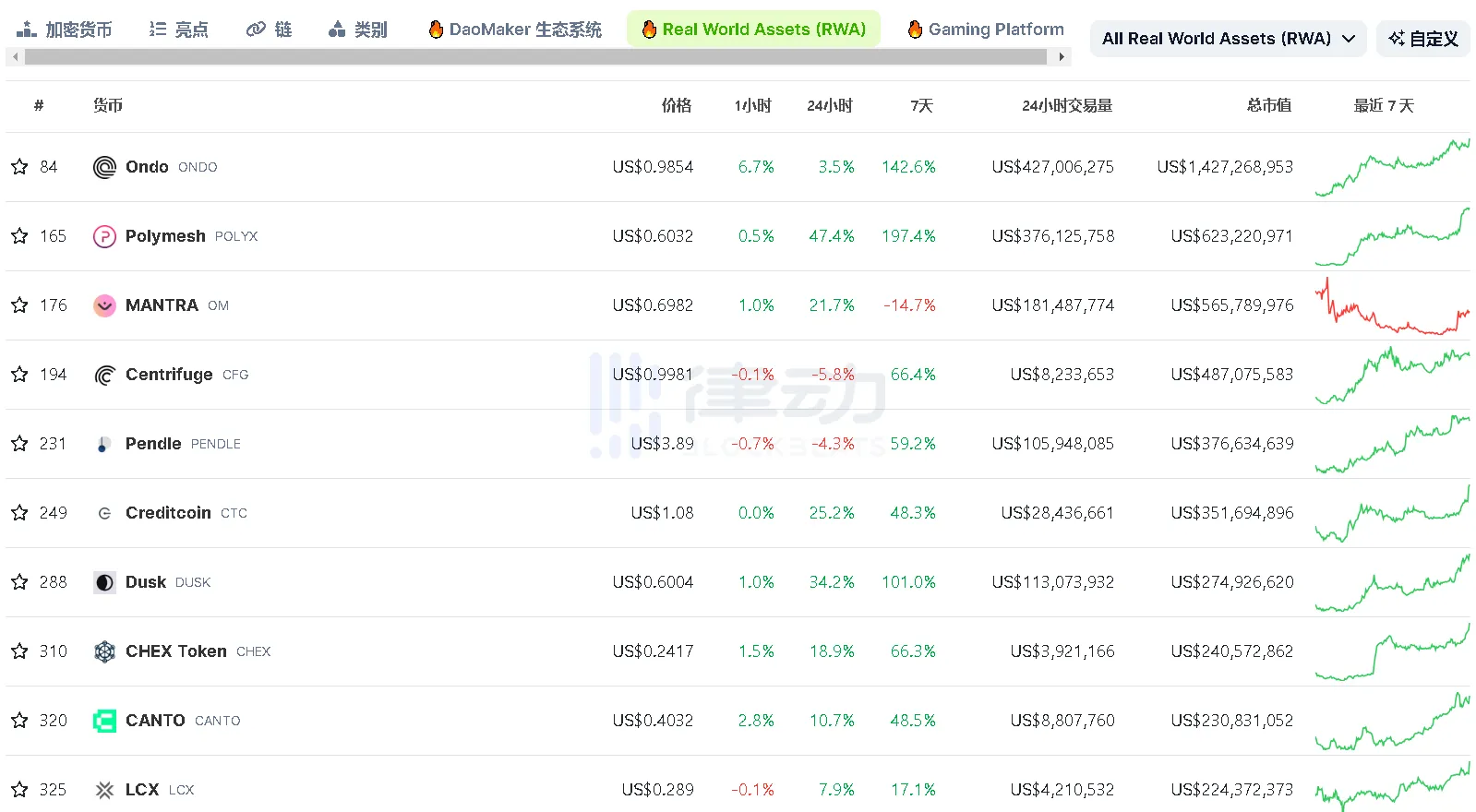

On March 26th, according to Coingecko data, the concept of RWA saw a general rise. Leading the pack, Ondo Finance's native token ONDO surged over 110% in a week, leading the entire RWA protocol track, with multiple project tokens continuously hitting new all-time highs.

Among them, POLYX (Polymesh) saw a weekly increase of 197.4%; TOKEN (TokenFi) saw a weekly increase of 210.5%; NXRA (AllianceBlock Nexera) saw a weekly increase of 129%; GFI (Goldfinch) saw a 24-hour increase of 97.3%; RIO (Realio Network) saw a weekly increase of 141.7%.

