Original Author: Jaleel, BlockBeats

For several months, Bitcoin has repeatedly hit historical highs, and the BRC20 token ORDI and SRC token STAMP in the Bitcoin ecosystem have also reached new highs, showing remarkable performance. On the other hand, the leading protocol ATOM in the high-purity Atomicals ecosystem has been under a cloud, with prices continuing to decline and the community sentiment of holders not being very positive.

Despite ATOM being listed on Unisat and OKX Web3 wallets, as well as on exchanges like Gate and Bitget, since reaching a high of $16 in December last year, the price of ATOM has been on a continuous decline. At the time of writing, the price of one ATOM is $6.478, and the price of one token is $6483. Based on the peak price of $16, ATOM has fallen by 62% over the past 4 months.

What changes have occurred in the Atomicals ecosystem? How is the development of AVM progressing? After in-depth discussions with several developers and enthusiasts in the Atomicals community, BlockBeats has written this article.

Ceiling of Atomicals

In the early stages of Atomicals, there was hardly any discussion about AVM.

Until this year, the protocol author of Atomicals, Arthur, has been dedicated to the development of the "split" function. It has been observed that the price of ATOM often rises with the progress of the split function. It can be seen that early community members holding positions have high expectations for the split function. In the ideal plan, once ATOM achieves the split, both trading volume and the number of addresses will increase significantly, allowing for earlier listing on trading platforms.

However, before the split, the liquidity of ATOM is like an expensive NFT or a real-world mansion, which is difficult for ordinary people to afford, even though the price of a single ATOM is as high as six thousand dollars, and there are only two thousand holding addresses.

Despite seeing Gate, Bitget, and OKX Web3 wallets go live with ATOM over the past few months, first-tier trading platforms like Binance and OKX have still not listed it. From the perspective of trading volume and holding addresses, it seems that first-tier trading platforms lack the motivation to quickly push for the listing of ATOM.

The recent path may also be the farthest path

Given its importance, why has the split function not been launched yet and instead turned to the development of AVM?

Wizz Wallet is the earliest wallet in the Atomicals ecosystem and currently the most widely used wallet in the Atomicals community. They have frequent private communication with the protocol author, Arthur. Wizz Wallet CEO Brutoshi told BlockBeats, "Most of the code for the 'split' function has actually been launched on the testnet, and it can now be understood as being postponed."

As for why the implementation of the split has been postponed in favor of AVM, Brutoshi also provided his understanding: "Before AVM, if you want to implement the split, you need to write a lot of code logic in the indexer. Although implementing the split function alone can solve the problem, it will result in a lot of redundant code being written, and there will be a lot of maintenance, testing, and promotion in the future, including additional efforts needed on the wallet and market side, which is very inelegant."

Every public chain or protocol has its own pronouns. For the Atomicals ecosystem, elegance, simplicity, non-redundancy, and high purity are some key words.

Both solutions are feasible. From the perspective of realizing holder benefits, implementing the split function separately may be the fastest solution. However, for the Atomicals ecosystem that Arthur wants to build, this is not the best choice. The seemingly closest path may also be the farthest path.

Arthur's turn to the implementation of AVM is not because the split function cannot be implemented, but because of the pursuit of a more elegant and simple solution. The benefit of doing so is that the efforts of everyone in the ecosystem are not wasted on solving a single specific problem, but are applied to more general problems.

"AVM is programmable and has its own scripting language, so the split function can be solved with just a few lines of code," Brutoshi added. It can be said that after the implementation of AVM, the split function will naturally follow.

Although the ceiling of AVM is high, during this long hiatus of several months, holders who prioritize liquidity for quick realization and have not managed their positions well have chosen to exit first. In the liquidity-driven cryptocurrency industry, time is calculated in multiples, and investors in the cryptocurrency industry often lack patience.

"The early holders of ATOM, the user profile is very clear, most of them are a group of people who understand technology and can code. Most of the early holders of ATOM have sold off," a philanthropist in the cryptocurrency community, who is an enthusiast of the Atomicals ecosystem and is active in the community, expressed to BlockBeats after long-term observation.

What can AVM really do?

Amidst the divergent voices in the community, AVM represents the ceiling of the entire Atomicals ecosystem, which has become a general consensus within the community. So, what can this AVM, which represents the ceiling of Atomicals, really do?

On December 13, 2023, Arthur, the protocol author of Atomicals Protocol, accepted an interview invitation from Ordinal Revolution Podcast, and in a non-face-to-face manner, shared recent developments in the Atomicals Protocol and his views on the Bitcoin ecosystem.

In the interview, Arthur briefly introduced the Atomicals Virtual Machine (AVM), which runs as a Turing-complete virtual machine, capable of executing various computational instructions required for complex blockchain applications, including enabling developers to create smart contract programs on Bitcoin and create unprecedented experiences.

