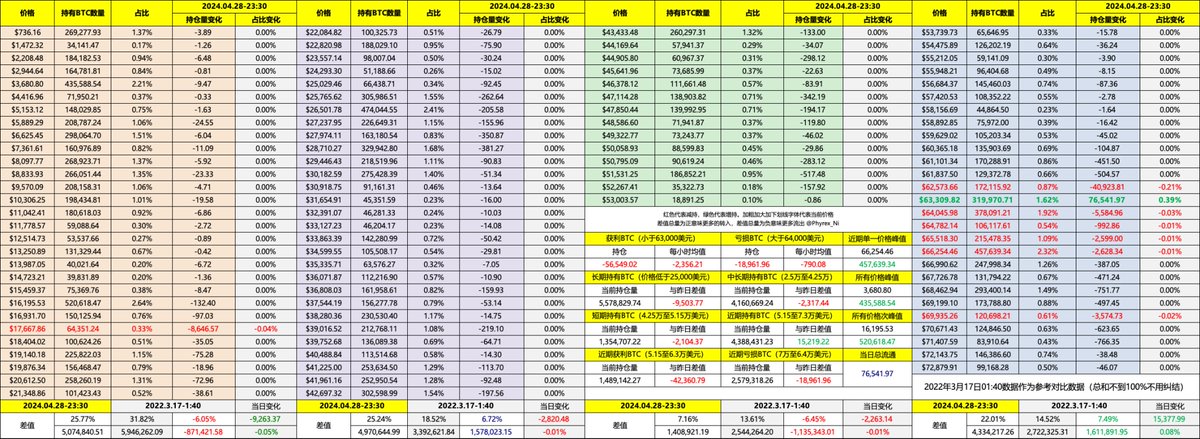

On Sunday, the liquidity is lower than on Saturday, and there should be no doubt about it. The actual results also confirm this. #BTC's on-chain liquidity continues to converge in the bear market based on the weekend data. Many people may think of price decline when they see the word "bear market," but in fact, the decline in price is just one aspect. Insufficient liquidity and decreased purchasing power and holding willingness of users are also reasons for the price drop.

Currently, purchasing power has indeed decreased, but holding willingness is still much stronger compared to the bear market. The main reason may still be the expectation for the halving cycle. Since the launch of spot ETFs, it has been almost 110 days. During these 110 days, the total BTC holdings of ten ETFs have increased by 214,381 BTC compared to the first day, reaching 836,732 BTC.

Moreover, this portion of BTC has not been released into the market yet. If we calculate the turnover, Grayscale's GBTC held nearly 620,000 BTC on the first day, and this number decreased to 300,000 BTC by Thursday. During these 110 days, nearly 320,000 BTC from GBTC have entered the holdings of institutions such as BlackRock and Fidelity. This portion of BTC is also temporarily "locked up."

Why do we say it's temporarily locked up? Because we don't know when these chips will be released into the market, and we also don't know how much of this #BTC is held by retail investors and how much is held by institutions. However, we do know that when nearly 530,000 BTC are not intended to be released, the market's liquidity has decreased by 530,000 BTC in 110 days.

I don't know if you guys can understand the meaning of this. This portion of BTC can be seen as a barometer of the market. Currently, the active circulation of BTC in the overall market is only about 3.4 million BTC, and some of it is held by exchanges and miners. In reality, the amount of BTC available for turnover is even less. We can also see that the overall BTC holdings of exchanges are decreasing, which also indicates that investors buying BTC are not eager to exit.

So, looking back at the current liquidity data, although liquidity is converging towards a bear market, there is indeed a significant decrease in purchasing power, but the willingness to sell is not obvious. From the data of ETFs on each working day, we can see that only GBTC is selling large amounts every day. But currently, BlackRock's holdings are almost the same as Grayscale's, not to mention Fidelity. If these two start to sell like GBTC, whether the current price can stay above $50,000 is another matter.

Personally, I strongly advise against speculating on the long or short positions now. I've been saying this for a long time because the current fundamental information is very chaotic. It's either a war or the Fed causing trouble, or it's the earnings season and low liquidity. The possibility of driving the price up and down in an unorderly manner is very high. If you are not a professional investor, it's better to be honest at this time. There are many opportunities to make money, and there's no need to feel uncomfortable if you don't trade for a day.

MSTR will announce its financial report at 2 am Beijing time. At this time, MSTR will probably announce how many BTC it bought in the first quarter of 2024 and the approximate unrealized gains, which will stimulate the market's nerves. Last time, it directly drove the #BTC price up. We'll have to wait and see this time.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。