Official tweets can be used to claim airdrops. When it was time to claim the airdrop, a tutorial was immediately released. I don't know if everyone still remembers it. The new Binance mining project @ethena_labs is currently underway and has gained high popularity across the entire network. The new decentralized stablecoin product has attracted widespread attention. In the past 40 days, the USDe supply of Ethena has also experienced significant growth, soaring from approximately $242 million on February 18 to $1.5 billion now. Below, let's take a detailed look at this project and break down the valuation system:

1/ Project Introduction

Ethena is a decentralized stablecoin project built on Ethereum. Its USDe **will provide a stable and scalable form of currency that does not rely on the traditional banking system for funds collateralized through Delta hedging Ethereum collateral, using "hedging hedging" to balance, and a globally accessible dollar-denominated savings tool "Internet Bonds". The inspiration for the project comes from BitMEX founder Arthur Hayes' Dust on Crust article published last year.

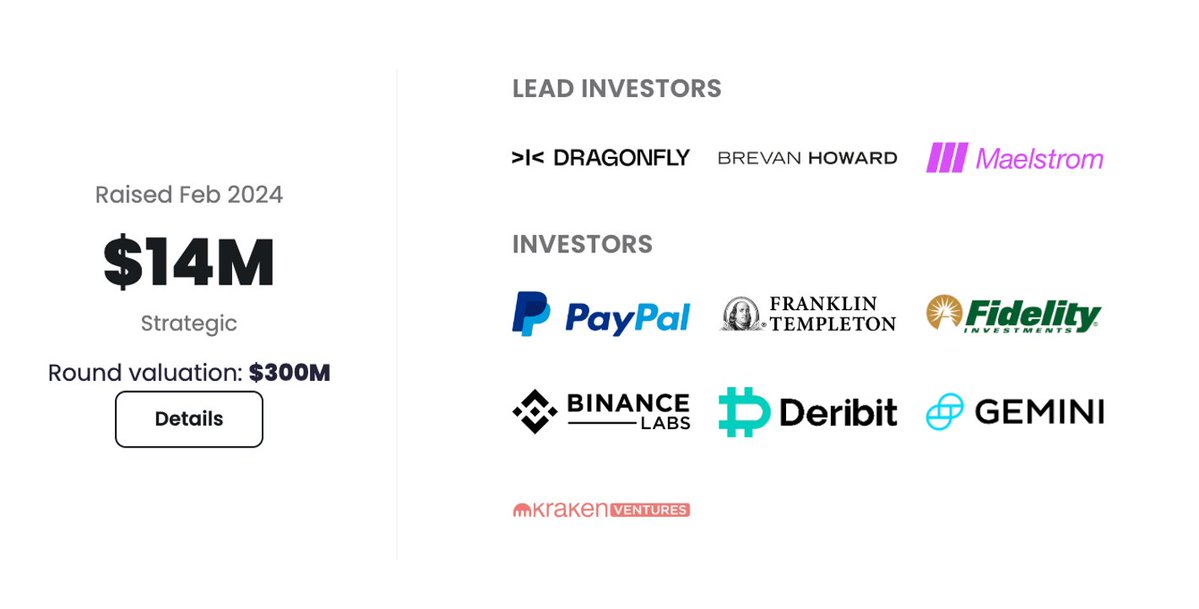

2/ Financing and Team Background

On February 16 this year, the project announced the completion of a $14 million strategic round of financing, with a valuation of $3 billion. Dragonfly, Brevan Howard Digital, and BitMEX founder Arthur Hayes' family office Maelstrom jointly led the investment. In July last year, it completed a $6.5 million seed round of financing, also led by Dragonfly, with participation from Deribit, Bybit, OKX, Gemini, and others. Founder Guy Young previously had 6 years of investment experience at Cerberus Capital Management.

