How to outperform more than 90% of investors? First of all, you must be completely opposite to 90% of people in many aspects. It's what we often call anti-human nature.

For example, when others like to go with the flow, you don't. When others like to sing praises for something, you tend to take a contrary view. This kind of reverse thinking and habits, this psychological habit is the first thing you must have. Another important point is that most people are lazy to learn, which is actually a common trait of contrarian people, one of which is that their thinking is relatively simple. They are afraid of complexity. Therefore, a person who wants to trade well must be diligent in thinking and researching, not afraid of hardship. They should take pleasure in thinking in order to have a chance to become a winner in this market.

Of course, most people like to know what to do. Just give me an answer, tell me which coin will rise tomorrow, don't bother me with so much, just tell me what to buy. Most people are like this, but it is precisely the minority who don't care about the answer, but care more about the logic behind the answer and the reasons behind it. Why don't they care about the answer?

Because the answer will change with the changing situation and environment. The conclusion given today may be invalid tomorrow, so it's meaningless for me to listen to your answer. But this kind of thinking hits the inertia of most people, that is, I have to ponder, I have to learn. When they hear they have to learn, they have to research, they have to think, many people feel weak. This is a characteristic of most people losing money, so we say that in order to break free from these 90% losers.

First of all, you have to be diligent in thinking. Your personality, at least in terms of investment behavior, you must be against the majority. Of course, it's not that going against the flow is always right, but you must have this kind of character first, then you have a chance to figure out how to defeat the 90% of people.

Bitcoin Last night, after rebounding to 64117, Bitcoin continued to fall. As of the time of writing, it is testing the previous low of 59678 again. I have also mentioned that the overall trend on the weekly and even monthly charts has not been completed yet. At present, we can only speculate on the rebound in the short term, with less than 23 hours left until the halving. Currently, the overall trend on the internet is bearish. However, everyone is betting on a decline to 53000-55000 or even 50000. Here, I want to remind you to pay attention to a rapid rebound after a quick decline. This is a characteristic of a bull market, washing out retail investors before a possible rally.

The weekly KDJ has turned downwards, the OBV indicator has crossed below the yellow line, and the RSI indicator has fallen back into the bearish zone overall. If the rebound fails to go up, do not chase after short positions. The daily MACD histogram continues to be below the zero axis, and other indicators also lean towards bearishness.

Although there was a slight rebound on the 4-hour chart, the market plummeted after that. The current low is close to the previous low, and the bottom is around 60000, with a pin at 59000. For now, it seems that the support is still there. Therefore, if it falls to the 50,000 range, it is a good opportunity for medium to long-term layout. In extreme conditions, if it falls below 49000 and fails to recover, you should also exit. It is worth noting that institutions such as BlackRock have an average ETF price of 55000. If it falls below 49000 and cannot recover, they will also suffer losses, which will be quite troublesome to guard against. Support: Resistance:

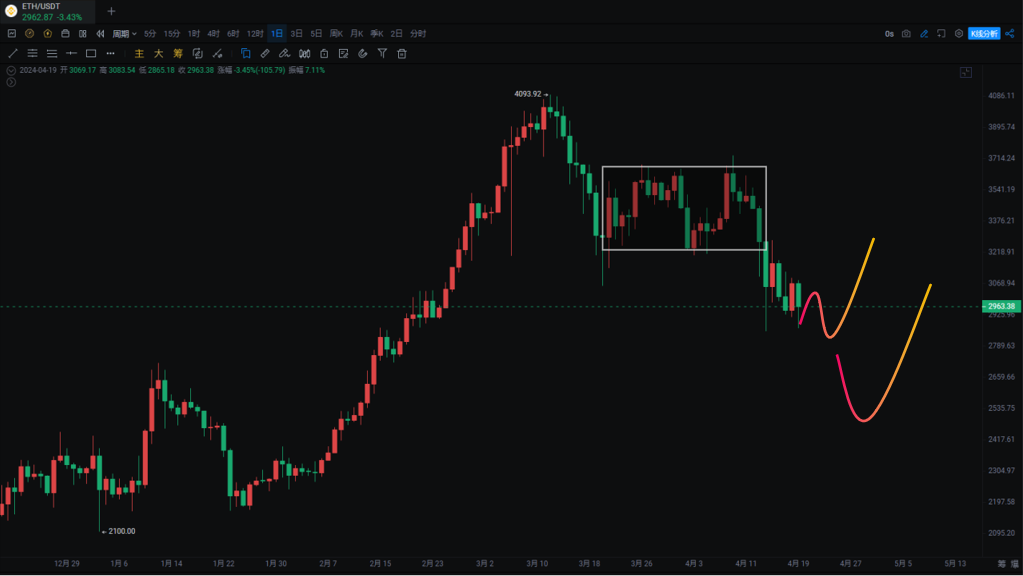

Ethereum Ethereum has fallen to near the previous low. It was previously mentioned that the rebound would not exceed 3678, and the downward C wave is inevitable. If it falls to 2500-2600, which is equidistant from the A wave, it is normal. The Fibonacci 0.786 (2581) is the support level. The daily technical indicators are worse than Bitcoin, and what's even worse is that the ETH/BTC exchange rate has hit a new low of 0.046 and is still at 0.047 after the rebound. It is best to pray that Bitcoin can hold or not fall too deeply, otherwise, those holding altcoins will be back to square one. Support: Resistance:

If you like my views, please like, comment, and share. Let's go through the bull and bear markets together!!!

The article is time-sensitive and is for reference only, with real-time updates.

Focus on candlestick technical research, win-win global investment opportunities. Public account: Trading Master Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。