Original author: dt

As the Bitcoin mining reward halving approaches, this bull market cycle was initiated by the narrative of BTC ETF and is now experiencing a major pullback as the BTC halving is about to take place. The BTC ecosystem has changed significantly in the past six months, with VC institutions actively entering the market. In addition to community-driven fair launch meme coins, many venture capital institutions or exchanges have also led to the emergence of BTC L2 or re-staking chain public chain projects.

This week's CryptoSnap Dr.DODO will introduce you to five popular BTC-related public chains and their capital support.

BounceBit

BounceBit is a public chain that uses the value of BTC as its security basis and boasts expanding the use cases of Bitcoin through its Restaking mechanism. It recently announced that its token $BB will be listed on Binance's Web3 wallet token issuance platform Megadrop. After receiving public investment from BinanceLab, BounceBit's popularity has surged. It has now announced that the token will cooperate with Binance's Web3 wallet, making $BB one of the few new BTC projects on Binance, attracting more users and funds.

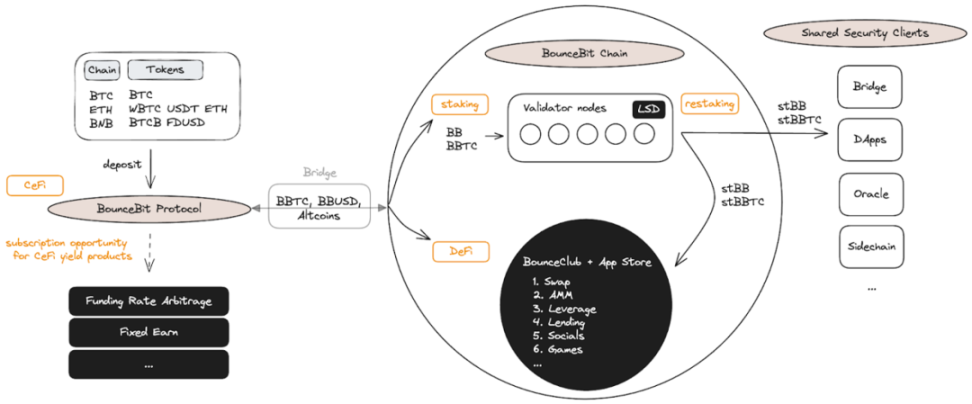

Unlike other BTC L2 solutions that rely on the security of the Bitcoin chain, BounceBit focuses on building an independent POS public chain based on the value of BTC. Through cooperation with CeFi asset management institutions, users can earn additional income from staking BTC through various forms such as fee arbitrage. The $BBTC certificates obtained by users can be used to run BounceBit Chain nodes or receive $BB token rewards in the form of LST protocol. In addition, the introduction of the Restaking mechanism allows other applications in the BounceBit ecosystem to rely on the $BBTC in the nodes to complete other verification tasks, such as oracles and cross-chain bridges.

Currently, BounceBit is still running a points program for users to deposit assets such as wBTC and BTCB to earn points, which will continue until the start of Metadrop.

