Translation:

Original text translation:

Title: Frank, Foresight News

Summary:

- On the surface, the highly anticipated Bitcoin halving event has historically been bullish;

- However, considering the limited number of halving events that can be studied and observing Bitcoin's performance in the overall market environment more carefully, it is difficult to make any high-certainty judgments based solely on the halving event itself;

- Overall, from a supply perspective, Bitcoin halving may not be a tradable event, but it has structural bullish factors. If there is appropriate macroeconomic support, Bitcoin may rebound again after halving;

The consensus on Bitcoin halving is bullish, and it is generally considered a tradable event, but is this really the case? In this report, we have conducted in-depth research on past halving events and analyzed supply and macro data for the 2024 halving to obtain comprehensive information about what this widely predicted event means for investors.

What is Bitcoin Halving?

Halving is a pre-programmed event in the Bitcoin network that refers to halving the rewards for Bitcoin miners. This is an important mechanism in Bitcoin's monetary policy, ensuring that only 21 million BTC will ultimately enter circulation to prevent inflation and reduce the issuance rate of new BTC in the future.

This program is updated every 210,000 blocks, roughly every four years. When Bitcoin was launched in 2009, the mining reward was set at 50 BTC. With the current halving being the fourth, in addition to the previous three halvings (in 2012, 2016, and 2020), the reward has now decreased to 3.125 BTC per block.

It is well known that Bitcoin uses the Proof of Work (PoW) consensus mechanism to verify and protect transactions on the blockchain. In PoW, miners compete to solve complex mathematical problems, and the first miner to solve it correctly can add the next transaction block to the blockchain.

As compensation for verifying transactions and adding blocks to the blockchain, the winning miner receives newly created Bitcoin as a reward—this reward is "halved" in today's halving event.

The Harsh Reality of "Halving" in History

On the surface, halving has been proven to be very beneficial for BTC in history.