From BlackRock to meme, is the market starting to speculate on the RWA track?

The reason for the heated RWA track may be related to BlackRock.

On March 21st, BlackRock launched the tokenized fund BUIDL, which will be subscribed to by Securitize Markets, LLC, providing qualified investors with the opportunity to earn USD income. BlackRock will pay the daily accrued dividends directly to investors' wallets as new tokens. The fund will invest 100% of its assets in cash, US Treasury bonds, and repurchase agreements, allowing investors to earn income while holding tokens on the blockchain. As a result, the price of ONDO soared, doubling its weekly increase.

Related reading: "ONDO doubles in a week, BlackRock's entry reignites the RWA track"

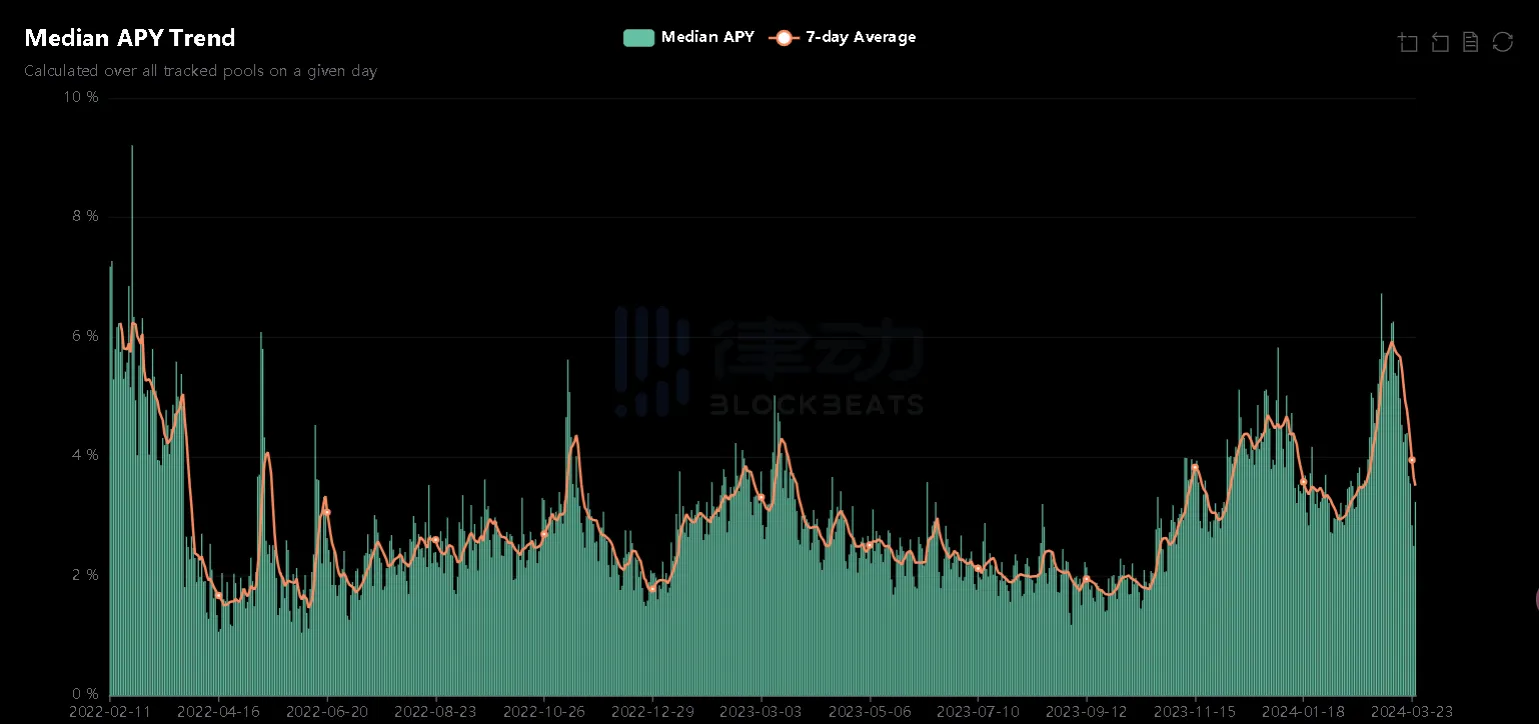

In addition, it seems that this round of bull market frenzy has not yet shifted to DeFi. According to DeFi Llama data, the median DeFi yield has risen from a low of 2% in early 2022 to 3.24 as of July 2023. However, this yield is still relatively low compared to the bond yield, which currently stands at 4.22 for the 10-year US Treasury market. According to CME FedWatch data, the Federal Reserve is highly likely to maintain the interest rate in the range of 5.25%-5.50% in May.

