Original | Odaily Planet Daily

Author | Wenser

From April 12th to 14th, the cryptocurrency market suffered a significant downturn due to the impact of the situation in the Middle East, with widespread losses.

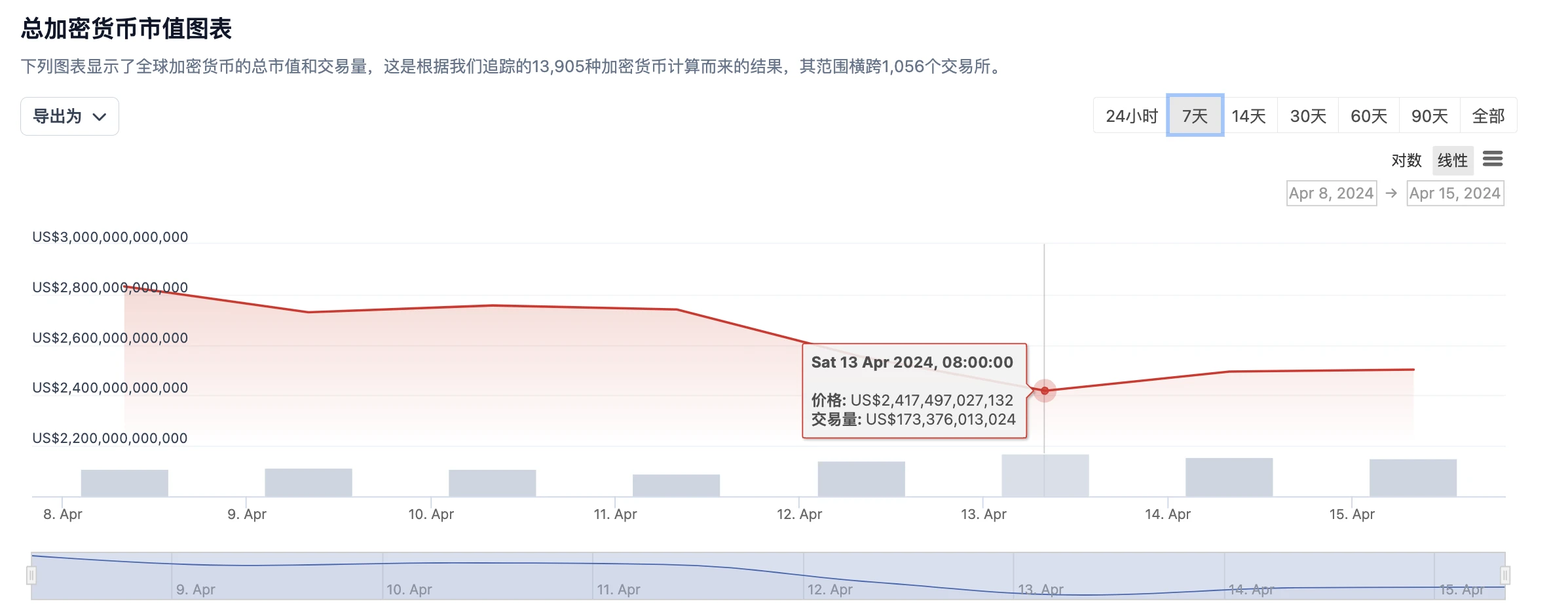

Coingecko data shows that the overall market value of cryptocurrencies once fell below $2.5 trillion, with BTC falling below $61,000 at one point; ETH fell below $2,800 at one point; SOL fell below $120 at one point. The pullback of altcoins was even more severe, with mainstream currencies such as MATIC, XRP, DOGE, BCH, etc., all experiencing declines of over 30%, and the previously popular MEME coin BOME even experiencing a decline of over 50%.  At the time of writing, due to the impact of the risk asset sell-off in the U.S. market, the price of BTC once again fell to around $63,000, the price of ETH once again fell to $3,100, and the price of SOL once again fell to around $138. Combined with the many altcoins that have not fully recovered, Odaily Planet Daily has compiled a "bottom fishing list" for everyone to discuss. (Odaily note: The recent market fluctuations have been significant. The following content is for sharing perspectives only and should not be considered as investment advice. Please pay attention to asset security and choose investment targets carefully.)

