Original Author |CoinShares

Compiled by | Golem

This article was written by CoinShares researcher Matthew Kimmell before the Bitcoin halving, with the core point being that Bitcoin transaction fees can offset the impact of the halving on miners. The first half of the article predicts that when Runes is launched, miner transaction fees will reach at least 150 BTC per day (actually 1070 BTC on the first day of launch, and has not been lower than 150 BTC per day so far); the second half mainly explains three other trading demands that can increase miners' income besides Runes.

As the first half of the original article mainly focuses on post-halving predictions and has become outdated, it will not be compiled in this article. This article mainly extracts the latter half of the original article, where Matthew Kimmell believes that besides Runes, there are three other Bitcoin trading demands that can increase miners' income for readers' reference.

On-chain collectibles and rare Sats

The release of the Ordinals protocol reveals a tracking system for the smallest unit of Bitcoin, Satoshis (equivalent to 0.00000001 or 10^-8 BTC), which users voluntarily agree to. According to the Ordinals protocol, each Satoshi is assigned an ordinal number. By adopting this standard, from the first mined Satoshi to the last released Satoshi, they will all be marked and identified along a sequential number. In other words, when Bitcoin's smallest unit is viewed in this way, each Satoshi becomes an independent and non-fungible unit.

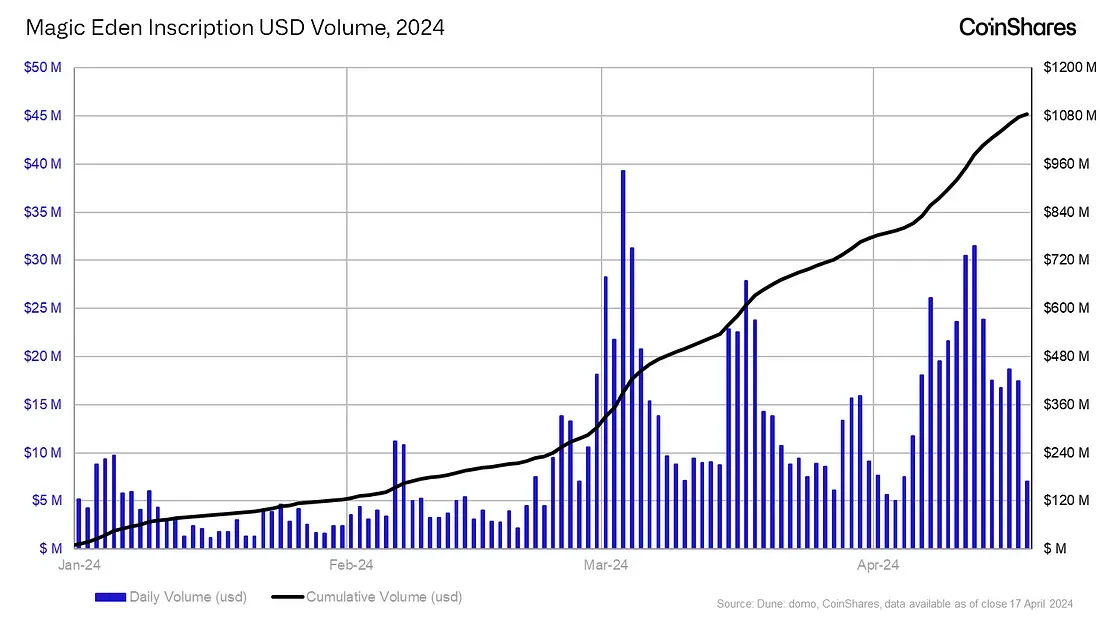

Users can also choose to attach arbitrary data files to the Satoshis they own to add additional uniqueness. These files are called inscriptions, and users can mix inscriptions with the Satoshis they own while retaining the ability to transmit and store such modified Satoshis on the Bitcoin network, just like regular Bitcoins.

As a result, many Satoshis are now marked with images, text, or even complete video game files, making them uniquely distinguishable from each other and providing investors with different reasons to evaluate the value of these Satoshis.

Due to the unique numerical significance of the ordinal itself or the related inscriptions, the collectible value of certain Satoshis has been proven in the market.

