Original Author: Chen Mo cmDeFi (X: @cmdefi)

Key Points: A synthetic stablecoin native to the crypto world, a structured passive income product between centralization and decentralization, custody of assets on-chain, maintaining stability through Delta neutrality, and earning income.

The background of its birth is that centralized stablecoins such as USDT & USDC dominate the stablecoin market, while the collateral for decentralized stablecoin DAI is gradually trending towards centralization, and algorithmic stablecoins LUNA & UST surged to the top five in stablecoin market cap before collapsing. Ethena's birth strikes a balance between the DeFi and CeFi markets.

The OES service provided by institutions custody assets on-chain and map the amount to centralized exchanges to provide margin, retaining DeFi's characteristics by isolating on-chain funds from exchanges to reduce the risk of exchange misappropriation and insolvency, while also retaining CeFi's characteristics to obtain sufficient liquidity.

The underlying income consists of Staking income from Ethereum liquidity derivatives and funding rate income obtained by opening hedging positions on exchanges. It is also known as a structured income product for universal funding rate arbitrage.

Incentivizing liquidity through a point system.

Its ecosystem assets include:

USDe - Stablecoin, minted by depositing stETH (more assets and derivatives may be added in the future).

sUSDe - Voucher tokens obtained by pledging USDe.

ENA - Protocol token/governance token, currently entering the market through point redemption for each period, locking ENA can obtain greater point acceleration.

Research Report

1/6 • How USDe stablecoin is minted and redeemed

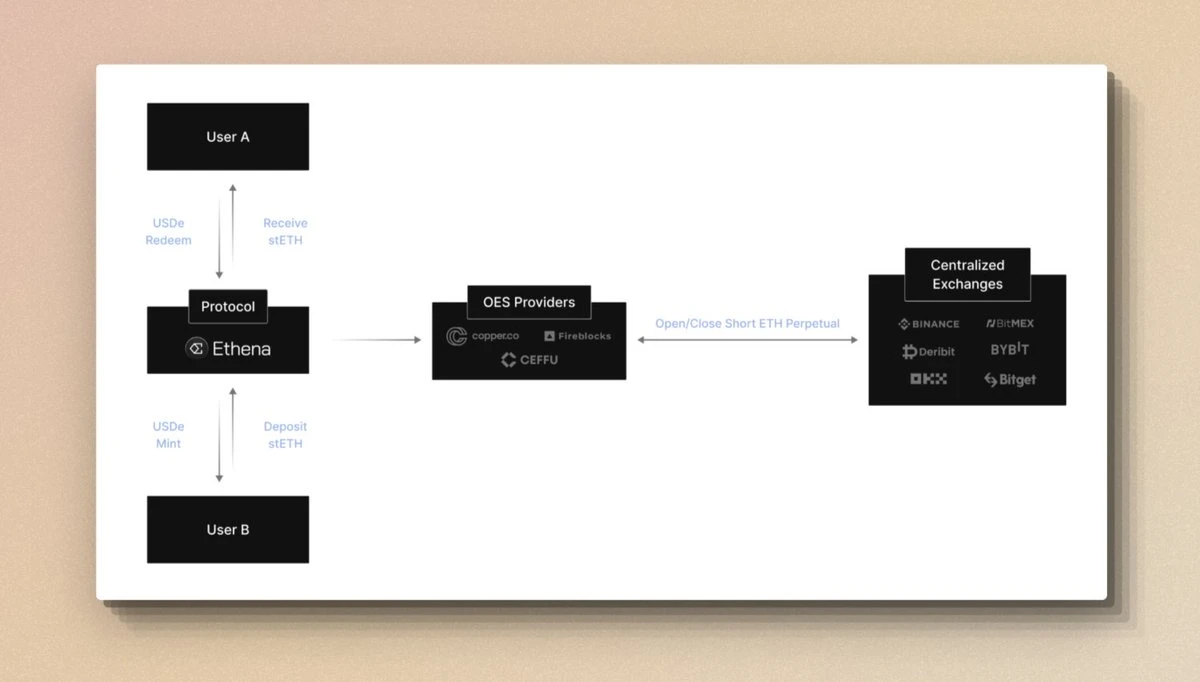

By depositing stETH into the Ethena protocol, USDe can be minted at a 1:1 ratio to the US dollar. The deposited stETH is sent to a third-party custodian, and the balance is mapped to the exchange through "Off-exchange Settlement," after which Ethena opens a short ETH perpetual position on CEX to ensure the collateral value remains Delta neutral or remains unchanged in USD terms.

