In 2024, the blockchain industry is experiencing a new paradigm shift, and the narrative of the entire chain is becoming the industry's theme. Mango Network ($MGO) is positioned as a Layer1 new public chain for a transactional full-chain infrastructure network, leading a new round of innovation in the DeFi industry with high performance, modular advantages, and the concept of full-chain liquidity pools.

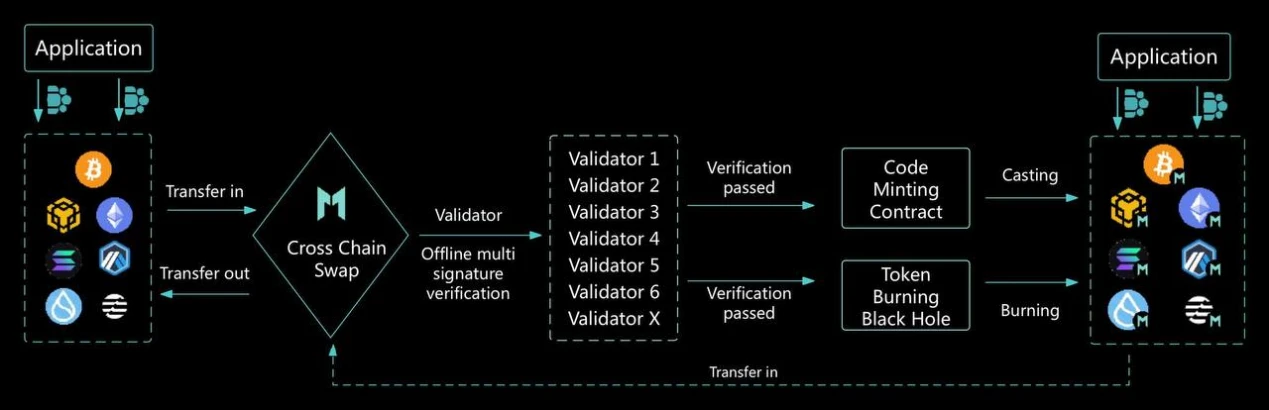

The Mango public chain is about to go live, supporting seamless transfer of tokens, NFTs, and data and information between heterogeneous L1/L2 public chains.

Mango efficiently facilitates the circulation of encrypted assets and liquidity pools across different public chains.

Mango's full-chain applications give rise to full-chain liquidity pools, providing new possibilities for Web3, especially DeFi, innovation.

In the past year of 2023, the global blockchain industry has undergone a transition between bull and bear markets. The annual narrative has gone through second-layer networks, the launch of Meta's new public chain mainnet, LayerZero's cross-chain competition, and the breaking of the circle of BRC20 inscriptions with MEME. With the influx of more users and the enrichment of industry ecological use cases, the demand for seamless interaction across multiple chains has become increasingly strong. On the other hand, the entire industry has increasingly realized that building a full-chain infrastructure is the most direct and effective way to break the "impossible triangle" of blockchain. The narrative of the entire chain is becoming the industry's theme, leading a new paradigm shift in 2024.

In response to industry pain points, Mango Network ($MGO) has taken the lead in aiming to become a Layer1 new public chain for a transactional full-chain infrastructure network, by building an all-in-one liquidity service full-chain network to provide users with a more secure, diverse, and convenient full-chain trading experience.

