This weekend, the decentralized betting platform ZKasino in the ZK ecosystem is deeply embroiled in a "runaway" controversy: tampering with website activity descriptions, refusing to refund users' ETH pledged for activities, revoking Telegram posting permissions, canceling the Dubai offline meetup, and unilaterally transferring user funds to Lido for staking… Many users are questioning whether ZKasino has already engaged in a "soft rug pull." This article will help clarify what exactly happened to ZKasino over the course of just one weekend.

ZKasino Incident Overview

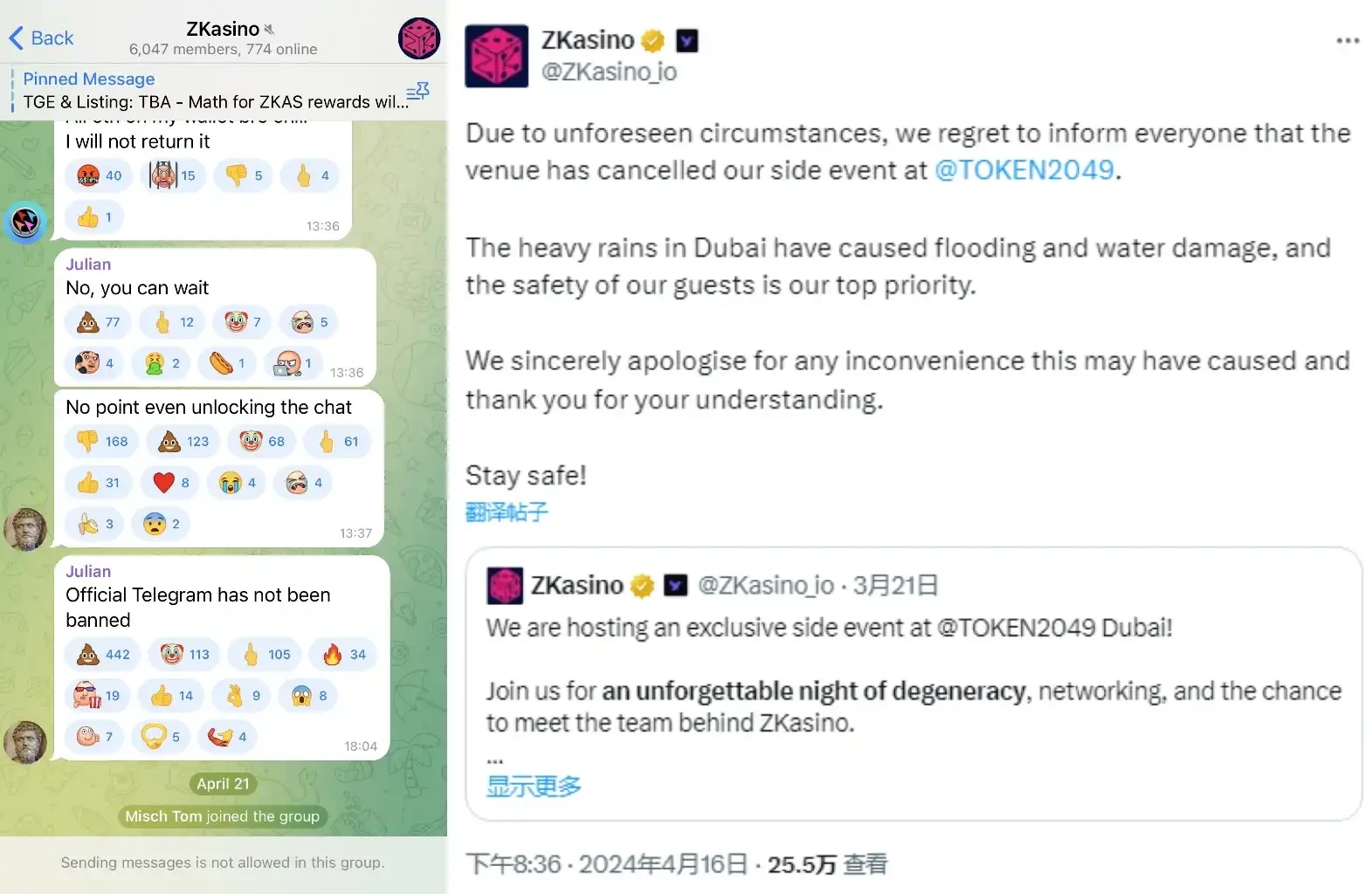

Going back to April 19th, several community users discovered that after the ZKasino staking activity ended, ETH refunds were not being made available. Subsequently, using the Wayback Machine to trace back, on April 18th, ZKasino deleted the phrase "Ethereum will be returned and can be bridged back" from the Bridge funds page on its official website, causing panic among users and raising suspicions of premeditated "exit scam." Users who participated in the staking activity flooded ZKasino's official Twitter to inquire, and Telegram also became a place for rights protection. However, not long after, ZKasino team members closed the Telegram posting permissions.

On April 20th, MEXC exchange, which was originally scheduled to list ZKasino (ZKAS) on that day, announced a delay in listing and withdrawals, and temporarily suspended ZKAS deposits. MEXC staff responded to the "runaway" speculation of ZKasino by stating, "We are just one of the investors, and the actions of the project team have nothing to do with us. As investors, we are also victims."

Perhaps due to pressure from multiple parties, ZKasino finally issued a brief response: there are currently many FUD rumors. ZKasino's network will continue to go live, and the (mainnet) was delayed due to the listing on the exchange.

However, users are not buying into this simple response, and questions like "When will the refund be made?" "Is it a soft rug pull?" and "Why change the mainnet refund description?" have become the main contradictions at present.

