Original | Odaily Planet Daily

Author | Fan Jiabao

A Brief Introduction to RWA

RWA, short for Real World Assets, refers to real-world assets. Different from "virtual" assets on the blockchain such as Bitcoin and Ethereum, RWA is the cornerstone of the DeFi track. The recent hot trend of RWA on-chain or RWA tokenization is to use technological means to put real-world assets (such as real estate, vehicles, and government bonds) on the chain, establishing a connection between blockchain assets and real-world assets, thereby achieving the tokenization of real assets.

For example, the most well-known RWA tokenization projects currently are USDT and USDC. The formation principle of the two is the same: the project company reserves US dollars, then mints the corresponding amount of USDT/USDC, tokenizing the US dollars into stablecoins, thereby achieving the tokenization of the US dollars.

RWA-related projects have established a connection between the blockchain and the real world. For the blockchain, the emergence of RWA provides real assets as the underlying support for a variety of tokens, increasing the stability of the DeFi system. For traditional finance, RWA projects to some extent replace traditional financial intermediaries, increase the circulation channels of assets, thereby increasing their liquidity and reducing asset turnover costs.

Stablecoin project overview, data source: RWA.xyz

Legal Framework of RWA

Since on-chain DAOs cannot directly act as legal entities, there are often inconveniences in signing agreements and liquidating claims. Therefore, for compliance considerations, DAOs have established off-chain foundations as legal entities to manage RWA projects, thus combining the real world and the on-chain world.

In addition, many projects also use SPVs, namely special purpose vehicles. These are independent legal entities established specifically for the corresponding fund pool of the project, serving to isolate bankruptcy risks, among other functions.

Introduction to Different RWA Tracks and the Legal Issues Involved

RWA projects can be divided into three types:

The first type is to put non-securities real assets on the chain. Such as real estate, bulk commodities, vehicles, artworks, etc. This type simply introduces ordinary real assets into collateral, diversifying the types of collateral and ensuring the stability of the underlying assets of the blockchain, thereby guaranteeing the stability of the DeFi system.

In this case, the pledger still owns the assets, but the tokens representing the assets on the chain are pledged, not actually owned and controlled by the pledger. In legal terms, there is a contradiction in ownership—tokens as proof of ownership and the control of real assets are inconsistent.

In other words, because creditors in RWA projects cannot directly control real assets off-chain, they can only control the tokens as evidence on-chain, resulting in a situation where, from the perspective of token control, both parties have a pledge relationship; but from the perspective of controlling real assets, both parties only have a collateral relationship. This directly affects the attribution of interest on the collateral and subsequent enforcement, among other issues.

Moreover, when the collateral is real estate and needs to be registered to declare the mortgage, the situation becomes even more complex. How the project party verifies the authenticity of the collateral and whether it can quickly register as the mortgagee are urgent issues that need to be clarified.

Furthermore, according to legal provisions, real-world assets can be subject to multiple mortgages. This could lead to a situation where the same real asset corresponds to multiple tokens. These tokens can all generate income and can also be used as collateral on-chain again, thus exacerbating the risk in a spiraling nested framework.

Finally, enforcement after credit default is also a major pain point. Civil and commercial defaults require the parties to collect evidence and file lawsuits themselves, and the project party needs to bear high litigation costs and even the risk of cross-border litigation. Even if the enforcement is successful, the liquidity of non-securities assets in the real world is usually severely insufficient, making it difficult to realize and settle the debt in a short period. This makes it difficult for this type of RWA to develop.