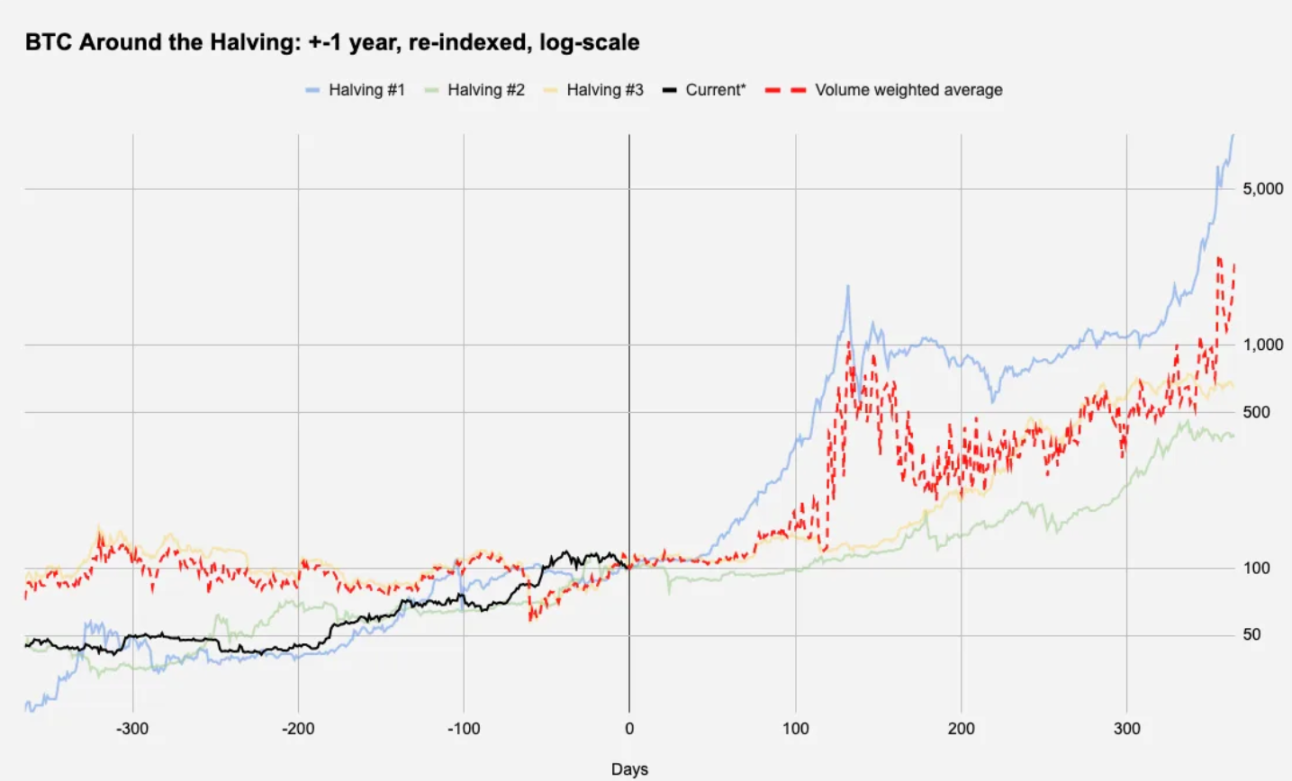

The above chart shows the historical price trends of BTC before and after each halving day (ranging from 1 year before to 1 year after halving), with the red dashed line showing the volume-weighted average of past halving events, and the black line showing the current BTC data.

The following table summarizes the relevant data. Note: Day 0 on the horizontal axis = halving date, and Day 0 on the vertical axis = 100. In addition, this article uses price data from April 17 for inference.

The logarithmic scale Y-axis in the first chart indicates that halving is a bullish catalyst. However, given that we only have three observations, and the first one was when BTC was only $12.80, and the third one occurred in May 2020—when all risk assets were sharply rising in the Covid rebound, any interpretation of the data seems to require skepticism.

In addition, when we look at the average 1-year return of BTC since mid-2011, except for the first halving in 2012, the 1-year return after other halvings does not seem very satisfactory.