At the time of writing, due to the impact of the risk asset sell-off in the U.S. market, the price of BTC once again fell to around $63,000, the price of ETH once again fell to $3,100, and the price of SOL once again fell to around $138. Combined with the many altcoins that have not fully recovered, Odaily Planet Daily has compiled a "bottom fishing list" for everyone to discuss. (Odaily note: The recent market fluctuations have been significant. The following content is for sharing perspectives only and should not be considered as investment advice. Please pay attention to asset security and choose investment targets carefully.)

Value Coins: SOL, CKB, W

Value investment is a conundrum that every crypto enthusiast cannot avoid. In this cycle, the representative "value coins" of the SOL ecosystem, BTC ecosystem, and cross-chain bridge ecosystem are none other than SOL, CKB, and W.

Despite the impact of the FTX scandal, SOL still relies on its strong Memecoin ecosystem, low interaction costs, and continuous development to gradually become an indispensable part of the current market. Therefore, compared to its recent high of $200, SOL still has a certain value for bottom fishing.

CKB is completely influenced by the RGB++ ecosystem and serves as the best bridge between the BTC ecosystem and the Nervos ecosystem. The birth of the first protocol asset SEAL in the RGB++ ecosystem caused CKB's price to briefly exceed $0.036. Therefore, with the continuous improvement of the asset issuance system and the feedback from the BTC ecosystem, CKB also has some room for upward movement.

W is a riskier choice for bottom fishing, with its low point dropping nearly 20% from its high point, and even halving at one point. However, in the long run, Wormhole's position in the cross-chain bridge ecosystem is evident. Therefore, although we may find it difficult to predict the specific timing of its resurgence, we can now include it in the watchlist and look for opportunities to bottom fish.

Restaking: PENDLE, ENA, ETHFI

As the "only lifesaver in the Ethereum ecosystem," Restaking played a crucial role from the second half of 2023 to the first quarter of this year. On the one hand, it provided an outlet for the excess liquidity of Ethereum's large holders, whales, and institutions. On the other hand, it offered small retail investors an opportunity to enter with a large total supply and low circulation, at least providing a certain beta return.

Therefore, PENDLE, ENA, and ETHFI are relatively cost-effective choices in this track. Although the recent declines of the three have been relatively small, in the long run, whether the news of the Ethereum spot ETF is approved or not, it can to some extent help them maintain an upward trend.

RWA: ONDO, MKR

As the intermediary tokens connecting real-world assets and virtual assets, the leaders in the RWA track are currently ONDO and MKR. The former is a synonym for the RWA track that has partnered with BlackRock Fund, and the latter is a well-established DeFi organization that has been consistently repurchasing, thus also having a certain value for bottom fishing.