Based on Move, naturally secure

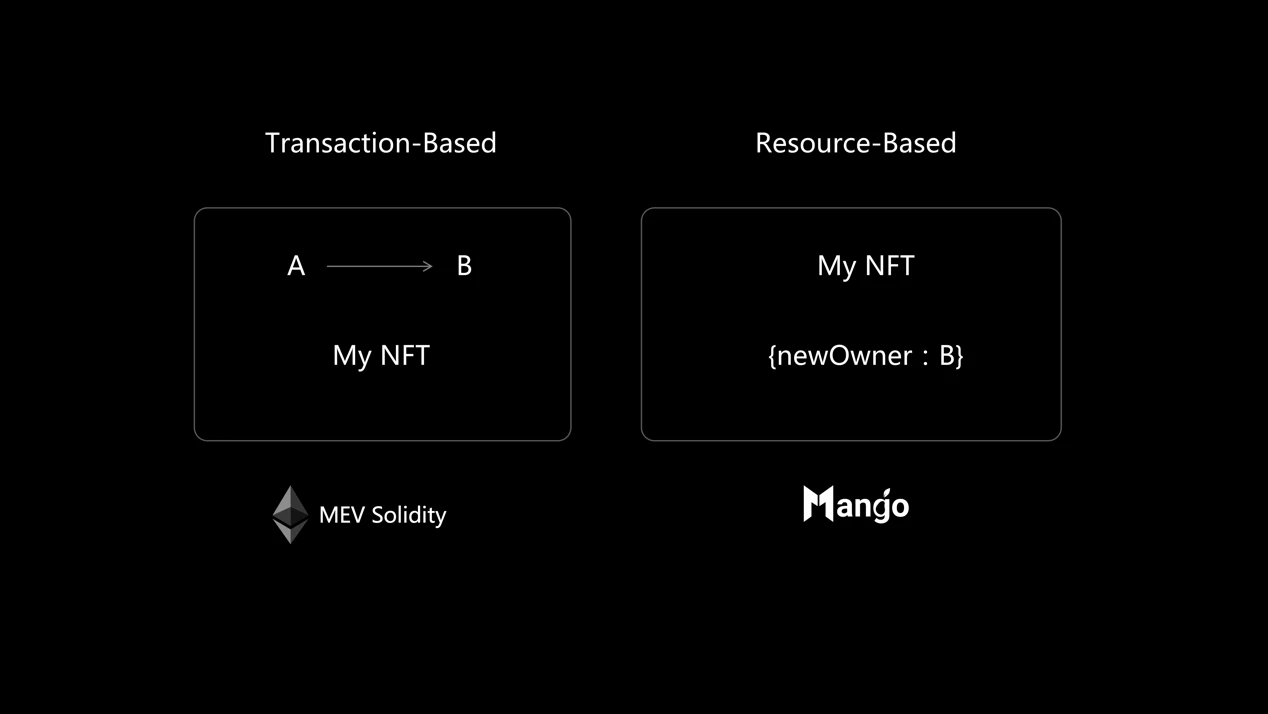

The Move language is a "valuable legacy" of Facebook's sovereign cryptocurrency project Libra. It addresses the shortcomings of Solidity and EVM, providing a high-performance, secure, and reliable smart contract programming environment specifically designed for encrypted assets.

Mango Move is a statically typed programming language with multi-thread processing capabilities, effectively reducing concurrency situations. The static language, combined with smart contracts, provides a secure environment for application development, ensuring that project source code is not tampered with in the event of an attack. Additionally, the Move language treats digital assets as first-class citizens, defining tokens as a separate resource category (Resource) distinct from other data. The asset transfer in Mango Move is object-oriented, ensuring the uniqueness and security of assets, adding an extra layer of security to on-chain DeFi projects.

Modular high performance, breaking the "impossible triangle"

Mango's modular blockchain, built on the Mango Move language, decomposes blockchain functionality into different levels of network architecture, achieving high security, high performance, and low cost, breaking the "impossible triangle" of decentralized networks.

Traditional blockchain systems typically integrate functions such as consensus, settlement, data availability, and execution into a single architecture. As the complexity of blockchain applications and the demand for them increase, a single architecture will be unable to meet the requirements of different scenarios.

Mango's modular blockchain separates these core functions, allowing each functional module to operate independently while maintaining collaboration with each other. This architecture makes the blockchain system more flexible and scalable, allowing for customization and optimization based on different needs.

Through features such as horizontal scalability, composability, and on-chain storage, the Mango public chain can achieve over 100,000 TPS of parallel transaction processing per second and sub-second settlement, supporting a wide range of on-chain assets. It also solves the common pain points of L1 with unparalleled speed and low-cost characteristics, providing developers and users with an amazing user experience.

Born full-chain, pioneering a new paradigm for applications

As a Layer1 public chain positioned for full-chain applications, Mango's greatest advantage is its ability to serve as an efficient execution and settlement layer, allowing developers to design applications from the perspective of full-chain interoperability, significantly reducing the complexity of user operations.