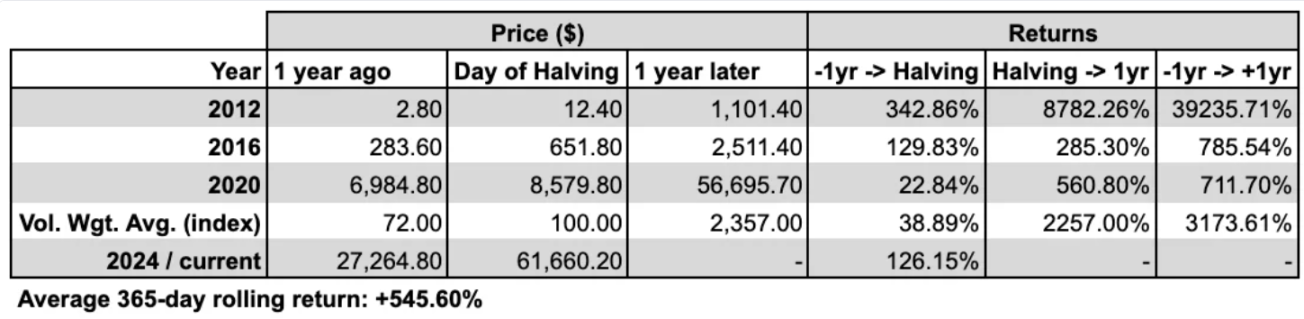

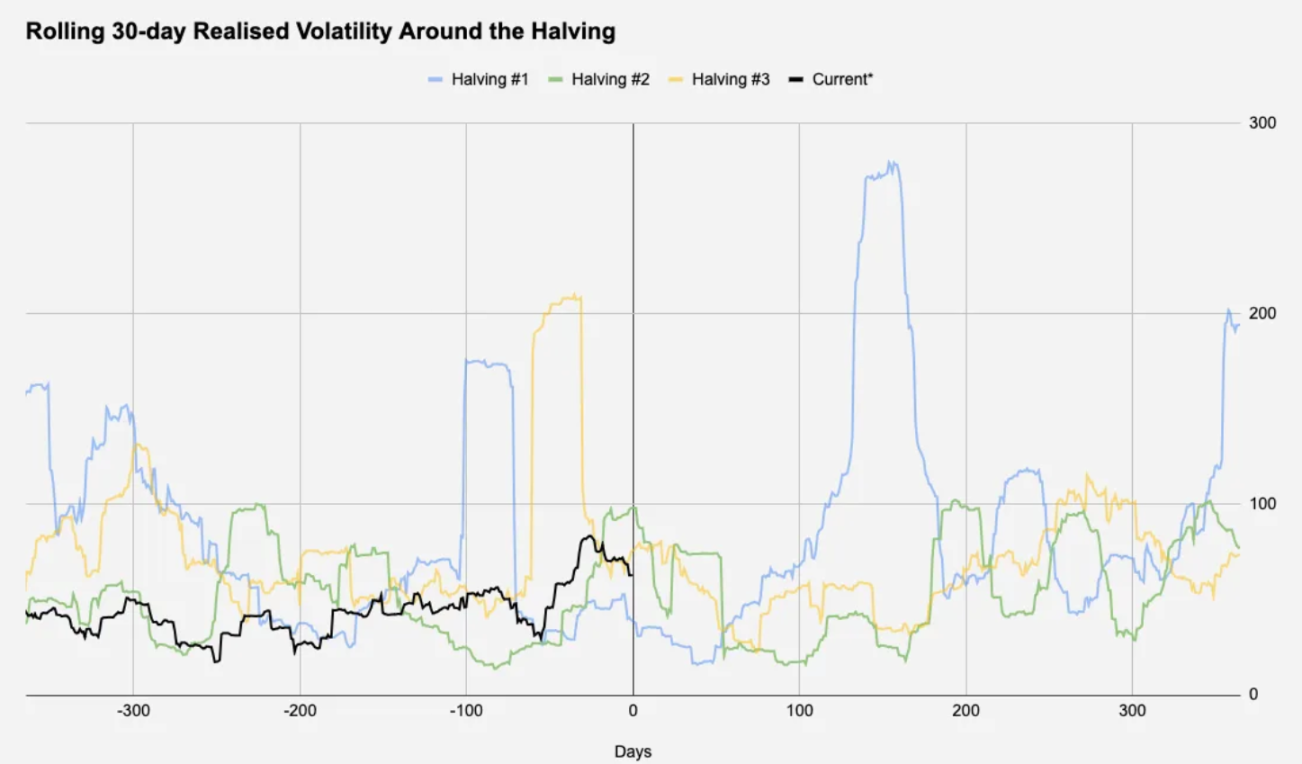

At the same time, the 2020 halving raised an interesting question about the overall performance of the global market. In the following chart, we compared stocks (especially the S&P 500 Index) as a benchmark for risk assets.

While the 1-year average rolling return of the SPX since mid-July 2011 is +11.42% (matching the historical price data of BTC), its 1-year average performance starting from Bitcoin halving exceeds +27%—more than twice the average!

This highlights an important reality that is often overlooked in common narratives. For the same reason, we cannot conclude that "the program update in the Bitcoin network that halves the rewards for miners is very beneficial for the S&P 500 Index," and we may not be able to make a truly conclusive statement from Bitcoin's past performance.

Otherwise, through certain indicators, such as the hit rate exceeding the average performance, you can even conclude that the positive impact of Bitcoin halving on the S&P 500 Index is higher than on Bitcoin itself!

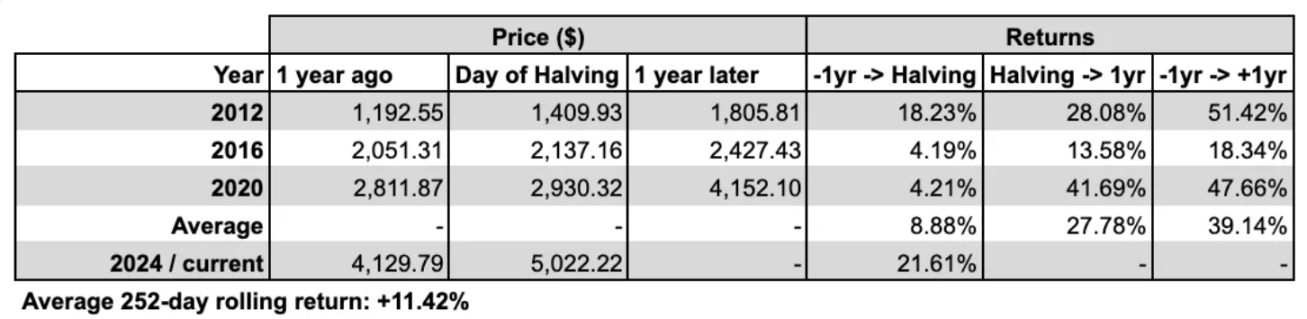

At the same time, for those interested in volatility, the data shows that volatility does not seem to have a clear relationship with the halving date or period. The following chart shows the actual volatility 30 days before and after the halving date (±365 days):

