Original Author: Jimmy Song

Original Translation: Luffy, Foresight News

Bitcoin halving is a planned event, one of the periodic festivals that occur on Bitcoin. Like the activation of soft forks and the introduction of various financial instruments, it is an unpredictable day that occurs every few years, so Bitcoin enthusiasts and mainstream media are particularly concerned.

This year's halving is also highly anticipated, but we have encountered some minor incidents that need further explanation. Bitcoin's fourth halving, the block subsidy has decreased from 6.25 BTC to 3.125 BTC at block 840,000, as expected. However, unexpectedly, there was a 37.626 BTC transaction fee, the highest ratio of transaction fees to block subsidies in Bitcoin's history, with one transaction paying nearly 8 BTC in fees.

More Fees

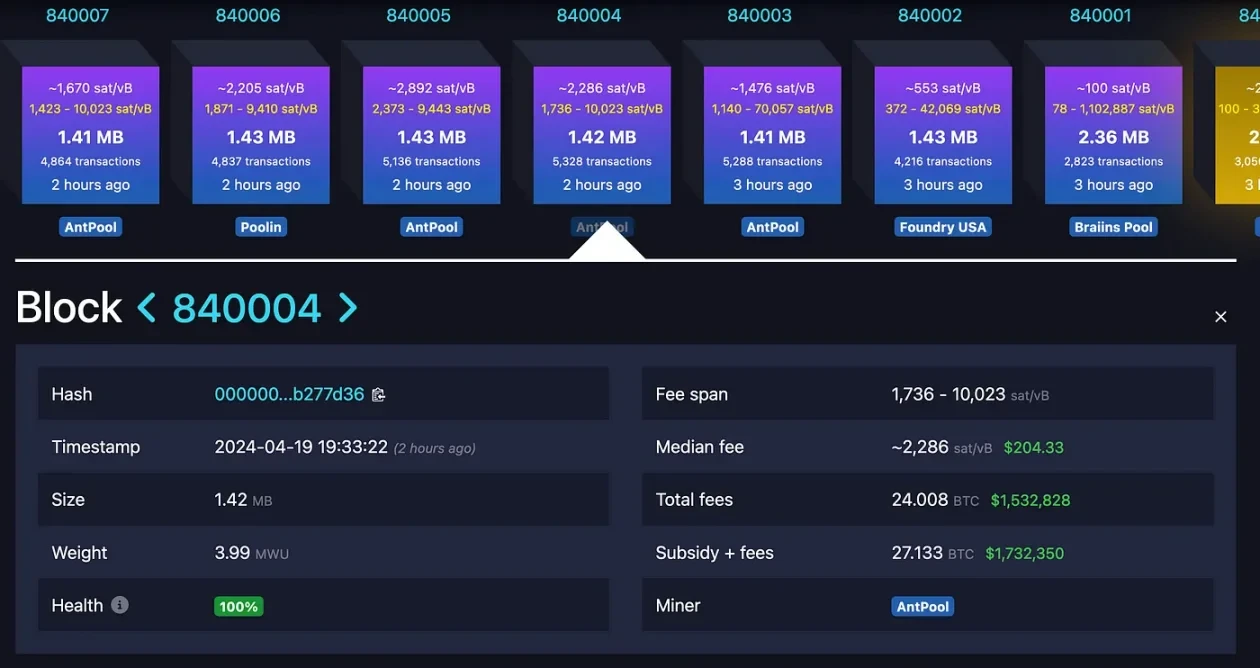

Not only was the fee for the 840,000th block high, but the fees for the next 5 blocks were also high: 4.486, 6.99, 16.068, 24.008, and 29.821 BTC, setting a historical record that has never occurred in the Bitcoin network before.

In the history of Bitcoin so far, it is very rare for fees to exceed block subsidies. There have been some instances when the block rewards were 50 and 25 BTC, usually due to user errors (often forgetting to input the change address), and almost all fees came from a single erroneous transaction. In the era of 12.5 BTC block subsidies, there were a few transactions at the end of 2017 where the cumulative fees exceeded the block subsidy. And during the recent 6.25 BTC era, there were many blocks with fees exceeding the block subsidy during the ordinal frenzy.