Screenshot from the interview

"With AVM, many possibilities arise, including solving historical legacy issues in a more elegant way," Brutoshi said.

So, what possibilities can AVM create? According to @PunkOnChain, an enthusiast in the Atomicals community, the breakthrough lies in AVM having a high-level execution environment capable of handling smart contracts and dApps; a custom instruction set to enhance performance and reduce gas costs; optimized state transition functions to increase parallel processing capabilities, thereby improving throughput and scalability; achieving interoperability and cross-chain communication; and providing a developer-friendly interface.

For those who cannot understand technical theories, it can be simply understood that AVM will enable Atomicals to have a smarter brain and a supercomputer capable of performing various tasks; a special toolkit that makes complex tasks easier, more efficient, and less time-consuming; a very smart manager who can ensure that everything runs smoothly; a translator who can communicate with other communities, making communication between the Atomicals system and other systems more convenient; and an extremely practical guidebook that can help developers learn how to use AVM more quickly.

"The reason I am optimistic about ATOM is that I think there is limited downside for ATOM and unlimited upside," said a philanthropist in the cryptocurrency community who is an enthusiast of the Atomicals ecosystem, to BlockBeats.

In his view, the Dragon II Atomicals accounting for 10%-20% of the market value of Dragon I Ordinals is not excessive. After the development of AVM, the entire ecosystem of Atomicals has been expanded, at least to the level of Ordinals, and in the long term, it is limitless. For an Atomicals that can issue both FT and NFT, coupled with the Realms system that allows users to attach their avatars, names, and links to online profiles, once AVM is truly implemented, the height of the ceiling will be significant.

"Working in Isolation"

In discussions surrounding AVM, we also hear many community members questioning how Arthur will implement AVM and, most importantly, when AVM will go live.

In some public messages, we caught some signals. Wizz Wallet's CTO Neeboo revealed in a Space event that the protocol author is expected to launch the first version of AVM around late April, around the time of the Bitcoin halving.

On March 19, Atomicals enthusiast 0xSea mentioned in a social media post about his conversation with Arthur regarding the progress of AVM: "The alpha version of AVM is about to be released. The specific timing is uncertain, but it should be soon. It is not far from what Neeboo revealed on Space about 'releasing a usable version before the halving.' Once AVM is live, it will easily support functions such as staking, borrowing, and depositing ARC-20 assets. Based on AVM, ARC-20 assets can be deposited into smart contracts, similar to how ERC-20 tokens can be deposited into Solidity contracts on Ethereum."

As for whether the development of AVM is working in isolation, this is a subjective viewpoint. However, it is undeniable that compared to typical protocol founders, Arthur indeed prefers to remain hidden behind the Atomicals protocol.

Since announcing the start of AVM design work in January, Arthur has not publicly released any documents. Although he has gradually revealed AVM design concepts on Twitter, Arthur has not publicly released any documents, causing some concern among community users. In contrast, Casey has already released the final implementation version of Runes on Github.

Neeboo mentioned in a tweet on Space in early March: "We have not seen the original design documents and some initial code yet." However, according to Wizz Wallet's disclosure to BlockBeats, Arthur holds regular meetings with them, and discussions with wallet and other infrastructure have continued for a long time.

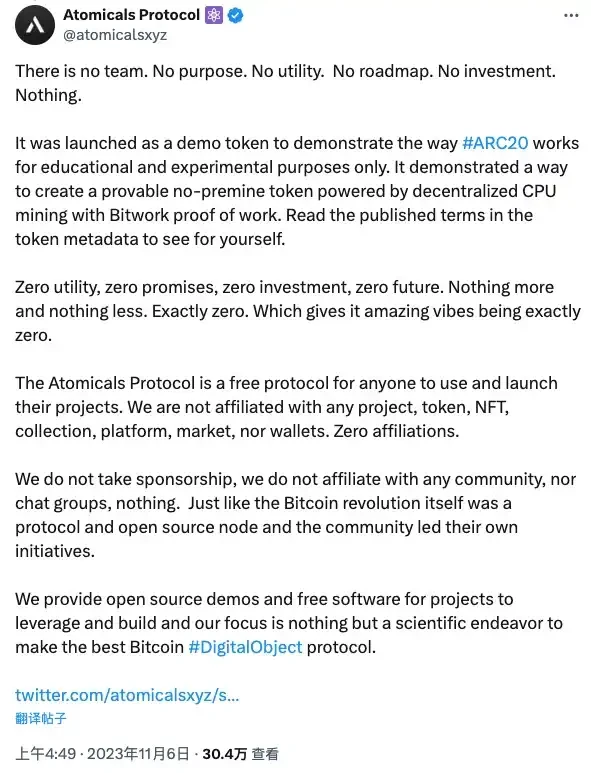

Every protocol has its own character, which largely depends on the character and values of the protocol author. Almost everyone who has interacted with Arthur knows that he has always identified himself as a scientist and technical researcher, without any intention of profiting from it. During a meeting with Wizz Wallet, Arthur explicitly stated that he has no financial requirements in building the Atomicals protocol.