Source: https://www.binance.com/zh-CN/research/projects/bouncebit

Merlin Chain

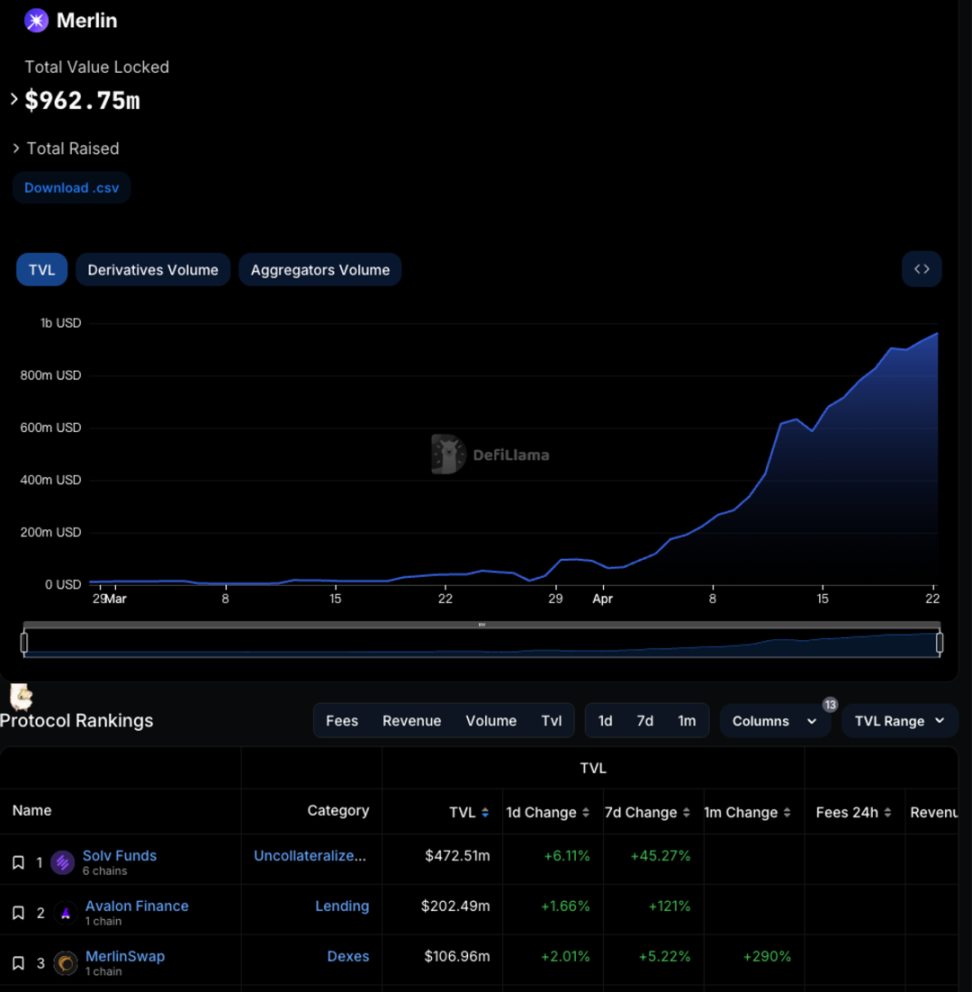

Merlin Chain is one of the five projects introduced today with the highest TVL, currently exceeding 950 million US dollars, and is the earliest BTC EVM L2 mainnet to launch. Its token $MERL has recently been listed on top exchanges such as OKX and Bybit following the Bitcoin halving event.