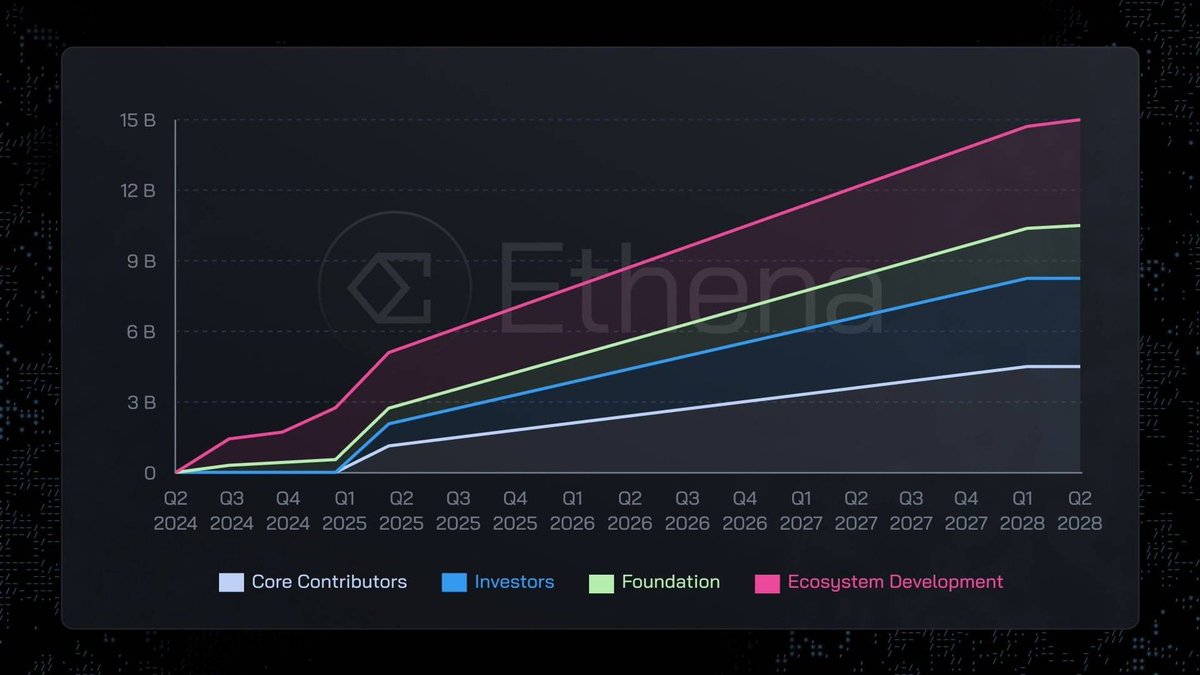

3/ Token Economics

The total supply of $ENA is 15 billion, with an initial circulating supply of 1.425 billion. In addition to the 750 million tokens airdropped to users, 675 million chips will be unlocked and invested in the foundation fund. Core contributors account for 30%, investors 25%, the foundation 15%, which will be used to further promote the popularity of USDe, and ecosystem development accounts for 30%, of which 5% is used for this first round of airdrops, and the remaining portion will support various Ethena plans and other incentive activities in the future.

4/ Activity Plan

This airdrop will distribute a total of 750 million $ENA tokens. The snapshot was taken on March 26, and the ENA chips will be distributed on April 2. In order to ensure the fairness of the chips and address selling pressure issues, Ethena will implement a 50% chip lock for the top 2000 wallets with the highest shard points, with the rest gradually unlocking over the next 6 months. Recently, Bybit Web3 announced a partnership with Mantle Network to launch the "Mantle Sharding With Ethena" campaign, providing MNT holders with the opportunity to share 2.5 billion Ethena Shards.

5/ Product Details

Ethena offers a series of products called "Internet Bonds", with 2 main tokens: USDe and sUSDe:

USDe: Stablecoin pegged to the US dollar at a 1:1 ratio.

sUSDe: Rewards obtained through pledging Liquid staking chips and funding rates. Initially, 1 sUSDe:1 USDe, over time, 1 sUSDe > 1 USDe.