Ordinary users can obtain USDe from permissionless external liquidity pools.

Accredited institutional parties that have undergone KYC/KYB screening and are whitelisted can directly mint and redeem USDe through the Ethena contract.

Assets are always kept in transparent on-chain custody addresses, so they do not rely on traditional banking infrastructure and are not affected by exchange misappropriation or bankruptcy.

2/6 • OES - Off-exchange Settlement for ceDeFi asset custody

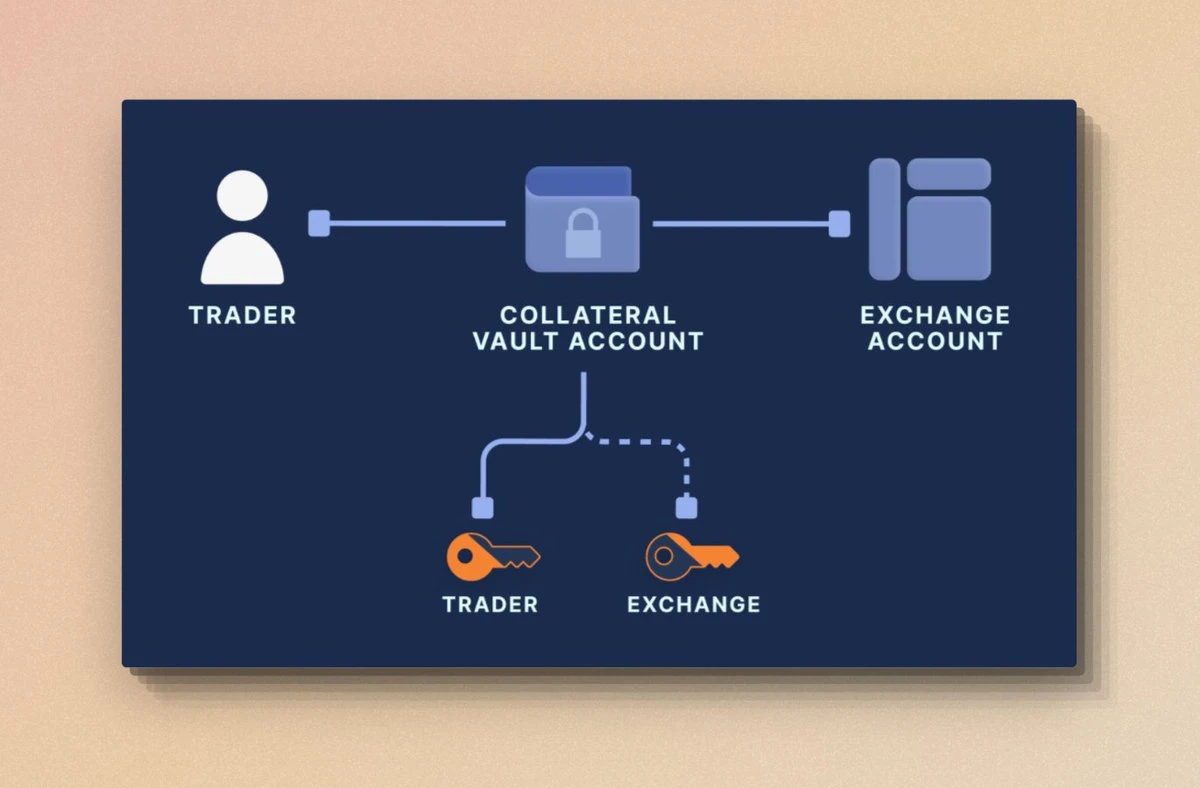

OES (Off-exchange Settlement) is a settlement method for off-chain asset custody that simultaneously considers on-chain transparency and decentralization, as well as the use of funds on centralized exchanges.

