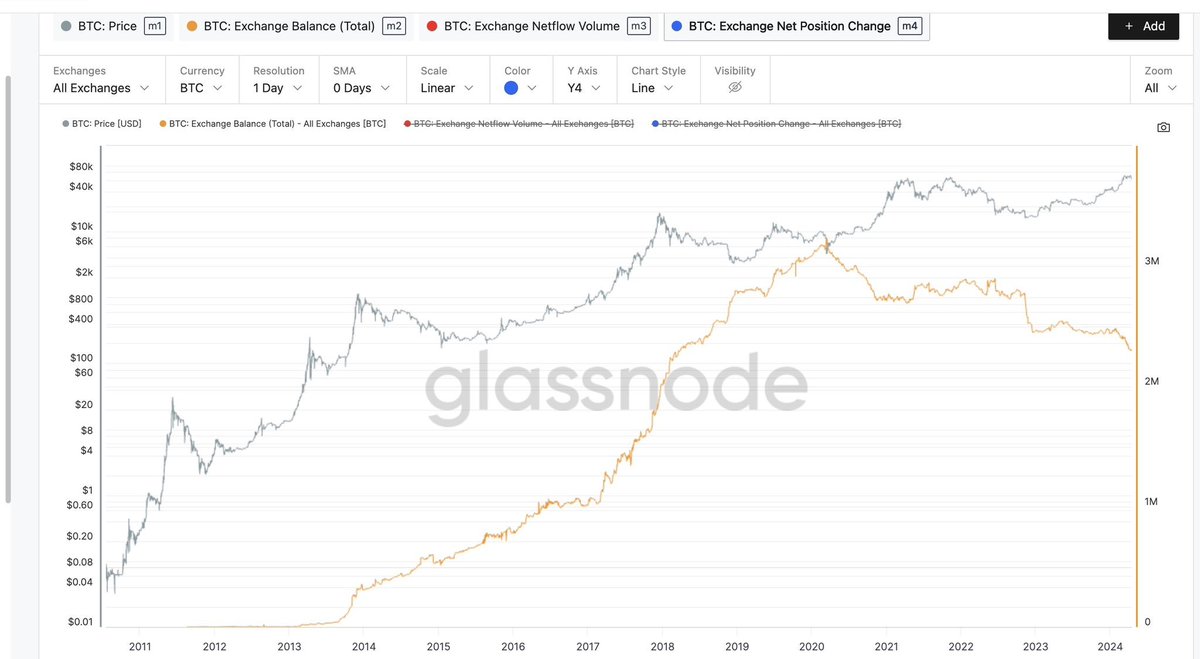

The inventory of BTC on the exchange is actually being explained every day. This thing can't be explained clearly, but the key point is still that if the inventory of #BTC on the exchange is continuously increasing, it indicates panic selling or investors wanting to exit in the short term are starting to increase. Conversely, it indicates that more investors buying in now are not eager to sell.

However, the inventory of BTC on the exchange is not equal to the price of BTC. Some friends said that the inventory of BTC has been declining since 2021, but from the detailed data, during the bull market process in 2021, the inventory of BTC on the exchange was basically fluctuating, almost in a straight line, and there was no particularly obvious reduction.

But it is obvious that there has been a decline since 2022, because the price has been consistently decreasing, especially by the end of 2023. By 2024, it should correspond to the increase in inventory in 2020, which is before the halving. However, in reality, not only did it not increase, but it also decreased. So, my personal judgment is that more investors are not willing to sell, including the current situation, where users are basically in a situation of hoarding.

This is also the reason why there has been a continuous refresh of the lowest inventory value in the past six years. Of course, this is also because there is no actual negative information. Although the Federal Reserve has been hesitant, there are still expectations for the three interest rate cuts. However, with the escalation of geopolitical conflicts, there may be additional impact on inflation and the Federal Reserve, which is also a negative sentiment for users.

Finally, regarding the inventory of USDT on the exchange, to be honest, it is not very significant. At the most bearish time in 2022, the total inventory funds on the exchange were already able to boost BTC to $69,000, which means that the inventory funds at that time were the same as in 2021 when BTC was at $69,000. However, more inventory funds do not necessarily mean that there will definitely be purchases, nor does it mean that this money is definitely related to the coin market.

So, relative to USDT, I would recommend paying more attention to the data of USDC.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。