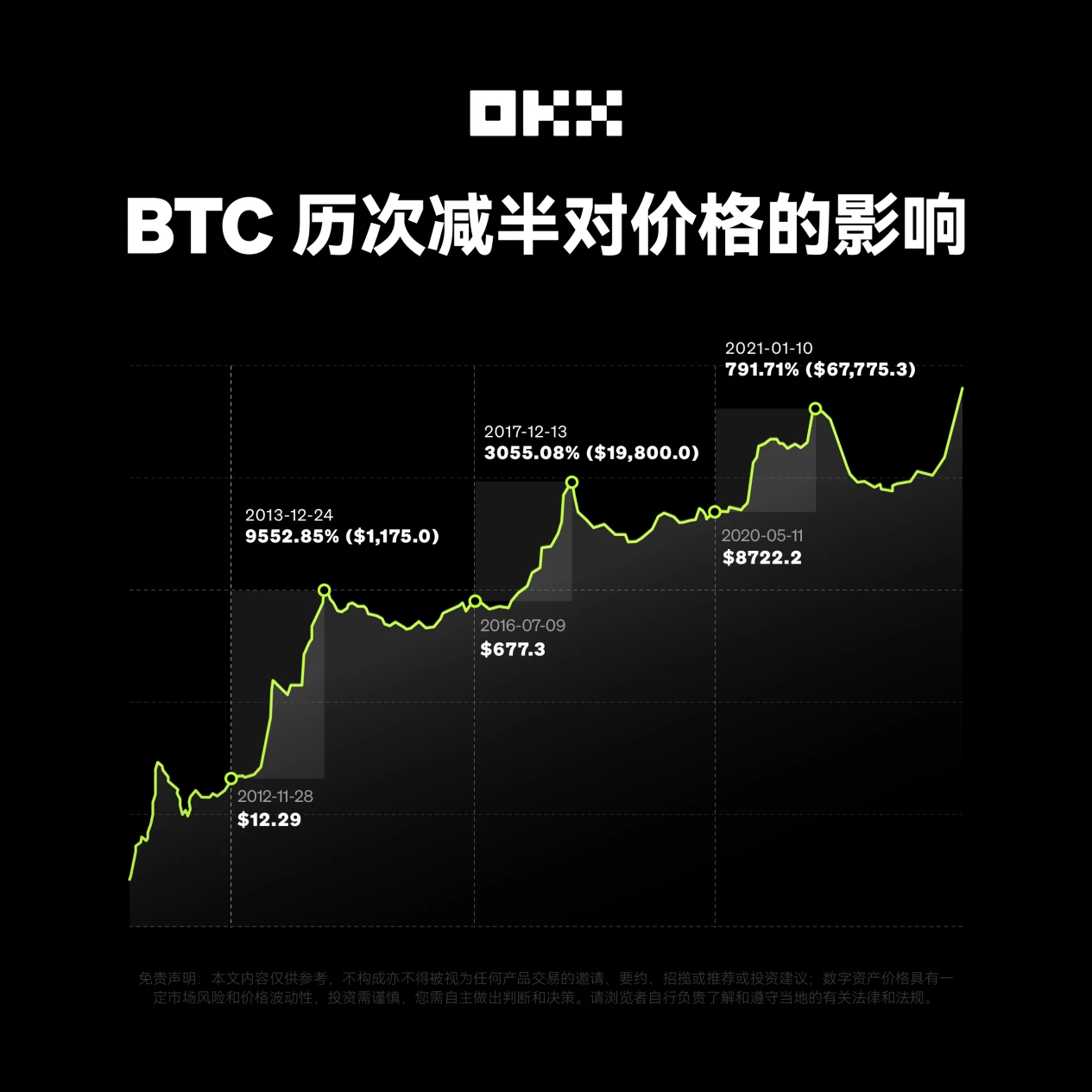

Looking back, since its birth in 2009, Bitcoin has experienced three halving events. The first halving occurred in November 2012, when the block reward decreased from 50 BTC to 25 BTC. The second halving took place in July 2016, further reducing the block reward to 12.5 BTC. Subsequently, Bitcoin began to gain more mainstream recognition and adoption, and following the supply and demand dynamics, the price of Bitcoin surged significantly after the second halving. Although there is no evidence to prove that halving drives price changes, the expectation of the "halving effect" has begun to deeply resonate with people.

In May 2020, Bitcoin welcomed its third halving, reducing the mining reward to 6.25 BTC. This was the most unique halving cycle, occurring during a global pandemic and macroeconomic adjustment period, with multiple and complex factors affecting market trends. Now, the fourth halving is approaching.

Historical data shows that after the first two halvings, the price of Bitcoin experienced significant growth. Past data to some extent provides a reference for observing and predicting its future market trends.

What are the differences in this halving compared to the past?

The rise in the price of Bitcoin has always been related to macroeconomic cycles, supply and demand dynamics, regulatory policies, and ecological innovation. Halving mainly involves changes in supply and demand dynamics, which is not significantly different from previous halvings. However, it is important to note that the approval of Bitcoin spot ETFs and the emergence of related innovations are driving structural changes in the Bitcoin market.

According to SoSoValue data, Bitcoin spot ETF had a total net inflow of $179 million on March 28. Grayscale's (GBTC) net outflow was $104 million yesterday, with a historical net outflow of $14.77 billion. The Bitcoin spot ETF with the highest net inflow yesterday was BlackRock's IBIT, with a net inflow of approximately $95.12 million, and a historical total net inflow of $13.96 billion. As of the time of writing, the total net asset value of Bitcoin spot ETF is $59.1 billion, with an ETF net asset ratio (market value as a percentage of total Bitcoin market value) of 4.25%, and a historical cumulative net inflow of $12.12 billion. The continued adoption of Bitcoin ETFs may significantly absorb selling pressure, potentially reshaping the market structure of Bitcoin and providing a new source of stable demand.