Using MPC technology to construct custody addresses, users' assets are kept on-chain to maintain transparency and decentralization, and the address is jointly managed by users and custodians, eliminating the counterparty risk of exchanges and greatly reducing potential security and fund misuse issues. This maximizes the assurance that assets are held by the users themselves.

OES providers typically cooperate with exchanges, allowing traders to map asset balances from wallets they jointly control to the exchange for related trading and financial services. For example, this allows Ethena to custody funds off the exchange while still using these funds on the exchange as collateral for Delta hedging derivatives.

MPC wallets are currently considered the perfect choice for a consortium to control a single pool of encrypted assets. The MPC model distributes individual keys to wallet users separately, jointly managing custody addresses.

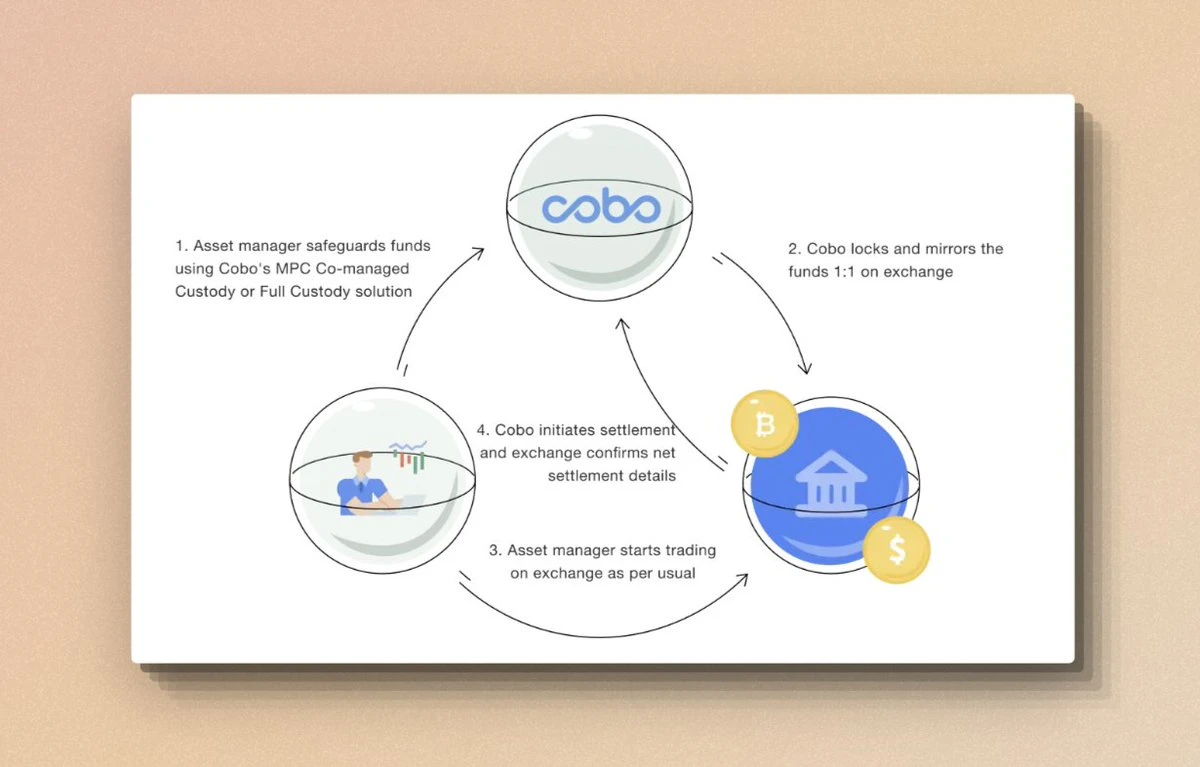

fireblocks off-exchange settlement

cobo SuperLoop

3/6 • Profit model

Ethereum liquidity derivatives bring staking income.

Funding rate income obtained by opening short positions on exchanges, basis spread income.

"Funding rate" is based on the difference between the spot price and the perpetual contract market, regularly paid to traders holding long or short positions. Therefore, traders will pay or receive funds based on the demand for long or short positions. When the funding rate is positive, long positions pay shorts; when the funding rate is negative, shorts pay longs. This mechanism ensures that the prices of the two markets do not deviate for a long time.