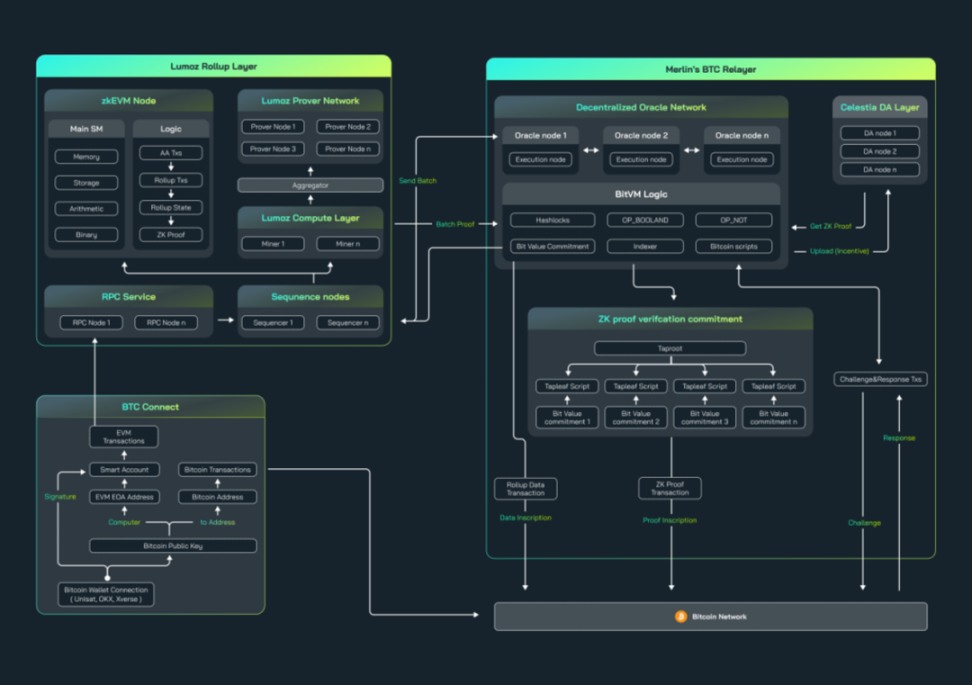

Merlin Chain, invested by The Sparta Group and OKX Ventures, is a Layer2 solution built on top of Bitcoin. It uses both OP-Rollup and ZK-Rollup architectures in parallel, referred to as optimistic ZK-Rollup, and introduces an off-chain decentralized oracle network (Oracle) as a Data Availability Committee (DAC) to solve data availability issues. Specifically, Merlin's sequencer sends transaction data to Oracle nodes and Prover nodes (using lumoz's Prover as a Service service). Oracle nodes are responsible for verifying ZK Proofs and publishing verification results to the Bitcoin chain (ZK-Rollup). As the Bitcoin chain cannot fully verify ZK Proofs, a fraud proof mechanism is introduced to allow others to challenge the verification process (OP-Rollup) to ensure network security.

Source: https://docs.merlinchain.io/merlin-docs/architecture

Merlin's ecosystem projects are currently the most developed among BTC L2 solutions. The TVL of asset management protocol Solv Funds, lending protocol Avalon Finance, and DEX protocol MerlinSwap all exceed the 100 million threshold. However, it is worth paying attention to whether there will be more airdrop hunters moving funds elsewhere after the successful launch of $MERL.

Source: https://defillama.com/chain/Merlin

B² Network

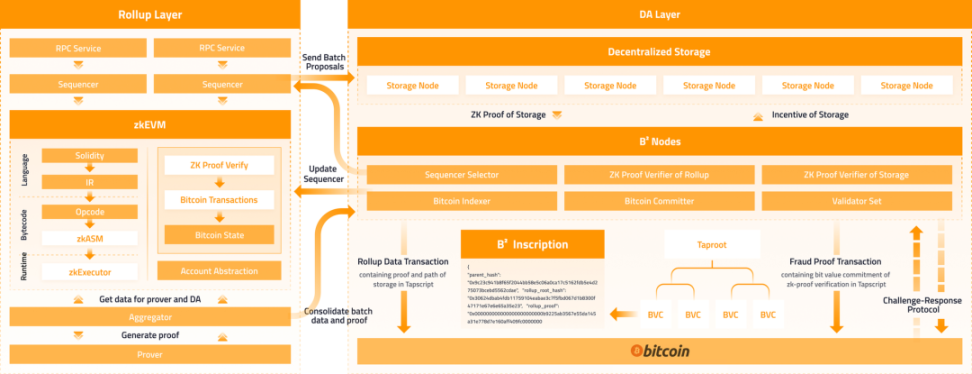

B² Network is also a BTC EVM Layer2 project, invested by institutions such as Hashkey Capital, OKX Ventures, and Kucoin Lab. Technically, B² Network is similar to Merlin Chain, as it uses ZK-Rollup and OP-Rollup in parallel as optimistic ZK-Rollup. It also collaborates with Polygon Lab to extend Polygon CDK to BTC using the zkEVM solution and allows users to interact with both EVM and BTC wallet accounts through account abstraction. Additionally, due to the inability of BTC to store large data, B² Network has built its own DA Layer B² Node and plans to upgrade it to B² Hub in the future, providing a data availability layer and state verification/proof system based on the Bitcoin network for other developers to use Polygon CDK and B² Hub to build their own Bitcoin Rollup.

