Original | Odaily Planet Daily

Author | Asher

EOS was once considered one of the most promising blockchains in the Layer 1 sector. At the time of its launch, EOS was among the top five cryptocurrencies by market value. On the morning of April 25th, Yves La Rose, CEO of the EOS Network Foundation (ENF), proposed a new token economics on the X platform and stated that he would discuss this topic with BPs later today.

Upon this news, according to OKX market data, EOS briefly broke through $0.95, with an hourly increase of over 12%, and is currently falling back to around $0.88. Next, Odaily Planet Daily will provide a detailed interpretation of the new token economic model proposed by EOS.

Comprehensive Analysis of EOS Token Economic Model

Review of the Iterative History of EOS Token Economic Model

2018: EOS tokens were launched with a supply of 1 billion, and its annualized inflation rate was 5%. Of this, 1% of the inflation was specifically used to reward block producers, while 4% accumulated in the "eosio.saving" account;

2020: Due to the absence of a framework to access and spend the assets accumulated in "eosio.saving," EOS block producers voted to reduce the network inflation rate to 1% and destroyed the remaining EOS tokens accumulated in "eosio.saving";

2021: EOS block producers chose to increase the network inflation rate to 3% to guide the EOS Network Foundation. 1% of the inflation continued to pay funds to block producers, while the additional 2% began to provide funds to the EOS Network Foundation;

2023: The EOS Network Foundation (ENF) began manually funding EOS Labs, establishing it as a new entity responsible for ecosystem investment and growth. ENF began allocating 0.5% of the network inflation funds through manual transfers to EOS Labs;

Early 2024: EOS block producers passed an MSIG to update the system contract, which would automatically pay 0.5% of the inflation fee to EOS Labs and reduce ENF's fee to 1.5%. The passage of this proposal marked the network's recognition of EOS Labs as an officially recognized foundational entity;

Current proposal: The EOS Network Foundation proposes to transform EOS from an inflationary token to a token with a total supply of 21 billion.

New Proposal: Restricting Inflation with a 21 Billion Token Supply, Burning 80% of Future Total Supply