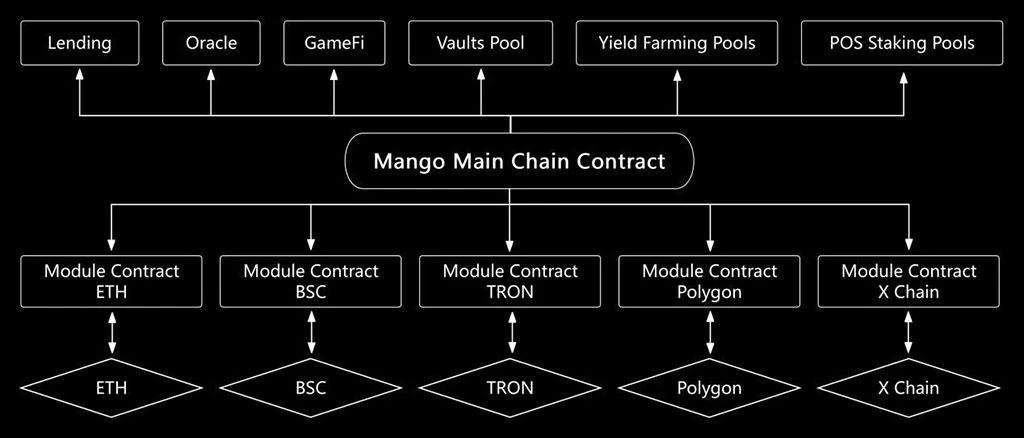

The technical architecture of Mango's full-chain applications consists of Mango main chain contracts and module contracts, with the main logic of the application stored in the Mango main chain, achieving "central control." Remote access modules are then built on other chains to interact with end users, receive user input, and output the desired results.

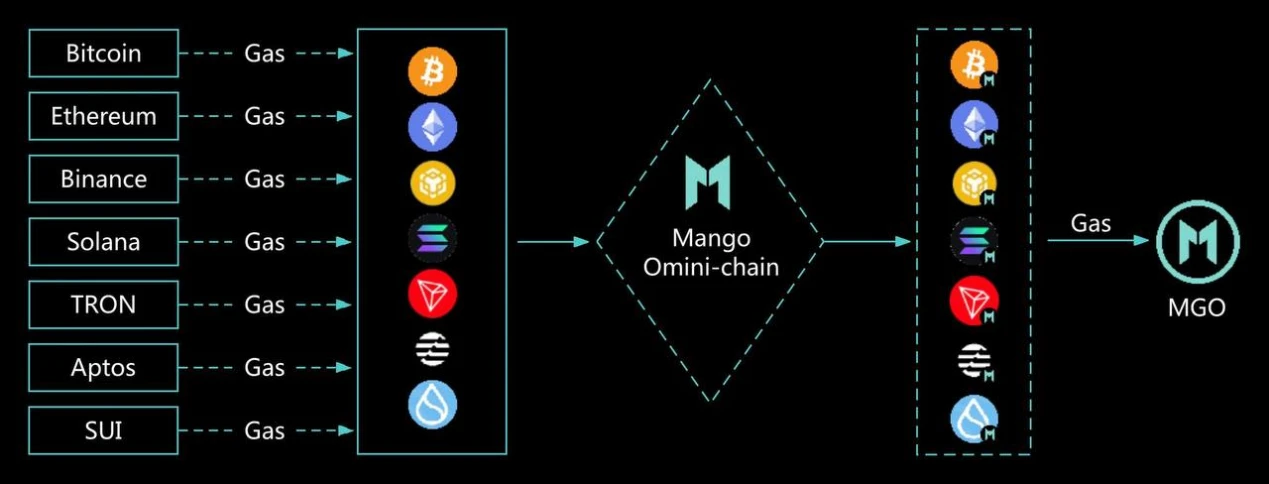

For example, DEX developers can deploy dApps on the Mango main chain, allowing users to operate the application from the Mango main chain and also through remote access modules on any other chain, making it as convenient as accessing a local program. This also means that users only need to prepare one type of token as gas, without needing to know on which chain the dApp is actually deployed, to achieve any cross-chain operation.