The biggest difference between B² Network and other BTC Layer2 solutions is its vision, which is not limited to a single BTC Layer2, but aims to become a BTC Layer2 center similar to Cosmos Hub or Op Stack through B² Hub.

Source: https://docs.bsquared.network/architecture

Currently, B² Network has also launched its mainnet during the BTC halving. The first phase of the lock-up airdrop activity has ended, and the second phase of random airdrops is underway. Users have the opportunity to receive airdrops when the protocol token is released by bridging BTC to the B² Network mainnet. This activity has no specific time limit, and the official statement only mentions that it may end at any time.

BOB

BOB (Build On Bitcoin) is also a BTC EVM Layer2 project invested by institutions such as Castle Island and Coinbase Ventures, with a seed round raising $10 million.

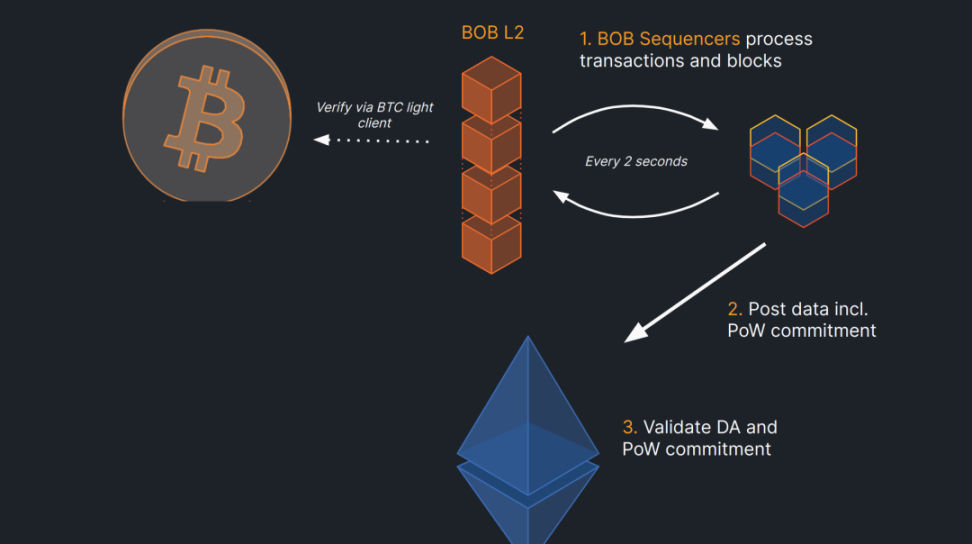

In BOB's roadmap, the technology is divided into three stages. In the first stage, BOD L2 will launch its mainnet in the form of Ethereum OP Rollup using OP Stack, with settlement occurring on Ethereum and tracking Bitcoin state through Bitcoin light nodes. It will verify block headers and accept transaction inclusion proofs to achieve trustless cross-chain operations.