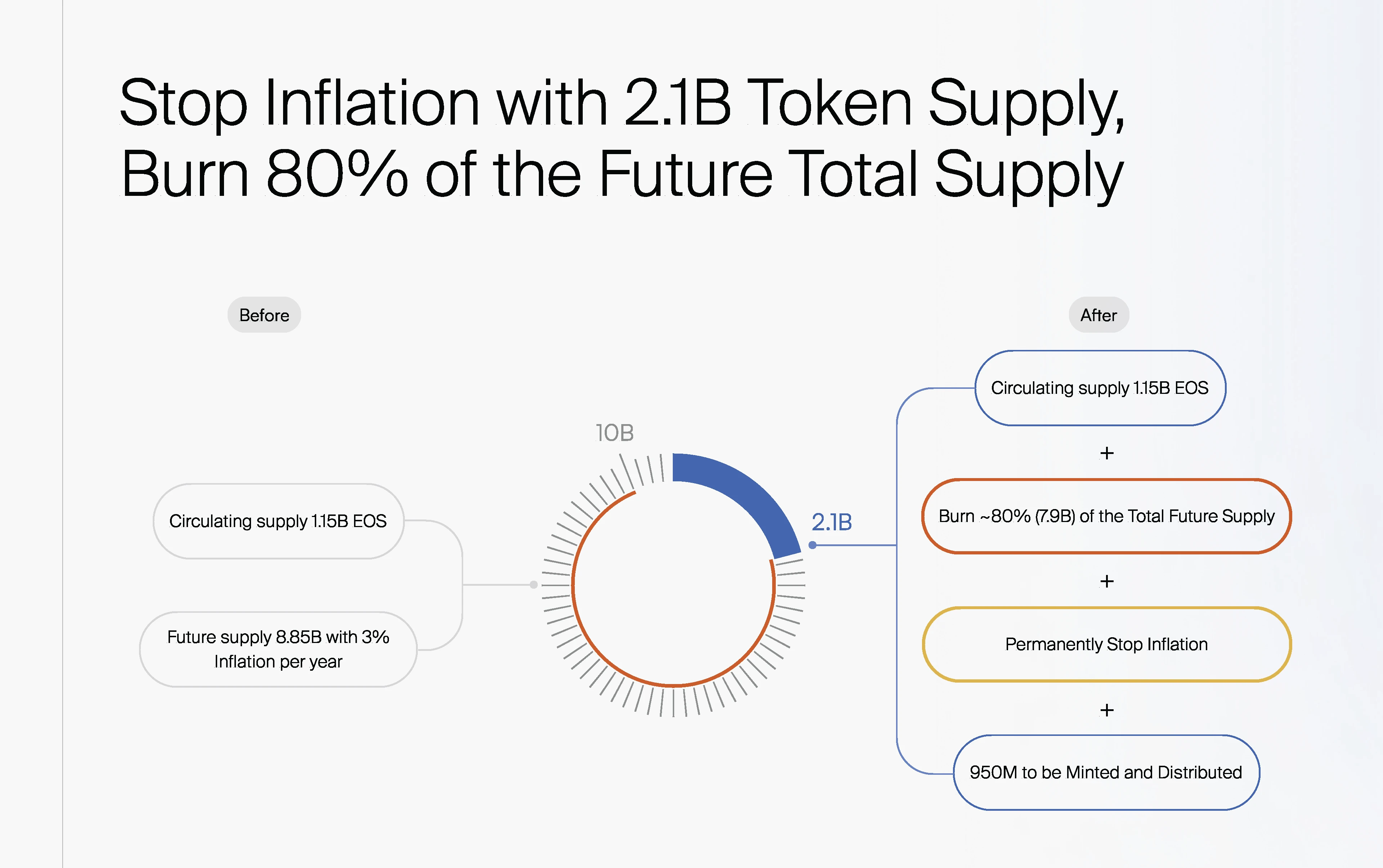

According to the latest proposal, EOS will transition from an inflationary token to a fixed supply token of 21 billion. The following image shows the comparison of token supply before and after the proposal:

Before the proposal (before token burning): It consists of two parts, with a circulating supply of 1.15 billion EOS tokens and a future inflation total of 8.85 billion EOS tokens, with an annual inflation rate of 3%;

After the proposal (after token burning): 80% of the future inflation supply (8 billion EOS tokens) will be burned. The final actual token composition consists of a circulating supply of 1.15 billion tokens and 0.95 billion tokens to be minted and distributed.