The biggest advantage of Mango's full-chain application architecture is the significant reduction in the complexity of cross-chain integration. When the main logic of the program is processed on the Mango main chain, the application has a unified state record. After deploying contracts on a new chain, it can inherit all state records and liquidity from the main chain. Meanwhile, when other applications integrate this program, they only need to connect on the main chain to use all its functions and liquidity.

Compared to cross-chain protocols like LayerZero, Mango's full-chain applications do not require frequent asset cross-chain operations between different blockchain networks, resulting in lower usage costs, faster confirmations, and higher efficiency. Additionally, full-chain transactions do not require assets or data to be stored in third-party institutions, thus ensuring higher asset security.

Full-chain applications achieve seamless integration of heterogeneous public chains, addressing multiple pain points such as user experience and liquidity fragmentation in Web3 applications and DeFi protocols. By building an all-in-one liquidity service network with main chain contracts and module contracts, Mango provides users with a unique trading experience.

Full-chain liquidity pools foster DeFi innovation

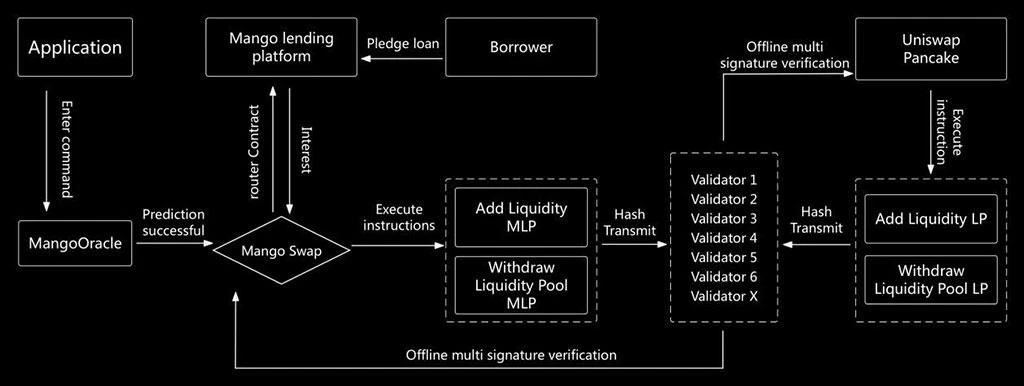

Mango's full-chain applications make it possible to build full-chain liquidity pools. In the past, DeFi projects needed to build liquidity pools separately on each public chain, reducing capital efficiency and increasing the complexity of user cross-chain operations. Based on Mango's full-chain applications, it is now possible to build a "one-stop liquidity pool" that supports full-chain assets and enables full-chain operations.

Mango's liquidity service network has the following advantages:

Unified user experience: Users can access other chain-based DeFi applications through the unified entry point of the Mango public chain.

Low cost: The process of asset cross-chain using Mango Network incurs extremely low transaction fees, and lower gas costs.

High asset liquidity: Users only need to use 1 type of token as gas to freely transfer assets between different chains.

Efficient security: Developed based on the Move language, it has inherent security advantages.

Users can transfer on-chain assets to the liquidity pool deployed on the Mango main chain through Mango Network, and then participate in DeFi operations on any chain through module contracts deployed on the target chain. This approach reduces the complexity of cross-chain operations, enhances security, reduces user gas consumption, and eliminates transactional wear and tear.

For example, users can cross-chain their ETH assets to the liquidity pool on the Mango main chain and interact with Pancake Swap on the BNB chain through Mango's module contracts on the target chain. This means that users holding only single-token assets such as BTC or ETH can also participate in DeFi projects on any chain, significantly increasing the potential scale of liquidity pools and giving rise to innovative DeFi applications such as full-chain liquidity borrowing, full-chain staking, new flash loans, and new algorithmic stablecoins.

For instance, full-chain liquidity borrowing is based on the single-coin pools of various public chains, with Mango Network serving as the bridge and settlement layer. The single-coin pools of various public chains allow users from any chain to provide liquidity to the protocol. Compared to the Aave protocol, which provides liquidity and borrowing on a single chain and uses third-party cross-chain bridges for cross-chain operations, full-chain liquidity borrowing based on Mango allows all operations to be carried out on any chain, significantly increasing the capital utilization of the borrowing protocol.

