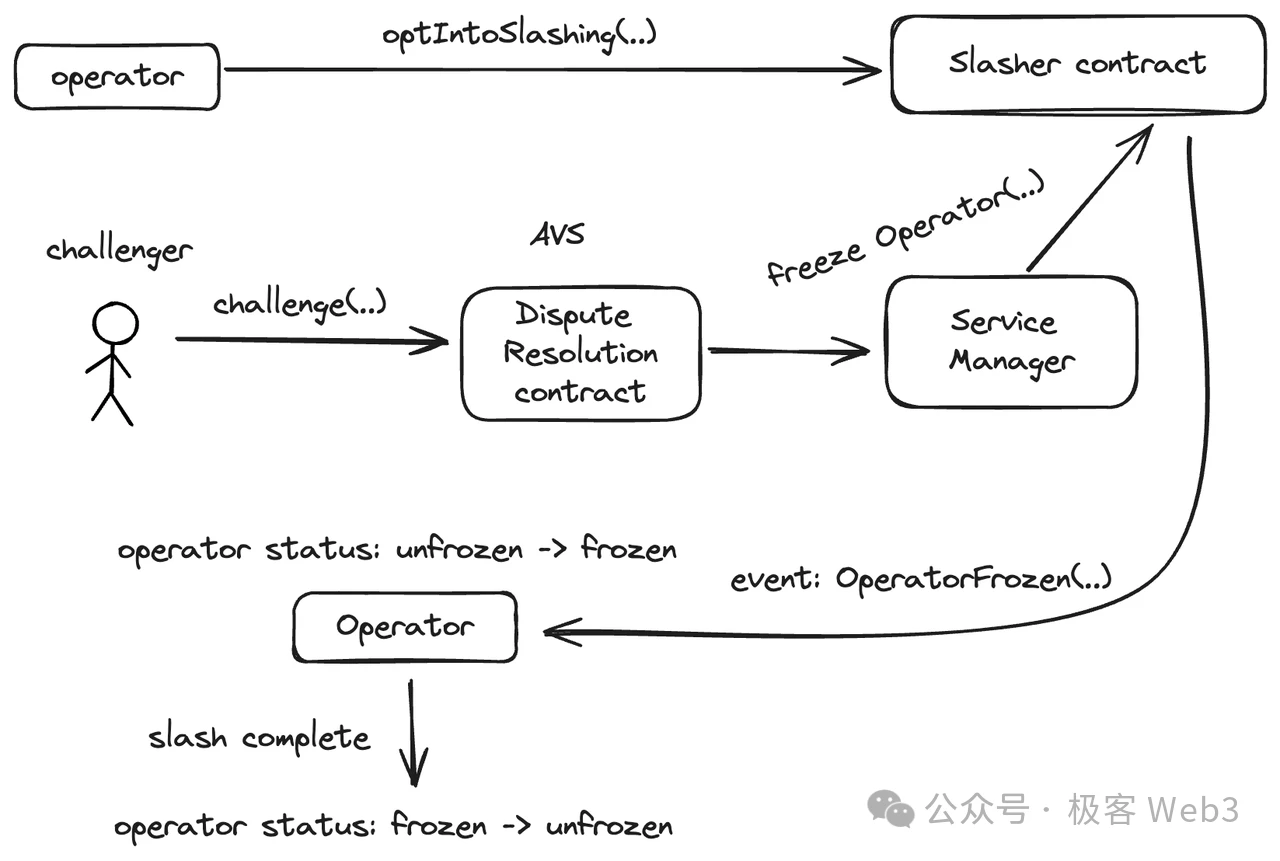

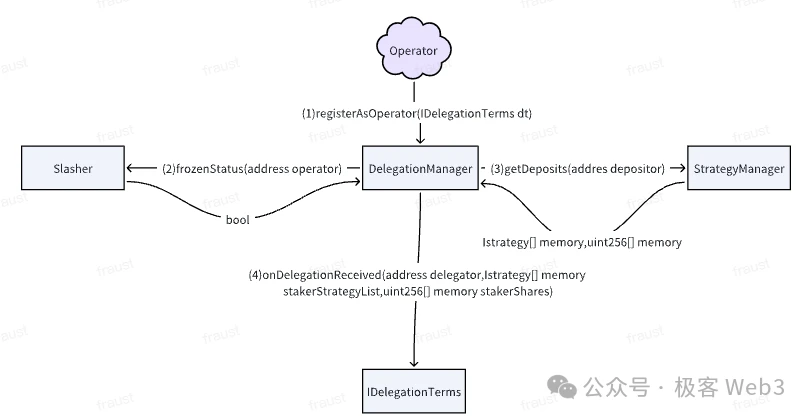

For an Operator to join the Eigenlayer platform, they must first call the optIntoSlashing function of the Slasher contract to allow the Slasher contract to constrain/punish the Operator.

Subsequently, the Operator must register through the Registery contract. The Registery contract will call the relevant functions of the Service Manager to record the Operator's initial registration behavior and then transmit the message back to the Slasher contract. Only then will the Operator's initial registration be completed.

Next, let's look at the contract design related to slashing. In Restaker, Operator, and AVS, only the Operator will be the direct subject of slashing. As mentioned earlier, for an Operator to join the Eigenlayer platform, they must register in the Slasher contract, authorizing the Slasher to carry out slashing operations against the Operator.

Of course, in addition to the Operator, the slashing process also involves several other roles:

AVS: While the Operator accepts the operation commission from AVS, they also have to accept the triggering conditions and standards for slashing proposed by AVS. Two important contract components here are the dispute resolution contract and the Slasher contract. The dispute resolution contract is established to resolve challenges, and the Slasher contract will freeze the Operator and carry out slashing operations after the challenge window ends.

Challenger: Anyone who joins the Eigenlayer platform can become a challenger. If they believe that an Operator's behavior triggers the slashing conditions, they will initiate a fraud proof process similar to OP.

Staker: Slashing the Operator will also cause corresponding losses for the staker.

The process for executing slashing against the Operator is as follows:

1) The challenger calls the challenge function in the Dispute Resolution contract established by AVS to initiate a challenge.

2) If the challenge is successful, the Dispute Resolution contract will call the freezeOperator function of the Service Manager, causing the Slasher contract to trigger the OperatorFrozen event, changing the specified Operator's status from unfrozen to frozen, and then entering the slashing process. If the challenge fails, the challenger will receive a certain penalty, to prevent malicious challenges against the Operator.