In the widespread risk-averse environment last year, institutions believed that the mid-single-digit returns provided by DeFi were too low for the associated risks. When large holders were unable to generate sufficient returns on-chain, bringing real-world returns into DeFi became a viable solution.

After the general rise of the RWA concept, following the meme frenzy, there even appeared a meme related to the RWA concept, ElonRWA. ElonRWA is the first Elon meme coin related to the RWA narrative, originating from a hand-drawn portrait of Musk. With Musk's "wealth effect," ElonRWA has shown a significant increase, with a 24-hour increase of 80.51%.

Notable RWA protocols

Realio Network

Realio Network was established in 2018 and was originally a peer-to-peer digital asset issuance and P2P trading platform focused on real estate private equity investments, headquartered in New York. Currently, Realio has established its own L1 blockchain network developed based on Cosmos SDK, with the mainnet launched in April last year.

The Realio platform provides a range of services using blockchain technology, including tokenization, digital asset issuance, and secondary market trading, with applications including realioVerse and the upcoming Freehold wallet. In the future, it will not only involve real estate but also securities. One of Realio's unique features is its distributed key management system, which helps ensure secure staking validators and delegators.

Realio adopts a native dual-token proof-of-stake model, RIO and RST, with functions including network staking, governance, and key management. Additionally, Realio has launched a tokenized fund, LMX, dedicated to low-cost Bitcoin production.

RST, which Realio cooperated with Algorand to issue in 2020, is a equity token sold as an Algorand Standard Asset (ASA) and has interoperability with other supported blockchains and platforms (such as RealioX). RST enjoys platform revenue distribution and can also be staked on the Realio Network to earn validator rewards. The maximum supply is 50 million, sold through presales and Security Token Offering products on realio.fund platform.

RIO is the native gas and utility token of Realio Network, with a maximum supply of 75 million, issued on multiple chains including Ethereum, Algorand, and Stellar networks, with no pre-mining. Additional issuance is through validator block rewards and liquidity mining. At the time of writing, the price of RIO is $2.04, with a weekly increase of 140.9%.