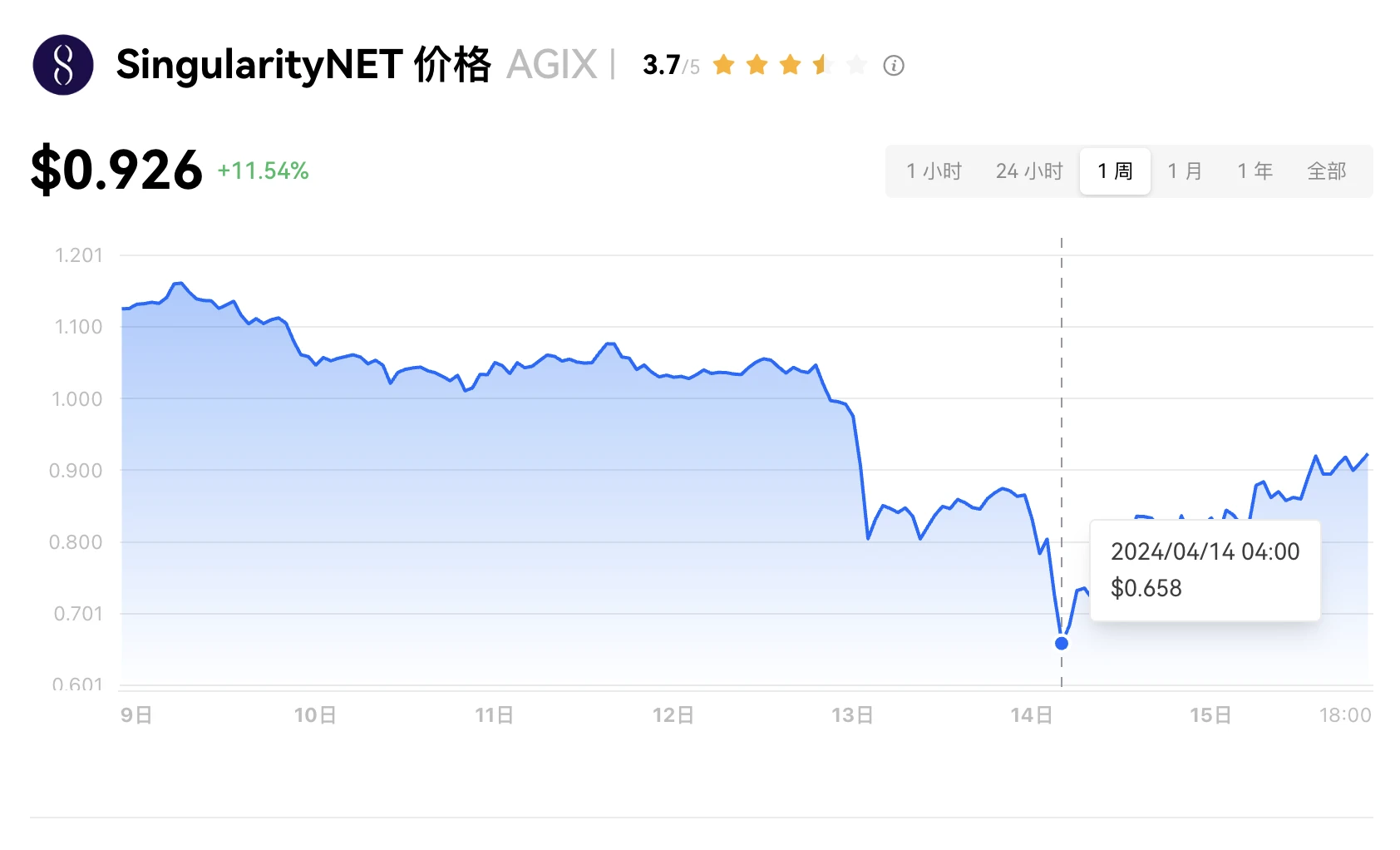

AI: WLD, AGIX

Although the AI track is still in the peak of the bubble, it is still a hot track for the present and the future, so it cannot be ignored.

Among them, although the price of WLD has fallen from its high point, it still holds a leading position in the concept of AI coins, so it can be considered for bottom fishing. AGIX benefits greatly from its token name, making it very speculative, and its main concept is "a decentralized artificial intelligence platform and market aimed at building a protocol that connects artificial intelligence and machine learning tools and forms effective applications," which aligns with the development trend of AI X Web3 concepts and is also suitable for bottom fishing considerations.

Memecoin: SLERF, BOME, DEGEN

In addition to the above-mentioned tokens showing good rebound momentum, as the representative track of this cycle, the performance of the top players in the Memecoin track is also quite impressive, especially SLERF, BOME, and DEGEN.

In addition to the impact of Drama's opening and the infectiousness of Meme, SLERF's locked LP and continuously deflationary economic model have led to increasing market expectations for it. Therefore, after experiencing a low point of around $0.22, it has now risen to around $0.35.

BOME is the top Memecoin in the SOL ecosystem, and compared to projects like WIF, its price is lower, making it relatively more valuable for bottom fishing.

The bottom fishing logic for DEGEN is based on Fracaster's social ecosystem and Degen Chain's Layer3 ecosystem. It is both an incentive token and native gas, and there is still room for further upward movement. If there are any players in the Base ecosystem worth looking forward to, DEGEN is definitely at the forefront.

Conclusion

Of course, the above are only subjective conclusions drawn from personal observations of the recent market trends. In the short term, the future trends of many cryptocurrencies, including BTC and ETH, are still full of great uncertainty due to the influence of global political situations and economic patterns. However, one thing is certain: this cycle is not over, and the bull market has not declared its end. Therefore, remain patient, face it optimistically, and see you in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。