Official statement: Atomicals has no team, no purpose, no utility, no roadmap, no investment, and nothing

Brutoshi stated: "Arthur's vision and values are very similar to Satoshi Nakamoto." He added, "Once Atomicals and AVM are stable, he may disappear. He has prepared for this. He has been anonymous from the beginning, and even when participating in interviews and voice conferences later, he used a voice mixer, placing great emphasis on privacy protection."

This is also why many community members unconditionally trust Arthur. In addition to their recognition of his character and values, his technical ability is also an important factor.

"At first, Arthur was inspired by Ordinals and wanted to implement some domain name-like functions on Ordinals. After trying for about two months, he felt it was not feasible as Ordinals could not support it. Later, he thought about starting over and spent about six months redeveloping the entire protocol. His technical ability is really strong, and he is very familiar with the Bitcoin protocol," Brutoshi told BlockBeats.

According to Brutoshi, Arthur has been involved in mining pool project development and has a special fondness for PoW, which is why the Atomicals protocol pioneered the PoW-based BitWork token issuance mechanism.

Returning to the criticism from some community members about the Atomicals protocol "working in isolation," it seems that Arthur has also realized this after a recent meeting with Wizz Wallet, and yesterday updated the development progress and plans of the protocol on social media. According to the upcoming protocol update plan from Atomicals Protocol, the goal is to allow the transfer of token quantities smaller than the 546 satoshi dust limit. This update aims to address the BTC protocol's limitation on the minimum transfer size, which was initially intended to prevent "spam attacks" on the Bitcoin blockchain. Due to the use of pure color coins in ARC20, it is also affected by this dust limit, preventing the transfer of tokens smaller than 546 units.

The solution is to allow partial coloring of UTXOs, but not exceeding the total unit count in the UTXO, in line with the principle of 1 coin ≥ 1 satoshi. This technical solution has three major advantages: first, it can send at least 1 token unit, effectively addressing the community's main concerns about the protocol; second, it can significantly reduce accidental token destruction; and finally, it improves the flexibility and reliability of smart contracts through the Atomicals Virtual Machine (AVM). Neeboo mentioned that "partial coloring technology in Arthur's plan still hopes to be implemented using contract capabilities, rather than directly adding rules to the indexer."

This protocol update is expected to be completed in a few weeks and will be synchronized with the release of AVM. The Atomicals protocol will continue to maintain the commitment of 1 token = 1 satoshi (or more). After the update, the open-source development team will focus on developing a test version, ensuring sufficient time for industry testing and consensus building before steadily integrating this technology.

Shift in Chip Structure Main Battlefield

In discussions with BlockBeats, the philanthropist mentioned the investment insights he gained from the chip structure: "The chip structure is the most important analytical perspective, and it can determine the direction of the market. Before buying, you need to think clearly, to whom will these chips ultimately concentrate? The market can truly take off when the chips flow into the hands of more powerful people. If these chips are all concentrated in the hands of the scientists who initially minted them, then the prospects for this project are not great."