The first example is a Satoshi inscribed with an image called "Genesis Cat," which was auctioned for $240,000. It is hailed as a unique 1/1 artwork with cultural and political significance, and it is also part of the Quantum Cat series, which aims to symbolize and support the restoration of previously deleted features in the Bitcoin protocol. Another example is a Satoshi sold for $165,100 even without inscriptions, as it was promoted as a rare Satoshi with a scarce supply, traceable back to the first difficulty adjustment period of Bitcoin.

These high-priced sales events provide motivation for those seeking valuable Satoshis on-chain. The purpose of selling Satoshis at prices far higher than the ordinary market on the secondary market is changing some users' tendency to pay transaction fees. It can be certain that in order to collect a Satoshi with special significance and sell it on the market for profits reaching hundreds of thousands of dollars, it will lead to competitors offering much higher fees than regular transactions.

Given that the halving is a completely predictable and scarce event in Bitcoin's history, competition is inevitable in collecting rare Satoshis and inscribing the first block's runes. It is expected that the Satoshis mined for the first time after the halving will be very valuable, to the extent that Foundry USA mining pool even plans to share its earnings with miners to win the right to mine a block. This may be temporary, but this intense competition will certainly lead to a surge in fees.

Private trading demands

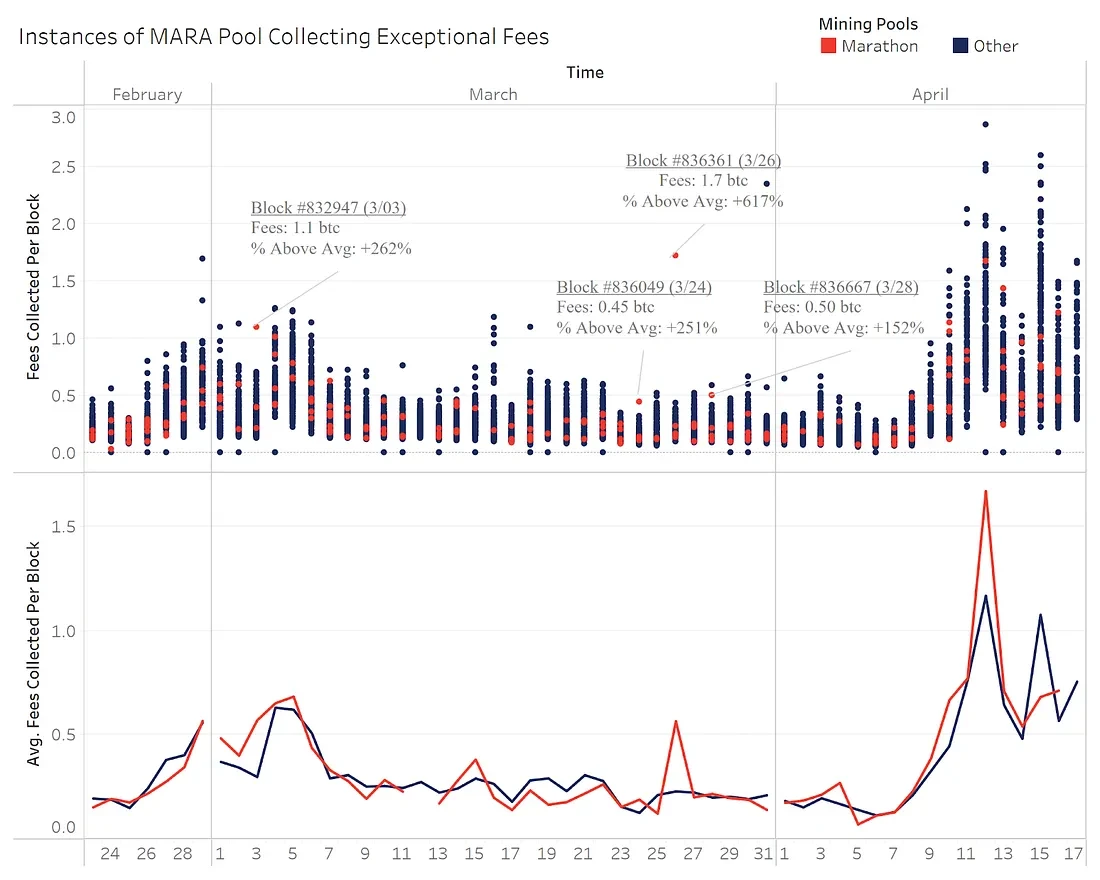

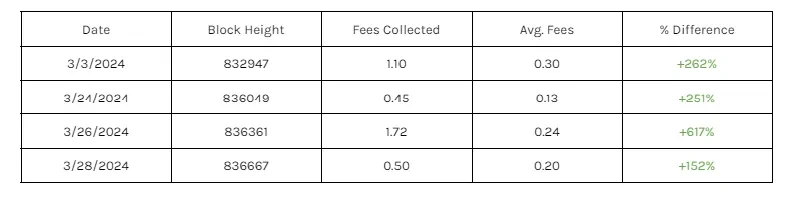

Another atypical demand may be for transaction accelerators. Marathon launched a product called Slipstream in late February, which provides users with a way to bypass the Bitcoin mempool (the area where transactions wait to be included in a block) and communicate directly with the MARA mining pool to pay for transactions. Although this product does not offer significant advantages in earning fees compared to other mining pools, there are still several successful examples.

Although not widespread, accelerators like Slipstream have the potential to indirectly increase fees in cases of sufficient demand. If transactions are submitted directly to the mining pool, the transaction will not be known to any other Bitcoin users in advance. Therefore, other users may find that their transactions within the block fee range actually need to continue waiting, because low-fee transactions submitted directly to the mining pool are covertly included in the block, but this does not reflect the true fee situation. This can confuse consumers, not knowing how much fee to add to expedite the transaction. With more and more transactions flowing to these accelerators, multiple fee markets will emerge, some of which are publicly part of the Bitcoin protocol, while others are private.

In situations where transactions need to be confirmed quickly, the confusion of this private fee market compared to the actual fee expectations of the public market may lead to overpayment by users. However, it is worth noting that we have not seen this situation occur on a large scale at present.