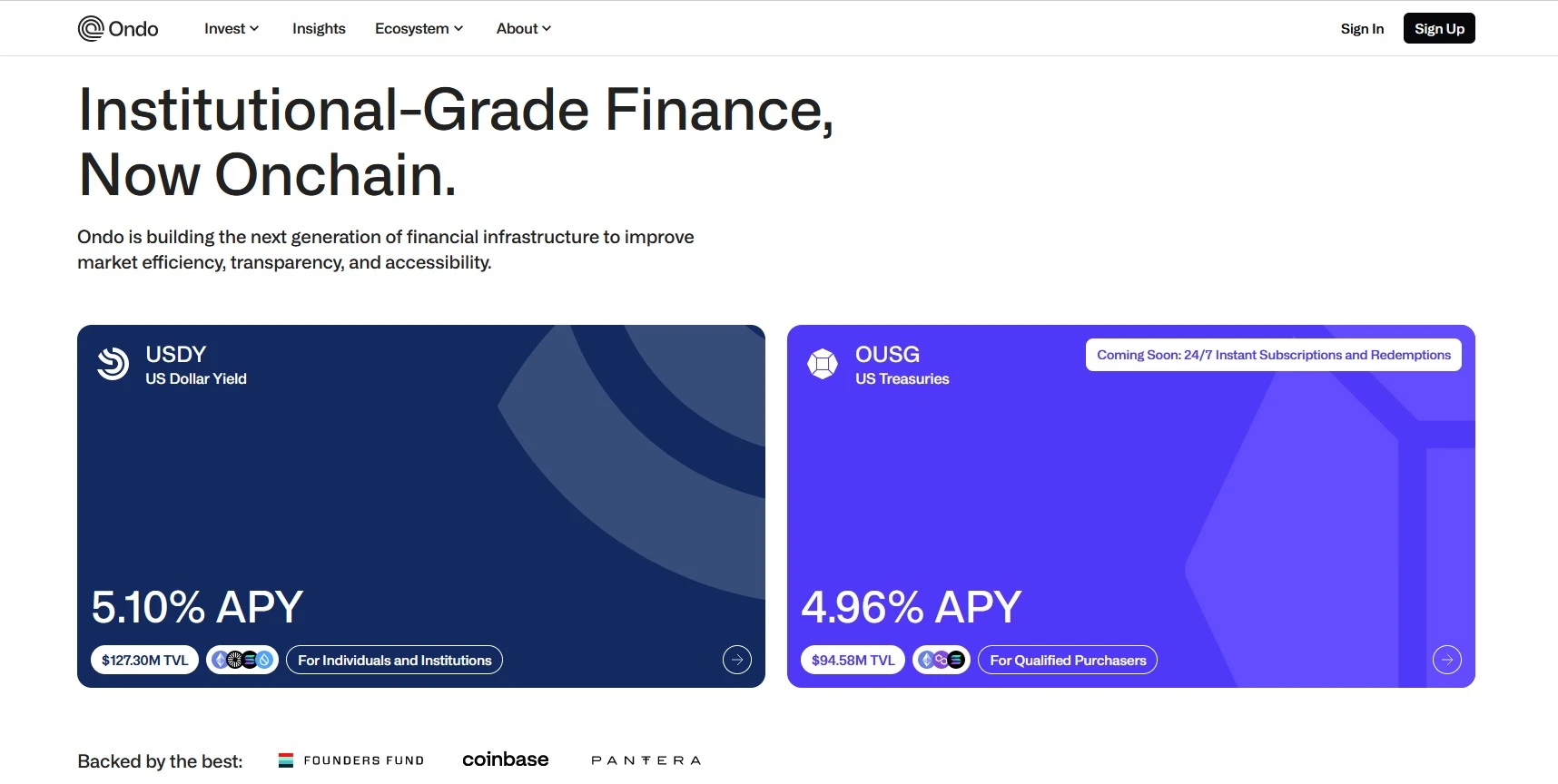

The second type is to introduce securities or funds as collateral for RWA. In this case, investors essentially hold tokens rather than funds. For example, Ondo Finance offers products such as USDY, OUSG, OSTB, OHYG, etc., corresponding to government bonds, short-term government bonds, corporate bond ETFs, and high-yield corporate bonds. The profits of these products come from the securities serving as the underlying collateral. It is worth mentioning that this structure design allows foreign investors to bypass restrictions and invest in US bonds, US stocks, and domestic ETF funds in the United States. Therefore, Ondo's whitelist review system is also relatively strict.

Ondo's homepage

Moreover, due to the natural volatility of the crypto market, every fluctuation of Bitcoin and Ethereum could potentially lead to the liquidation and default of a large number of DeFi protocols. Introducing securities such as government bonds and large corporate bonds satisfies the core of DeFi, which is asset growth, while ensuring safety and stability. It is also better regulated and more convenient for liquidation processing, making it the main track for the current development of RWA.