6/ Technical Features

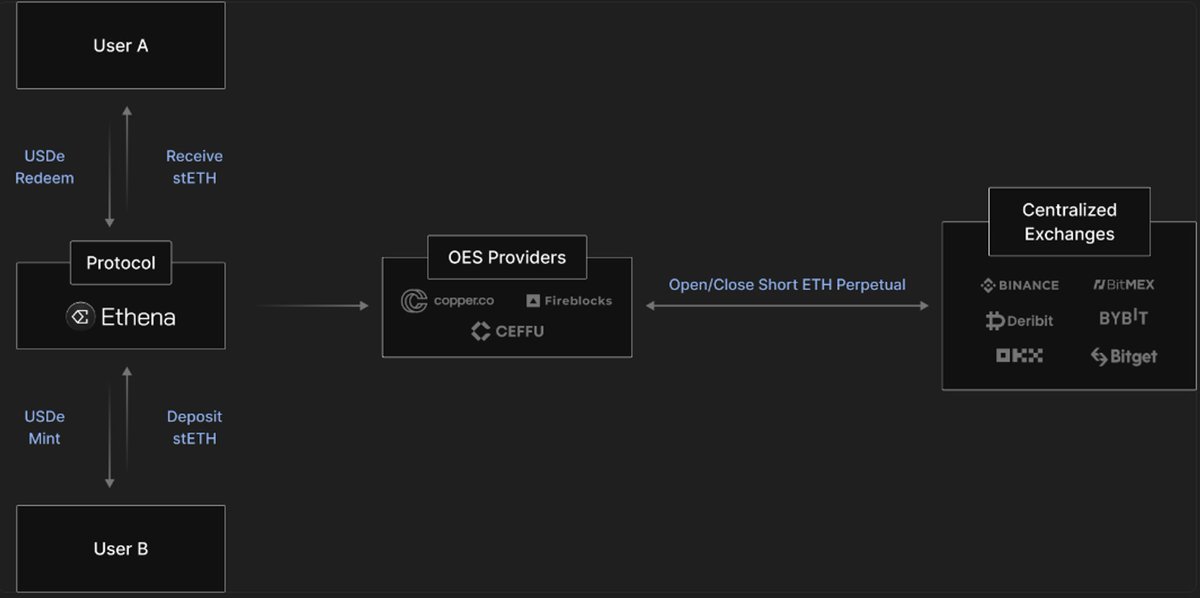

Delta Neutral: In finance, if the Delta value of a portfolio is 0, it can be considered "Delta Neutral". This means that the portfolio will not be affected by changes in the underlying asset's value. For example, suppose ETH is now $1. When creating 1 USDe, you need to deposit 1 ETH as collateral through a derivative exchange and short 1 ETHUSD perpetual contract. Suppose the price of Ethereum drops from $1 to $0.1, the value of ETHUSD's ETH = $1 / $0.1 = 10 ETH, the ETHUSD position profit/loss = 10 ETH (current value) - 1 ETH (initial value) = +9 ETH. Ethena's total equity balance on the exchange is 1 ETH (initial margin) + 9 ETH (profit from the ETHUSD position), now the total balance is 10 ETH. Although the price of Ethereum is now $0.1, the total value is still $1, i.e., $0.1 * 10 ETH. Similarly, the reverse is true.