Miner Extractable Value (MEV)

MEV is another emerging dimension of Bitcoin block space demand. MEV refers to the opportunity for miners (or mining pools) to earn additional profits by manipulating the order of transactions within a block. Previously, due to Bitcoin's strict functional limitations and simple transaction models, MEV was a potential feature of Bitcoin and was limited. However, as Bitcoin software and the nature of Bitcoin transactions have changed, MEV has become more apparent. Here are three possible sources of MEV income:

On-chain collectibles: Because certain inscriptions and Satoshis have high value, and the market technology is still relatively inefficient, it becomes possible to purchase, snipe, and resell mispriced assets, or even for miners to sacrifice fee income to seize higher-value Satoshis.

Tokenized assets: Runes, BRC-20, RBG, Taproot assets, and other potential tokenized assets open the door for miners to engage in front-running and arbitrage trading to earn additional rewards.

Bitcoin plugins: As more external platforms or Bitcoin L2 use Bitcoin as settlement, miners may be able to exploit early design flaws and additional incentive measures (such as merged mining) to earn higher income.

The halving means further reduction in block rewards and relatively increased transaction fees are important for miners. This may provide additional motivation for miners to seek transaction-related interests and find diversified sources of income. Therefore, we believe that MEV will be at least attempted.

Conclusion

The diversification of Bitcoin trading demands may become a lifeline for the mining economy. With the reduction of block rewards due to the halving, these new uses of Bitcoin block space may significantly increase transaction fees. This is crucial for miners, as these fees can offset the loss of block rewards and maintain their profitability.

As mentioned earlier, recent transaction fees will be significantly increased by the competition in new market areas, including issuing assets and finding unique collectibles. These applications not only bring additional transaction fees but may also encourage the emergence of more strategic transaction processing methods.

Ultimately, the transition of miners to a more complex and transaction fee-dependent economic model highlights the importance of understanding and leveraging new Bitcoin transactions to remain competitive.

Looking ahead, I expect that in certain blocks, transaction fees will far exceed mining income by 50%. In the two months at the end of 2023, this period was mainly influenced by the inscription market, with average transaction fees accounting for 30% of post-halving mining income (193 BTC per day). If this average is maintained, it will offset 43% of the impact of the halving on miners' income.

However, the sustainability of these transactions driven by demands other than Bitcoin itself remains a mystery—is it leading to long-term changes in the Bitcoin transaction market, or is it just a short-term symptom of a bull market?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。