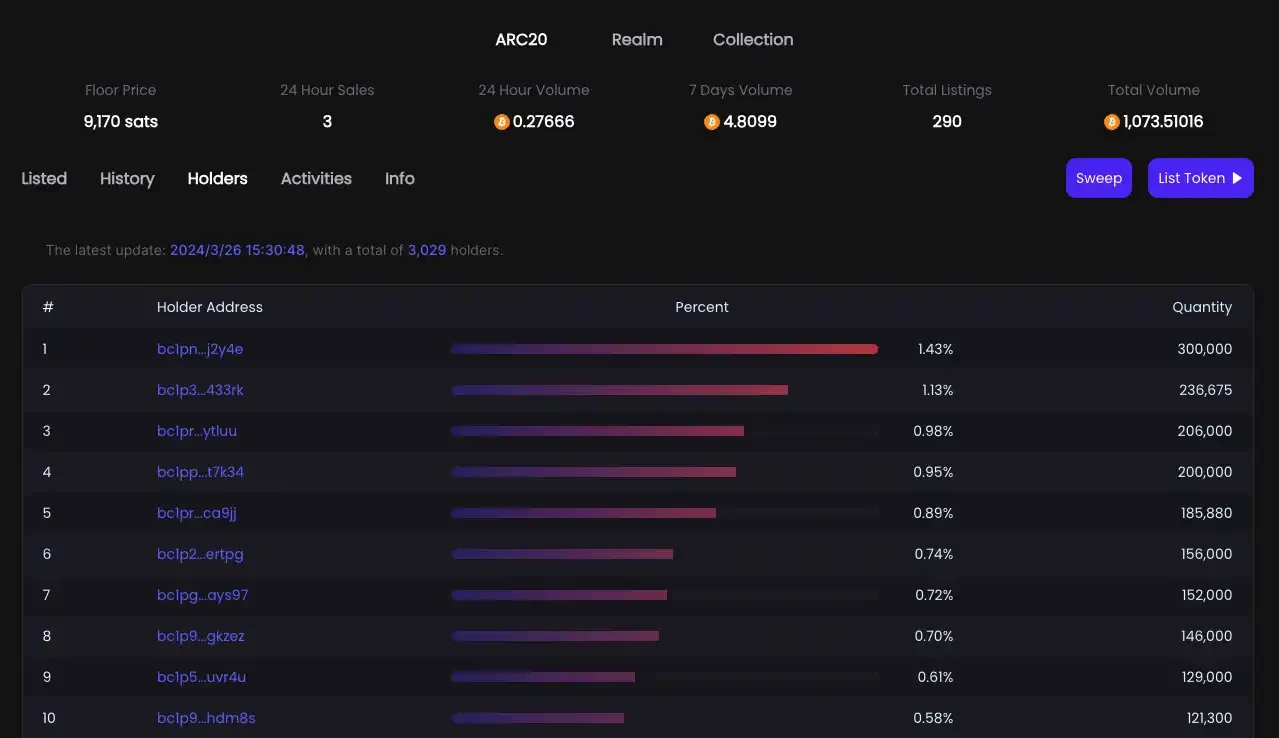

To study the holding data of ATOM and the specific distribution of chips, BlockBeats conducted an investigation into the wallet addresses of the top 100 holders of Atom in the Atomicals Market.

In the top ten holding addresses of ATOM, there are no longer holders based on "minting." Observing the top 20 ATOM holding addresses, it is found that only the address ranked 12th is "minted." Between ranks 20 and 30, only the address ranked 29th is "minted," and there are no minted holders between ranks 30 and 40.

Continuing to observe, there are no longer holders based on "minting" among the top 40 to 50 holders. Between the top 50 and 60, only the address ranked 59th is "minted." Between the top 60 and 70, only the addresses ranked 63rd and 65th are "minted." Among the top 70 to 80, only the address ranked 73rd is "minted," and there are no minted holders between the 80th and 90th positions. Finally, among the top 100 holders, only the address ranked 93rd is "minted."

In the top 100 holders, there are 6 addresses that own ATOM through "minting." The number of holders based on "minting" has significantly decreased. This indicates that early holders have reduced their holdings of ATOM or transferred their chips.

Whether it's "turnover" or "washout," it's clear that there has been a significant change in the liquidity and market influence of ATOM, and the main battlefield is shifting.

Looking back at ORDI, both the price trend and community sentiment are very similar. "ORDI from June to September, it was really dead, no different from being dead," the philanthropist recalled. The ORDI community at that time, like today's ATOM community, experienced many trials and moments of pessimism.

After launching on the GATE trading platform in May 2023, the price of ORDI reached a previous high of about $25. However, over the next four months, the price of ORDI experienced a long period of decline, falling to $2.86 in September 2023.

It wasn't until November 7, 2023, when ORDI was listed on Binance, that the price surged to over $50. Then, after the approval of the Bitcoin ETF in January of this year, there was no longer any doubt that it was a bull market, and the price of ORDI reached another peak in March 2024, hitting a historical high of $96.17. The holders who truly held ORDI from the initial minting to the peak of $96.17 are definitely few and far between, even rare. A period of very low turnover is a normal process.

"But it is precisely because consensus was formed during this process and there was an outbreak of energy that the project was able to truly take off. Those lacking confidence were able to leave the market quickly and sell off, giving more people the opportunity to get on board," Brutoshi said. "Having different opinions leading to different investment decisions between long and short positions is normal and healthy market behavior, turnover is a good thing."

Compared to ORDI's bleak four months, falling from $25 to $2.86, experiencing an 88.56% decline, ATOM's drop from $16 to the current $6, is about 62.5%, which is not too high. Looking back to November last year, minting was almost a "national movement," with hundreds of minting projects on various chains, but very few have truly "survived" to this day.

"From January to March this year, the protocol author has been researching AVM. Wanting AVM to come out immediately and boost the price is definitely not realistic," although the philanthropist has always suspected that someone is suppressing the price of ATOM, he also acknowledges the possibility that ATOM has not attracted capital. "But what I can be sure of is that the market has differences, and that's where the opportunity lies."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。