Source: https://docs.gobob.xyz/docs/learn/bob-stack/roadmap

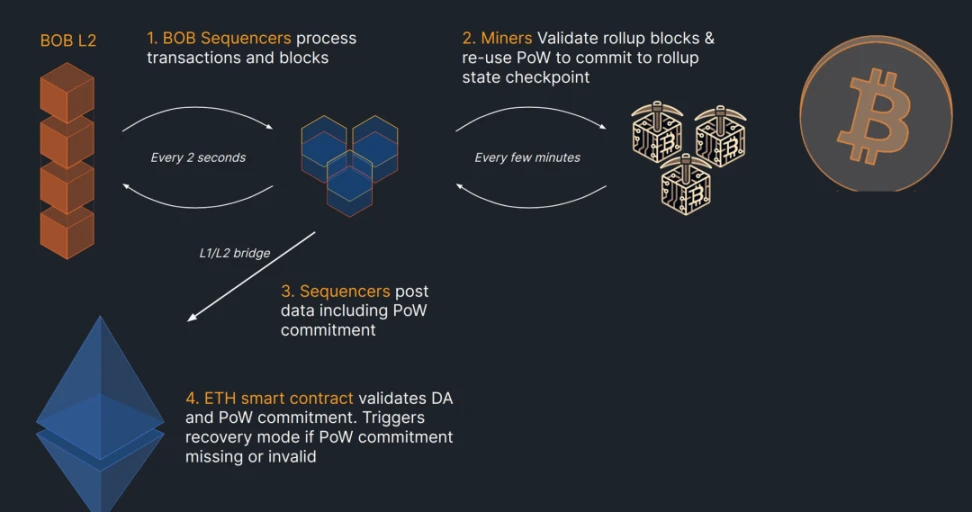

The second stage will introduce Bitcoin PoW security using a new merged mining protocol called OptiMine, separating block production from PoW. The BOB sequencer will process transactions and blocks, which will be verified by Bitcoin miners for BOB Rollup state. Only when the state transition is correct will miners include the commitment as part of PoW, minimizing trust in the sequencer. Finally, the sequencer will submit data covering PoW commitments to Ethereum, using Ethereum as the DA Layer to verify data availability.

Source: https://docs.gobob.xyz/docs/learn/bob-stack/roadmap

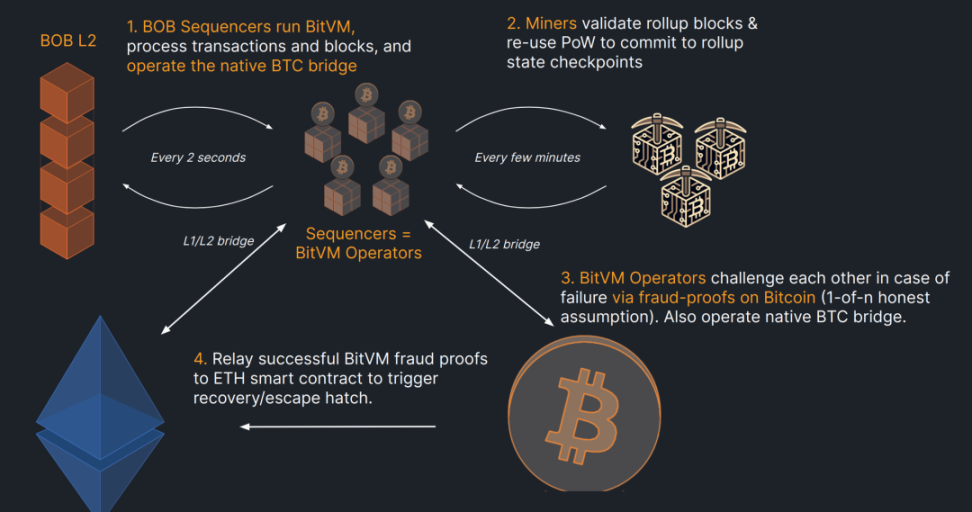

The third stage will introduce Bitcoin as the settlement layer. BOB's goal is to introduce Bitcoin as the settlement layer (currently under research). Possible solutions include introducing ZK compression as part of the fraud-proofing process and collaborating with ZK infrastructure providers. It will also design BOB light clients, build bidirectional bridges, and extend the BitVM program to achieve BOB Rollup state verification.

These three stages demonstrate BOB's development path from the initial optimistic Ethereum Rollup, to introducing Bitcoin PoW security, and finally to using Bitcoin as the settlement layer. Through this progressive hybrid design, BOB aims to inherit the security of Bitcoin and the programmability of Ethereum, providing an innovative Layer-2 solution for the Bitcoin DeFi ecosystem.