2024 Halving Theme #1: Long-term Holders

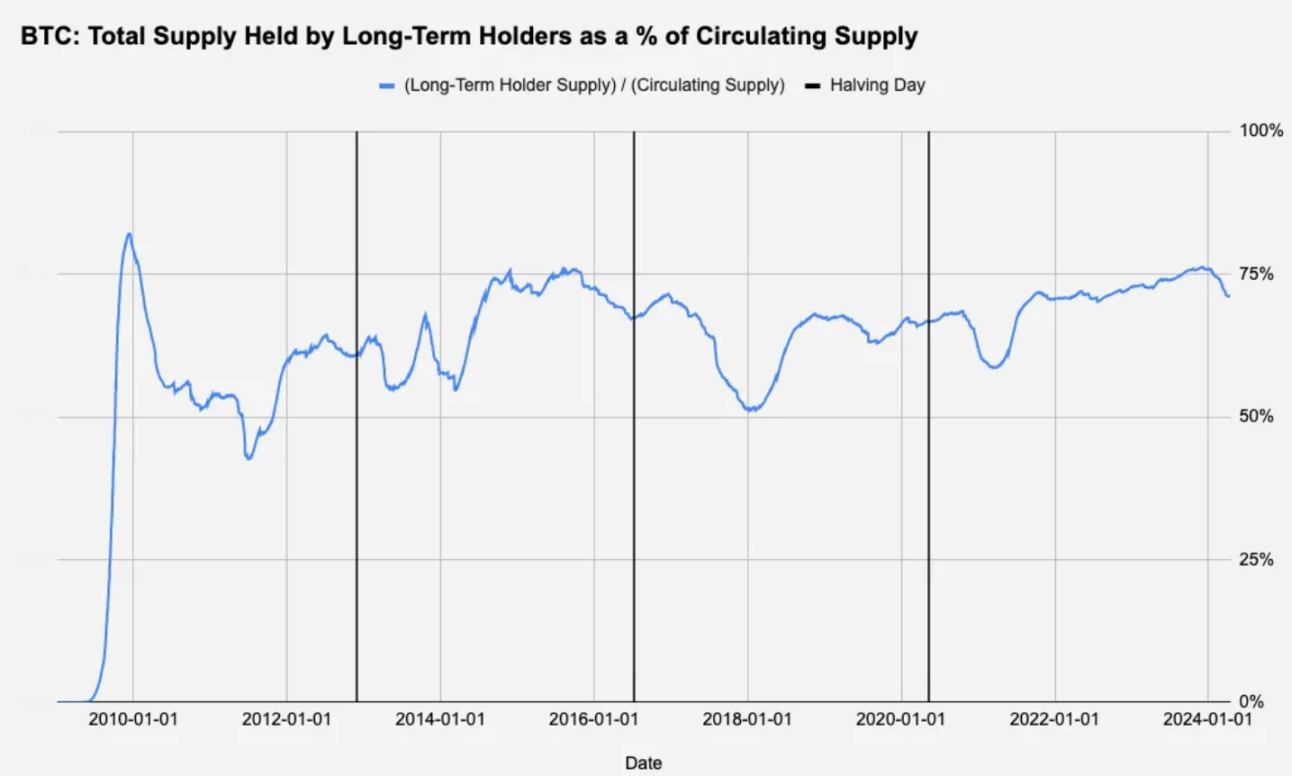

Here, we look at the total amount of BTC held by long-term holders and adjust it based on the supply of BTC.

Considering that the circulating supply of Bitcoin will continue to increase until it reaches the hard cap limit of 21 million BTC, we divide the number of long-term holders by the current circulating supply to view the holdings as a percentage:

Although the situation in 2020 is subtle, Figure 5 indicates that long-term holders may take profits before the halving, and a decline may also occur in 2024. This selling dynamic is usually attributed to miners; as the halving essentially reduces the income from each block by 50%, miners typically sell part of their treasury to upgrade their hardware for more efficient mining. This structural selling pressure may be happening now as we approach the 2024 halving.