3) After the slashing process is completed, the Operator's status will be reset to unfrozen and continue to operate.

During the execution of the slashing operation, the Operator's status is always in a frozen "inactive" state. In this state, the Operator cannot manage the staked funds of the staker, and stakers who have staked funds with this Operator cannot withdraw them. This is similar to being under suspicion and unable to escape punishment. Only when the current penalty or conflict is resolved and the Operator is not frozen by the Slasher, can they engage in new interactions.

Eigenlayer's contracts adhere to the above freezing principle. When a staker stakes funds with an operator, the isFrozen() function is used to check the Operator's status. When a staker initiates a request to redeem their staked funds, the isFrozen function of the Slasher contract is still used to check the Operator's status. This is Eigenlayer's comprehensive protection of AVS security and staker interests.

Finally, it should be noted that within Eigenlayer, AVS does not unconditionally obtain security from Ethereum. Although the process for project teams to obtain security on Eigenlayer is much simpler than building their own AVS, attracting Operators on Eigenlayer to provide services and attracting more stakers to provide assets for their POS systems is still a challenge, which may require effort in terms of APY.

Economic Impact of Restaking on the Crypto Market

Undoubtedly, Restaking is currently one of the hottest narratives in the Ethereum ecosystem, and Ethereum holds a dominant position in Web3. Coupled with the fact that various Restaking projects have gathered a high TVL, its impact on the crypto market is crucial and may continue throughout the entire cycle. We can analyze it from both micro and macro perspectives.

Micro Impact

We must recognize that the impact of Restaking on various roles in the Ethereum ecosystem is not singular and brings both income and risks. The income can be divided into several points:

Restaking indeed enhances the underlying security of downstream projects in the Ethereum ecosystem, which is beneficial for their long-term development.