On April 21st, according to blockchain analyst Yu Jin's monitoring, ZKasino transferred the 10,515 ETH that users bridged into ZKasino to a multi-signature address, and subsequently deposited it into Lido. These ETH were bridged by users into ZKasino for mining, but the ZKasino project team modified the official website description, forcibly converting the ETH deposited by users into their platform token.

On April 22nd, Big Brain Holdings, previously disclosed as one of the investment institutions of ZKasino, issued a "clarification" denying involvement in ZKasino's financing.

At this point, users' concerns seem to be gradually "confirmed." Some users have also discovered that as early as March 16th, Kedar, the founder of the Ethereum Layer 2 ecosystem DEX project ZigZag, had warned that ZKasino seemed to have issues. In Kedar's tweet, he mentioned that most of ZKasino's revenue was fabricated, and users should be cautious about participating in their ICO activities.

Currently, ZKasino's latest tweet only announced the project's next steps: "All ZKasino games will be moved to a new chain - and will still be available on Arbitrum and Polygon. Native DEX and stablecoins will be launched soon. The first batch of ZKAS has been distributed to the bridgers."

However, there were no congratulations or celebrations in the tweet replies, only users repeatedly asking, "When will the refund be made?"

Advice and Views from Crypto VCs and KOLs

As a "star" project on ZK, there were many KOLs who participated in and recommended the project in the early stages. Now that such a negative event has occurred, these KOLs have naturally become targets of criticism. In the crypto field, how to avoid pitfalls, and who should be responsible when a project encounters problems? ABCDE Capital co-founder Du Jun, crypto KOL 0xSatoshis, and @0xkillthewolf have expressed their views. BlockBeats has compiled their opinions as follows:

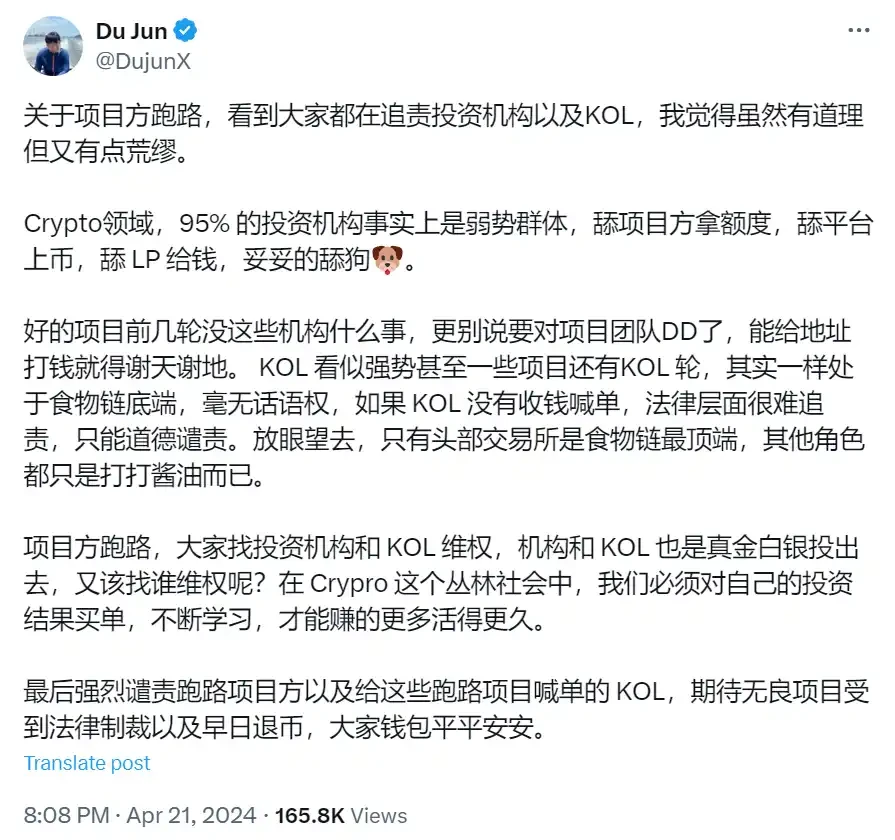

ABCDE Capital Co-founder Du Jun (@DujunX):

Regarding the project team's runaway, I see everyone blaming investment institutions and KOLs, and I feel that while it makes sense, it's also a bit absurd.

In the crypto field, 95% of investment institutions are actually a weak group, licking the project team for quotas, licking the platform for listings, licking LP for money, and being a complete lapdog.

Good projects didn't have these institutions meddling in the early rounds, let alone conducting due diligence on the project team. They should be grateful if they can send money to the address. KOLs may seem strong and some projects even have KOL rounds, but they are still at the bottom of the food chain, with no say. If KOLs didn't receive money to promote, it's difficult to hold them legally accountable, only morally. Looking around, only the top exchanges are at the top of the food chain, and all other roles are just bystanders.

When the project team runs away, everyone looks to investment institutions and KOLs for rights protection, but these institutions and KOLs also invested real money, so who should they turn to for rights protection? In this jungle society of crypto, we must bear the consequences of our own investments, constantly learn, in order to earn more and live longer.

I strongly condemn the runaway project team and the KOLs who promoted these runaway projects, and look forward to unscrupulous projects being legally sanctioned and coins being returned soon, and everyone's wallets being safe and sound.

Crypto art creator Niq (@niqislucky) replied:

Admit it: the vast majority of staking projects are just sending money to "multi-signature addresses." Unless the team is well-known, VC endorsements are almost the entire basis of trust for retail investors. KOLs? Responsible for dissemination, and even taking the blame.

Weakness only exists in comparison between VCs. If you can't get into the divine gathering, you're just a novice. Even if you're a novice, you're still completely overwhelmed in terms of information/funds. Who are you writing for? Retail investors only feel like crocodile tears…

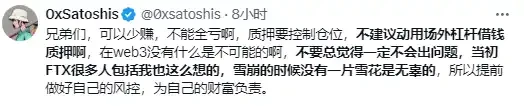

Crypto KOL 0xSatoshis (@0xSatoshis):

Given the soft rug pull status of Zkasino, I have reviewed all the staking projects I am currently involved in, except for ATOM+OSMO+TIA+DYM staking

The current staking projects I am involved in are:

