Summary of Recent Important Fund Situation

1) Stablecoins continue to increase issuance, with an increase of $2.3 billion in the past 10 days. However, the total market value is still $20 billion lower than the last bull market.

2) BTC and ETH continue to flow out from exchanges, with a net outflow of 12,000 BTC in the past 10 days. Since January, the cumulative net outflow has reached 200,000 BTC.

3) Binance and OKEx have had a net inflow of $2.3 billion in stablecoins in the past 10 days, coincidentally matching the increase in issuance.

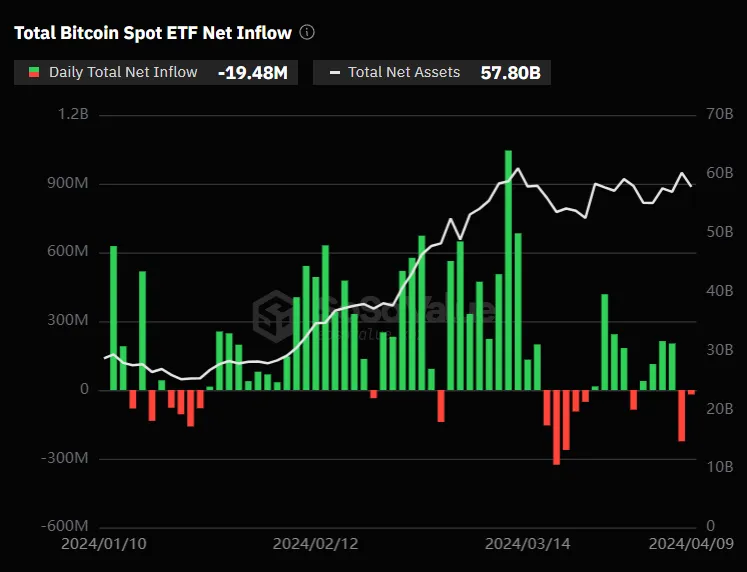

4) The net inflow of BTC ETF has significantly slowed down, with a daily net inflow of around $200 million after April, compared to an average net inflow of $600 million in March.

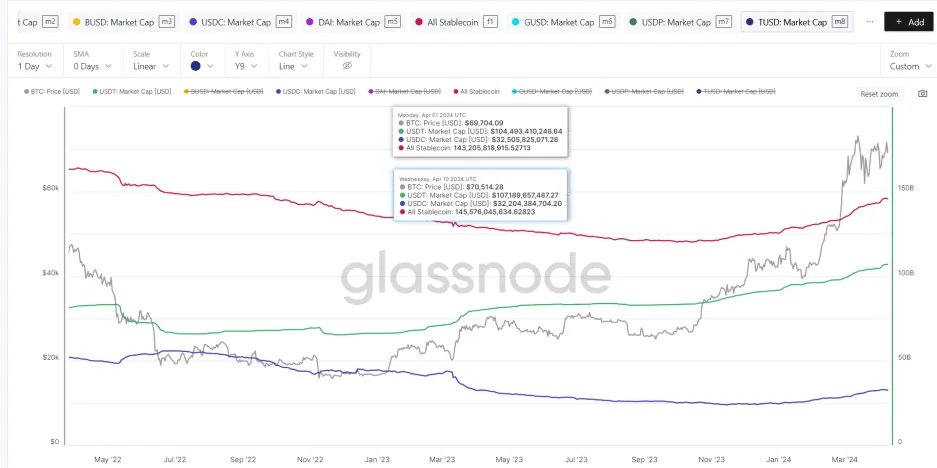

- Total Market Value of Stablecoins

Since April, the total market value of stablecoins has been continuously increasing. The total market value has increased from $143.2 billion to $145.5 billion, an increase of $2.3 billion. For mainstream stablecoins, USDT has increased from $104.4 billion to $107.1 billion, an increase of $2.7 billion. USDC has decreased from $32.5 billion to $32.2 billion, a decrease of $0.3 billion.

Although the total market value of stablecoins has been reaching new highs recently, it still has not reached the height of the last bull market. In March 2022, the total market value of stablecoins reached a peak of $163.3 billion, leaving a gap of approximately $20 billion.

- Inventory of Mainstream Exchange Stablecoins

Regarding the inventory of stablecoins on Binance and OKEx exchanges, Binance has increased by $2.2 billion, while OKEx has increased by approximately $100 million.

For Binance, the inventory of USDT has increased from $23.6 billion to $25.4 billion, with a net inflow of $1.8 billion. USDC has decreased from $1.5 billion to $1.2 billion, with a net outflow of $0.3 billion. FDUSD has increased from $2.0 billion to $2.8 billion, with a net inflow of $0.8 billion.

For OKEx, USDT has increased from $5.75 billion to $5.81 billion, with a net inflow of $60 million.

The net inflow of stablecoins on the two exchanges totaled $2.3 billion, coincidentally matching the increase in the total market value of stablecoins. Of course, it is not possible for the newly issued funds to directly enter the exchanges, but it does indicate the influx of funds.

- Inventory of BTC/ETH on Exchanges

BTC and ETH continue to flow out from exchanges.

Since April, the inventory of BTC on exchanges has decreased from 23.10 million to 22.98 million, with a net outflow of 12,000 BTC. ETH has decreased from 132.5 million to 131.6 million, with a net outflow of 70,000 ETH. Looking at a larger time frame, BTC has been continuously flowing out since January, with a net outflow of 200,000 BTC.

- BTC ETF Situation

The situation of BTC ETF funds has noticeably cooled down since April compared to February and March. There have been two net outflows since April, and even during the inflow periods, the daily net inflow has only been around $200 million. In contrast, the daily net inflow in March was around $600 million, indicating a significant decrease.

BTC #BTCETF

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。