Restaking frees up the liquidity of ETH and LST, making the economic circulation in the ETH ecosystem smoother and more prosperous.

The high yield of Restaking attracts staking of ETH and LST, reducing the active circulation and benefiting token prices.

The high yield of Restaking also attracts more funds into the Ethereum ecosystem.

At the same time, Restaking also brings significant risks:

In Restaking, an IOU (financial claim) is used as collateral in multiple projects. If there is no proper coordination mechanism between these projects, it may lead to the over-amplification of the value of the IOU, resulting in credit risk. If multiple projects simultaneously demand redemption of the same IOU, it will be impossible to meet the redemption requirements of all projects. In such a situation, if one project encounters problems, it may trigger a chain reaction, affecting the economic security of other projects.

A considerable amount of LST liquidity is locked in Restaking. If the price of LST fluctuates more than ETH, and stakers are unable to withdraw LST in a timely manner, they may suffer economic losses. Additionally, the security of AVS also depends on TVL, and high price volatility of LST poses a risk to the security of AVS.

(3) The staked funds of Restaking projects are ultimately stored in smart contracts, and the amount is very large, leading to excessive concentration of funds. If the contract is attacked, it will result in huge losses.

Microeconomic risks can be mitigated through adjusting parameters, flexible rules, and other means, but due to space limitations, a detailed discussion will not be provided here.

Macro Impact

First and foremost, it is important to emphasize that the essence of Restaking is a form of multiple leverage. The influence of Restaking on the crypto space must be understood in relation to the relationship between leverage and market cycles. Restaking adds two layers of leverage to the ETH ecosystem, as mentioned earlier:

First layer: LSD effectively doubles the value of staked ETH assets and their derivatives.

Second layer: Restaking involves staking not only ETH, but also LST and LP Tokens, which are tokenized assets, not actual ETH. Therefore, the LRT generated by Restaking is an asset built on top of leverage, equivalent to a second layer of leverage.

So, is leverage beneficial or harmful to an economic system? In conclusion, the discussion of leverage must be placed within the context of market cycles. In an upward phase, leverage accelerates development, while in a downward phase, leverage accelerates collapse.

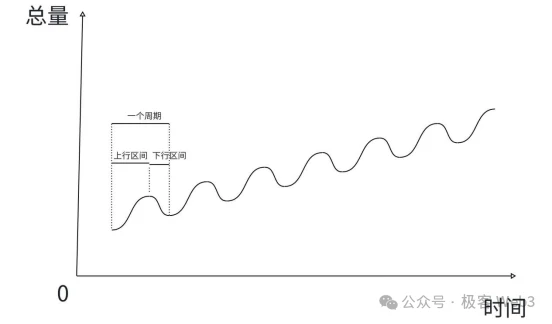

The development of the social economy follows the pattern shown in the above figure, where a prolonged rise is followed by a decline, and a prolonged decline is followed by a rise, constituting a cycle. The total economic volume spirals upward in this cyclical pattern, with each cycle's bottom higher than the previous one, and the overall volume increasing. The current crypto market cycle is very apparent, currently in the period following the Bitcoin halving, which is typically a bull market for 2-3 years, followed by a bear market for 1-2 years.

However, while the Bitcoin halving cycle roughly aligns with the bull and bear market cycles in the crypto economy, the former is not the fundamental cause of the latter. The true cause of the bull and bear market cycles in the crypto economy is the accumulation and collapse of leverage in the market. The Bitcoin halving is simply a catalyst for capital inflows and the emergence of leverage in the crypto market.

How does the process of leverage accumulation and collapse lead to the succession of market cycles in the crypto economy? If everyone knows that leverage will eventually collapse, why do they still use leverage during an upward phase? In fact, the underlying laws of the crypto market are similar to those of the traditional economy. Let's first look for patterns in the development of the real economy. In the development of modern economic systems, leverage is inevitable and must occur.

The fundamental reason is that during an upward phase, the rapid development of social productivity leads to an excessive accumulation of material wealth. To ensure the circulation of the surplus products in the economic system, there needs to be a sufficient amount of currency. While currency can be increased, it cannot be increased arbitrarily and infinitely, otherwise the economic order will collapse. However, if the amount of currency cannot meet the circulation needs of the surplus products, it can easily lead to stagnation in economic growth. What can be done in such a situation?