"Basis spread" refers to the deviation in prices between spot and futures markets, as they are traded separately. The deviation in their prices is called the basis spread, and as futures contracts approach expiration, their prices usually tend to converge with the corresponding spot prices. At expiration, traders holding long contracts need to purchase the underlying asset at the price specified in the contract. Therefore, as the futures expiration date approaches, the basis spread should tend toward 0.

Ethena uses mapped funds on exchanges to implement different arbitrage strategies, providing diversified income for holders of USDe on-chain.

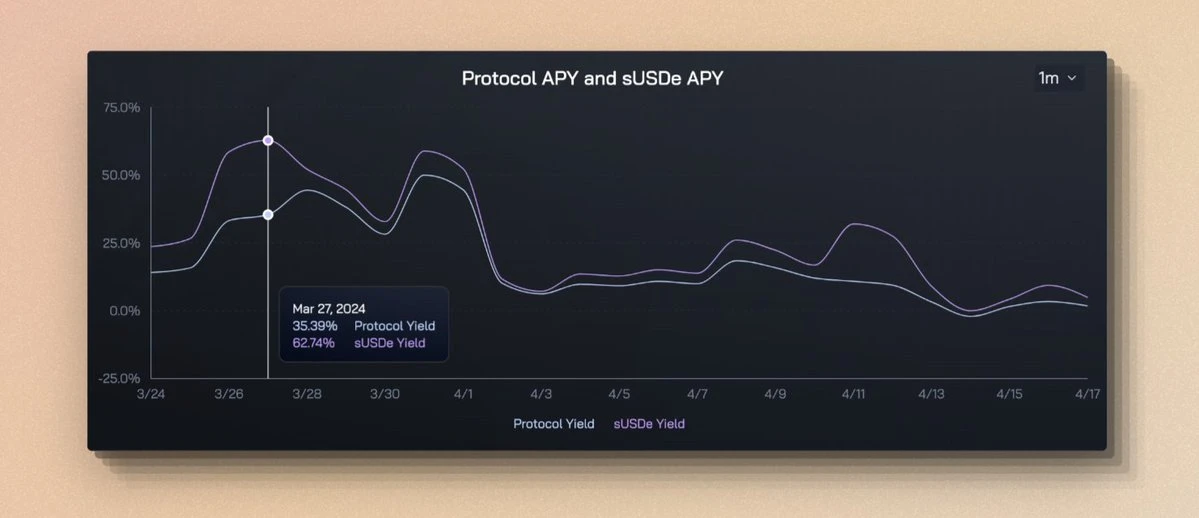

4/6 • Yield and sustainability

In terms of yield, the protocol has earned an annualized yield of up to 35% in the past month, with a yield of 62% allocated to sUSDe. The difference here is because not all USDe has been converted to sUSDe through pledging, and in fact, it is almost impossible to achieve a 100% pledge rate. If only 50% of USDe is pledged and converted to sUSDe, then this portion of sUSDe captures 100% of the entire yield with only 50% of the collateral. As USDe's use cases enter DeFi protocols such as Curve and Pendle, this not only meets the needs of different use cases but also potentially increases the yield of sUSDe.

However, as the market cools down and there is less long capital in exchanges, funding rate income will also decrease. Therefore, after entering April, overall yields have shown a clear downward trend, with Protocol Yield decreasing to 2% and sUSDe Yield dropping to 4%.

So in terms of yield, USDe is quite dependent on the situation in the futures contract market of centralized exchanges and will also be constrained by the scale of the futures market, as when the issuance of USDe exceeds the corresponding futures market capacity, it no longer meets the conditions for further expansion of USDe.

5/6 • Scalability

The scalability of stablecoins is crucial, referring to the conditions and possibilities for increasing stablecoin supply.

Stablecoin protocols like Maker are usually limited in scalability due to the requirement for over-collateralization, needing more than $1 of collateral to mint $1. What sets Ethena apart is that its primary constraint on scalability will be the Open Interest of the ETH perpetual market.

Would you like to continue with the remaining sections?

Open Interest refers to the total number of open contracts on an exchange. Here, it specifically refers to the total value of open positions in perpetual contracts for ETH on centralized exchanges. Currently, this number is around $12 billion (April 2024). This figure reflects the current holding level of market participants for ETH.