Although the situation in 2020 is subtle, the above chart indicates that long-term holders may cash out before the halving, and this situation also occurred in 2024.

This selling choice is usually attributed to miners—since the halving essentially reduces the income from each block by 50%, miners typically sell part of their stored BTC to upgrade their hardware for more efficient mining, and this structural selling pressure may be happening now.

2024 Halving Theme #2: Exchange BTC Balances

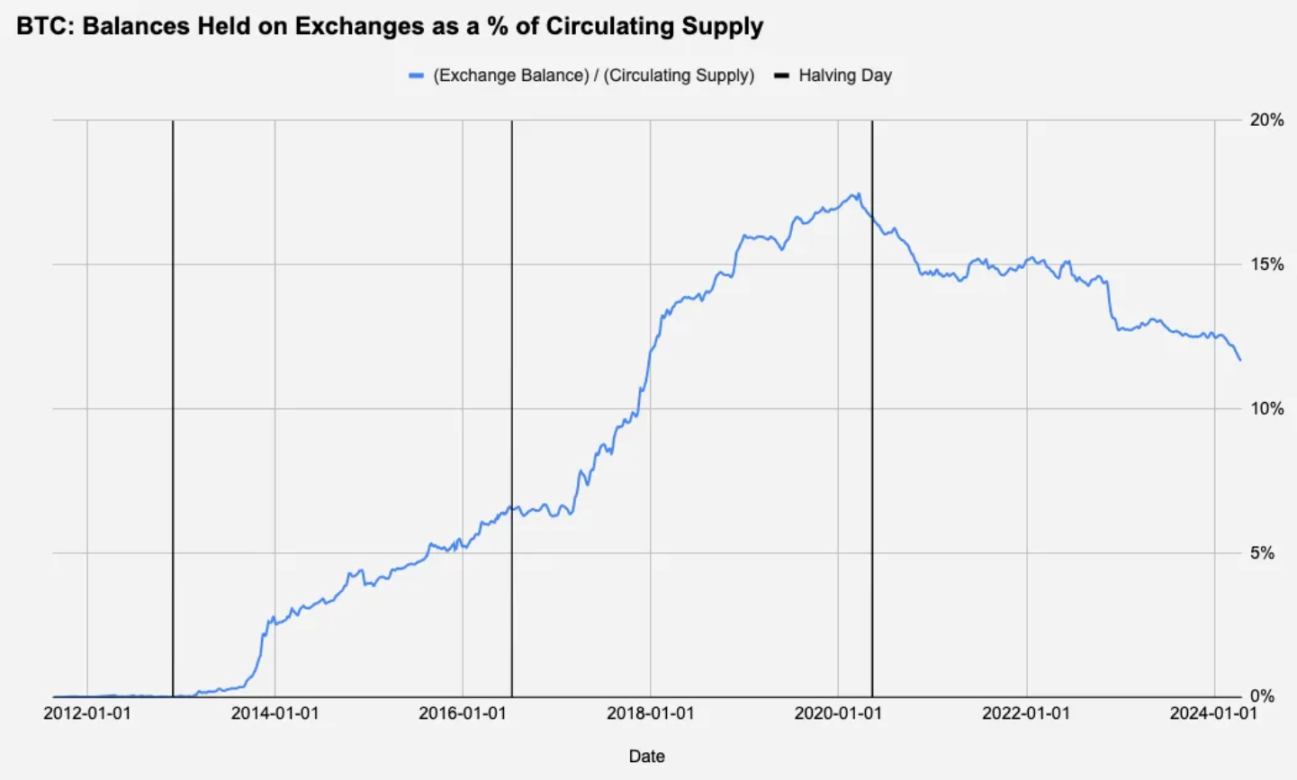

Although exchanges do not make directional bets, we still look at the reserves of BTC held by exchanges (and possibly their internal market makers) to see if there is any followable pattern around the halving day:

The above chart divides the total supply of Bitcoin held by cryptocurrency exchanges by the circulating supply at the time, and there doesn't seem to be anything interesting. The only observable trend is a long-term trend—after about 6 years of accumulation, the amount of BTC held by exchanges has steadily decreased with the start of the last bull market.