BeingDex, an innovative full-chain order matching trading platform

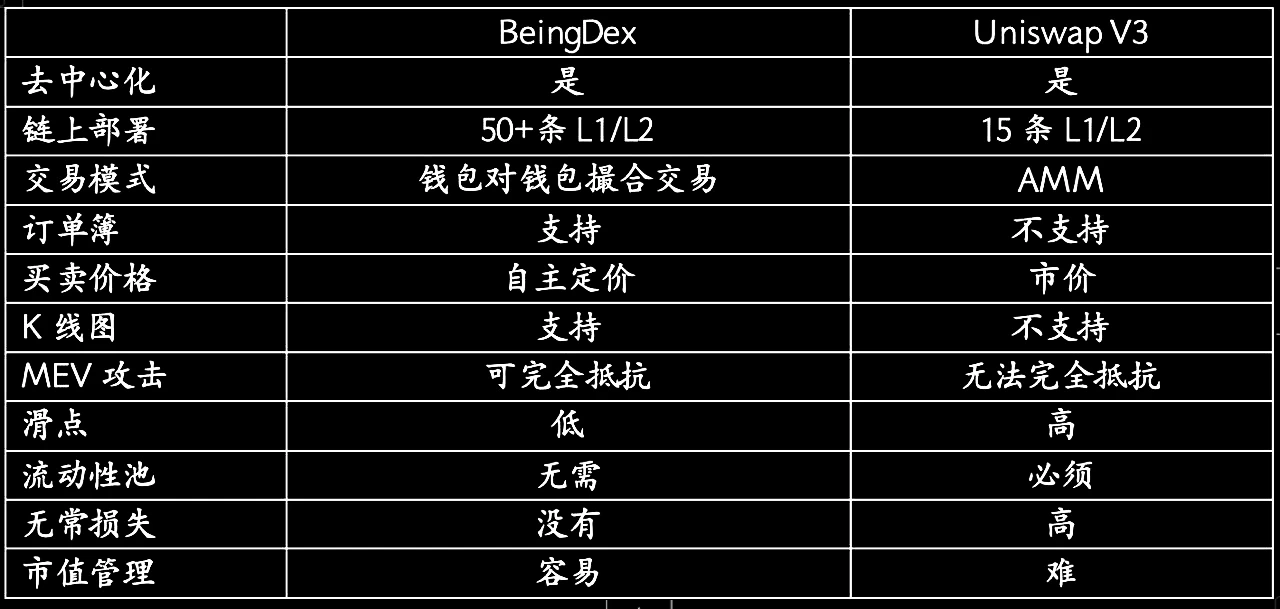

BeingDex is a decentralized exchange developed based on Mango Move, supporting full-chain on-chain order matching trading. Its outstanding innovations include wallet-to-wallet order matching trading, order book mode, support for candlestick charts, and no need for liquidity pools.

This approach differs significantly from Uniswap V3. Order book trading can provide greater trading depth, leading to higher price transparency, as users can see all open orders, making it easier for them to find the best trading prices. Additionally, Mango Move language uses static calls, and the execution order is immutable, effectively resisting MEV attacks and further reducing trading slippage for users.

BeingDex supports full-chain on-chain assets, including tokens, NFTs, and inscriptions, and can bring full-chain liquidity into various Web3 applications as a liquidity gateway. The BeingDex team is continuously expanding its service boundaries, providing users with one-stop asset management services through critical Web3 infrastructure such as Crypto Wallet, DeFi, yield farming pools, POS staking pools, IDO, NFT trading platforms, decentralized social applications, and DAO.

Overall, full-chain trading is an inevitable trend in the development of Web3 applications. Full-chain trading can enhance asset liquidity, improve capital efficiency, reduce transaction costs, expand application scenarios, and provide users with more convenient, efficient, and diverse services.