In fact, it may be worthwhile to look at the development trend of gold ETFs to glimpse into the future of Bitcoin spot ETFs. In November 2004, the first gold ETF in the United States, SPDR Gold Shares (GLD), was born, accumulating over $1 billion in assets within three days. In its first year, GLD's assets under management (AUM) quickly rose to over $30 billion. By 2023, the global gold ETF's assets under management had reached approximately $150 billion, proving the profound and lasting impact of these investment tools on the gold market.

In addition, the emergence of inscriptions has revitalized on-chain activities. As of February 2024, over 59 million NFT-like collectibles have been inscribed, bringing in over $200 million in transaction fees for miners. With the continuous launch of Bitcoin ecological innovation protocols such as Runes, the vitality of the Bitcoin ecosystem is likely to be further stimulated.

Of course, more importantly, as the cornerstone of Crypto, Bitcoin has a strong global consensus on value.

Currently, the cumulative number of Bitcoin addresses has exceeded 1.2 billion. According to tokenterminal, the monthly active user count for Bitcoin is approximately 13.7 million, and the on-chain transfer data is 17.5 million. In terms of on-chain data growth, the size of Bitcoin's blockchain is approximately 507GB, an increase of 70% from three years ago. All of these reflect the explosive growth in the usage of crypto assets, especially Bitcoin.

Moving into the new era of the Bitcoin ecosystem with long-term builder OKX

As an active builder of the Bitcoin ecosystem, the OKX research and development team has always been inspired by the origin of Bitcoin and its geek spirit, which is the core reason why OKX has been able to enter the field and support ecosystem development at the earliest opportunity.

Since last year, the birth of the Oridinals protocol and the BRC-20 token standard has brought about a craze for inscriptions, redirecting attention to the asset issuance protocols on Bitcoin, leading to the emergence of diverse asset issuance protocols such as Atomicals, Runes, BTC Stamps, and Taproot Assets, as well as the creation of ARC-20, SRC-20, and ORC-20. Essentially, the inscription track has brought a new model of fair launch to the market, bringing significant attention to the Bitcoin ecosystem and reigniting interest in the Bitcoin ecosystem.

In addition to asset issuance protocols and scaling solutions, there are increasingly more projects emerging in the infrastructure sector, such as wallets that support inscriptions, decentralized indexers, cross-chain bridges, launchpads, and more. The OKX Web3 team has been continuously exerting efforts in the first layer of asset issuance protocols and the construction of application layer infrastructure, previously leading in supporting the Ordinals market.

As early as July last year, the OKX Web3 Ordinals market had become the largest marketplace for BRC20 token trading volume. With the continuous development of the Bitcoin ecosystem, the OKX Web3 team has been actively involved in the construction of the Bitcoin ecosystem in various aspects, from wallet tools, browsers, trading markets, protocol standards, cross-chain bridges, to Bitcoin Layer2, and more. On one hand, OKX DEX has supported Bitcoin cross-chain transactions early on. In terms of second-layer scaling solutions, OKX Web3 has been continuously supporting the integration of related projects, such as Babylon, Merlin, and B². Additionally, it is worth noting that the OKX Web3 wallet has launched the Runes market page, and will support the protocol at the earliest opportunity, allowing users to mint and trade assets under the Runes protocol.

Currently, OKX Web3 provides users with a one-stop experience for exploring the Bitcoin ecosystem. Users can easily acquire and trade assets through the Web3 wallet, discover and participate in popular projects in the Bitcoin ecosystem, and directly access the DeFi section to achieve on-chain staking of Bitcoin assets and enjoy on-chain rewards with low gas fees.

Furthermore, as an investment fund under OKX, OKX Ventures is committed to supporting the innovative development of the Bitcoin ecosystem and has already invested in projects such as ALEX, B^2 Network, Bitmap Tech, Babylon, bitSmiley, BounceBit, Nubit, Portal DeFi, and Zeus Network. According to previous reports, OKX Ventures will allocate $10 million to continue investing in and supporting emerging entrepreneurs in the BTC ecosystem, accelerating the improvement of blockchain technology, and providing services and resources to help partners develop together.

Looking back at the development of Bitcoin over the past decade, each cycle has been an evolution, and OKX, which has accompanied and provided strong support for the development of the Bitcoin ecosystem, is no exception. The Chief Innovation Officer of OKX once stated in an interview that OKX's team of developers had been studying the Bitcoin whitepaper around 2012, when Bitcoin was only popular in geek circles, and every innovative idea was exciting. Since then, all of OKX's innovations have been inspired by that initial spirit. Today, as Bitcoin enters a new development cycle with the arrival of the fourth halving, OKX will continue to innovate and support the next decade in the field of Web3 business, exchange business, and innovation in the Bitcoin and crypto industry.

Disclaimer

The content of this article is for reference only and should not be construed as an invitation, offer, solicitation, or investment advice for any product transaction. Investment should be made cautiously, as digital asset prices have certain market risks and price volatility, especially in trading such as contract options, which are more susceptible to market risks and price fluctuations, and may even result in the loss of the entire investment amount. Therefore, digital asset trading may not be suitable for all investors, and you should understand the operation mode of the product and make independent judgments and investment decisions. Viewers are responsible for understanding and complying with relevant local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。