Twitter: https://twitter.com/realio_network

Website: https://realio.network/

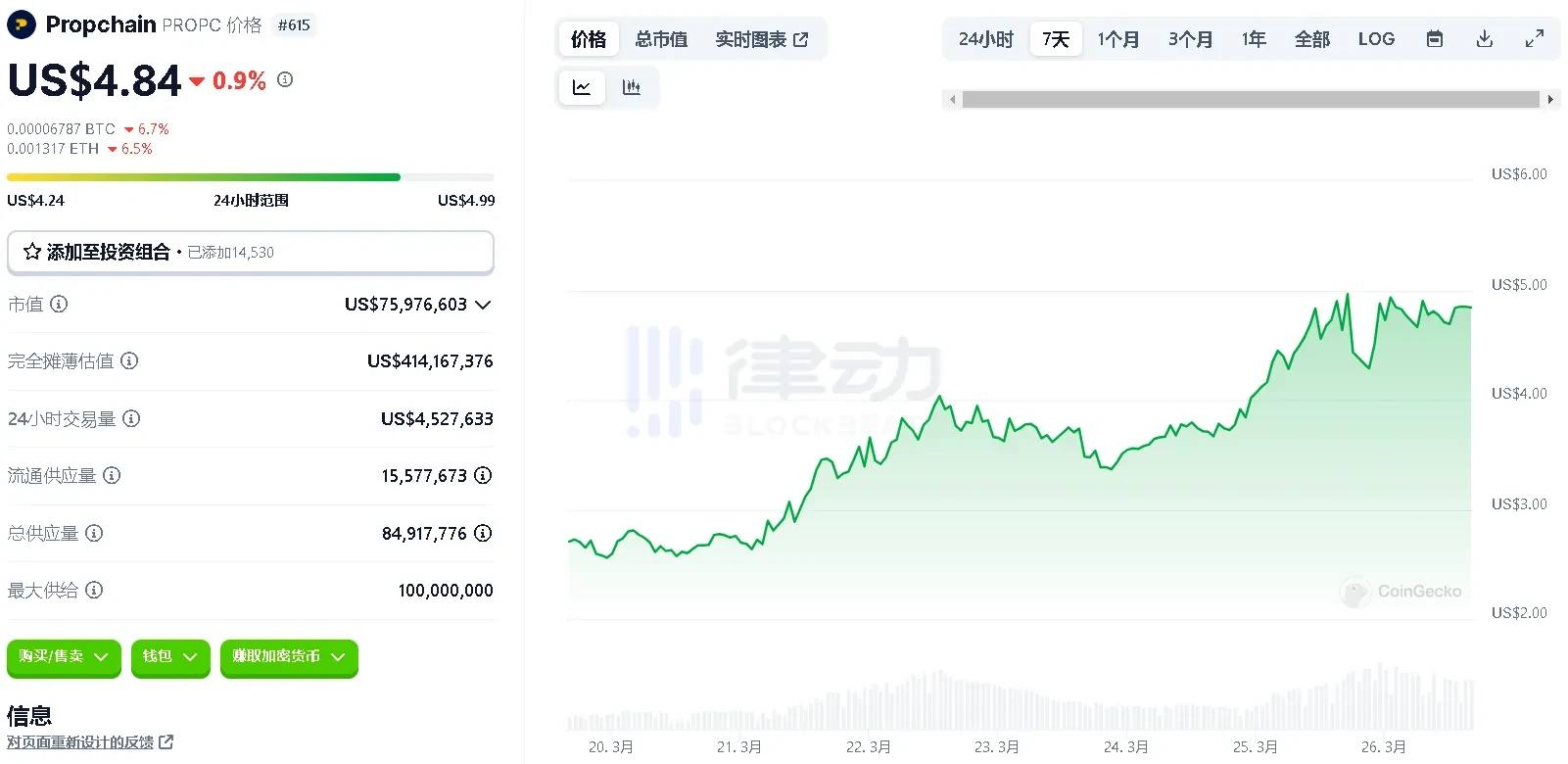

Propchain

Propchain is a blockchain-based real estate token investment market that provides users with channels to invest in the global real estate market, as well as tools of various nature, scale, and valuation. Propchain solves many problems encountered by real estate investors in traditional markets, continuously acquiring new properties and listing tokens after due diligence to ensure that the platform never runs out of investment choices and guarantees the security and sustainability of the properties.

Propchain allows investors to invest with a minimum threshold of 1000 euros. All properties are managed by Propchain's property management team, and investors only need to collect rent from the properties. At the time of writing, the price of PROPC is $4.84, with a weekly increase of 83.4%.

Twitter: https://twitter.com/PropChainGlobal

Website: https://propchain.com/

AllianceBlock Nexera

AllianceBlock is an infrastructure provider for decentralized tokenized markets. It provides liquidity to enterprises and allows them to issue, manage, and trade tokenized digital assets, including RWA, in a compliant manner. AllianceBlock's tokenization technology enables institutions and enterprises to develop compliant and efficient solutions.

AllianceBlock has launched the NFT protocol Nexera, which is built on current NFT standards and can create variable and composable NFTs, known as MetaNFT.

MetaNFT is the third-generation NFT that can simultaneously possess variable data and metadata to expand their functionality, allowing them to dynamically evolve over time with new attributes and restrictions. This makes MetaNFT an on-chain variable storage entity that can interact with on-chain and off-chain data. MetaNFT widely supports existing and emerging NFT standards, allowing developers to quickly adapt and integrate future standards.

MetaNFT can also automatically enforce loan terms between borrowers and lenders. Additionally, MetaNFT can power asset-backed lending platforms through the fractionalization of NFTs. In other words, MetaNFT can use existing NFTs as collateral and divide them into smaller NFT fractions, which can be sold or auctioned directly or through NFT marketplaces.

The native token of Nexera, the Nexera token (NXRA), has a maximum supply of 850 million and currently operates on Ethereum, Binance Smart Chain, Avalanche, Polygon, and EnergyWeb Chain. At the time of writing, the price of NXRA is $0.28, with a weekly increase of 139.7%.

Twitter: https://twitter.com/allianceblock

Website: https://allianceblock.io/

Plume Network

Plume is a modular L2 blockchain dedicated to RWA, integrating asset tokenization and compliance providers directly into the chain. Plume aims to simplify the complex process of deploying risk-weighted asset projects and provide a blockchain ecosystem for investors. Through its DeFi applications, Plume aims to achieve composability of RWA-specific assets and provide connections to high-quality buyers to increase the liquidity of all tokenized RWAs.