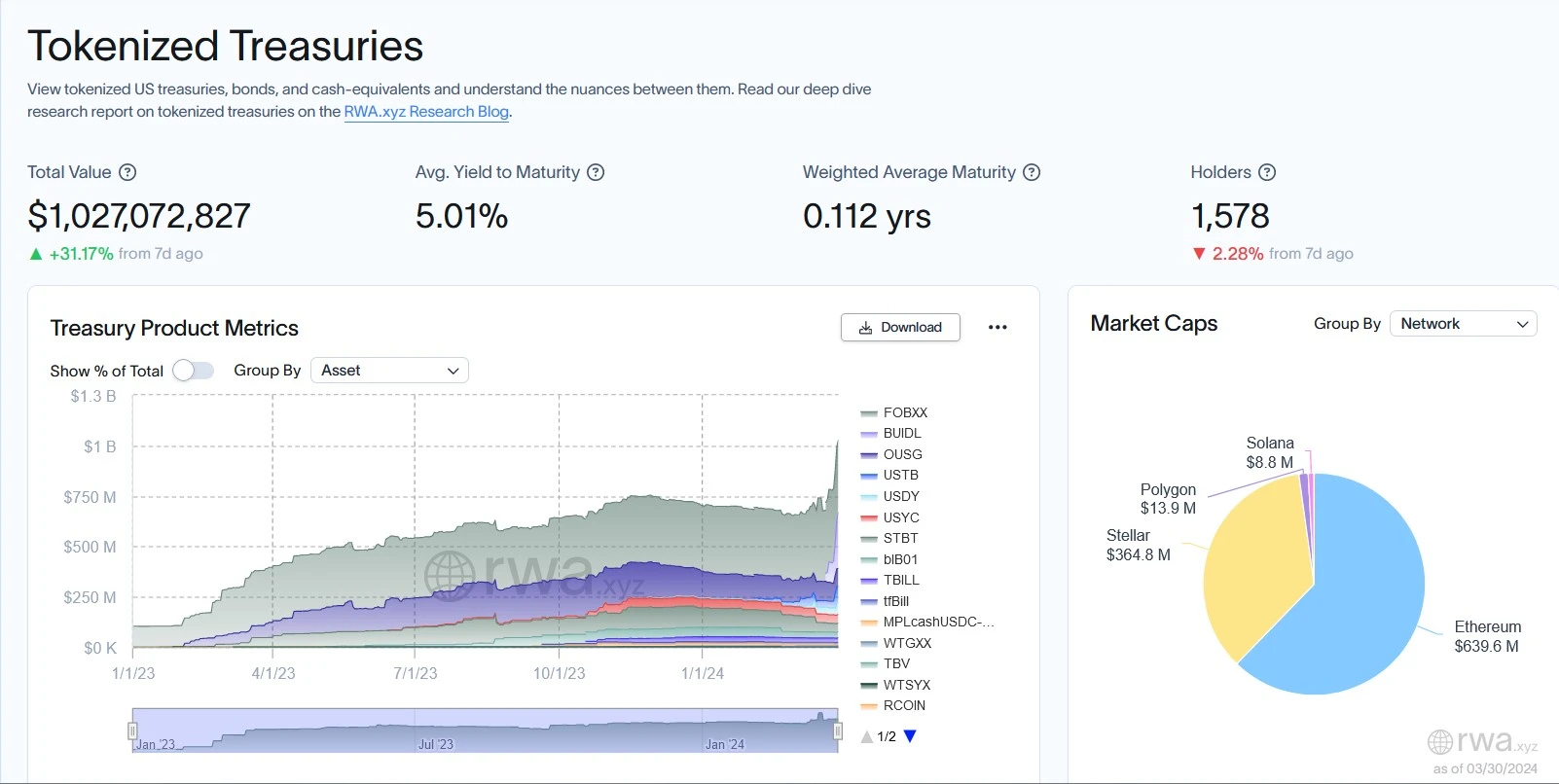

Overview of tokenized government bond projects, data source: RWA.xyz

In the third case, the project party uses an off-chain foundation as the core holder of securities or funds, attracting investors to purchase tokens as proof of holding shares in the fund. These projects issue tokens on-chain and hold the corresponding securities or funds through the foundation off-chain. Unlike the second type mentioned earlier, in this case, the tokens held by investors serve as proof of the fund shares, and investors essentially hold the fund. In this case, the blockchain is used as an accounting and management tool, so these projects tend to lean towards CeFi. These project parties have also built an operating system that adapts to the local legal framework, resulting in fewer legal issues.

Future Development of RWA

Regarding the future development of RWA, we believe that:

Real assets, especially real estate, are difficult to be monitored and controlled by on-chain DAOs, and the execution cost after default is high. Therefore, the main development direction of RWA for a considerable period in the future should be the tokenization of securities.

Debt-based assets on-chain will mainly focus on government bonds, corporate bonds, and enterprise bonds.

Asset mortgage services for individuals will mainly serve large clients to reduce default risks and execution costs.

Regardless of the RWA track, since off-chain foundations have been established as legal entities, RWA will be strictly compliant to prevent legal risks.

Since RWA is essentially a DeFi project, with the development model mainly focused on yield, it will be combined with more DeFi models in the future, such as re-collateralization.

With BlackRock boosting the RWA track, we have reason to believe that RWA will be a hot spot for this round of bull market and even the long-term growth focus of the crypto market. Projects like Ondo, MakerDAO, and Pendle will also shine.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。