In comparison, since the early stages of Ethena in 2024, ETH Open Interest has grown from $8 billion to $12 billion. Recently, Ethena has also supported the BTC market, and the current BTC Open Interest is around $300 billion. The circulation of USDe is approximately $2.3 billion, which includes various factors such as natural growth of market users, price growth of ETH and BTC, and more. However, it should be noted that the scalability of USDe is closely related to the size of the perpetual market.

This is also why Ethena cooperates with centralized exchanges. In 2023, the stablecoin project UXD Protocol on the Solana chain adopted the same Delta-neutral method to issue stablecoins, but it chose to execute hedging strategies on decentralized exchanges on-chain. However, due to limited on-chain liquidity, when the stablecoin circulation reached a certain scale, it meant that more short positions needed to be taken, ultimately leading to negative funding rates and generating additional costs. Additionally, UXD used the leverage protocol Mango on the Solana chain for shorting, and when Mango was attacked on-chain, among other reasons, the project ultimately failed.

So, can the market value of USDe reach that of USDT or DAI?

Currently, the market value of USDe is around $2.3 billion, ranking it 5th in the overall stablecoin market value, surpassing most decentralized stablecoins but still with a $3 billion gap from DAI.

Currently, ETH Open Interest is approaching historical peak levels, and BTC Open Interest has reached historical peak levels. Therefore, the expansion of USDe's market value must involve increasing corresponding value in short positions in the existing market, which presents a certain challenge for the current growth of USDe. As the main source of income for USDe, the funding rate is a mechanism in perpetual contracts used to adjust prices to align with the spot market. This is usually achieved by regularly paying funding fees from longs to shorts or from shorts to longs. When an excessive amount of USDe is issued and the number of short positions in the market increases, it may gradually drive down the funding rate, or even turn it negative. If the funding rate decreases or becomes negative, it may reduce the income Ethena obtains from the market.

In a market with unchanged sentiment, this is a typical market supply and demand balance issue that requires finding a balance between expansion and yield. If the market sentiment turns bullish and the sentiment for long positions increases with rising prices, the theoretical capacity for issuing USDe will increase. Conversely, if the market sentiment turns bearish and the sentiment for long positions decreases with falling prices, the theoretical capacity for issuing USDe will decrease.

Considering yield and scalability, USDe may become a stablecoin with high yield, limited scale in the short term, and long-term alignment with market trends.

6/6 • Risk Analysis

Funding Rate Risk - When there are insufficient long positions in the market or when USDe is over-issued, there is a risk of negative funding rate income, and Ethena needs to pay fees from shorts to longs. Although historically, Ethena has concluded that the market has mostly had positive funding rates, it's worth noting that Ethena uses LST (such as stETH) as collateral for USDe, which can provide additional safety margins for negative funding rates in the form of earning an annualized yield of 3-5% from stETH. However, it's worth noting that similar protocols have attempted to expand the scale of synthetic stablecoins in the past but failed due to inverted yield rates.

Custody Risk - Fund custody relies on OES and centralized institutions providing services. Bankruptcy of exchanges may lead to losses for unrealized profits, and bankruptcy of OES institutions may lead to delays in fund retrieval. Although OES has adopted MPC and the most concise way to custody funds, there is still a theoretical possibility of fund theft.

Liquidity Risk - At specific times when rapid liquidation or position adjustments are needed, a large amount of funds may face liquidity shortages, especially in tense or panic market conditions. Ethena attempts to mitigate and address this issue through cooperation with centralized exchanges, such as progressive liquidation, gradual position closures, or other convenient policies to mitigate market impact. This cooperative relationship may provide strong flexibility and advantages, but it also introduces centralized risk.

Asset Anchoring Risk - stETH is theoretically anchored 1:1 with ETH, but there have been brief decoupling situations in the past, mainly before the Shanghai upgrade. In the future, there may still be some unknown risks at the level of Ethereum's liquidity derivatives. Asset decoupling may also trigger exchange liquidation.

To address the series of risks mentioned above, Ethena has established an insurance fund, funded by the distribution of income from each period, with a portion being allocated to the insurance fund.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。