Original | Odaily Planet Daily

Author | jk

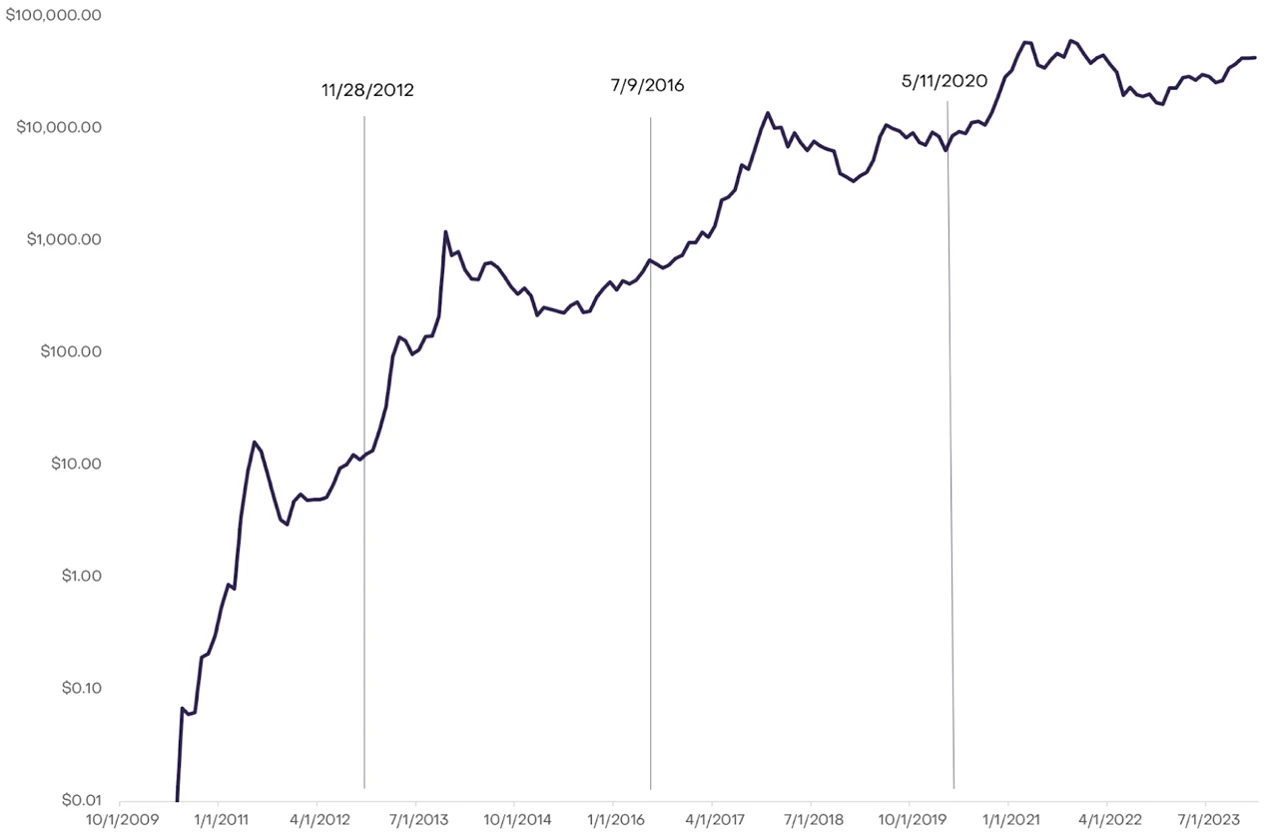

In the past 24 hours, the global cryptocurrency market has experienced a dramatic price fluctuation. From the evening of April 12th to the early morning of April 13th, the market value of major digital currencies such as Bitcoin, Ethereum, and various small tokens has generally declined. This sudden market turmoil has attracted widespread attention from market participants. Analysts are trying to interpret the reasons behind this phenomenon, including possible external economic factors, policy changes, or a sharp change in market sentiment.

Market Summary

From a macro perspective, the total market value of cryptocurrencies has fallen to $2.5379 trillion, with a 7.3% decrease in the past 24 hours. As of the time of writing, Bitcoin is currently trading at $66,814, with a 4.91% decrease in the past 24 hours, and it once fell below $66,000; Ethereum is currently trading at $3,217, with an 8.16% decrease in the past 24 hours, and it once fell below $3,100, with a maximum decrease of 9.34%; SOL fell below $150 and then rebounded to $151, with a 12.57% decrease in the past 24 hours. Other mainstream currencies such as MATIC, XRP, DOGE, BCH, etc., all experienced a decrease of more than 10%.

Bitcoin's price trend on the morning of April 13th. Source: Coinmarketcap

According to Coinglass data, the total liquidation volume in the past 24 hours was $878 million, with long liquidation reaching $784 million.

Reasons Behind the Plunge

In terms of the market, many people are already worried that this may be a precursor to the interruption of the bull market. Currently, there are several different views on the market's plunge:

Some believe that the plunge is due to the pullback before Bitcoin's halving. Several key reasons for the market's pullback before Bitcoin's halving may include:

First, as the block rewards for Bitcoin mining will be halved, miners will receive fewer bitcoins for the same mining work. This potential reduction in income may force them to sell bitcoins at relatively high levels to cover higher operating costs for the next quarter, increasing the supply pressure in the market and thus lowering prices.

Second, market expectations and speculative behavior before the halving event may have driven up prices, and once these expectations are not met, prices may sharply reverse. In addition, if the market has bought in large quantities too early before the event, any minor triggers close to the event could lead to massive profit-taking, resulting in a sharp price drop.

Finally, based on historical patterns and psychological expectations, investors often use historical patterns to guide their current market actions. Given that past halving events have sometimes led to significant price increases, market expectations are high. However, if these expectations start to appear overly optimistic, investors may start selling their holdings before the halving to take advantage of the current high prices, which could lead to a market downturn.

Therefore, although the halving itself is a positive signal for Bitcoin, the uncertainty and speculation before the halving may lead to significant fluctuations and price pullbacks in the market.

From a macro perspective, the Federal Reserve's balance sheet continues to shrink, reducing the supply of dollars in the market. A decrease in dollar liquidity, especially in the global financial system, usually leads to a decline in the prices of risk assets, including stocks and cryptocurrencies. As the cryptocurrency market is very sensitive to changes in liquidity, capital outflows may lead to sharp price declines. In addition, when the market expects the dollar to become scarcer, investors may turn to more stable or traditional assets, reducing their investment in cryptocurrencies.

According to Arthur Hayes' point of view,

It is expected that Bitcoin block rewards will be halved on April 20th. This is usually seen as a bullish catalyst for the cryptocurrency market. I agree that this will push up prices in the medium term; however, the price action directly before and after the halving may be negative. The narrative that the halving is beneficial to cryptocurrency prices is deeply ingrained. When the majority of market participants reach a consensus on a certain outcome, the opposite usually happens. This is why I believe that Bitcoin and general cryptocurrency prices will fall during the halving period.

Considering that the halving occurs during a period when dollar liquidity is usually tight, this will add fuel to the fire for the sale of cryptocurrency assets. The timing of the halving further reinforces my decision to suspend trading until May. …Therefore, I choose to sell.

Despite the current market uncertainty, many investors and analysts remain optimistic about the long-term prospects of cryptocurrencies. They believe that this price adjustment may provide a good opportunity for long-term investors to enter the market. Every market adjustment is a test of investor sentiment and market trends, as well as a layout period for potential future growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。