The emergence of Mango Network brings new opportunities for the development of the blockchain industry. It is expected to become a leader in full-chain interoperability, preparing the ground for a paradigm shift as a transactional full-chain infrastructure in the Web3 domain.

Key Points Interpretation of Mango Network Whitepaper

A. Positioning: Transactional Full-Chain Infrastructure

Keywords: L1 new public chain, DPoS, full-chain applications, Move language, modularization

B. Technical Highlights

Support for full-chain applications—Users only need to prepare 1 type of token as gas to interact and operate on various heterogeneous blockchains.

High performance—Up to 297.47K+ TPS, sub-second settlement, low gas fees, and excellent user experience.

High security—Based on the Move language, the static language combined with smart contracts ensures project code integrity and effective defense against attacks.

Modularization—Decomposes blockchain functionality into independent modules, allowing customization to meet different application scenarios' requirements.

C. Implementation of Mango Full-Chain Applications

Mango's full-chain applications adopt a design architecture of main chain contracts and module contracts. The main business logic is deployed on the Mango main chain, achieving "overall coordination" functionality. On other public chains, interaction with end users, such as input acquisition and output results, is achieved through the deployment of remote access modules.

The specific operation process involves users inputting through remote modules on a new chain, with the module transmitting the input information across chains to the Mango main chain. After processing on the main chain, the output is returned to the corresponding remote module on the new chain. This approach provides users with a localized interaction experience. Additionally, to meet scalability needs, certain functional modules within the main chain can also be deployed on other public chains, collectively forming a virtual main chain system.

Overall, this architectural design achieves the goal of full-chain interconnection of cross-chain applications through the abstraction decoupling between main chain and module contracts. Users can use distributed full-chain services across multiple chains through a simple interaction interface, providing a more convenient and unified experience.

D. Technical Advantages of Full-Chain Applications

Provides settlement and execution layers between heterogeneous public chains. Previously, users needed to use cross-chain bridges like LayerZero to transfer assets between heterogeneous chains and had to prepare corresponding tokens as gas on different chains. Now, users only need to migrate assets to the Mango main chain through Mango's own cross-chain bridge to interact and operate on any target chain through module contracts. Compared to cross-chain bridges, full-chain applications have significant advantages:

Easy to expand—The main logic of the program is processed on the Mango main chain, and the application has a unified state record. After deploying contracts on a new chain, users can inherit all state records and liquidity from the main chain without reinventing the wheel.

Better user experience—Users do not need to be concerned about which chain the program is deployed on and can access the application from the main chain of the full-chain as if accessing a local program. They also do not need to frequently use cross-chain bridges and only need 1 type of token as gas to operate and interact on any chain.

Easy cross-chain integration—When integrating this program, other applications only need to connect on the main chain of the full-chain to use all its functions and liquidity.

E. Composition of Mango Public Chain Infrastructure Protocol

ZK Zero-Knowledge Proof—Enables anonymous transactions, privacy protection, and cross-chain interaction authentication.

Distributed storage—Uses IPFS to store data, ensuring data redundancy, reliability, and scalability.

MgoDNS Domain Name Service—It is a solution based on cross-chain protocol for distributed domain names, providing domain name and domain name data analysis services for decentralized networks. MgoDNS is decentralized, with blockchain as its underlying layer and traditional internet as its upper layer. MgoDNS can also connect various types of public chains and consortium chains, collectively forming a super hub connecting various blockchains.

Mango Client—It is a consistent replica that maintains the effective state of the system, used for auditing and building transactions or operational services.

F. Roadmap and Schedule

Mango Network will launch its testnet in the second quarter.

Applications within its ecosystem such as Being Wallet, BeingDex (order book-style full-chain order matching trading platform), etc., have already been deployed on the development network.

About Mango Network

Mango Network is a Layer1 public chain based on the Move language, aiming to become a transactional full-chain infrastructure network. It achieves full-chain applications through modularization and builds a one-stop liquidity service network, providing users with a more secure, trustworthy, diverse, convenient, and autonomous trading experience. MGO is its native token.

Mango Network is developed by MangoNet Labs, a technology company focused on Web3 infrastructure, with a vision to help 1 billion users smoothly apply Web3.

For more updates, please see the official Twitter account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。