2024 Halving Theme #3: Macro Background

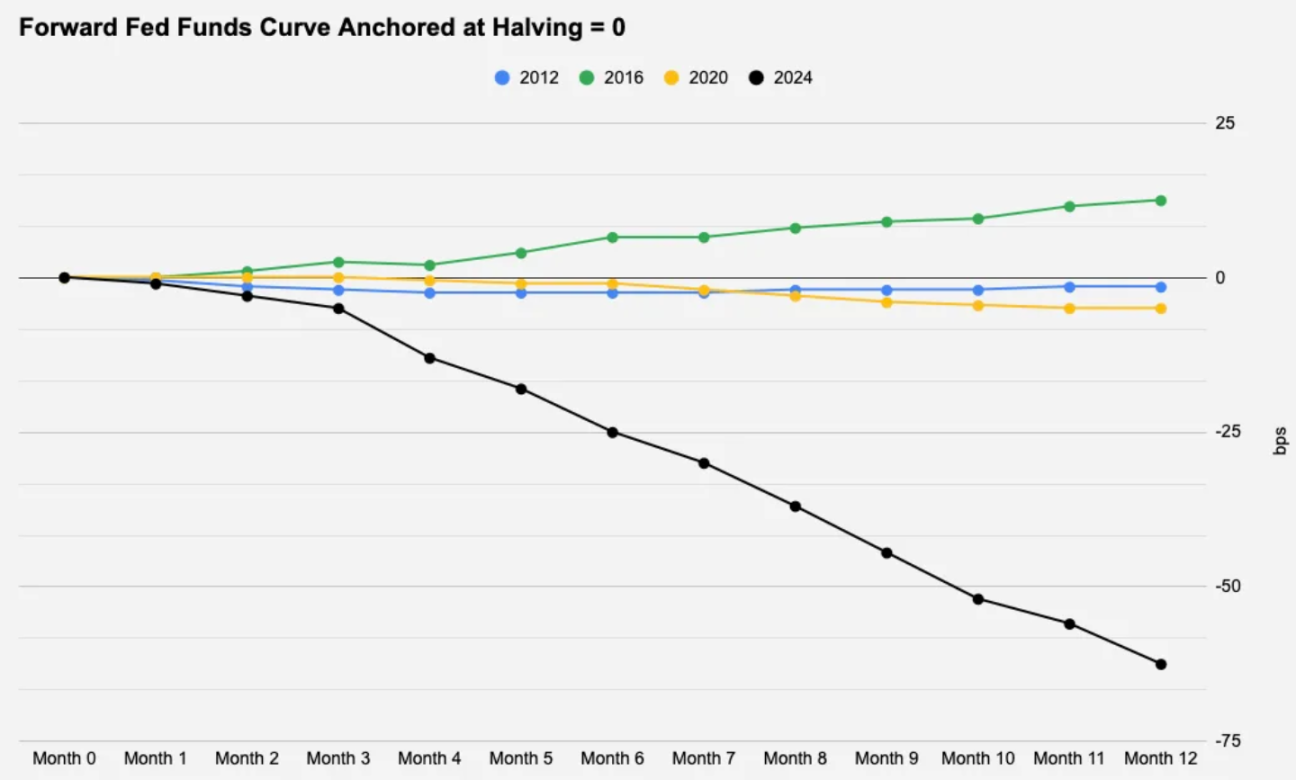

The correlation between macro conditions and Bitcoin is often debated, but macro cycles, especially dollar liquidity (as a function of monetary policy/interest rates, risk appetite, etc.), remain the primary driver of asset prices in the medium to long term. With this in mind, we carefully studied the market pricing corresponding to the future 12-month federal funds rate after the halving day in the following chart.

It is evident that the 2024 halving is an outlier, with almost 3 rate cuts priced in, or more simply put, the market has anticipated any form of interest rate change.