Since currency cannot be increased infinitely, the utilization rate of unit funds in the economic system must be increased. The role of leverage is to increase the utilization rate of unit funds. Here's an example: Suppose $1 million can buy a house, and $100,000 can buy a car. The house can be used as collateral for a loan, with a collateral ratio of 60%, meaning the house can be used to borrow $600,000. If you have $1 million and no leverage is allowed, you can only choose to buy one house or ten cars.

With leverage, allowing borrowing, you can buy one house and six cars, effectively spending $1 million as if it were $1.6 million. From the perspective of the entire economic system, without leverage, the circulation of currency is limited, and everyone's purchasing power is restricted, market demand cannot grow rapidly, and naturally, there will not be high profits on the supply side, leading to slower or even regressive development of productivity.

However, with leverage, the issue of currency volume and purchasing power is quickly resolved. Therefore, during an upward phase, leverage accelerates the development of the entire economy. Some may argue that this is a bubble. However, during an upward phase, a large amount of off-market funds and commodities enter the market, and at this time, there is no risk of the bubble bursting. This is similar to using contracts for long positions, where in a bull market, there is often no risk of liquidation as the coin price rises.

What about during a downward phase? The funds within the economic system are continuously absorbed by leverage, and ultimately, there will be a day of depletion, leading to a downward phase. During a downward phase, prices will fall, and the collateralized house will no longer be worth $1 million, leading to its liquidation. From the perspective of the entire economic system, everyone's assets face liquidation, and the sudden shrinkage of the circulation of funds that were originally supported by leverage will lead to a rapid decline in the economic system. Using contracts as an example, in a bear market, if there are no contracts and only spot trading, the assets will only shrink; but with contracts, there is not only asset shrinkage, but direct reduction to zero. Therefore, during a downward phase, having leverage will lead to a faster collapse than without leverage.

From a macro perspective, the appearance of leverage is inevitable, and leverage is not entirely good or entirely bad; it depends on which phase it is in. Returning to the macro impact of Restaking, the leverage within the ETH ecosystem plays a very important role in driving the bull and bear market cycles, and its appearance is inevitable. In each cycle, leverage will inevitably appear in the market in some form. The so-called DeFi Summer in the previous cycle was essentially the dual pool mining of LP Tokens, which greatly fueled the bull market in 2021. This round's bull market catalyst may have turned into Restaking, although the mechanisms appear different, the economic essence is the same, both are for the purpose of digesting the influx of capital in the market and meeting the demand for currency circulation through leverage.

Based on the discussion of the interaction between leverage and market cycles, this multi-layer leverage of Restaking may accelerate the upward phase of this cycle, leading to a faster rise and a higher peak, while also potentially causing a more severe downward phase and a wider chain reaction, resulting in a greater impact.

In conclusion

Restaking is a derivative of the PoS mechanism. Technically, Eigenlayer uses the value of restaking to maintain the economic security of AVS, using the mechanism of staking and slashing to achieve "borrowing and repaying, and not difficult to borrow again." The redemption window for staked funds not only provides enough time to check the reliability of Operator behavior, but also avoids the collapse of the market and system due to a large amount of funds being withdrawn in a short period.

In terms of its impact on the market, it is necessary to analyze it from both micro and macro perspectives. From a micro perspective, Restaking provides liquidity and returns to the Ethereum ecosystem, but also brings some risks, which can be mitigated through adjusting parameters, flexible rules, and other means. From a macro perspective, Restaking is essentially a form of multiple leverage, exacerbating the economic evolution of the overall cryptocurrency market cycle, creating a significant bubble, making the upward and downward phases of the cryptocurrency market more rapid and intense, and likely serving as a key factor in the collapse of this cycle's leverage and the transition to a bear market. This macroeconomic impact is in line with the underlying economic laws and cannot be changed, only adapted to.

It is important to understand the impact of Restaking on the entire crypto space, and to utilize its dividends during the upward phase, while preparing for the collapse of leverage and the market's decline during the downward phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。