Image Source: EOS CEO Tweet

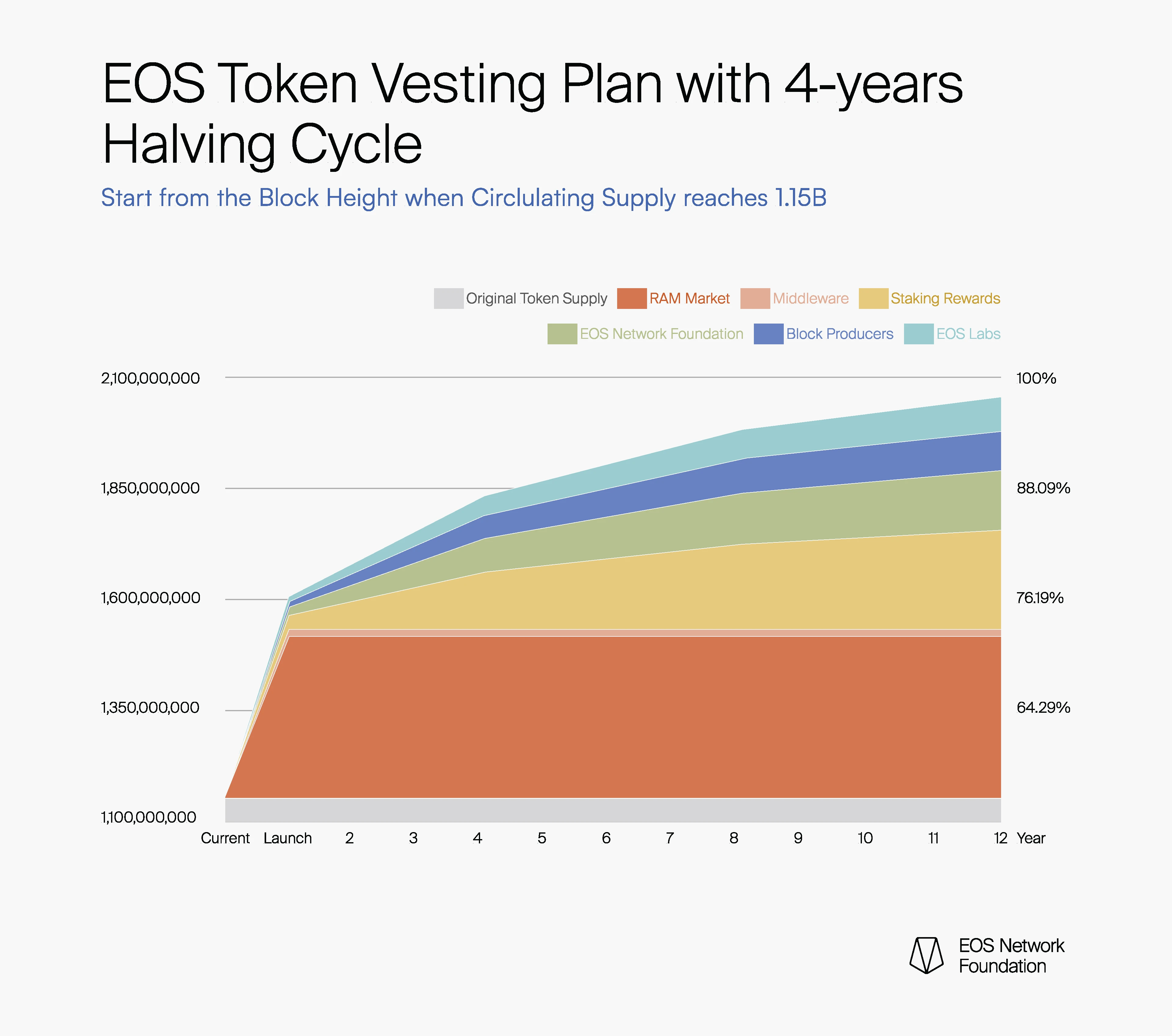

Specifically, if the new proposal is implemented, the actual token distribution will be as follows:

Original token supply: 1,150,000,000 EOS, accounting for 54.8% of the total supply. The current token quantity existing before this proposal will remain unchanged, totaling approximately 1.15 billion EOS tokens, with a commitment not to make any other changes to this initial supply;

RAM Market: 350,000,000 EOS, accounting for 16.7% of the total supply. A total of 350 million EOS will be used for the development and expansion of the RAM market and its crypto community. Specifically, a portion will be used for RAM market making and liquidity supply. 315 million EOS will be allocated for market making and liquidity supply for centralized exchanges and DeFi across multiple blockchains. Another portion is for programmatic RAM purchases. 35 million EOS tokens will be used to programmatically purchase RAM from the system Bancor pool within a TBD timeframe, and the RAM purchased through this mechanism will support or fund EOS ecosystem plans;

Staking Rewards: 250,000,000 EOS, accounting for 11.9% of the total supply. A total of 250 million EOS tokens will be used for staking rewards, with the reward release rate controlled by EOS block producers. The proposal suggests using a logarithmic curve to allocate rewards;

EOS Network Foundation: 150,000,000 EOS, accounting for 7.1% of the total supply. The EOS Network Foundation will allocate 150 million EOS tokens, equivalent to the current 1.5% network inflation over 8.5 years;

Block Producers: 100,000,000 EOS, accounting for 4.8% of the total supply. In order to make block production and network infrastructure more sustainable in the long term, all network fees generated by PowerUC, RAM transaction fees, and name auctions will be evenly distributed to the top 21 block producers;

EOS Labs: 85,000,000 EOS, accounting for 4% of the total supply. These tokens will be used for ecosystem growth investment, liquidity supply for ecosystem projects, and partnerships;

Middleware: 15,000,000 EOS, accounting for 0.7% of the total supply. 15 million EOS tokens will be specifically used for public product funding for middleware development to improve the availability of the EOS network.

EOS Release Table under the New Token Economic Model

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。