1) swell+eigenlayer+renzo+puffer (total of less than 20E)

2) blast initially invested 25E, now only 6E remains, severe token inflation

3) lista over 5000 U

4) merlin staking only Runestone

5) bouncebit less than ten thousand U

Next, I will periodically withdraw the principal or reduce the position to a reasonable level (so-called reasonable means zero, which is also acceptable). I always feel that the current risk of staking is very high. Putting one dollar into projects A\B\C\D\E for staking once turns the TVL into 5 dollars, but the market still only has 1 dollar. In case the project runs away in the middle, or a hacker attack occurs, the risk is continuous. It's better to withdraw some liquidity while it's still available.

Furthermore, I want to emphasize again, don't trust KOLs' calls to invest, including me, a small retail investor. Just seriously study the content they share. As for whether to invest in the end, it must be decided by yourself. Investing is our own business. KOLs provide us with content and information to assist our decision-making.

For beginners, it's better to participate less in staking projects. The principal comes first. Veteran retail investors should control their positions and bet on low-cost attacks.

Brothers, you can earn less, but you can't lose everything. Control your positions for staking. I don't recommend using off-chain leverage to borrow money for staking. In web3, nothing is impossible. Don't always think that there won't be any problems. Many people, including me, thought the same about FTX at the time. When the avalanche happened, no snowflake was innocent. So, prepare your risk control in advance and be responsible for your wealth.

Finally: All the projects I am involved in in this article are just my own review and do not constitute investment advice. I am currently reducing my positions. Everyone, please make your own judgment, DYOR!

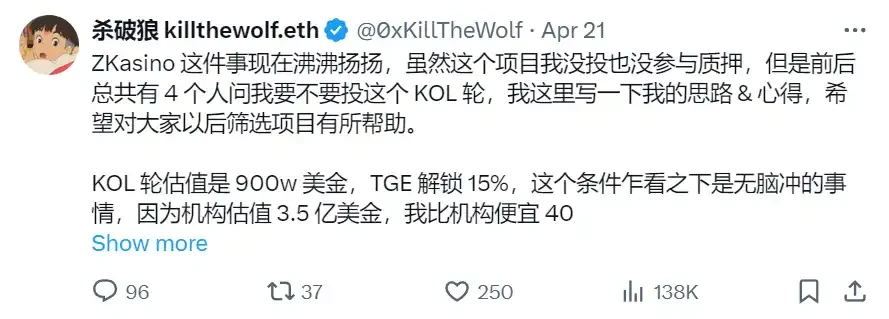

Crypto KOL killthewolf.eth (@0xkillthewolf):

The ZKasino incident is now making waves. Although I didn't invest in or participate in staking in this project, a total of 4 people asked me whether to invest in this KOL round. Here, I will write down my thoughts and experiences, hoping to help everyone in selecting projects in the future.

The KOL round valuation is $9 million, with 15% TGE unlock. At first glance, this seems like a no-brainer, because the institutional valuation is $350 million, and I am 40 times cheaper than the institution. As for the TGE only unlocking 15%, in fact, with a FDV of $60 million at the opening, I can break even, and the institution has already given a valuation of $350 million.

The main reasons I ultimately did not participate are:

First, why is the valuation $350 million? Recently, Ethena, listed on Binance, was valued at $300 million, and Puffer Finance was valued at $200 million. Why can ZKasino, a gambling platform, be valued at $350 million? Because of this valuation number, I have doubts about this round of financing.

Second, the project claims to have revenue of $8 million. Although everyone assumes that this number is somewhat inflated, I still checked the top 20 user addresses for platform gambling volume, all of which are suspected small accounts of the project team for volume manipulation.

Third, the founder's character is very problematic. Previously, their official account used a bloody video of a murder case as a joke for marketing, which caused a big stir at the time. @zachxbt also exposed various things this person has done: https://x.com/zachxbt/status/1731025316204745113

So, from my perspective, this project has a fake valuation, fake revenue, bad character, and no conscience. So, in the end, I did not participate and luckily avoided a big pit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。