The team members of Plume Network come from major companies, including Coinbase, Robinhood, Layerzero, Binance, Galaxy Digital, Scale Venture Partners, and dYdX. Currently, Plume Network has not yet issued tokens but has a points program. Plume is currently deployed as an L2 on the Ethereum Sepolia testnet, and participants have the opportunity to receive airdrops by participating in Plume's testnet, completing bridging tasks, and claiming test tokens.

Twitter: https://twitter.com/plumenetwork

Website: https://www.plumenetwork.xyz/

Polymesh

Polymesh is an institution-grade permissioned blockchain specifically built for RWA tokens. It incorporates governance, identity, compliance, and confidentiality into the core of the blockchain. All participants, including token issuers, investors, and node operators, must first undergo decentralized KYC verification.

The native token $POLYX of Polymesh is classified as a utility token under Swiss law. In April last year, Binance announced its participation as a node operator for Polymesh, causing a more than 10% increase in POLYX at the time. Currently, POLYX is also showing an upward trend, with the price of $0.64 at the time of writing and a weekly increase of 219.1%.

Twitter: https://twitter.com/PolymeshNetwork

Website: https://polymesh.network/

Mineral

Mineral is the world's first BRC-420 inscription supported by Bitcoin mining RWA. Unlike many unsustainable DeFi 1.0 projects that rely on subsidies and liquidity locking, Mineral introduces positive externalities from mining, creating a sustainable income-generating DeFi model.

By staking Mineral on L2, users can obtain Bitcoin and the native token MNER. The treasury will continuously hold new RWA income-generating assets as the project develops. In addition, Mineral will collaborate with other projects based on the BRC-420 environment and implement one-coin multi-mining by staking Mineral inscriptions in L2.

Through its native token MNER, Mineral continuously consolidates value with RWA and opens up broad possibilities for cross-project collaboration through high composability, achieving a multi-flywheel design for DeFi. MNER serves as the Mineral L2 Treasury token, supported by RWA, specifically represented by Bitcoin hash power. Over time, the Treasury will benefit from continuous net income from BTC mining and other RWAs, cross-project collaboration income, and enhanced net income from newly acquired RWAs.

Twitter: https://twitter.com/mner_club

Website: https://www.mner.club/

Galileo Protocol

Galileo Protocol is a tokenization platform aimed at changing the authentication and ownership of luxury goods and RWA. Galileo Protocol focuses on using pNFTs as proof of ownership and authenticity, benefiting luxury brands, enterprises, individual collectors, and metaverse users.

pNFT provides the traceability, immutability, and security advantages of NFTs while abstracting much of the complexity involved in trading physical assets, allowing all changes in the product lifecycle to be recorded on pNFTs. The protocol includes a mobile application for iOS and Android devices, allowing users to verify luxury goods and manage their related pNFTs. The application uses computer vision algorithms to analyze the physical characteristics of luxury goods and compare them with the metadata stored in their related pNFTs.

Additionally, Galileo Protocol provides a B2B tokenization platform for luxury brands and enterprises to verify their products and track them through their supply chains. The platform allows companies to easily create and manage pNFTs for their products, ensuring the authenticity of each item is accurately recorded on the blockchain.

Galileo Protocol will issue 150 million LEOX tokens, with an initial circulating supply of 28.9 million. At the time of writing, the price of LEOX is $1.34, with a weekly increase of 120.7%.

Twitter: https://twitter.com/galileoprotocol

Website: https://www.galileoprotocol.io/

MANTRA

MANTRA Chain is an L1 blockchain built on the Cosmos SDK, aiming to become a network for inter-enterprise collaboration, attracting enterprises and developers to build any applications from NFTs, games, metaverse to compliant DEX. The first dApp on MANTRA Chain is MANTRA Finance, which aims to be a globally regulated DeFi platform, bringing the speed and transparency of DeFi to TradFi, allowing users to issue and trade RWA tokens.

On March 19th, MANTRA announced the completion of a $11 million funding round, led by Shorooq Partners, with participation from Three Point Capital, Forte Securities, Caladan, Virtuzone, Hex Trust, Token Bay Capital, GameFi Ventures, Mapleblock, Fuse Capital, and 280 Capital.

The new funds will be used to help MANTRA achieve three key goals: building compliant infrastructure, providing support for developers, and expanding the scope of RWA tokenization projects. At the time of writing, the price of OM is $0.72, with a 24-hour increase of 26.7%.

Twitter: https://twitter.com/MANTRA_Chain

Website: https://www.mantrachain.io/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。