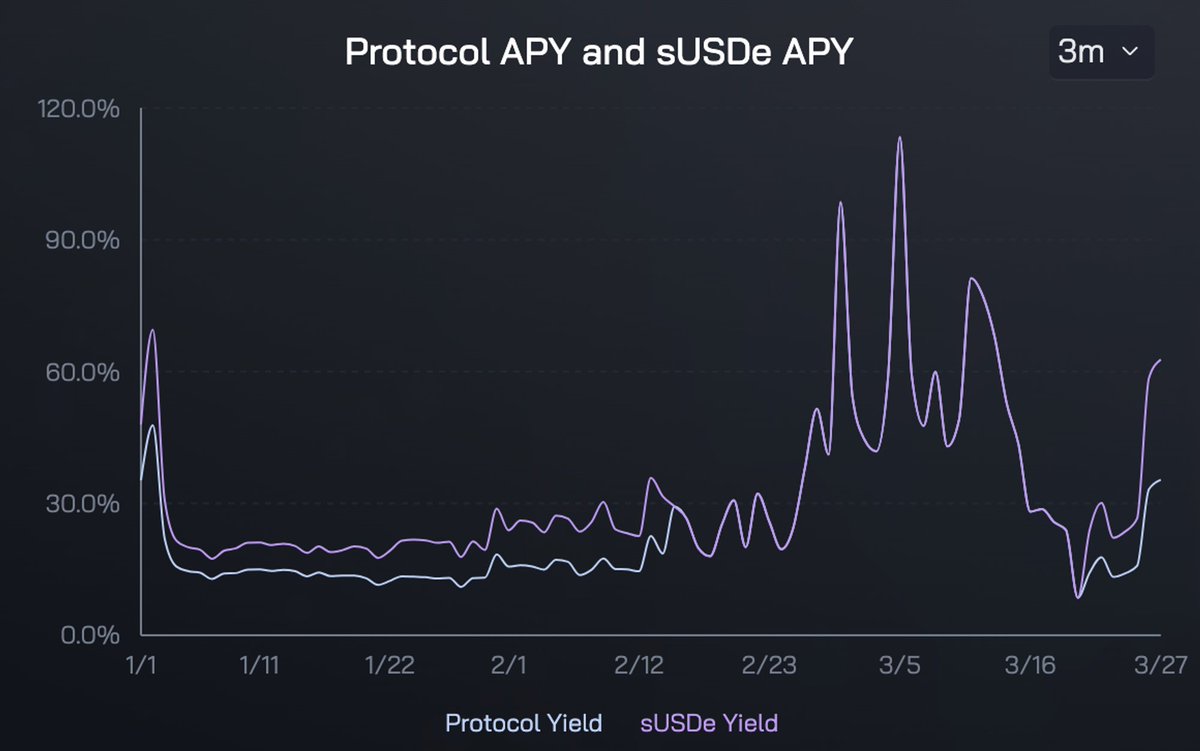

High Yield: Users participating in pledging USDe can earn dual income, one from stable returns on spot long positions. Ethena Labs supports pledging spot ETH through liquidity staking derivative protocols such as Lido, earning around 4% annualized return; the other comes from the unstable returns of funding rates for short futures positions. In the long run, most of the time, the funding rate for short positions is positive, which also means that overall returns will be positive.

7/ Risk Warning

Ethena's mechanism itself is collateral and deposit. If problems like the FTX event on the exchange occur, users' assets will still disappear. In addition, the reward portion of sUSDe is largely dependent on market volatility. If Liquid Stake chips lose their peg when used to collateralize short Ethereum positions, the collateral assets on the short position will be liquidated immediately, or when the entire market is not good, the annual interest rate will also decrease, which needs to be noted, but this is also an extreme case.

8/ Participation Method

The total amount of LaunchPool mining this time is 300 million chips, accounting for 2% of the total supply, from 08:00 on March 30, 2024, to 07:59 on April 2, 2024. BNB and FDUSD can be deposited into the ENA mining pool on the Binance website to receive $ENA token rewards. In addition, new Binance users can also receive $ENA airdrops: https://t.co/3Php7tJIt7

9/ Future Prospects

The launch of Ethena may change the traditional dependence of the crypto market on stable assets. With further project development and new funds entering, it has already reached a TVL of billions of dollars and may lead to a brand new DeFi product explosion in the bull market. Projects invested by old black may also produce a hot product, possibly breaking $1 directly.

After reading, please like, comment, and share. At the end of the article, we will also provide you with some secondary projects we are watching, $pixel and $APRS. We recommend that you carefully observe their investment lineup and project development. If the gaming track is hot, these two will not be absent. Take a look again at the low position. #Binance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。