Source: https://docs.gobob.xyz/docs/learn/bob-stack/roadmap

Currently, BOB is conducting its first season points activity, where depositing tBTC, WBTC, stablecoins, and ETH LST tokens can earn points rewards. With the halving event approaching, the official announcement states that the mainnet will be launched on 4/24, at which point the first season activity will end and the second season points activity will begin. Details are currently undisclosed.

Mezo

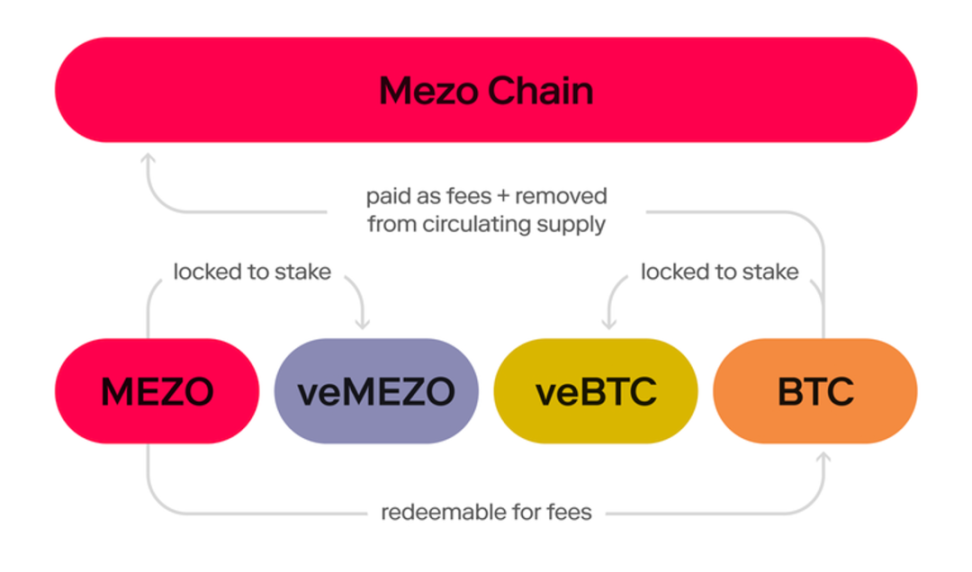

Mezo, recently announced to have raised $21 million in funding led by Pantera Capital, with participation from Multicoin and Hack VC, is a new Bitcoin public chain developed by the Thesis team, which created the BTC-backed asset tBTC. They describe themselves as the "economic layer" of Bitcoin, aiming to create an application ecosystem based on users' economic needs, focusing on expanding BTC application scenarios, and using Proof of HODL as their consensus mechanism. This involves users locking BTC and MEZO tokens and executing CometBFT consensus to verify transactions and protect the network.

Mezo is also conducting a HODL points activity, allowing users to deposit native BTC, WBTC, or tBTC to earn points. Currently, Mezo has disclosed few technical details. All deposits in Mezo are stored in a locked contract controlled by the team's multi-signature until bridging to the Mezo mainnet.

Source: https://info.mezo.org/proof-of-hodl

Author's Viewpoint

The public chain narrative is always the grandest and most highly valued narrative in the blockchain ecosystem, with the most funding. Many institutions are eager not to miss out on the surge in the Bitcoin narrative during this bull market, launching various public chain projects linked to the concept of Bitcoin. In practical terms, does Bitcoin really need these L2 solutions, or in other words, do cryptocurrency users care whether they are using the BTC or EVM underlying chain?

From the author's perspective, the race of BTC-related public chains is more about the injection of resources behind them, which is a market of capital competition among various institutions. For retail investors, it simply means having another new chain to speculate on, whether it's MEME, DEX, or lending mining targets.

Therefore, for the author, the best way to participate may be to assess the quality of the capital behind each project and participate early in airdrops, lock-up points, and other activities to obtain free tokens. Additionally, after the mainnet is launched, it may be worth paying attention to whether there are leading Memecoins or official endorsements of Memes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。