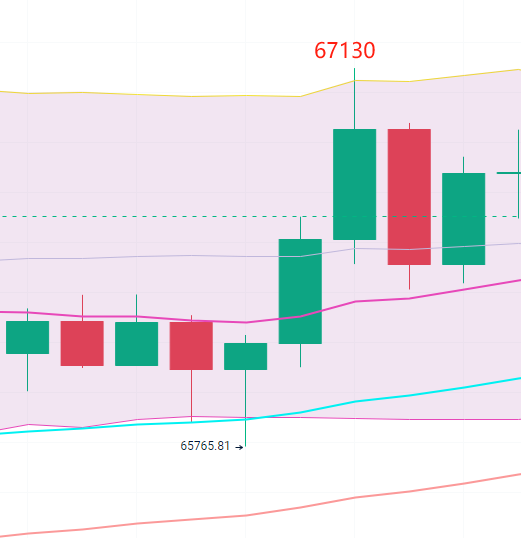

BTC 4-hour:

Although Bitcoin broke through yesterday, it failed to refresh its high point and then underwent an adjustment. Despite still being in an upward trend, the bullish trend of Bitcoin has now turned into a consolidation phase due to the upcoming repayment of Mt.Gox's debt.

📉Mt.Gox plans to complete the debt repayment before October, which may have a negative impact on the price of Bitcoin. Although the possibility of creditors of Mt.Gox selling Bitcoin in a lump sum is low, traders concerned about selling pressure may continue to be cautious about Bitcoin investments, leading to continued consolidation.

Due to the failure to break through the resistance above, although it is in an upward trend, the bearish view has increased. However, the intraday master will continue to maintain a bullish outlook.

The first resistance level to watch for intraday is 66800, and the second resistance level is 67120. If the price breaks through the first resistance level, it may refresh the short-term high. However, the current volatility may lead to the formation of upper shadow lines, so everyone needs to pay attention.

If the candlestick stays at the resistance level after breaking through the resistance, we can consider it as a support level and enter a long position on the pullback.

The first intraday support level is around 66350, and the second support level is around 66000. Since the closing price yesterday remained at the first support level, we can gradually set 66200 as the support and enter a long position again. If there is an adjustment in the market, we can consider 66000 as the maximum downside risk. After breaking through 66000, we can switch to a bearish outlook.

In addition, in the short term, we can observe the trend of the 120-day moving average on the 4-hour level. If the candlestick remains stable above it, the possibility of a rebound will continue to increase.

In today's trading, considering the consolidation phase, we will continue to maintain a bullish perspective. If the market does not fluctuate much, once there is bearish or bullish news, it often clarifies the direction of the market.

4.24 Master Chen's Short-term Pre-buried Orders:

Plan 1: Go long if the price breaks through 66911

Plan 2: Go short if the price falls below 66435

Because the market is currently in a waiting period for a breakthrough, it is expected that once these key levels are broken through or breached, the market will have a significant move. Therefore, today we can use the entry points of Plan 1 and Plan 2 as the main reference for trading.

This article is exclusively planned and published by Master Chen (WeChat public account: 币神师爷陈). If you need to understand more real-time investment strategies, untangling, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication. I hope it can help you find what you want in the currency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% trend-following; daily updates on macro analysis articles across the network, technical analysis of mainstream coins and altcoins, and spot mid-to-long-term replay price prediction videos.

Gentle reminder: This article is only written by Master Chen in the column public account (as shown in the picture above), and other advertisements at the end of the article and in the comment section are not related to the author. Please discern carefully, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。