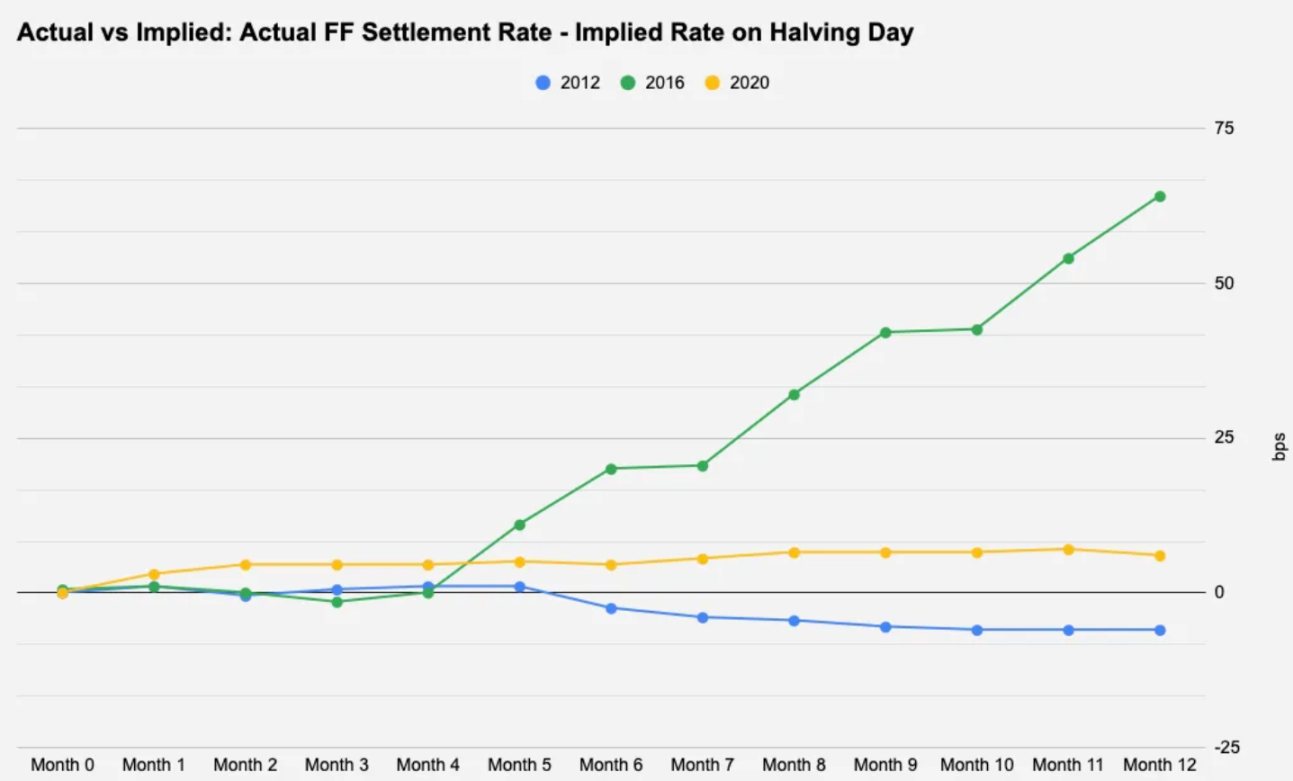

Rate cuts are usually favorable for risk assets, but for price trends, what is important is often not the factors already priced in, but the degree of deviation from market expectations—whether it's inflation data or the statements of the Fed chairman. In the following chart, we compare the difference between the actual settled implied interest rate and the market expectations for each halving day to assess the accuracy of forward-looking pricing in the previous chart.

The data for 2012 and 2020 is quite unremarkable, with a difference of +-10 basis points from the initial expectations, but 2016 is worth studying because the Fed raised interest rates twice at that time, and the market did not price it in.

Interestingly, the previous charts show that the 12 months after the 2016 halving were the worst performing month for BTC in the first three halvings, and the only month with a performance lower than its 1-year average return. Therefore, as the market has already priced in two or more rate cuts in the next 12 months, the more important driver after this BTC halving may be sustained U.S. inflation or anything else that might encourage the Fed to continue to hold off on rate cuts.

Conclusion

We briefly explored the unique macro background of this halving, but other considerations—such as the recent launch of spot BTC ETFs—were not mentioned in this report. With all the attention BTC has recently attracted, this is definitely the most anticipated halving so far. The widespread institutionalization of BTC introduces new participants and may change the dynamics of supply and demand and price trends. It is worth noting that the newly launched ETF holds over 4.1% of the circulating supply of BTC, and MicroStrategy holds over 1% of the supply.

Given that there have only been three halvings before, it is difficult to draw statistically significant conclusions from past performance to determine if this is a tradable event. However, structurally and from a supply perspective, this is undoubtedly a bullish event.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。