Nevertheless, this situation is still relatively rare. Even in the period before Bitcoin's fourth halving, most block fees did not exceed 1.5 BTC. However, in this new era of 3.125 BTC subsidies, as of the writing of this article (block 840018), the fees for each block have exceeded the subsidy, some even several times over. So what happened? Why are the block fees so high after the halving?

Runes

The reason is related to a new protocol called Runes, designed by Casey Rodarmor in September 2023, which is another colored coin protocol based on Bitcoin. The main idea is to allow the issuance of tokens on the native UTXO set.

Looking back, colored coins have been around for a long time. The main idea is that you can "color" certain Bitcoin transaction outputs, giving them meanings beyond the Bitcoin amount. It can be another "asset" and be issued as a token. The first implementation of this protocol occurred 11 years ago in 2013, and there have been multiple attempts since then, including MasterCoin (renamed Omni), CounterParty, and more recently RGB, Taro Assets, and BRC-20.

As Rodarmor mentioned in his blog, his motivation for creating the new protocol was to introduce some assets issued on other chains into Bitcoin. To make the release of this protocol more interesting, Rodarmor decided to start issuing from block 840,000, leading to the chaos we are seeing.

Simplification and Game Theory

Casey Rodarmor is also the creator of ordinals, and he adopted a concept from it, using uppercase Latin letters on Runes to name assets. This is a normal choice, but what happens when there is a conflict? How do we distinguish them if two assets have the same name?

To simplify the operation, the protocol only needs to check for existing assets, and if the name conflicts with an existing asset, the new asset will not be issued. This does simplify the client and provides a globally unique name for each asset. Unfortunately, this also brings some terrible incentive issues.

Sniping Asset Issuance

The first incentive issue is that if the transaction issuing the asset is sent to the Bitcoin mempool, when the transaction is broadcast to network nodes, other observers can steal the name by using an earlier transaction.

Now, "earlier" in Bitcoin is a strict concept. Blocks are ordered, and transactions within blocks are also ordered, first come, first served. But if you want to preempt a good symbol name, you can look for mempool transactions attempting to create new assets and create your own asset with higher fees. This is the essence of sniping.

What's truly frightening about this situation is that both transactions have the potential to enter a block, but only the first transaction can successfully issue the asset. The second transaction will not issue the asset but will still incur fees.

Miners typically sort transactions by fee rate, so higher fees may mean they will be able to issue the asset. I say "may" because there is a second incentive issue here, which I will discuss shortly. But from a game theory perspective, both sides are incentivized to continually raise fees to outbid each other. This dynamic is similar to a bidding war, where participants will ultimately make rational choices but end up with irrational results (e.g., paying $1.50 for $1). Each loser pays a large fee but gains nothing.

Second-Order Game

Given the existence of the above mechanism, it is not surprising that many issuers initially intentionally set high fees to prevent anyone from attempting to preempt the symbol. After all, if your preemptive attempt fails, you will lose the fees you tried to preempt. For this reason, the use of RBF (fee replacement) has also significantly increased, allowing you to preempt and snipers to take the same action against issuers.

Note that RBF cannot avoid paying fees here, as the replacement transaction must pay more fees than the previous transaction. In either case, miners will ultimately benefit.

Now back to the role of miners. If willing, miners can prioritize lower fee transactions for inclusion in blocks. In fact, the incentive measures are to give miners as much off-chain fees as possible, so as to sort transactions in a way that does not reveal how much you paid. Miners have a lot of leverage in this protocol.

Conclusion

Runes has led to very high fees in the Bitcoin network. It is difficult to know whether this design is intentional or unintentional, but what we do know is that Runes has been hyped for the past few months, and people have been anticipating it. As one of the first batch of assets issued under the protocol, it certainly has some marketing value.

Sadly, apart from the completely centralized scams of altcoins, the cost of block space congestion is higher, and the current fee of 1000 sats/vbyte is not enough to enter certain blocks. Currently, Rune asset issuance almost covers all other use cases.

That being said, the current speed of Rune issuance is completely unsustainable. In just the first 18 blocks, over $20 million in fees were spent, with most of it used for Rune issuance. At this rate, Rune issuers will spend $150 million per day or $1 billion per week. Frankly, I don't think this situation will last long. Meanwhile, the miners producing these blocks must be very happy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。